Global Allocation Fund commentary for the month ended April 30, 2021. The following has been translated from Spanish to English.

Q1 2021 hedge fund letters, conferences and more

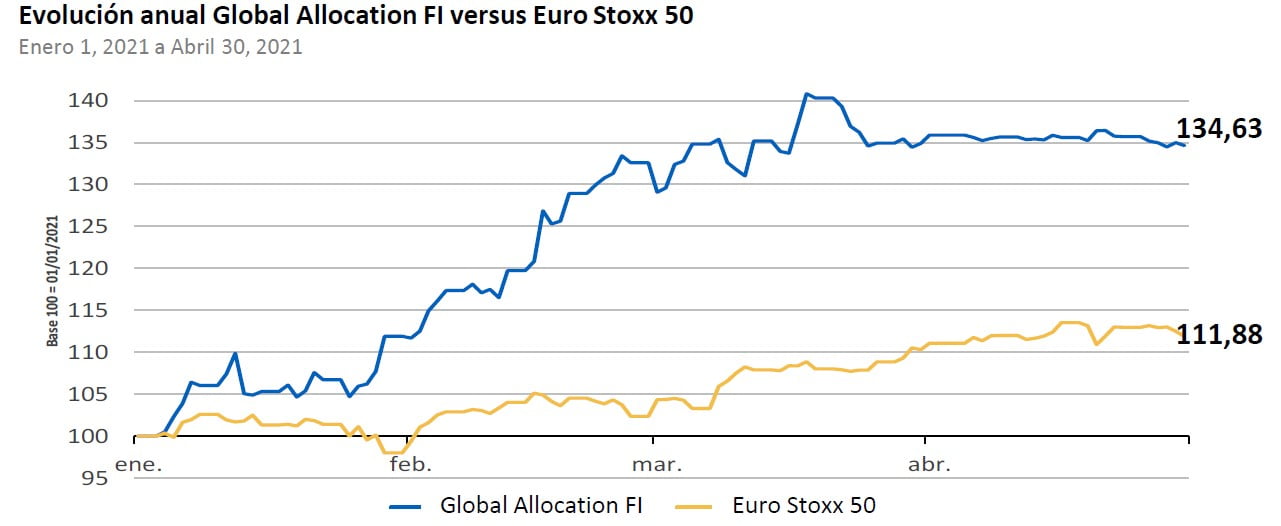

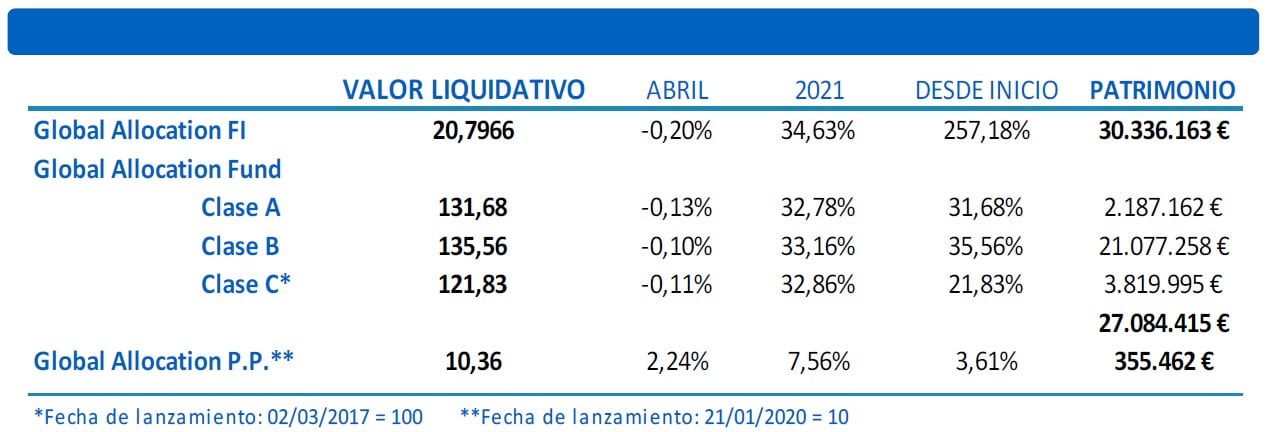

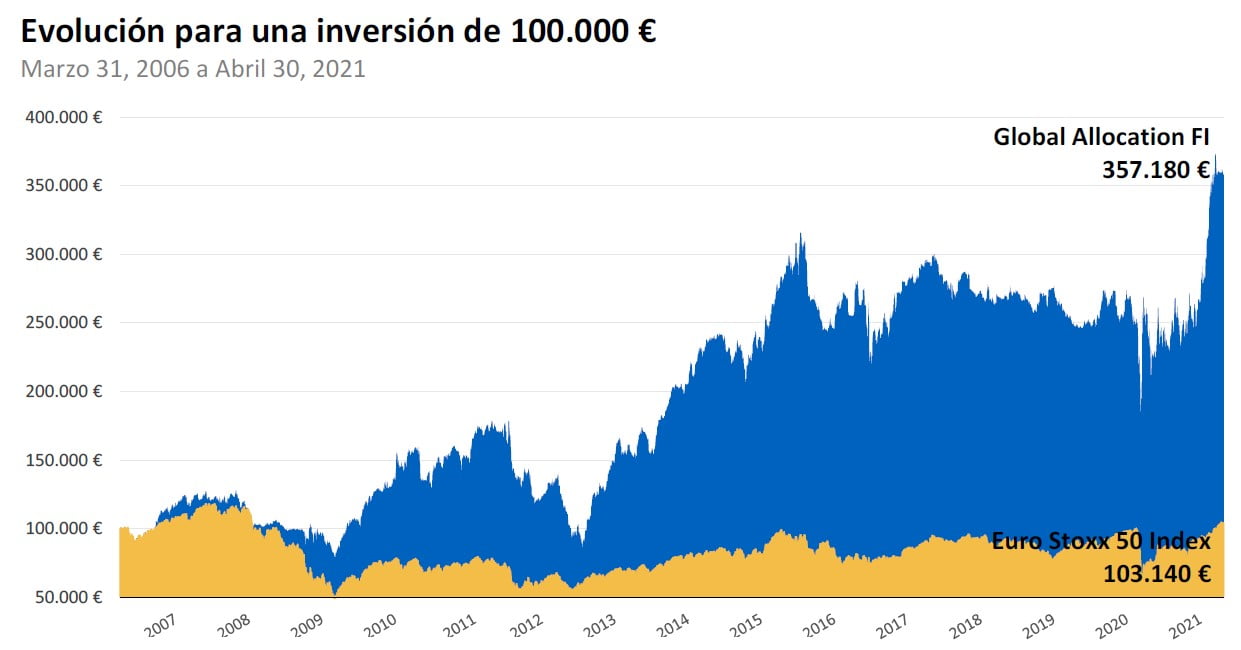

Global Allocation Fund April 2021 Performance

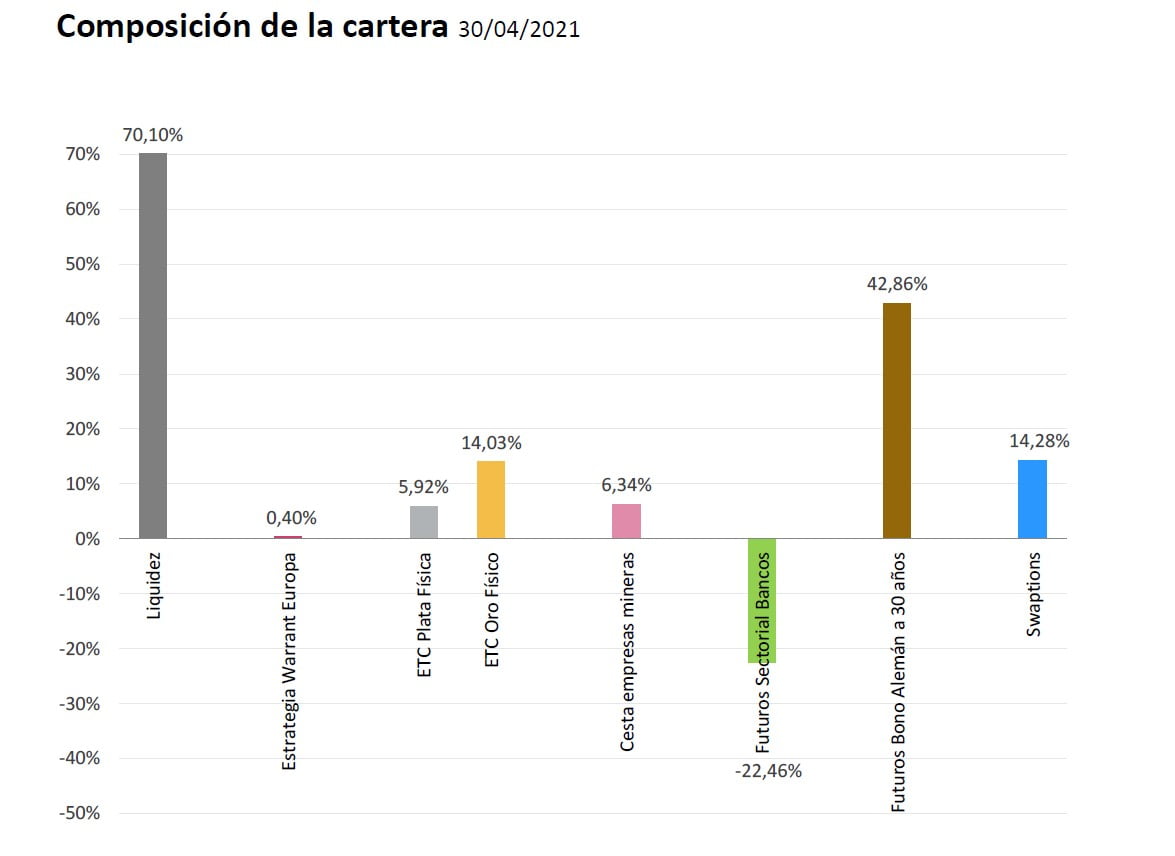

April has been quite a month "in terms of the evolution of the Global Allocation Fund, due not only to the evolution of the markets, where we have seen a small correction in interest rates, especially in the US curves, but also at the" hedges that we implement, raising the investment in precious metals (silver and mining) to 25 as well as the purchase of German 30-year bonds, and a sold position in banking sector indices, have achieved that the movements have been almost negligible.

Therefore, we currently have a position with very little risk, although we still have options on the European curve, due in October this year, similar to those we had on the US curve that expired in March, apart, of course. , of the options that we have on 