Stanphyl Capital’s commentary for the month ended May 31, 2021.

Q1 2021 hedge fund letters, conferences and more

Friends and Fellow Investors:

For May 2021 the fund was up approximately 17.8% net of all fees and expenses. By way of comparison, the S&P 500 was up 0.7% while the Russell 2000 was up 0.2%. Year-to-date the fund is up 40.9% net while the S&P 500 is up 12.6% and the Russell 2000 is up 15.3%.

.............

Stanphyl's Portfolio Performance

In May our small-cap equity longs were up nicely along with our long gold position (via GLD), as were our large short positions (i.e., the prices went down) in two of the most vile entities ever to list on a U.S. stock exchange, Tesla (TSLA), which by now you know well, and the ARK Innovation ETF (ARKK), whose only “innovation” was creating the most convenient one-stop shorting in modern history for a large collection of near-worthless bubble-stocks.

Our gold position has been supported by a rapidly increasing rate of inflation (as evidenced again this month in CPI, PPI and PCE core) that, because the Fed insists it’s “transitory” while continuing to print $120 billion a month (likely into late this year or early 2022 with only a gradual “taper” to follow), is resulting in increasingly lower real (i.e. inflation-adjusted) interest rates. If you’re in the “transitory” camp, kindly have a look at this chart (below) and explain—as velocity accelerates in the post-COVID environment—how that inflation won’t stick around for a long while:

…and why it won’t be further exacerbated by the Democrats in D.C. who (with or without Republican acquiescence) will jam through trillions more in inflationary “green” and socialist mandates. Additionally, here’s a great new Twitter thread from @TaviCosta explaining why he thinks we have a major bout of inflation coming.

In light of this, the stock market is increasingly beginning to suspect that higher inflation may not be “transitory,” and thus high PE (and no “E” stocks such as those in ARKK) are moving lower. (As in the first half of the stagflationary 1970s, the negative effect on stock prices from PE multiple compression will initially far outweigh any inflation-induced rise in nominal earnings.)

Meanwhile, equity indexes are so stretched that myriad exogenous events (both “known unknowns” and “unknown unknowns”) could pop this market even independent of inflation fears or Fed actions. Here’s a great chart showing what happens when the S&P 500’s real earnings yield turns negative, as it is now; as Twitter user @MichaelaArouet pointed out, the last three times this happened were in 1987, 1999 and 2008, and we all know what happened then:

And have a look at the dangerously rapid increase in margin debt, to a point similar to those of the tops in 2000 and 2007:

And complacency is high too; courtesy of @ISABELNET_SA we can see that short interest for the median S&P 500 stock is exactly where it was just before the crash of 2000:

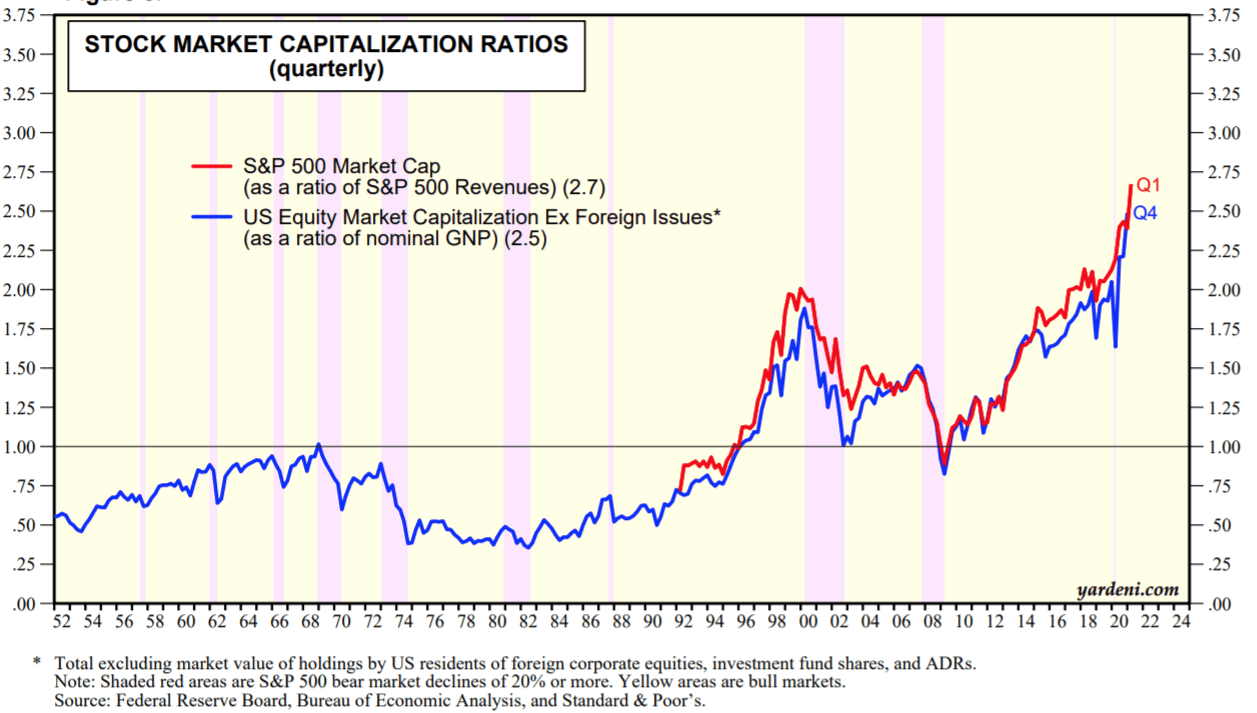

And courtesy of Yardeni Research we can see that the S&P 500’s ratio of price-to-sales and the overall stock market’s ratio of price-to-GNP are the highest they’ve been in modern history…

