In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

China’s economic activity is still contracting based on its official Caixin Purchasing Managers Index (PMI), which slipped to 49 in December, down from 49.4 in November. Analysts at Nomura said, “A large wave of Covid inflections has swept across the country since early December, which resulted in a sharp disruption to mobility, shipment and business activity.” That is the bad news.

Q3 2022 hedge fund letters, conferences and more

The good news is that as the Chinese population achieves “herd immunity” after recovering from the latest Covid variant, China’s economic activity should increase in the upcoming months.

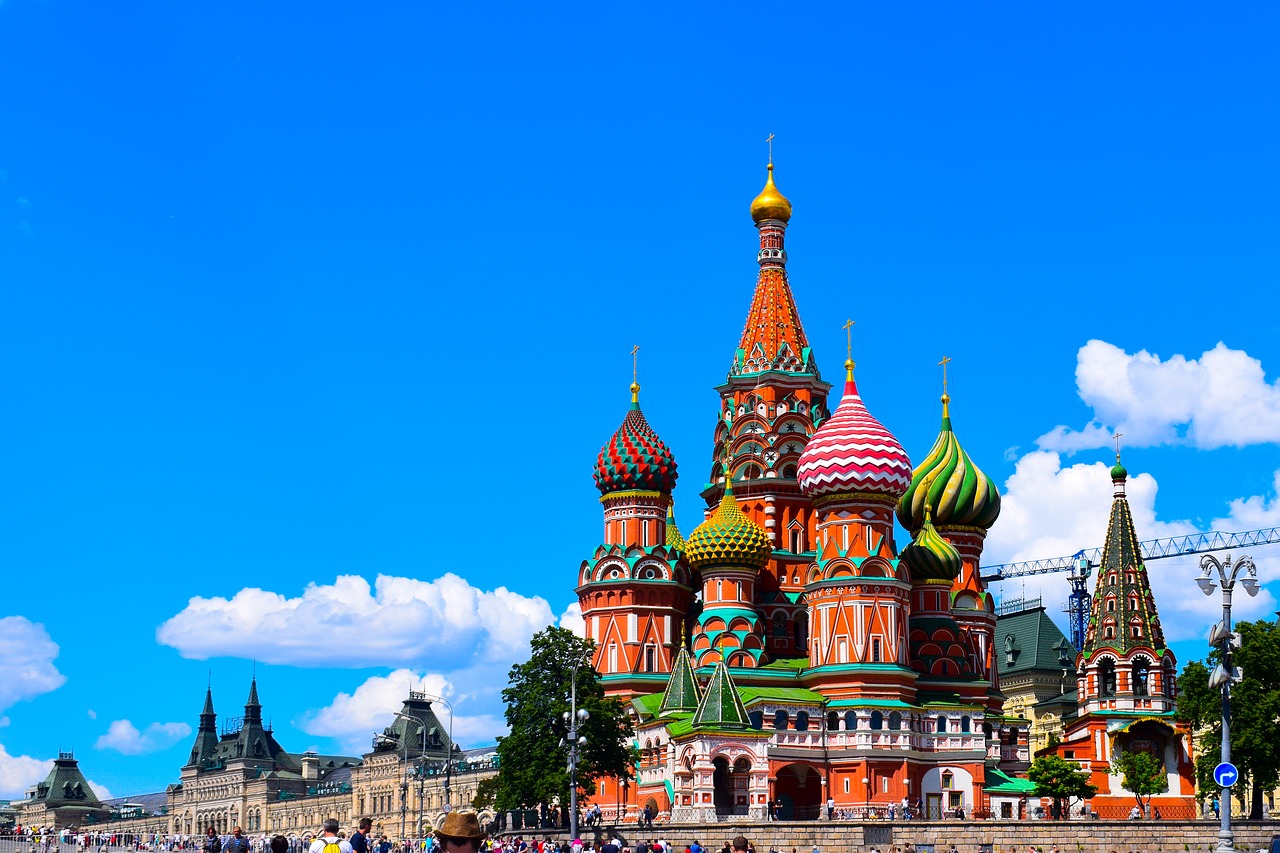

Winners From Russian Chaos

Russia remains a wildcard for the global economy and energy markets around the world. Despite an anticipated 12% Russian crude oil production cut, India has become the primary winner from the chaos, since India is refining Russian crude oil and exporting refined products (e.g., diesel, heating oil, jet fuel and gasoline) back to Europe and other countries.

Turkey is another winner from the Russian chaos since its exports rose 13% to $254 billion as Turkey refused to comply with Western sanctions on Russia. Inflation has been running at an 80% annual pace in Turkey as the country’s unorthodox monetary policies have caused inflation to spiral out of control. However, a weak Turkish lira has also helped the country boost its exports.

