There seem to be to schools of thought when it comes to investing. One is the so-called value investors community, where folks look at low P/E ratios, high dividend yields, low price to book or price to sales. In other words, value investors try to acquire assets at a portion of their worth.

Q3 2020 hedge fund letters, conferences and more

On the other hand, there are some growth investors, who believe that companies with growing sales, and growing earnings are more valuable. They do sophisticated discounted cashflow analyses to project future growth, and discount at a certain rate to come up with fair value.

Warren Buffett’s Take On Value And Growth

Then there is Warren Buffett, who believes that Growth and Value are part of the same equation. Growth and Value are attached at the hip, which means that you have to look at both the valuation metrics like P/E or dividend yield for example alongside with growth in earnings or dividends.

Buffett stated the following in his 1992 letter to shareholders:

“Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth.” Indeed, many investment professionals see any mixing of the two terms as a form of intellectual cross-dressing.

We view that as fuzzy thinking (in which, it must be confessed, I myself engaged some years ago). In our opinion, the two approaches are joined at the hip: Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive.”

Looking At Value And Growth As One Thing

As a Dividend Growth Investor, I have followed an approach that looked at value and growth as one thing. I looked at things like P/E ratios, but also looked at growth, along with sustainability and defensibility of the earnings stream throughout past economic cycles. Please check my article on how to value dividend stocks.

I recently found the following video, which explains this neatly. (Youtube)

I have also included the transcript from the 2001 Berkshire Hathaway Meering your reference: (Source: CNBC)

13. “There is no such thing as growth stocks or value stocks”

WARREN BUFFETT: Zone 3.

AUDIENCE MEMBER: Good morning. Mo Spence from Waterloo, Nebraska.

You’ve often stated that value and growth are opposite sides of the same coin.

Would you care to elaborate on that? And do you prefer a growth company that is selling cheap or a value company with moderate or better growth prospects?

WARREN BUFFETT: Well, actually I think you’re — you may be misquoting me. But I really said that growth and value, they’re indistinguishable. They’re part of the same equation. Or really, growth is part of the value equation.

So, our position is that there is no such thing as growth stocks or value stocks, the way Wall Street generally portrays them as being contrasting asset classes.

Growth, usually, is a chance to — growth, usually, is a positive for value, but only when it means that by adding capital now, you add more cash availability later on, at a rate that’s considerably higher than the current rate of interest.

So, there is no — we don’t — we calculate into any business we buy what we expect to have happen, in terms of the cash that’s going to come out of it, or the cash that’s going to go into it.

Buying $200 Million Worth Of Simulators

As I mentioned at FlightSafety, we’re going to buy $200 million worth of simulators this year. Our depreciation will probably be in the area of $70 million or thereabouts. So we’re putting $130 million above depreciation into that business.

Now that can be good or bad. I mean, it’s growth. There’s no question about it. We’ll have a lot more simulators at the end of the year. But whether that’s good or bad depends on what we earn on that incremental $130 million over time.

So if you tell me that you own a business that’s going to grow to the sky, and isn’t that wonderful, I don’t know whether it’s wonderful or not until I know what the economics are of that growth. How much you have to put in today, and how much you will reap from putting that in today, later on.

And the classic case, again, is the airline business. The airline business has been a growth business ever since, well, you know, Orville [Wright] took off. But the growth has been the worst thing that happened to it.

It’s been great for the American public. But growth has been a curse in the airline business because more and more capital has been put into the business at inadequate returns.

Now, growth is wonderful at See’s Candy, because it requires relatively little incremental investment to sell more pounds of candy.

So, its — growth, and I’ve discussed this in some of the annual reports — growth is part of the equation, but anybody that tells you, “You ought to have your money in growth stocks or value stocks,” really does not understand investing. Other than that, they’re terrific people. (Laughter)

Charlie?

Not Having To Be Smart Again

CHARLIE MUNGER: Well, I think it’s fair to say that Berkshire, with a very limited headquarters staff — and that staff pretty old — (laughter) — we are especially partial to laying out large sums of money under circumstances where we won’t have to be smart again.

