For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

Two weeks ago, I called the 20th century an era of Growth, and the 21st century an era of Debt, since over 80% of our national debt was added in the last 20 years, while our growth rate was cut in half. Now, the situation is about to worsen.

In the short term, we face an 11th hour debt ceiling debate with little or no thought of long-term debt reduction or tending that abandoned orphan in this drama: Prosperity – Growth!

Looking at debt first, April is generally a big tax-income month due to the major April 15 tax deadline, but not this year. April 2023 saw the monthly budget surplus fall 73% from April 2022, according to The Wall Street Journal in an editorial (“Spending Soars, Revenue Falls”). The Journal added these details:

“The deficit for the first seven months [of FY’23] is already $928 billion, or 236% higher than in 2022 with timing adjustments. Keep in mind that this is happening when the economy is still growing, and the unemployment rate is still low. The big culprit is spending, which is up 12% in the first seven months, or nearly $400 billion…

Entitlements are up 11% and education spending owing to student-loan changes is up 56%… Interest on the national debt rose 40%, or $107 billion, and is already $374 billion for the first seven months” (Wall Street Journal, May 8, 2023).

James Madison’s Rule Book

Nobody likes to wade through 18 column inches (half a meter) of statistics, so I usually try to place these columns in a broader historical perspective. Last Tuesday was the 272nd birthday of that vertically challenged (5’4”) but brilliant Virginia statesman, James Madison, who drafted that most brilliant compromise ever struck between freedom and order, The United States Constitution (1787).

Madison also had to fight for the Constitution’s ratification in The Federalist Papers, along with John Jay and Alexander Hamilton, in what amounted to 85 intelligent newspaper Op-Ed pieces within a 7-month window.

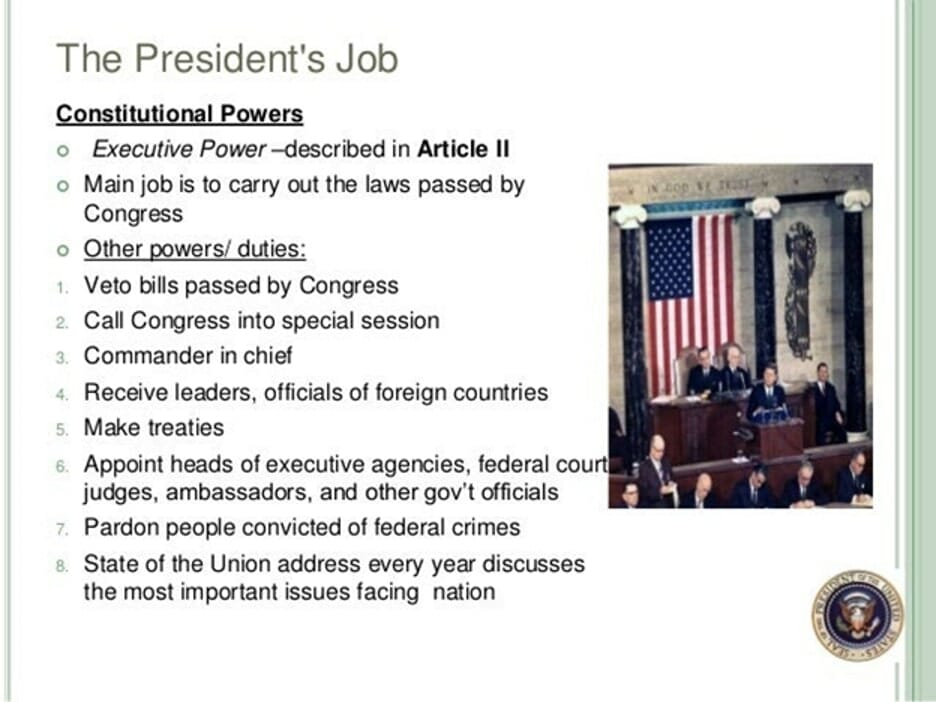

In Article I, Madison defended giving primary authority to a bi-cameral Congress with limited enumerated duties. Then, in a shorter Article II, he assigned very few duties to the Chief Executive.

