Below comment and analysis from Wave Financial Group on the importance of a diversified portfolio in today’s investment climate.

Diversification – The Only Free Lunch

As both traditional and alternative asset markets descend into turmoil this month, it’s important to remember the inherent strengths of a diversified portfolio. A market rout always causes correlation to go to 1 across virtually all assets as investors flee to the perceived safety of cash. This can give rise to unfounded narratives based on extremely narrow datasets as investors panic and question sound investment principles. The market always comes back.

These short-term correlations are not as important to portfolio structure as studying the way an asset reacts across a range of economic environments. For that reason, we’ve isolated our research on each market period. First, we explore the nature of historical correlations between cryptocurrencies and traditional assets, preceding the recent panic. Later on, we will dissect bitcoin’s behavior during the recent flight to safety.

Why You Should Be Diversified: Executive Summary

- Bitcoin has historically achieved nearly zero correlation with the US dollar and with US equities, EM equities, and the oil markets.

- On a risk-adjusted basis, a more diversified portfolio is more efficient.

- Bitcoin and stocks have different responses to changes in economic environments, which drives the volatile correlations observed.

- High correlation in a black swan doesn’t invalidate the benefits of diversification in every other situation, including (and in particular) sector-specific crises.

- The pattern of Bitcoin’s returns thus far should make any portfolio manager pause to consider the truly diversified source of risk it provides in a well-constructed portfolio.

Priming the Pump: Correlation as a Tool

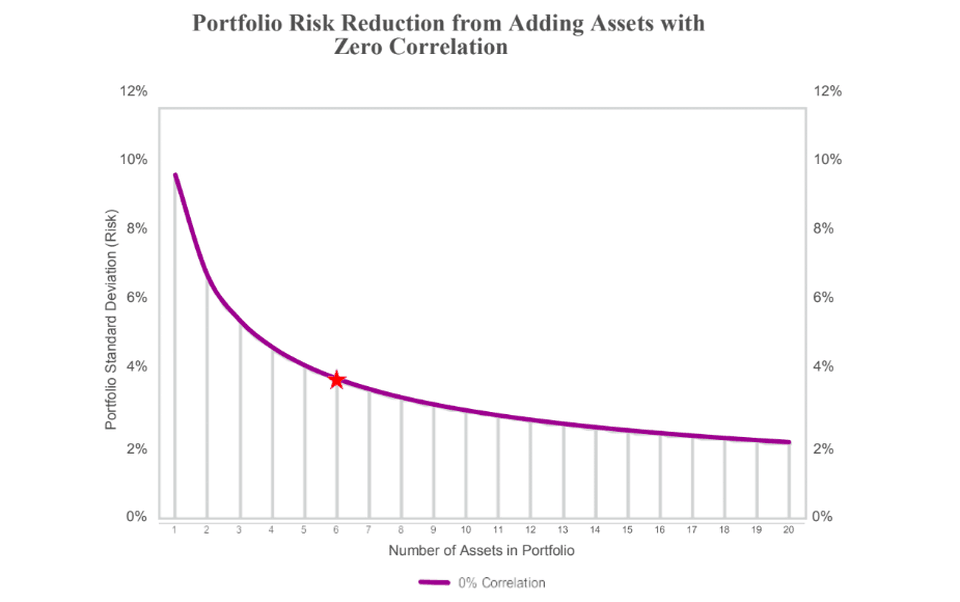

To begin at the beginning, adding low correlation assets to any portfolio will improve its risk profile. While the portfolio’s expected return will change commensurately, we evaluate portfolio performance on a risk-adjusted basis, and so we can produce any desired expected return from a portfolio of sufficient Sharpe ratio by merely adding in some leverage.

Portfolio Expected Volatility Decreases as 0% Correlation Assets are Added

(1)

Note the mechanism by which diversification reduces risk – even if you had assets all with the same expected volatility, low correlation means that as one asset swings into a downturn, the other has no reason to follow it down, and so returns are smoothed out.

