Another astonishing quarter as bond prices dropped sharply and bond yields advanced. This is clearly in anticipation of a strong growth recovery.

Q1 2021 hedge fund letters, conferences and more

Stock vs Bonds

The long-term bond price index fell 10% last quarter and the major stock index was up 11% adding 21% to the return of stocks vs bonds and lifting stock prices and valuation to a new all-time high.

As indicated in our latest quarterly update where we referred to bonds as "toxic" for long term investors as age-based allocation methods leave older investors with a dangerous overexposure to bonds at exactly the wrong time.

This strong recovery outlook has a strong caveat in that it is being supported by ignoring looming inflation.

Cash Is Trash

What is unexpected and even bizarre is the Treasure Bill decline (TBills) which is still closer to zero but now 0.015%; the lowest ever! Tbills are the risk-free rate, zero default risk, zero interest rate risk and act as a valuation benchmark in many asset-allocation models. As interest rates approach zero, the value of assets approaches infinity. An asset valued at $100 before covid, when TBills yielded 1.5%, is now worth $10,000 with TBills yielding 0.015%.

Effectively zero rates of return on low-risk investments are forcing people into higher risk assets and recently that has driven a broad increase in asset prices. That exponential increase in asset valuation appears as new high prices in every higher-risk asset class in recent months. With very high-risk asset classes like crypto-currency and stocks of insolvent companies staging the biggest gains.

Corporate Growth Hit Bottom

US corporate growth marks its worst quarter. From the peak in 2018 US Corporate average sales-growth rate fell from 13.6% to the current annual rate of 5.4%; down slightly from last period. However, last quarter showed 50% of companies (accounting for 65% of market capital) are achieving an improvement in sales-growth. At the low point in the second quarter of 2020 only 25% of companies (accounting for 40% of market capital) recorded sales-growth up.

Big Companies Lead Recovery

This is a broad sales-growth improvement and illustrates that, on the top-line, large companies had a better sales growth experience than small companies Over the two-year growth downturn, the average gross profit margin declined from the peak of 53% to 45% last period.

In the annual period 2020 just completed, 60% of companies (accounting for 47% of market capital) achieved an improvement in the gross profit margin. That illustrates that, converse to sales growth, small companies are achieving a gross margin improvement more commonly than large ones.

Which Are The Risky Stocks?

There was a high frequency of gross margin improvement among companies with sales growth negative and falling.

These companies are shrinking, laying off people, closing capacity, and applying available cash to debt obligations attempting to forestall bankruptcy long enough for a recovery to take hold. These are particularly risky stocks and more commonly trading at premium prices after the recent risk-on shift in the market.

Volatility seems assured and a market decline probable as interest rates rise. Cash may be trash but holding a cash position now seems opportune, at least until growth trends become clearer. The new update for the first quarter 2021 has begun but will peak on May 8.

What Next?

We continued to see companies with sales growth steeply negative and still falling in the quarter ended in February 2021. As inflation looms, there is no real evidence of a recovery yet and it is only dramatic cost reductions that is keeping these companies’ solvent as cash flow drops. With stocks at a new high relative to bonds we are most interested in the post virus growth rate and trend.

There is no doubt that the next two quarters will show a dramatic recovery from the virus shutdown. Recently stock-market performance has rotated toward companies expected to benefit post virus. That has resulted in broadly extended share prices among companies with very poor growth attributes.

What To Buy?

This is an opportune time to enhance the growth and financial condition attributes of your portfolio since many companies with superior and improving growth attributes are currently broadly depressed.

The recent broad growth improvement from US companies means that the portfolio must have more acceleration attributes (i.e., higher sales growth and higher profit margins).

The recent sharp increase in share prices of higher risk investments has created a buying opportunity for lower risk and more stable growth companies with much improving growth attributes.

Many stocks of companies in the Healthcare Group that have exceptional growth attributes are now trading at steep discount in share prices.

Quidel Corporation, $128.830 Buy This Rich Company Getting Better

Quidel Corporation (NASDAQ:QDEL) has been an exceptionally profitable company with persistently high cash return on total capital of 19.3% on average over the past 7 years. Over the long term the shares of Quidel have advanced by 327% relative to the broad market index.

