S&P 500 moved marginally higher in spite of its short-term very extended position, powered by liquidity and almost defying the odds. Credit markets were hinting at deterioration, the yen carry trade I talked a week ago has run into a brick wall as viewed by the USD/JPY exchange rate reversal – but stocks didn‘t listen, and their market breadth indicators are actually quite healthy.

Q1 2021 hedge fund letters, conferences and more

We‘re still in the rare constellation I discussed two days ago – Treasury yield moves are exerting no real pressure either on value stocks or technology including heavyweights, which are picking up the tech upswing slack. Microrotations still pointing higher are the name of the game, on the wave of infrastructure bill expectations as well.

Still, the risk-reward ratio for the bulls is at unsavory levels in the very short run even as the longer time frame perspectives remain really bright. Consider these points made yesterday:

(…) we have seen quite a record number (around 95%) of stocks trading above their 200-day moving averages, which is similar to the setup right after the post-dotcom bubble bear market 2002/3 lows, or 1-2 years after the bull market run off the Mar 2009 lows. Hard to say which one is more hated, but I see the run from Mar 2020 generational low as the gold medal winner, especially given the denial accompanying it since.

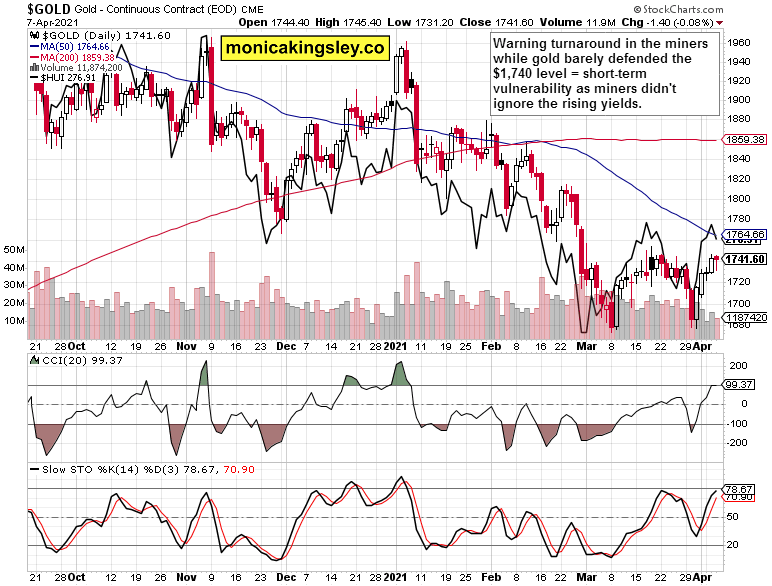

Gold kept its run above $1,740 intact and regardless of the daily weakness in the miners – should that one be repeated more consistently, it would become worrying for the bulls. Looking though again at the USD/JPY chart, I‘m increasingly optimistic that the currents working against the king of metals, have turned. That‘s because whenever yen, the currency perceived by the market place as a safe haven one, strengthens, gold tends to follow its cue – and that‘s where we are now. The precious metals run to the key $1,760s or even better above $1,775 is approaching, and has already sent my open gold position solidly into the black.

The soft patch I cautioned against at the onset of yesterday‘s session, has materialized in the miners, and might be very well over by today‘s closing bell. Yes, I look for mining stocks to reverse yesterday‘s weakness even in the competition for money flows with the S&P 500 holding up gained ground.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

