Many investors probably feel a lot like Wile E. Coyote right about now.

Q1 2021 hedge fund letters, conferences and more

They’ve run off the edge of the cliff, and now reality is catching up with them.

This is particularly true for traders following momentum strategies — and other investors unconsciously doing the same — since mid-February.

Momentum trading sounds simple. You buy stocks that are going up the most and sell them before they go down again.

The buying part is easy. Just follow the crowd.

Deciding when to sell, on the other hand, is the hardest job in investing.

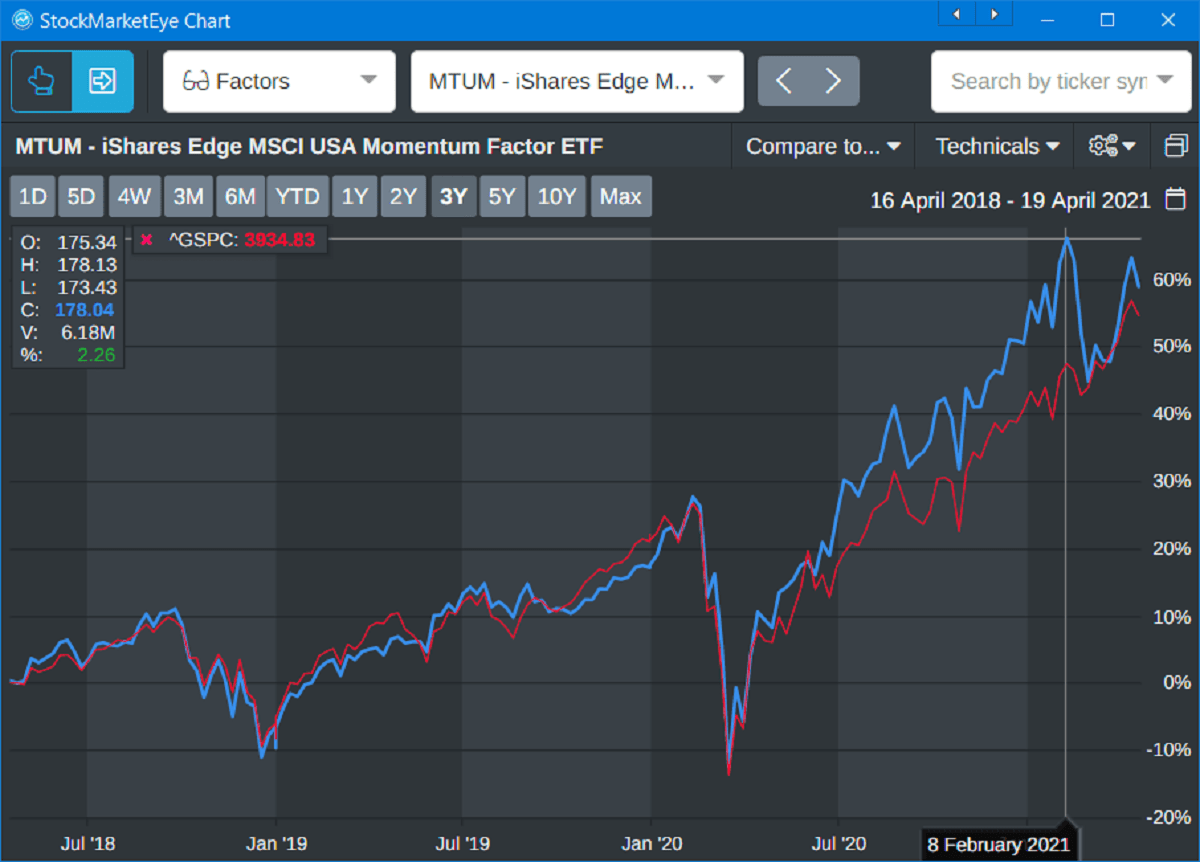

The chart below shows the iShares MSCI USA Momentum Factor ETF (NYMARKET:MTUM). It’s the largest U.S. exchange-traded fund (ETF) following a momentum strategy. It holds stocks that are rising significantly faster than the rest of the market.

For the last decade, those have mostly been technology stocks. MTUM (in blue) usually tracks the S&P 500 (red) closely.

But starting at the COVID-19 market bottom in March last year, it broke away. At one point it exceeded the S&P 500’s performance by nearly 20 percentage points.

This was unusual by historical standards.

The next chart shows MTUM’s progression since it started trading in 2013.

Carried Away

During uncertainty about the Fed’s interest rate intentions from 2015 to 2017, momentum stocks slowed. They became overbought during 2018 and pulled back at year-end on interest-rate fears. But they recovered in 2019, and by early 2020 momentum stocks were once again significantly above their historical trendline.

(Click here to view larger image.)

But the most important thing about this chart is the enormous gap between the red trendline and MTUM’s performance since the COVID-19 low. Momentum stocks’ gains have been out of all proportion to previous years.

Why?

Following the Herd…

Some of the companies in the momentum category had solid reasons to grow their stock price last year, such as Amazon and Apple. But the rise of most small-cap momentum stocks comes down to investor sentiment.

When the Fed stepped in to support financial markets in March 2020, retail investors sold off in shock.

But they quickly reversed course when they realized that low interest rates, cheap liquidity and stimulus money would encourage other investors to buy up-and-coming companies with promising futures. The reasoning was: “If others are going to buy, prices will go up. So I might as well buy, too.”

From electric vehicles to renewable energy — and via the special-purpose acquisition company (SPAC) boom — many investors were happy to plunk down money on companies with no profits … and often no revenues.

All it took to get the herd moving was “buzz.” Clever leaders of small-cap tech companies quickly learned how to generate that.

MTUM …Right off the Cliff

The charts above show a big slide in MTUM starting in early February this year. This final chart zeros in on that to show the relative performance of the momentum strategy against the S&P 500 since the beginning of the year:

MTUM fell off a cliff in February, and by early March was nearly 15% off its earlier high — a technical correction.

Since then, it has tried to regain ground. But 4 out of the 5 most recent trading sessions have been sell-offs.

The bottom panel shows a short-term money flow index for the ETF. This indicator, which measures both price and volume, shows a steep drop. That means investors are fleeing momentum stocks once again.

What Now?

My advice is to avoid all but the best of last year’s high-rising “darlings” for the time being.

“Best” means profitable companies with solid fundamentals and a sure path to future growth. In some cases, it also means unprofitable companies with a proven business model that will shine in the future.

As for last year’s momentum darlings — the many shady SPACs and other revenue-free tech startups — well, they are no longer momentum stocks. They’re losing value rapidly.

In data going back to 1926, the 10% of stocks with the best trailing-year returns pulled back sharply in the final six weeks of every bull market. During those same six weeks, the 10% of stocks with the worst trailing-year returns rose the fastest.

There’s a good chance that pattern is repeating itself now. If it does, it’ll be for the same reason as before.

In the final “exuberance” stage of a bull market, sentiment takes over and rationality takes a backseat. Investors convince themselves that everyone is thinking the same thing — if everyone is buying a certain type of stock, then they might as well do it, too.

But eventually that strategy — like Wile E. Coyote — walks off a cliff. But also like Wile E., investors don’t realize that immediately.

When they do, their herd behavior goes into reverse. They take their money out of bull market winners in a hurry. If they’re smart, they reallocate it to things such as commodities, consumer staples and other cyclical/defensive stocks.

That’s certainly what I’m doing … at least until the market regains some direction. I suggest you do the same.

Kind regards,

Editor, The Bauman Letter

Article by All Value Investing