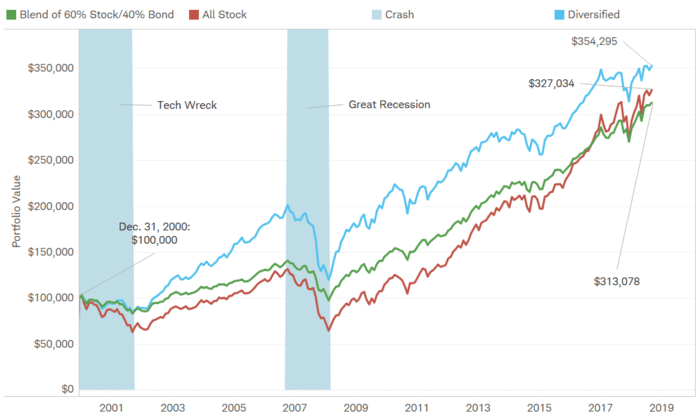

Cumulative Returns of Concentrated and Diversified Portfolios, 2000-2019

(2)

The above chart gives a sense of how diversification has performed through time, allowing for the fact that 2000-2019 is a peculiar and short time scale over which to observe gains.

Bitcoin’s Starring Role

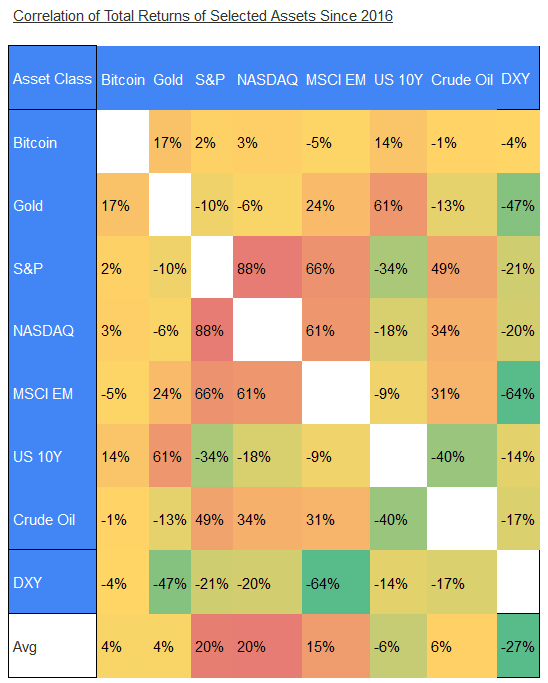

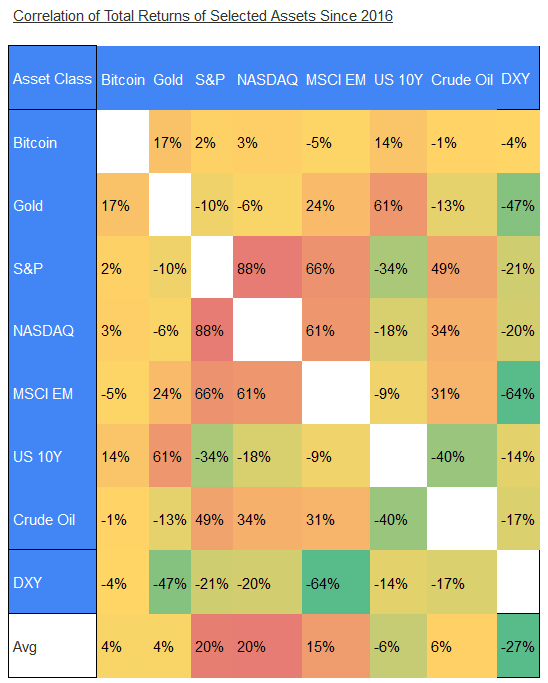

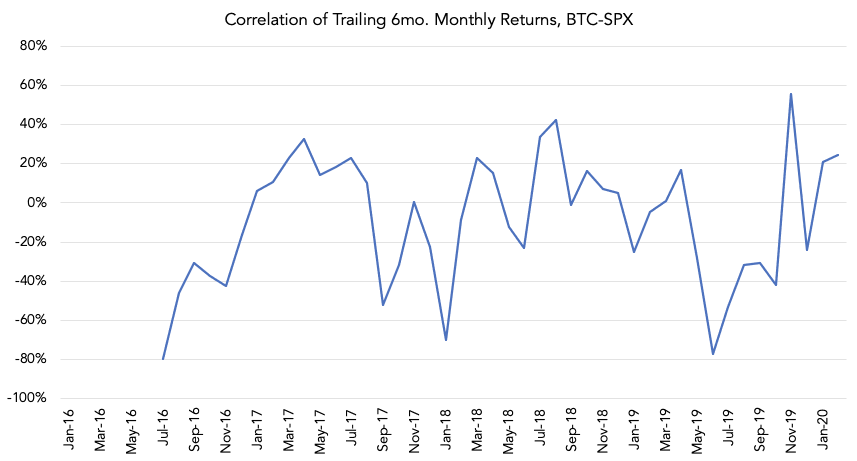

Equipped as we are now with some knowledge of the theory and recent market history, we can start to benchmark just how accretive a BTC investment into a traditional diversified portfolio might be. Bitcoin since 2016 has had low correlations to other assets. Moreover, this pattern has persisted in a random, unsystematic fashion.