Section 1 of Article II is about the election process, and Section 4 covers impeachment. Just to show you how limited the President’s role is, his entire duties in Sections 2 and 3 can be summarized in 150 words:

Article II, Section 2: “The President shall be Commander in Chief of the Army and Navy of the United States…and he shall have Power to grant Reprieves and Pardons for Offences against the United States, except in Cases of Impeachment.

He shall have Power, by and with the Advice and Consent of the Senate, to make Treaties, provided two thirds of the Senators present concur; and he shall nominate, and by and with the Advice and Consent of the Senate, shall appoint Ambassadors, other public Ministers …

Article II, Section 3: “He shall from time to time give to the Congress Information of the State of the Union, and recommend to their Consideration such Measures as he shall judge necessary and expedient; he may, on extraordinary Occasions, convene both Houses, or either of them, and … he shall take Care that the Laws be faithfully executed, and shall Commission all the Officers of the United States.”

That final and most time-consuming duty – executing the laws Congress passes – implies that Congress must pass those laws first. The President does not pass laws by Executive Order or any other shortcut or sly skullduggery.

There’s nothing in Madison’s masterpiece authorizing about 95% of what most modern Presidents do, or about 98% of what President Biden is doing now, most notably the power to bypass the free choice of most citizens, corporations, and Congress by forcing the remaking of all automobiles within a decade, or outlawing fossil fuels and remaking all utilities – virtually killing the world’s growth engine.

Taking Over the Auto Industry and Utilities by Presidential Fiat

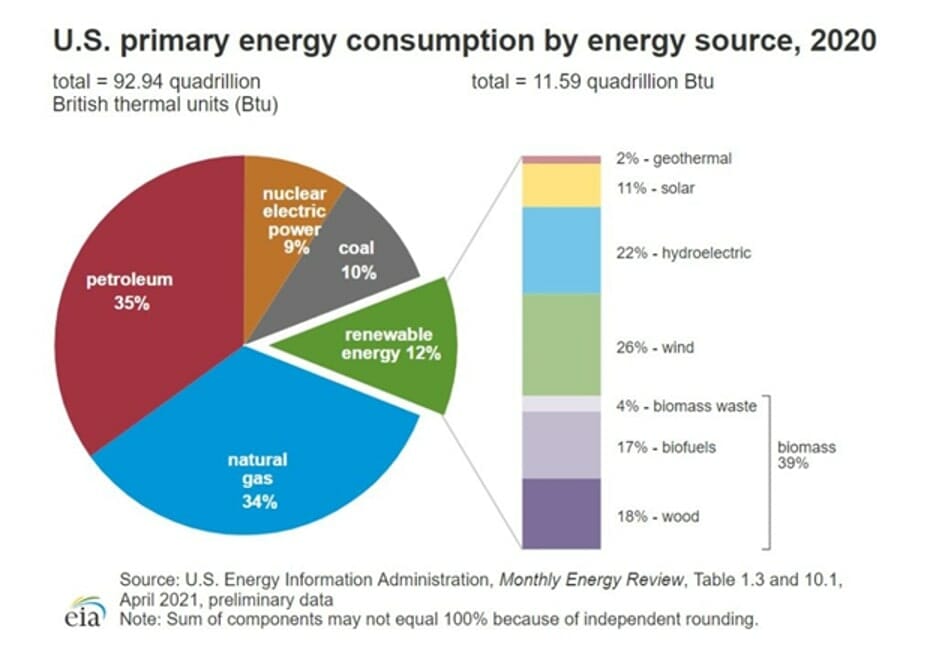

Last week, the Biden EPA unveiled a massive new rule book to mandate that most U.S. coal- and natural gas-fired power plants reduce their carbon dioxide emissions by 90% in the five years after 2035 or be closed by federal regulators.

According to Energy Information Administration (EIA) data, this new rule would target 60% of all U.S. power plants. Congress was not consulted, as is required by Madison’s rule book. The dates may seem far away, but plants would need to retool very soon to meet these deadlines.