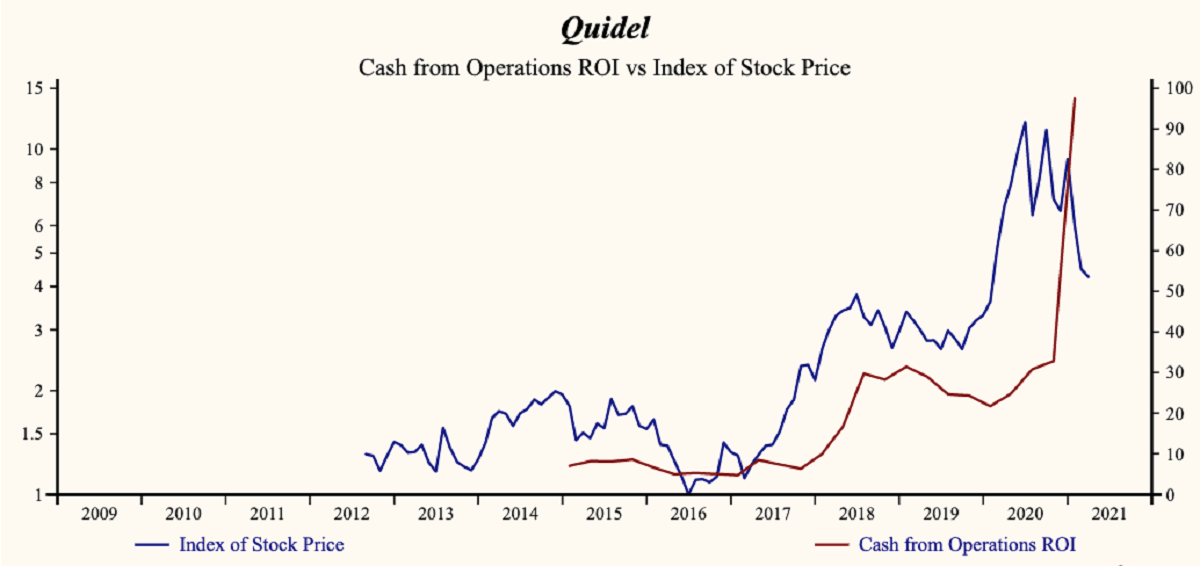

The shares have been highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Cash-Operating Activities ROI which has been 83% correlated with the share price with a five-quarter lead.

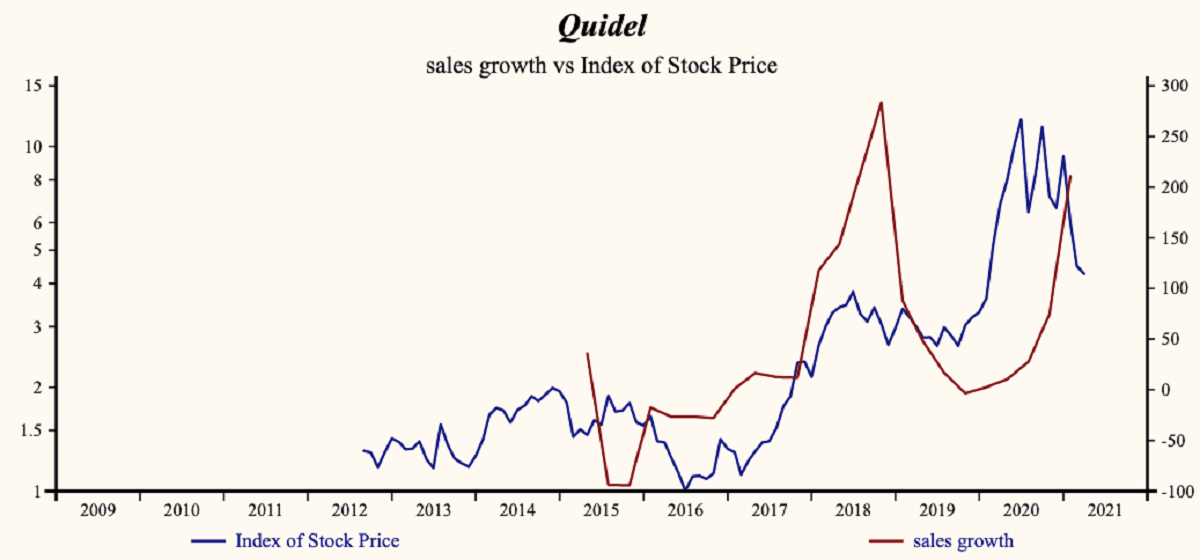

Currently, sales growth is 210.7% which is very high and higher than last quarter.

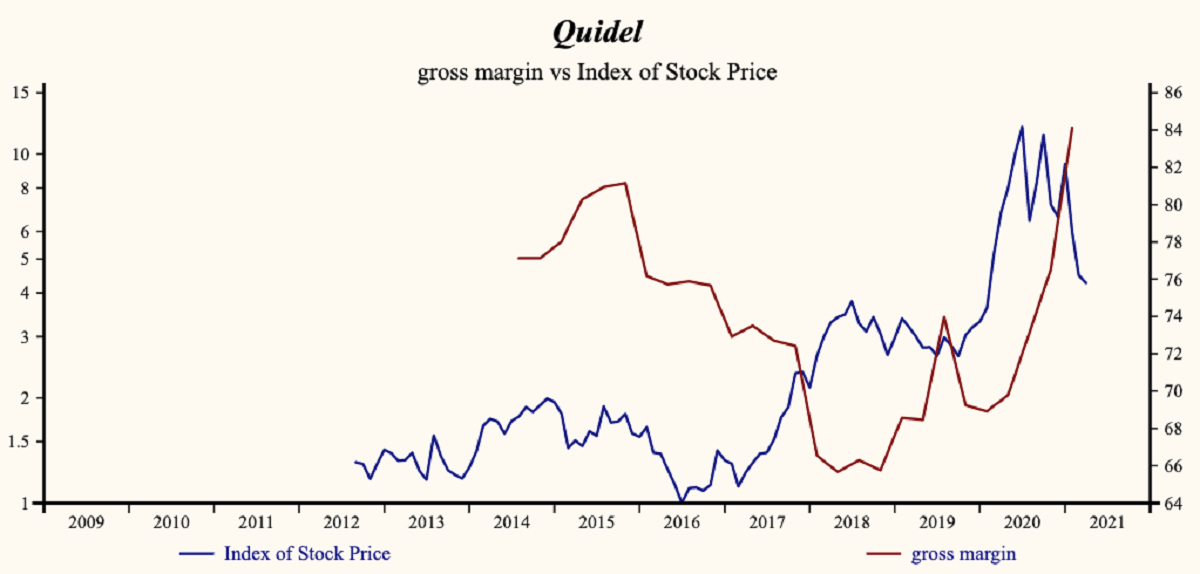

The company is recording a rising gross profit margin. SG&A expenses are low in the record of the company and falling. Higher gross margins and lower SG&A expenses are producing a leveraged acceleration in EBITD relative to sales.

More recently, the shares of Quidel have advanced by 41% since the October, 2019 low. The shares are trading at lower-end of the volatility range in an 18-month rising relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.