A particular comparison between the correlations of BTC and gold is instructive. In the above table, gold features some astounding correlations: -47% against the US dollar, -64% against emerging markets equities.

On second notice, however, these correlations emerge almost as accounting identities – gold and the dollar cannot both go up at the same time, except in extreme circumstances, as they trade against one another (investors sell dollars to buy gold, or sell gold to buy dollars, which is not what happens when investors move from US bonds to US equities – there they are holding dollars all the time). Likewise for EM currencies, which are the main drivers of volatility in EM equity holdings.

BTC, by contrast, has achieved nearly zero correlation with the US dollar and with US equities, EM equities, and the oil markets. One fact this pattern suggests is that the sources and uses of capital in the BTC markets are not the same as in traditional markets – else BTC could not have the same level of correlation against so many different assets.

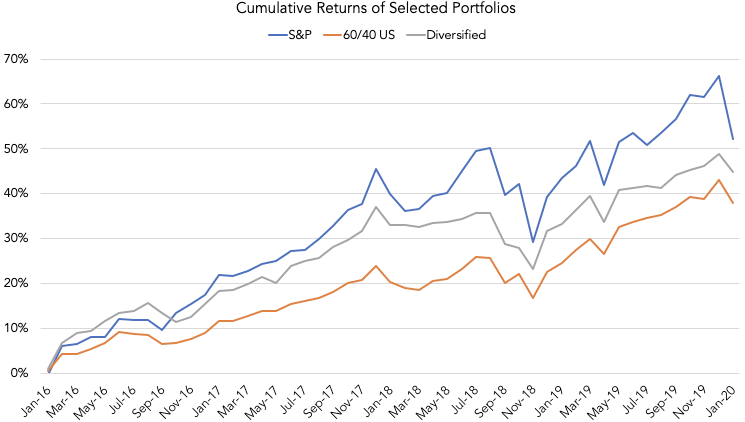

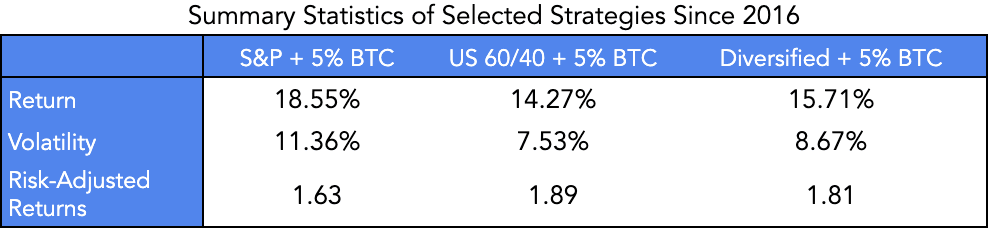

Having established a sense for how correlated BTC is against other assets, we next take a look at how different portfolios would have done over the same period with a tilt towards Bitcoin. Following the lead of the chart above, we examine a long-only S&P 500 portfolio, a US-based 60/40 portfolio, and a diversified portfolio.

(4)

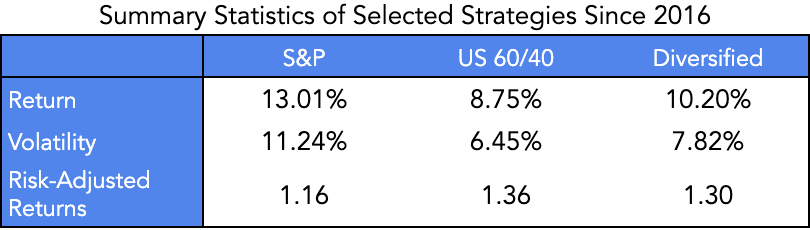

As you see above, given the incredible bull market for equities, it’s no surprise that being long-only US equities has outperformed other strategies. But this is merely evaluating on a returns basis – all of that outperformance comes from S&P vol being higher than the volatility of either the 60/40 or the Diversified portfolio.