These transitions are very expensive, and likely would have little or no impact on the climate, yet they will likely result in the bankruptcy of some profitable (as well as many marginal) businesses.

Politicians who make these decisions have seldom run a business and don’t understand cost tradeoffs. Maybe the Congress (Article I) or Supreme Court (Article III) or voters will veto these abuses of power before 2025.

You could argue that the omnibus “Inflation Reduction Act” gave the President scope to regulate fossil fuels, and the Supreme Court may decide that, years from now; but a cleaner way to draft laws is to simply outlaw the internal combustion engine or fossil fuels, if that is your intent, not use weasel words.

This nationalization of the automotive industry is something like what the totalitarians of Europe tried to do in the 1930s, and FDR tried to emulate with his National Industrial Recovery Act (NIRA) of 1933, struck down by the Supreme Court in 1935 when some Kosher butchers refused to put the NRA Eagle above their religious dietary codes (I simplify, but it’s not much different than today’s ban on gas stoves).

Whether or not climate change is an “existential crisis,” many scientists, engineers, and economists know of far better and sounder ways of getting from point “A” to point “B” than banning one form of energy and enforcing another by fiat and expensive mandates.

In today’s world, reliance on electricity alone for all power in homes, vehicles, and power grids for our expanding array of electronics and power needs is a national security risk of immense proportions. Even today, our electricity grid cannot support our needs.

What about weather disruptions? Last week there was an earthquake that cut off power in San Francisco for large portions of the population. What if electricity is our ONLY source of power? What happens when an earthquake hits the Gulf of Mexico region, and millions are mandated to evacuate in hundreds of thousands of electric cars on stalled Interstate highways with no electric charging stations that work and cars with an effective six-hour charge?

What happens on the West Coast when a quake in the Cascadia or San Andreas fault shuts off electricity for a week? Or in the East Coast in winter during an arctic blizzard storm when all electricity is cut off? Today, we have our automobiles, trains, and trucks to help those in need, to deliver food and supplies by gasoline-powered vehicles in a pinch. What will he have tomorrow?

The Costs of This Transition Will Be Astronomical – Limiting Future Growth and Fueling Massive Debts

We can’t grow or profit when we force losses on major corporations. Ford is losing more than $66,000 on every EV unit sold, according to energy economist Robert Bryce, and GM is losing $58,000 per EV.

The average income of an EV buyer is twice the national average, as EVs are currently mostly being bought by consumers who drive short distances, can charge them easily, and are wealthy enough to afford them; but a huge portion of America lives in rural states, subject to weather disruptions and heavy usage.

A second theme I have often covered here is – “Who will rule the 21st Century: China or the U.S.?” While the U.S. is incurring voluntary hamstring injuries to its biggest growth muscles, China has no conscience.

Energy data organizations like Global Energy Monitor and the Centre for Research on Energy and Clean Air report that China has quadrupled the number of its new coal-powered plant approvals in 2022 vs. 2021, and “China has six times as many plants starting construction as the rest of the world combined.”

India and China, with 35% of the world’s population, have the dirtiest air and don’t seem to be doing much about it, making our Herculean efforts to clean up our already-clean air noble but pointless.

Heartland Institute President James Taylor reminded us: “This proposed rule would be the death knell of America’s global economic competitiveness and a dream come true for a hostile China…

We simply cannot remain globally competitive if we eliminate the utilization of America’s most affordable, reliable energy sources — which this regulation would do — while China, India, and most of the rest of the world wisely continue to power their economies on affordable coal and other conventional energy sources.”

We’re driving into an unknown world. Engineer Ken Gregory estimates that “the total capital cost of electrifying the U.S. economy via wind and solar power is estimated at $290 trillion,” or 13.5 times the 2019 (pre-COVID) GDP. Can we afford this, much less the risk of a coming total energy failure?

Navellier & Associates does not own Ford Motor Co. (F), or General Motors (GM), in managed accounts. Gary Alexander does not own General Motors (GM), or Ford Motor Co. (F) personally.