When it comes to investing, don’t forget the power of compounding interest.

Stock Market Magic – Compounding Interest – That’s It!

Q3 hedge fund letters, conference, scoops etc

Transcript

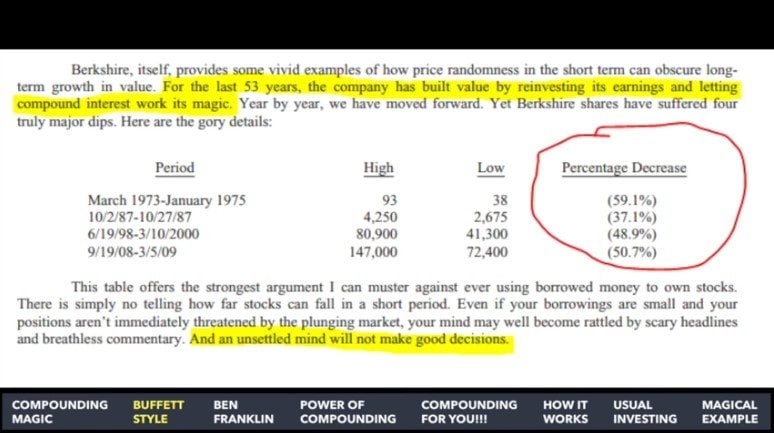

Good afternoon investors. I talked to make the last episode for 2018 about something that should be the most important message when it comes to stock market investing. In 2008 19 and beyond that is the power of compounding. Einstein said compound interest is the eighth wonder of the world. He who understands it earns it. He doesn't base it Buffett clearly explains what his investing focus is. In this excerpt from his last letter to shareholders I quote For the last 50 years the company has built value by Arain vesting its earnings and letting compound interest work its magic. So what that is so important about compounding interest. Let me show you another example. Going back to Benjamin Franklin who was such a visionary that he understood the power of compounding bet. Back in 1790. So the real story goes something like this Franklin decided to leave that positive 1000 bounce back then about 4400 dollars. One to his native home town of Boston and then another 1000 pounds to his adopted hometown of Philadelphia on the condition that they keep those funds invested for the next 100 and then 200 years so frankly said that the funds should be used to make loans at 5 percent interest to craftsmen's under the age of 25 to help them set up their businesses. The loans were to be given only to those craftsmen's who were married had completed their apprenticeships and could obtain to co-sign or to vouch for them.

After 100 years each city was to take about 75 percent of the fund to use for public works like bridges or whatever they were to then continue loaning the money for another 100 years after the end of those 100 years. Each city would get about 25 percent of the money and their respective states would get the rest. Head Boston and Philadelphia followed through with Franklin's wishes successfully they would have each had nearly 20 million in their funds at the end of two hundred years. Of course its politics. States cities governments they didn't follow through. But still they managed to have about 5 million with Boston after 200 years. And Philadelphia has just about 2 million but still they started with just four thousand and ended up with 5 and 2 million. After 200 years. That is because they invested in different things insurance things like that that didn't work out as planned. Plus they could take out parts of the money after a certain amount of time. Nevertheless turning 9100 dollars with what they started to 7 million is something important. And that is the power of compounding because Franklin said that they cannot invest the money for the first 100 years and this shows the power of compounding. One thousand dollars at 8 percent compounded annually after 10 years. It's already more than double 2100. After 20 years 4000 after 40 years. One thousand dollars is already ten thousand which means that's 10 times your initial investment. After 50 years we are 46 times 60 years 100 times. And then the power of compounding really kicks in. And then after 100 years you are two million something. Now you'll say Svend OK but how does this work for me. After 60 70 80 years I'll probably be dead. So who cares about compounding.

Well this is the problem with compounding it is that it doesn't give instant gratification. You might see a dividend of five bucks as nothing. However even something small grows and compounds over time.