A little over two years ago I launched a project, where I am trying to show readers how I would go about building a dividend portfolio from scratch. I invest about $1,000/month in ten dividend growth stocks, which I believe to be attractively valued. I reinvest dividends, and stick to the plan, in order to reach a stated goal and objective. This is the type of investing I have been working on for the past 10 – 15 years, and which I have discussed on this blog.

[soros]Q4 2020 hedge fund letters, conferences and more

Generating Dividend Income

The goal of this dividend portfolio is to generate $1,000 in monthly dividend income. I want a stable dividend income, from a diversified portfolio of blue chip companies, which grows at or above the rate of inflation without any new capital added in.

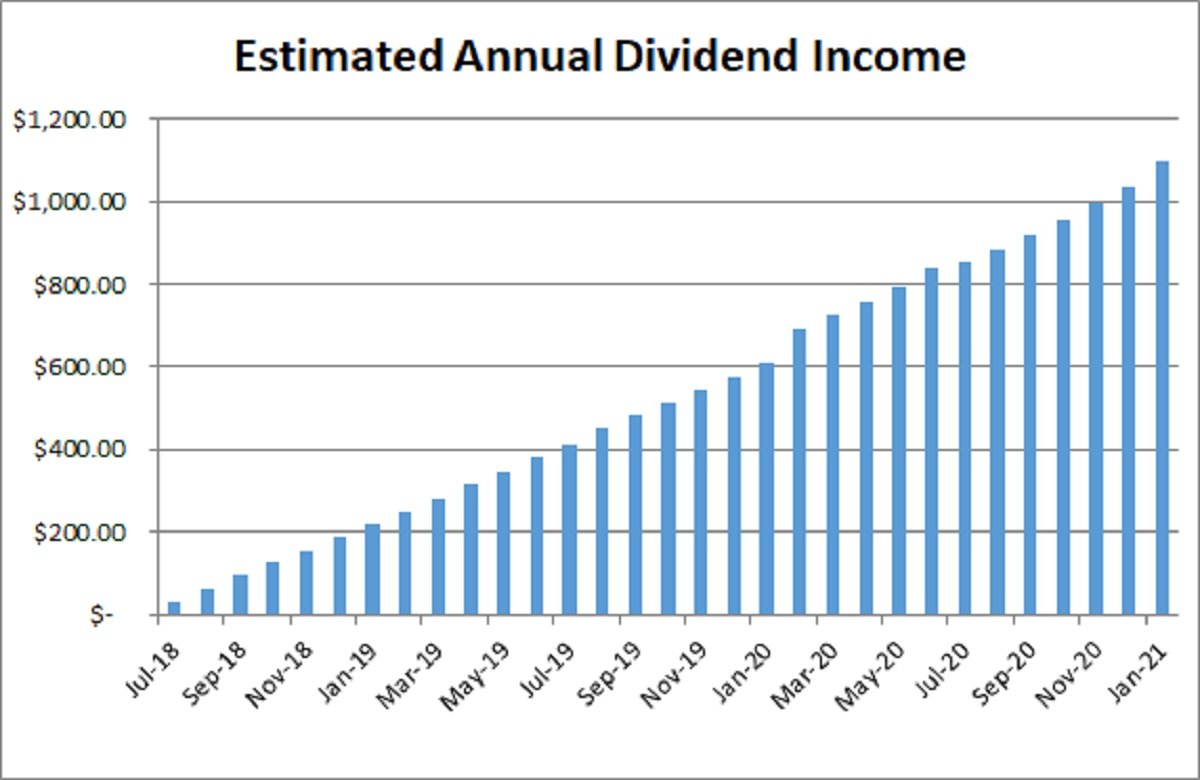

The portfolio following this strategy is on track to earn $1,100 in annual dividend income or $91.64 in monthly dividend income.

Most of us invest or have invested with the stated goal of reaching the coveted dividend crossover point. Given the limits I outlined above, I believe that reaching $1,000/month was a decent goal.

The Journey To The Coveted Dividend Crossover Point

Based on my calculations, which are dependent on factors outside my control, I can expect to reach those objectives within ten to fifteen years from the launch date. Based on my experience and observations, the journey to the coveted dividend crossover point for many investors could easily take at least 10 – 15 years. This is all dependent on people’s savings rates, ability to keep investment costs and taxes low, and the availability of quality companies at affordable valuations.

I keep reminding myself that every investing journey is more of a Marathon than a Sprint. I tell this to myself as a reminder, after feeling good about some company I bought. This reminder is helpful from becoming too overconfident in my abilities, when the shares have appreciated or the dividend keeps growing and humming along.

I also remind myself that whenever I end up kicking myself for investing earlier in the month, when prices were lower later or vice versa ( not investing early in the month when prices are higher later). My research has uncovered that it doesn’t matter if you are buying at the high of the month, the low of the month or the close of the month, as long as you are investing every month. I believe that Time in the market beats timing the market.

Sometimes I get the urge to do some short-term move like buying a higher yielding security, which would increase current income, but would result in lower dividend growth going forward. The immediate gratification is great, and would immediately flow through my results. The problem is that the long-term dividend growth of the portfolio will suffer. I do not want to be in a position where I have reached my goal, but the dividend income is not growing organically.

Short-Term Wins May Lead To A Long Run Suffering

Going for the quick short-term wins may feel good, but would lead to a performance that suffers in the long run. Just like everything else in life, the good things in life take time to achieve. Delayed gratification works wonders in the end, but at the heat of the moment it is always challenging to go through the motions, constantly improving and grinding through in the initial stages. In the initial stages, it sounds like there is not progress to be made. In reality, the initial grind sows the seeds of future success.

For my portfolio, this means not overpaying for securities, focusing on defensive earnings streams, and well covered dividends. I want earnings that grow over time, in order to generate higher dividends over time. It means having adequate diversification, but focusing more of a bottoms up approach on defensiveness, rather than focusing on diversification for the sake of diversification. It also means focusing on quality, and using a streak of annual dividend increases as a factor in initial determination of quality. It also means having adequate risk controls in place, in order to focus on prudent allocation of new capital, strategic reinvestment of dividend income and knowing when to continue building a position versus letting a position go. It means focusing on a process, investing regularly and consistently, keeping costs low, and avoiding turnover like the plague.

At the end of the day the true results from this strategy won’t be felt until several years down the road. If the foundation is built right however, it would withstand anything thrown at it. It might even become stronger and more resilient as a result of any adversity.

That’s really the important part, because we want income to keep growing, even when all dividends are spent and no new capital is added to the portfolio.

Relevant Articles: