For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

Tax-Filing Deadline

As April 15 approaches this weekend, rest assured that your tax-filing deadline has been postponed, not just one day, not just two days to Monday, which turns out to be Emancipation Day in Washington DC, where federal workers have more days off than anyone in America, but to Tuesday, April 18 this year.

Q1 2023 hedge fund letters, conferences and more

April 18 happens to be Patriot’s Day in Boston, the evening when Paul Revere made his midnight ride, replicated these days in the Boston Marathon, when feather-weight East Africans won 19 of the last 20 races, running 26 miles in the opposite direction – toward Boston – with this year’s race held on April 17.

Americans fought for freedom from lower British taxes than we face today, but April 12, ironically, marks a little-observed tax victory. On April 12, 1770, the British Parliament actually listened to our faraway tax protest by repealing most of the dreaded Townshend Acts, the bills passed in 1767 and named after their sponsor, Charles Townshend.

These acts levied a controversial set of tariffs, including duties on paint, paper, and tea. Colonial outrage prompted the British to roll back all of those hated acts and revenue duties, except that pesky one, the tea tax, which led to a certain Tea Party in Boston later on.

But don’t get complacent. President Biden is no Charles Townshend. Our fearless leader, who looked us in the eye and said he would never raise taxes on anyone earning less than $400,000, has proposed a gigantic tax increase that will hit those earning well under $400,000 as well as almost everyone else.

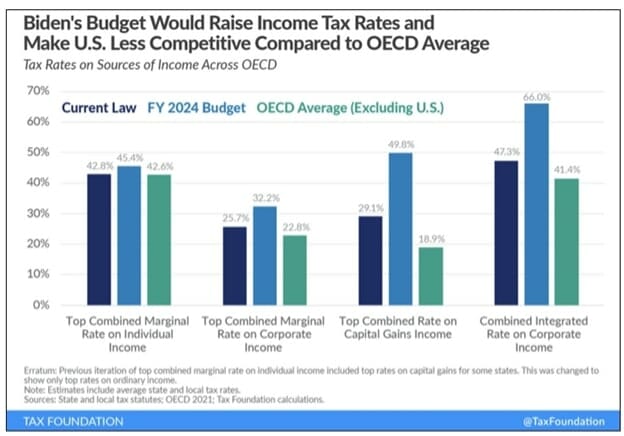

Within the President’s massive 2024 budget are tax increases that the Tax Foundation computes would leave the USA with the highest income tax burden of any of the 38 Western OECD countries:

The top capital gains tax rate (near 50%) is particularly chilling, as well as the nearly two-thirds (66%) total rate on corporate income. Investors and corporations might as well throw in the towel if this bill passes.

Biden's Tax Bill May Not Pass

The good news is this bill won’t pass. President Biden’s budget (and this tax rip-off) are dead on arrival on Capitol Hill, thanks to last November’s narrow Republican majority in the House, but something like this level of highway robbery will be on the table in conference rooms between now and the end of 2023.

Also, don’t forget that inflation is pushing many Americans into higher tax brackets. Inflation is the quiet tax increase on the middle class and poor. The recent Inflation Reduction Act “may go down as one of the greatest confidence tricks on taxpayers in history,” said The Wall Street Journal in an editorial on March 25, 2023.

It was promised to cost $391 billion in the decade from 2022 to 2031, but now, the Journal says, “A Goldman Sachs report projects its myriad green subsidies will cost $1.2 trillion – more than three times what the law’s supporters claimed.”

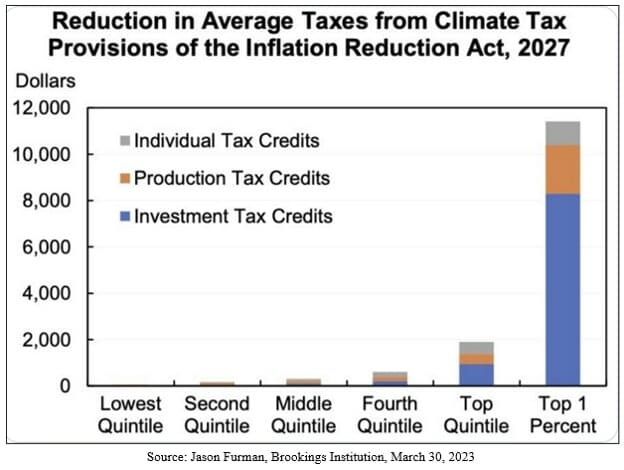

Furthermore, Jason Furman of Harvard University and the left-of-center Brookings Institution (Furman was also head of the National Economic Council in the Obama Administration) said the green energy subsidies of this “Inflation Reduction Act,” went mainly to the rich.