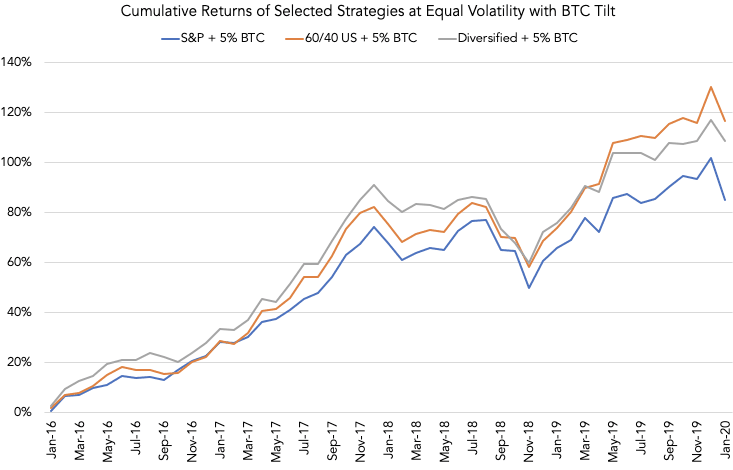

On a risk-adjusted basis, the more diversified portfolios are more efficient, so we ought to see higher returns at equity-level volatility for each of them. We can model this by levering up the holdings in the other two portfolios. Once done, the benefits of diversification are plain to see:

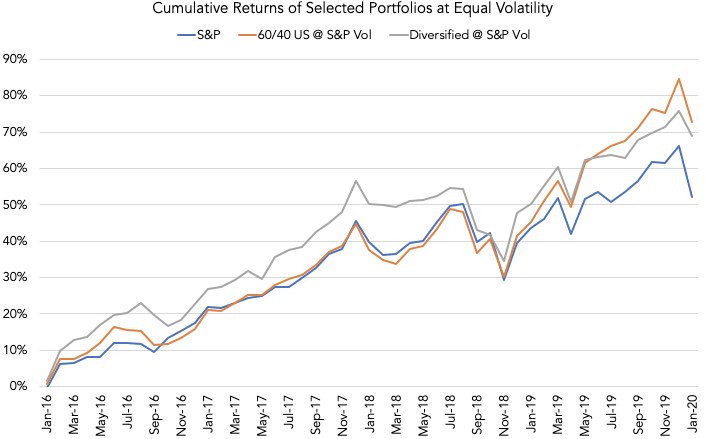

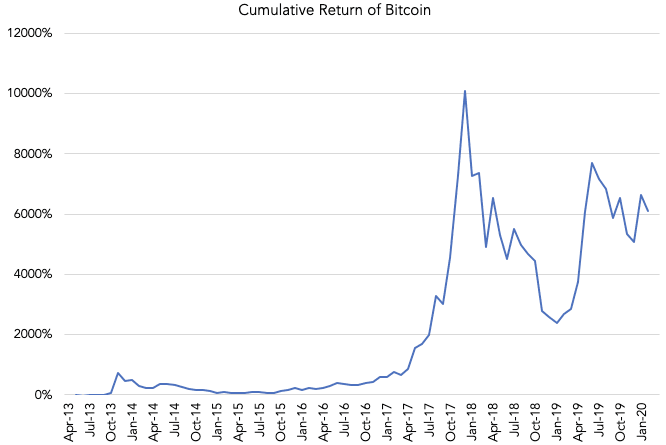

Now we want to conduct the same analysis, but for a tilt towards BTC. Again, some priors: the performance of Bitcoin as an asset class in the past decade is like nothing before seen in financial markets.

Performance like that gives it an annualized return of 113% and an annualized volatility of 85% since 2016. Traditional assets achieve performances of that magnitude usually only via bankruptcies, in which case the signs on an investor’s return are unhappily reversed.

