The Sure Analysis Research Database service is our most valuable service. We’ve been thrilled with the positive response to Sure Analysis since our launch of the service in April 2018.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

This email answers many of the most frequently asked questions we've had so far, and includes one of our Sure Analysis reports as an example.

Frequently Asked Questions

"What do the 2 Page PDF Research Reports look like?"

You can download one of our reports by clicking here or read it below!

United Parcel Services (UPS)

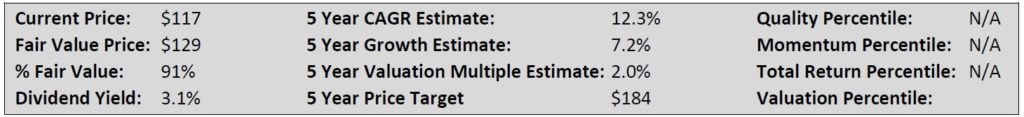

Key Metrics

Overview & Current Events

United Parcel Services (UPS) is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance and financing. Its operations are split into three segments: US Domestic Package, International Package, and Supply Chain & Freight. UPS is valued at $101 billion. The company was founded in 1907 and is headquartered in Atlanta, GA.

UPS reported its most recent quarterly results on April 26, the company earned $1.55 per share during the first quarter (up 17% year over year). UPS recorded revenues of $17.1 billion, an increase of 10% versus the prior year’s first quarter, and the company also announced that it expects earnings per share of $7.03 to $7.37 during 2018. Free cash flow generation was very strong during Q1 ($2.6 billion), but is always distributed unevenly over the year, guidance for 2018 sees free cash flows of ~$4.5 billion.

Growth on a Per-Share Basis

During the last financial crisis UPS’ profitability declined substantially (earnings per share dropped from $4.11 in 2007 to $2.31 in 2009), but since then profits have risen relatively consistently. When we look at the 2008-2018 time frame earnings per share grew by 7.5% annually (based on the midpoint of UPS’ guidance for the current year).

Profit growth during 2018 will be higher than in recent years, which is due to the positive one-time impact of a tax rate decline due to tax legislation changes in late 2017. Even without that impact the growth rate would not be bad, though, as UPS benefits from macro tailwinds and is performing well operationally at the same time.

One such tailwind is e-commerce, which leads to growth in the amount of packages that have to be transported across the country. UPS was able to grow volumes in the US by 5% during the most recent quarter, whilst also growing the revenue per piece as higher base-rate pricing and fuel surcharges came into effect. International results were even better, as growth in the Export segment allowed for a 15% revenue gain.

The strong economy drives demand for UPS’ services by businesses as well as by consumers (which increase their spending due to higher disposable incomes), and with online shopping growth continuing to outpace brick-and-mortar growth in the foreseeable future UPS should continue to benefit from strong demand for its services.

UPS has pointed to a favorable pricing environment that could positively impact margins going forward. And, UPS has also reduced its share count in recent years, which allowed for some additional earnings per share growth. We expect that UPS will continue to grow its profits per share at a high-single digits pace going forward. UPS did not cut its dividend during the financial crisis and continues to lift it at a solid pace (the most recent hike was a bit higher, at 10%).

Valuation Analysis

UPS’ shares trade at a bit more than 16 times this year’s earnings. The current valuation is at the low end of the historic range. Relative to the long term median P/E ratio of 18 shares trade at a discount of ~10%, which provides some share price appreciation potential. Shares offer a dividend yield of 3.1%, which is substantially more than the broad market’s dividend yield, and which is relatively attractive when we factor in the high-single digits dividend growth rate.

Safety, Quality, Competitive Advantage, & Recession Resiliency

UPS produces a very high amount of gross profits relative to the assets the company possesses, although we have to note that operating profits and net profits are substantially lower than the company’s gross profits. The return on assets is therefore a lot lower, at 11.5%, which is still relatively attractive.

UPS is highly leveraged in terms of debt to all assets, but since the interest coverage ratio is quite high the debt levels are not problematic at all. The company could easily reduce its debt levels meaningfully thanks to strong cash generation, and if it would stop its buybacks more equity would build up on the balance sheet, which would result in a lower debt to assets ratio.

UPS is the biggest logistics / package delivery company in the US (by market capitalization). Its top peers include FedEx, DHL Express, and the United States Postal Service. Due to a macro environment that is beneficial for the whole industry (online shopping, strong economy) none of the big players has any interest in a price war, as volumes are rising even if they increase the base pricing for their services. Competitive pressures should therefore remain muted for the foreseeable future. During the last financial crisis profits were roughly cut in half, as lower economic activity and lower consumer spending hurts UPS, but a less severe recession will not lead to such an extensive impact on UPS.