50-year interest rates, and that we think will finally be the ones that will make the fund have a significant revaluation in the medium term These options will expire in more than 3 and a half years, and we continue to think that they will finally meet their objective, although not in the short term.

Interest Rate Curve In Europe

On the other hand, we are waiting for the right moment for "the term of the options on the interest rate curve in Europe, also taking advantage of the positive carry" that these positions currently have (that is, time benefits us).

Regarding equities, we maintain our short position in banks, mainly due to the opposite evolution of the sector based on the evolution of long-term interest rates. This compensates us for the risk derived from a sharp drop in the same, being able to take advantage of the negative convexity of the banks to the interest rates. That is to say, the banks benefit from a slight increase in interest rates but if this became more abrupt, it would weigh them down significantly due firstly to the bulky portfolios (and which have recently increased significantly) that they maintain in public debt, as well as the significant increase in non-performing loans caused by this increase in interest rates.

Regarding the rest of the variable income, we continue to see a constant inflow of flows, many of them also derived from the policies of the banks, which begin to charge their main clients for keeping the money in cash, trying to pass on the costs that they support themselves due to the negative rates. We understand that it is a situation that can be extended over time, with even higher rises, although it has a greater danger every day, due to the valuations that many companies have reached, and, especially, for the aversion to risk that this profile of clients that are currently going public may have at the moment when there is the least setback that affects equities Many of these clients are investing in the stock market for not paying 0 50 and can be found with losses of 5 10 or 20 in a very short space of time, which we suppose would unleash a general rout We will wait for these circumstances to occur s to be able to enter in a moderate way, and with a much more content risk than we see right now.