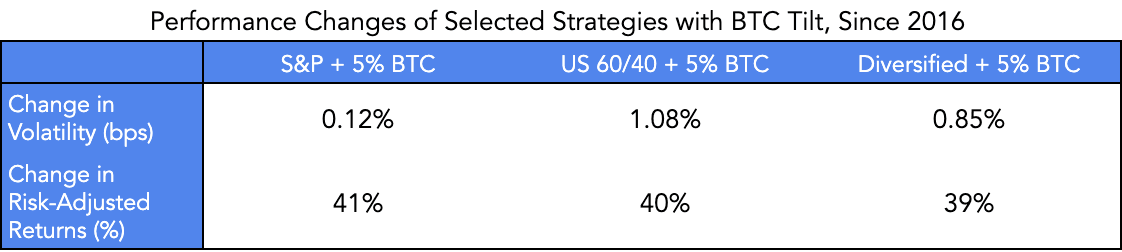

These dramatic characteristics, however, may be moderated through prudent weighting within a portfolio: a portfolio of 95% cash and 5% BTC, for example would have had since 2016 an annualized volatility of 4.25% and annualized return of 5.6%, while retaining its low correlation to other assets. If we adopt this approach towards risk-weighting and add a BTC slice of that size to the portfolios we examined above, we observe the following:

The upshot: a small addition of BTC to each portfolio dramatically improved its efficiency, raising risk-adjusted returns in every strategy while raising volatility only moderately.

For a final illustration, we examine the cumulative performance over time of each strategy with its tilt, scaled to native equity volatility.

Not bad for a free lunch!

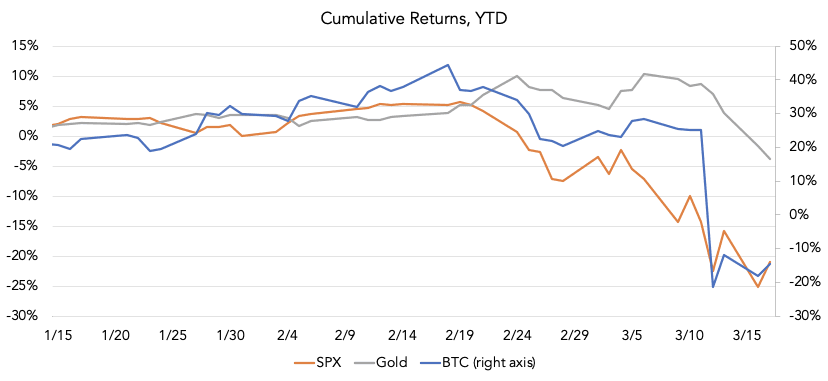

Assessing The Benefits Of Diversified Portfolio In Crises

The outbreak of truly concerning movements in the financial markets, with consecutive circuit breakers in the equities markets, multi-trillion dollar stimuli across the globe, 40% plunge in the price of BTC and stocks has hurled us into an entirely new dynamic. While short-term insights can be gleaned from emerging data, the importance of these insights can be difficult to ascertain until the turmoil has played out. Therefore we’ve chosen to insulate our long-term historical insights from the last two weeks of data, and instead parse that recent volatility separately.

With that said, it’s worth taking another look at what’s happened recently in order to (1) shore up some of the theoretical predictions made earlier and (2) reassess what benefit a diversified portfolio is in a real honest-to-God crisis.

The reader is likely familiar with the following financial facts, but they are worth a quick revisit:

The impact of the novel coronavirus on the global economy has rapidly brought an end to the longest bull market in history, and for good reason: already activity is slowing to a crawl across the developed world, while the emerging economies which power so much of our growth are either shaking themselves back to life, like China, or yet to feel the full brunt of the disease, like India or the Latin American economies.

But if this were only a growth shock, you might expect stocks and growth-sensitive commodities like oil to underperform, while assets which don’t have as great a sensitivity to growth to muddle through without large price declines.