And as the economy does recover, here’s the insane amount of debt we face; the only “solution” for this is the aforementioned PE multiple-crushing inflation:

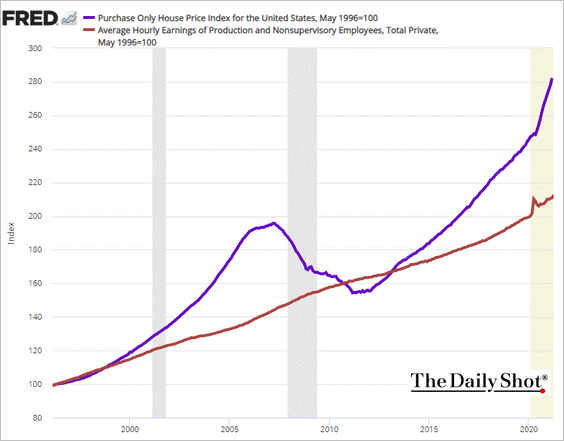

And hey, let’s not just settle for a stock market/cryptocurrency/NFT/baseball cards/art/sneakers/ “whatever” bubble… For good measure, let’s also have another housing bubble:

As noted earlier, we continue to be short shares of ARKK, an ETF consisting of the most execrable story-stocks on Nasdaq—a collection of companies with a blended PE of “infinity”—run by perhaps the wackiest portfolio manager on Earth. ARKK is today’s equivalent of the Internet bubble funds of 1999-2000, and we know what happened to those. We also continue to be short Tesla, the biggest stock bubble of this (or any) bubble market (much more on that in the back half of this letter).

Long Positions

Here are the fund’s current long positions, followed by our regular update on Tesla; please note that we may add to or reduce position sizes as stocks approach or recede from our target prices…

We continue to own Data I/O Corporation (DAIO), a manufacturer of semiconductor programming devices, which in April reported a solid Q1 2021, with revenue of $6 million, up 26% from the year-ago quarter and 22% sequentially, a 55% gross margin, a net loss of just $333,000 and positive adjusted EBITDA of $173,000. Most importantly, the guidance was quite strong, as management said the improvement in the business is accelerating. DAIO has $13.6 million in cash (over $1.60/share) and no debt. This company is a great play on the increasing electronic content in cars—particularly hybrids and EVs—and a great buy-out target. An EV of 2.5x run-rate revenue of $24 million would put the stock at around $8.70/share.

We continue to own Aviat Networks, Inc. (ticker: AVNW), a designer and manufacturer of point-to-point microwave systems for telecom companies, which in May reported a solid Q3 for FY 2021, with revenue up 8.2% vs. the year-ago quarter (despite having one fewer selling week) and both GAAP earnings (adjusted for a one-time tax credit gain) and adjusted EBITDA up hugely, at $0.49/share vs. $0.28/share (2:1 split-adjusted) and $7.7 million vs. $3.5 million, respectively. The balance sheet is beautiful too, with $45.8 million in cash (over $4/share), no debt, and hundreds of millions of dollars in NOL carryforwards, and Biden’s wireless infrastructure plan should provide a nice revenue tailwind. A valuation of 20x run-rate earnings plus the net cash would make this roughly a (split-adjusted) $44 stock.

We continue to own Spok Holdings, Inc. (SPOK), which combines a slowly fading (by around 5% a year) high-margin medical paging division with a high-margin medical software business that management is trying to grow. In April Spok reported a mediocre Q1 2021, with the all-important software revenue & backlog roughly flat year-over-year and down slightly sequentially. On the bright side, thanks to better expense management GAAP net loss was considerably improved vs. a year ago (0.12/share vs. 0.24/share), and management raised its 2021 revenue guidance significantly, although its expense guidance was raised by a similar amount and thus there was no anticipated improvement in profitability. Overall though, Spok is an 80% gross margin company with a great balance sheet ($71 million in net cash, which is over $3.50/share) that burns only around $3 million a year, and had strong 2020 and 2021 insider buying. A valuation of 5x revenue for the software business plus 1x revenue for the paging business would value the stock at around $25/share, and while we wait SPOK pays roughly a 4.4% dividend yield. However, there’s no guarantee that the software business will improve enough to realize that valuation, and following the mediocre April earnings report I lightened the position a bit.

Finally on the long side, as central banks increase their money-printing to ever higher levels in order to fund multi-trillion-dollar annual deficits, we continue to hold long positions in the gold and silver ETFs (GLD and SLV); the likelihood of the Fed maintaining negative real interest rates for years to come adds a substantial tailwind to these positions, while silver is also a major component in the solar cells the Biden administration is expected to heavily subsidize.

Thanks and stay healthy,

Mark Spiegel