Tom Morello, of Rage Against The Machine, whose last tour was sponsored by Capital One, tweets his support for Black Lives Matter.

Nasdaq Hits New High Despite America’s Chaos

America is going through its worst civil unrest in 52 years, with business districts in major cities looted.

Tweet via journalist Michael Tracey.

More than 112,000 Americans are dead from COVID-19, an epidemic that was so worrisome that many of America’s governors banned outdoor gatherings and shut down most economic activity for two and a half months. Then they turned on a dime and allowed the George Floyd protests, which coincided with an orgy of rioting across the country.

So why did the Nasdaq hit a new high on Tuesday? In my previous post, I offered two explanations for why the market was unperturbed by the chaos:

Two reasons come to mind. The first is that the messages of solidarity with the protesters by brands from PepsiCo’s Doritos to Disney’s Star Wars suggest Corporate America has nothing to fear from the unrest, aside from some smashed in storefronts.

The second is that the tolerance of the mass protests indicates that the COVID-19 lockdowns are effectively over. So, after the unrest ends, the economy can reopen. COVID-19 deaths will tick up or down, but economic life will go on.

Evidence since then suggests both reasons were correct.

Raging With The Machine

To support the first point, that the protests were raging with the machine rather than against it, I was going to link to Ashley Rae Goldenberg’s Medium post listing the companies and brands that had come out in support of Black Lives Matter.

But Medium took down her post and suspended her account. Before they did, a Twitter user recorded his phone scrolling through the list. It included 279 companies and brands at last count, from Activision Blizzard to Zoom. Might as well add Medium to it and make it 280.

Meme via Twitter.

Outdoor Gatherings And Ending The Lockdowns

Conveniently enough given the moral panic about George Floyd, the World Health Organization has now decided that asymptomatic COVID-19 carriers aren’t that contagious after all.

Tony Robbins tweets the WHO’s about face on COVID-19.

Also on Tuesday, the governor of New Jersey, the state second-worst hit by COVID-19 after New York, announced he was allowing “non-protest” outdoor gatherings (this, after he had joined in a George Floyd protest over the weekend that violated his previous executive order against outdoor gatherings).

Tweet by New Jersey governor Phil Murphy.

Investing Implications: Bet On The Machine

The investing implications here are clear: bet on the machine. Portfolio Armor is doing that now with its top names. I mentioned in a previous post that we recently changed the way we selected our top names:

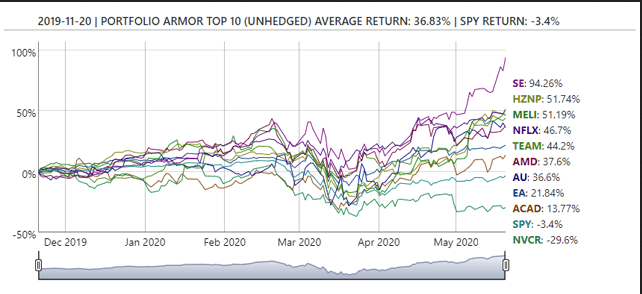

At the same time, we’ve been tracking the performance of our “cash substitutes” list. These are names that are expensive to hedge with puts, but generate large net credits when tightly collared. We actually started tracking the performance of these a few months earlier, but cash substitute performance began to explode higher in November. Here’s the performance of the November 20th cohort.

In early March, when the previous version of our ranking system had shifted mostly away from stocks, the cash substitute list was already going long tech names like Tesla and Nvidia. As a result, it has outpaced SPY since the March lows.

Since the cash substitutes have done so well, names that fit the cash substitutes criteria get a corresponding boost on our daily top names ranking. As of Tuesday, 7 of the 10 top names were also cash substitutes, and 8 of 10 were stocks. Portfolio Armor is betting on the machine, but, as always, hedging in case it ends up being wrong.