The U.S. has also been a winner from the Russian chaos, but the Biden Administration’s sale of over 180 million barrels of light sweet crude oil from the SPR is expected to abruptly cease, which I anticipate will cause crude oil prices to rise as seasonal demand picks up. As a result, I expect big energy bets to pay off in the upcoming months.

Natural gas prices are low due to unseasonably warm winter weather in both Europe and the U.S., while crude oil prices remain relatively firm. Outside of the energy sector, expectations for earnings remain very low due to difficult year-over-year comparisons as well as a strong U.S. dollar impeding multi-international companies.

I also expect the blowback against ESG investing to persist since all those ESG portfolios at major universities that shunned fossil fuels and in blue states had a rude awaking last year. Fossil fuels accounted for approximately 84% of the world’s energy output in 2022, up from 80% in 2020, just two years earlier.

In fact, the International Energy Agency (IEA) said that coal consumption is due to hit an all-time record in 2022, due somewhat to the fact that Germany reactivated many of its closed coal plants, plus all the new coal plants in China and India.

Decisive Day

The other thing to watch in the New Year is the analyst community. Often when the analyst community gets back from skiing and their holiday vacations, they tend to update their fourth-quarter earnings announcements. I for one will be curious if the analyst community will be revising their earnings estimates higher or lower in the first half of January before the fourth quarter announcements commence.

Before the fourth quarter earnings announcement season kicks off, January 12th is expected to be a decisive day. Specifically, that is when the December Consumer Price Index (CPI) will be announced. There is a CPI component, Owners Equivalent Rent, that should start falling since it represents housing and rental costs.

In the past 12 months, pending home sales declined 37.8% and home sales have plunged to the lowest level since immediately after the pandemic. If the Owners Equivalent Rent component stops rising or even declines, the CPI and core-CPI (excluding food & energy) should moderate, which will help convince both the bond market and Fed that inflation is cooling off fast.

Outside of energy, there are no sectors in the S&P 500 that are forecasted to post positive earnings growth, so it is slim pickings out there when looking for stocks with strong sales and earnings. We are now in a 15% market, where once we leave the top 15% of stocks, there are lackluster sales and earnings. As a result, I expect that the overall stock market will be led by barely 15% of stocks with positive sales and earnings as well as positive guidance.

Bunny Stocks

You may have noticed in December how illiquid the overall stock market has been. This is a good time to remind you that many small-to-mid capitalization stocks are “bunny stocks” that like to “sit” and “hop” four times a year around their quarterly earnings announcements.

The rest of the time, Algorithmic trading systems from Citadel and Virtu Financial are running “mean reversion” programs to create stock movement to stimulate trading and to “shake out” uncertain investors. The good news is these stock market algorithms tend to disappear around earnings announcement season!

I want you to enjoy the upcoming earnings announcement season since I expect that it will be every stock for itself in the upcoming weeks. The overall stock market is grossly oversold as demonstrated by the fact that my small-to-mid capitalization stocks are trading at 6.8 times median current earnings and just 2.8 times median forecasted 2023 earnings.

I must add that we are in unchartered waters since I can never remember when valuations have been so low. Clearly, the price-to-earnings (PE) compression has become ridiculous and relentless as many Tesla shareholders have learned since last May when Tesla was kicked out of the S&P 500 ESG index, which resulted in relentless institutional selling pressure.

As major technology stocks fall in weight in the S&P 500, it triggers more systematic selling pressure as the tracking managers that dominate Wall Street trading are forced to cut their technology exposure. When the technology bubble burst back in March 2000, the institutional selling pressure persisted for seven straight years.

Back then, small-to-mid capitalization stocks in the tail end of the S&P 500 became the new market leaders. That is effectively where we are at the present time since I expect more small-to-mid capitalization stocks to lead the way.

We are now at the time of year when a January effect often occurs and small-to-mid capitalization stocks become the new market leaders. If small-to-mid capitalization stocks follow their forecasted earnings higher, they would easily appreciate 100% or more in 2023.

If forecasted median 2023 price-to-earnings ratios expanded from 2.8 to 5.6 times earnings, then small-to-mid capitalization stocks could appreciate 200% or higher. As a result, 2023 is shaping up to be a potentially incredible year for small-to-mid capitalization stocks.

Coffee Beans

A West Virginia woman was reunited with her long-lost wallet after losing the item at a school dance nearly 55 years earlier. The school closed permanently in 2019, and workers renovating the building to become apartments saw the wallet fall out of some ductwork, along with several long-lost items. Source: UPI. See the full story here.