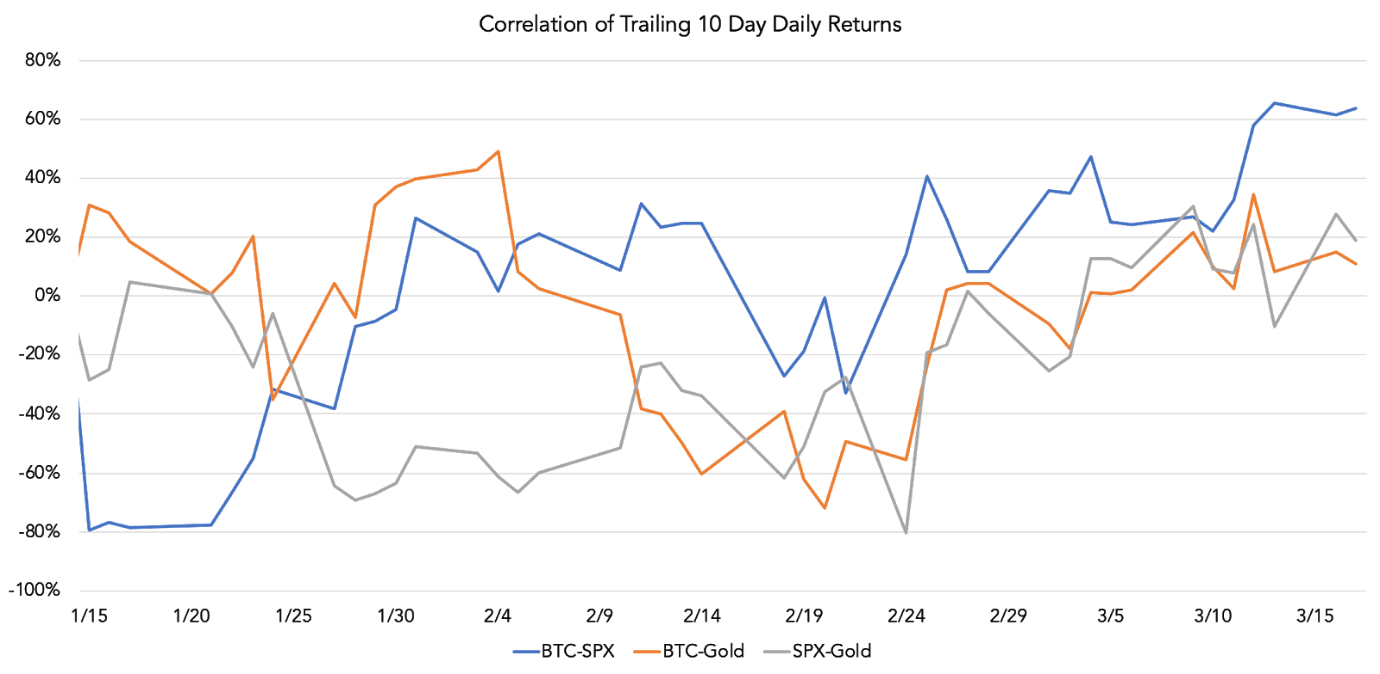

These varying responses to different economic environments are the basis of correlations between assets. In some sense, BTC and stocks must have different responses to changes in economic environments, else we wouldn’t observe the volatile (yet, on average, negative!) correlation between them that we do.

In this period, however, we haven’t seen that; to the contrary, all assets have nosedived in tandem with stocks.

One way to see that, aside from looking at cumulative returns plunging in unison, is to measure correlations. Indeed, previously volatile correlations have made way for a harmonizing towards unity, as correlations between all assets approach 1.0.

What lessons can we take from correlation behaviors in a crisis? In the first place, the common competition between assets and cash is an undiversifiable risk – when all hell breaks loose, nothing looks as good as holding your principal steady (before March 14th, you could still get 1.25% on it!).

No passive holding would do well, so there isn’t any cleverer allocation a portfolio could hold to protect itself from something like this. Environments like these are instead the province of active management, but that’s another story.

In the second place, the lack of diversification in a crisis doesn’t invalidate the benefits of diversification outside of crises. Crises are still rare, and even seemingly dire events in the global economy don’t usually rise to the level of triggering asset-wide selloffs. Instead, normal reactions take place: if, say, another oil shock were to emerge (itself less likely given changes in the distribution of the supply of oil and the level of demand of oil, but, again, another story), you might see violent moves in inflation-linked bonds, nominal bonds, commodity-producer currencies, commodity-importer currencies, factor-exposed equities, non-factor-exposed equities, gold, and certainly oil, but those moves would differ. And in an environment like that, diversification would be precisely the cure to a concentrated portfolio’s ills.

Bitcoin is too young to tell us precisely what it’ll do in certain cases – for instance, the world hasn’t seen high inflation since 1981. The pattern of Bitcoin’s returns thus far, however, should make any portfolio manager pause to consider the truly diversified source of risk it provides in a well-constructed portfolio.

Authors:

Henry K. Elder, Director Investment Strategies, Wave Financial

Ryan Anderson, Associate, Wave Financial

About Wave Financial

Wave Financial (Wave) is a Los Angeles and London based investment management company that provides institutional digital asset fund products. Led by a team of highly experienced financial services professionals, Wave applies traditional investment strategies to digital assets and in a tokenized form of high growth, real assets such as whiskey. Wave also provides treasury management services and consultation to the digital asset ecosystem.

Wave is regulated as a California Registered Investment Advisor (CRD#: 305726).