In other words, if we buy good businesses run by good people at reasonable prices, there’s a good chance that you people will prosper us for many decades without more intelligence at headquarters. And you can say, in a sense, that’s growth stock investing.

WARREN BUFFETT: Yeah, if you had asked Wall Street to classify Berkshire since 1965, year-by-year, is this a growth business or a value business — a growth stock or value stock — you know, who knows what they would have said.

But, you know, the real point is that we’re trying to put out capital now to get more capital — or money — we’re trying to put out cash now to get more cash back later on. And if you do that, the business grows, obviously. And you can call that value or you can call it growth. But they’re not two different categories.

And I just cringe when I hear people talk about, “Now it’s time to move from growth stocks to value stocks,” or something like that, because it just doesn’t make any sense.

Dividend Growth Investor here. That is a very insightful discussion from Warren Buffett and Charlie Munger.

The Returns And Sources Of Returns

When evaluating investments, it is very helpful to think about the returns and sources of returns. I follow the idea that returns are a function of three factors:

1) Initial Yield and dividend reinvestment

2) Earnings/Dividend Growth

3) Changes in valuation multiples

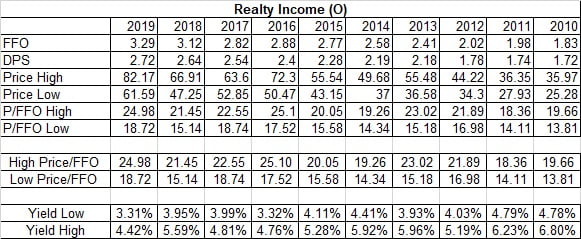

I will illustrate this principle by looking at Realty Income (O). Check my last analysis of Realty Income for more information behind the company.

In 2010 the stock sold between $35.97/share and $25.28/share. At an FFO/share of $1.83, this meant that the stock sold between 19.66 and 13.81 times FFO.

Someone looking at the range may have considered that 19 times FFO is “high” and 14 times FFO is a “low” price. The problem is that Realty Income never sold below 14 times FFO again. The closest it went to was 14.11 times FFO in 2011 and 14.34 times FFO in 2014.

Obviously, buying Realty Income at $25/share in 2010 would have worked out better than buying it at $35/share. But in reality, buying and holding the stock for the next decade would have entitled the investor to $20.47 in dividends between 2011 – 2019 and a stock that is selling at $60 as of the start of 2021.

The REIT grew FFO/share from $1.83 in 2010 to $3.29 in 2019. Even if you paid a notch too much, the growth in intrinsic value bailed you out.

Even if you paid 19 times FFO in 2010, you turned out fine, because the company kept growing FFO/share. As a result the value of the business grew as well. It definitely helped that the dividend increased from $1.72/share in 2010 to $2.72/share in 2019.

If FFO/share was flat however, dividends would have been flat as well. That would have likely depressed the Price/FFO ratio. Investors would have also most likely demanded a higher dividend yield.

Another REIT selling at an FFO/share of 15 in 2010 that did not grow, would have been more expensive going forward through 2020. That’s because its dividends would have remained largely flat, and the share price would have remained flat too, as intrinsic value failed to grow.

Of course, hindsight is always 20/20. But on the other hand, we only have past data when we are making decisions, which is why intelligent investors should look for ways to determine the likelihood that future results.

Realty Income is a quality company with a management team that has a proven track record of growing Funds from Operations, managing the portfolio etc.

I see Realty Income as the gold standard in triple net leases. The future is always uncertain, but I think the management has kept up with being transparent, and I have watched their collectibility slowly creep up. If you look at Price/FFO ranges in the past decade, the current high is within that range. The nice thing of course is that FFO/share grows over time, and the dividend is in my opinion secured by the cash flows from the leases. Value and growth are attached at the hip.

Relevant Articles:

- How Dividend Growth Investors can prosper even if interest rates increase

- Evaluating Dividend Growth Stocks – The Missing Ingredient

- How to value dividend stocks

- Rising Earnings – The Source of Future Dividend Growth

Article by Dividend Growth Investor