Final Thoughts & Recommendation

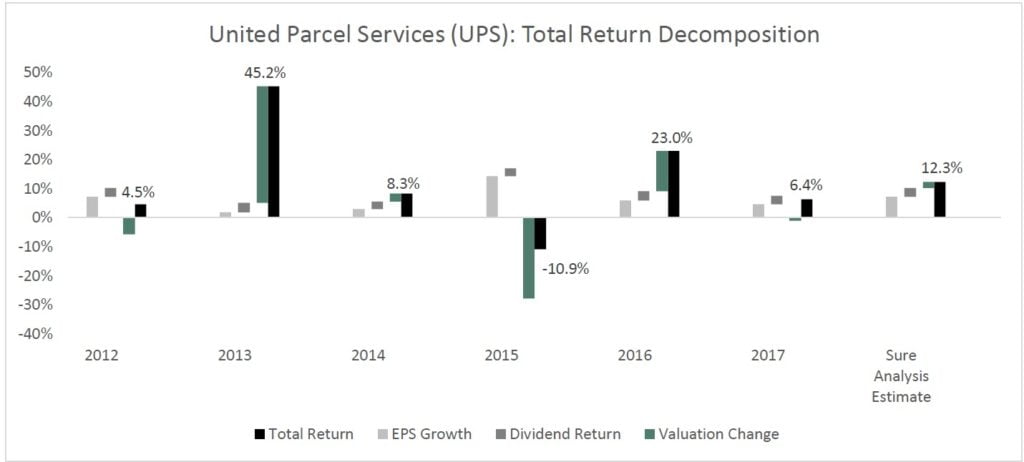

UPS is a key player in an industry with a favorable outlook. UPS can offer compelling total returns over the coming years through a combination of solid growth, a relatively high dividend yield and an inexpensive valuation. The company is a buy at current prices for conservative dividend growth investors looking for double-digit total returns.

Total Return Breakdown by Year

The example report is a potential buy recommendation for a stock we believe offers solid total return potential and lower than average risk. Obviously, some of our 301 reports are bullish, many are neutral, and some are bearish.

"Will you keep writing the Sure Dividend, Sure Retirement, and Sure Dividend International Newsletters?"

Yes, we will continue to write and publish these newsletters on our regular schedule. The Sure Analysis Research Database is in addition to our current newsletters, not a replacement of them. Your Sure Analysis subscription comes with access to all 3 of our premium monthly newsletters: Sure Dividend, Sure Retirement, and Sure Dividend International.

"How will the Sure Analysis Research Database further empower my investing process and portfolio?"

Imagine the ability to easily analyze the expected total return potential for dividend stocks and make investments that are the most likely to generate excellent total returns in the future to compound your wealth...

That's what the Sure Analysis Research Database offers.

Members can quickly filter through the database with an included Excel spreadsheet to find the highest expected total return dividend stocks around.

"How often are company reports updated?"

Each report in the database is updated quarterly to ensure that all information remains timely and actionable.

"What stocks will be added next?"

We currently have 301 stocks in the Sure Analysis Research Database, with more being added nearly every day. We've already added all of the:

- Dividend Kings

- Dividend Aristocrats

- Dividend Champions

- Past Sure Dividend Newsletter Recommendations

- Past Sure Retirement Newsletter Recommendations

We are adding more stocks research reports nearly every day. We also take Sure Analysis customer suggestions for what dividend stocks to add next.

"How long will the $50/year discount offer be available, and what is the regular price?"

The regular price for Sure Analysis is $299/year. The $50 off coupon link in this email expires this Friday at 2PM Central Time, no exceptions.

"Will my price increase after joining?"

No, your price will not increase after joining. When you join, you lock in the discounted price of $249/year.

"What is included with a subscription to the Sure Analysis Research Database?"

- Access to our 300+ (and quickly growing) stock PDF research report database

- The Sure Analysis Excel sheet ranking document

- Access to our 3 Premium Newsletters

- Risk-free 7 day trial of all 3 newsletters and the Sure Analysis Database

- Locked in low annual price that won't increase after joining

- Access to our Member's only Slack community

The deep discount offer expires at 2PM Central, 6/22/18, no exceptions

Click this link now

to start your 7 day free trial of Sure Analysis

Thanks,

Ben Reynolds

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.