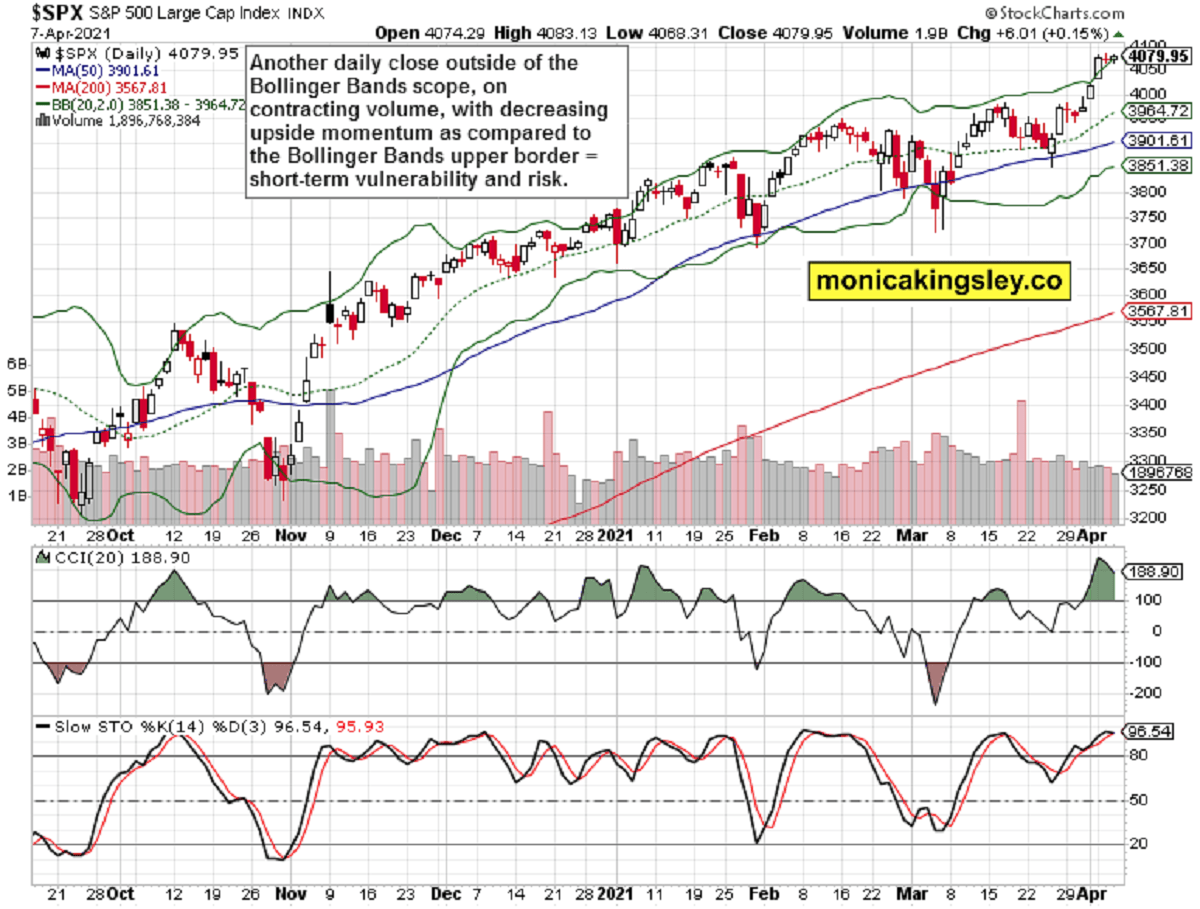

S&P 500 Outlook

S&P 500 keeps hugging the upper border of Bollinger Bands, and the willingness to trade at these extended levels, has decreased as the volume shows. Long-term investors correctly perceive higher highs as coming, short-term ones view the entry point as unfavorable.

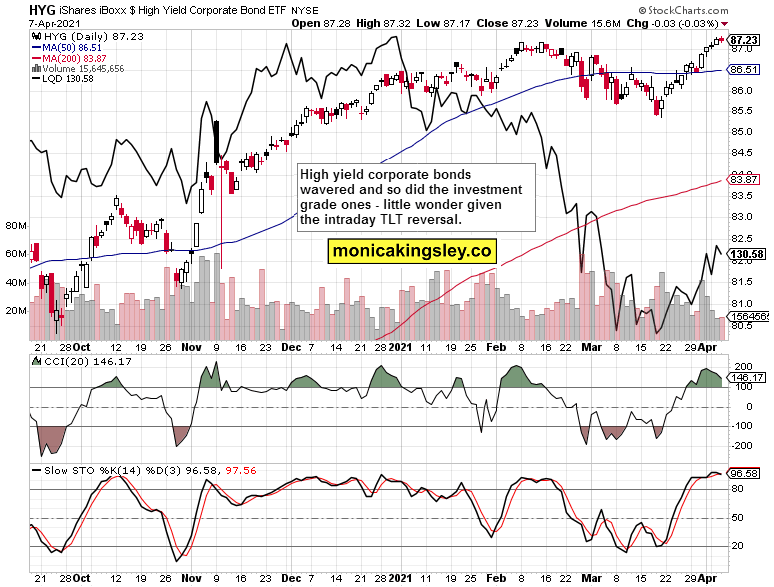

Credit Markets

Bond markets wavered yesterday – both corporate and Treasury ones. Yet, note the turn higher in both high yield corporate bonds and investment grade ones, defying TLT – this bodes well for the stock market upswing health.

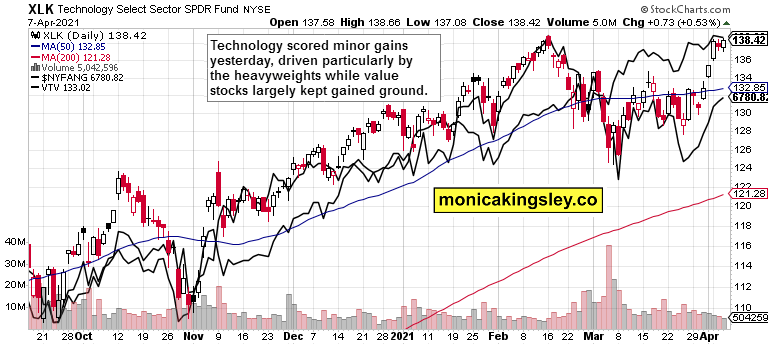

Focus on Technology and Value

Tech (XLK ETF) reversed its Tuesday‘s retreat, and $NYFANG (lower black line) powered upwards while value stocks (upper black line) or Dow Jones Industrial Average didn‘t yield an inch. The advance is broad-based but tech heavyweights might take a moment in overcoming their mid-Mar highs.

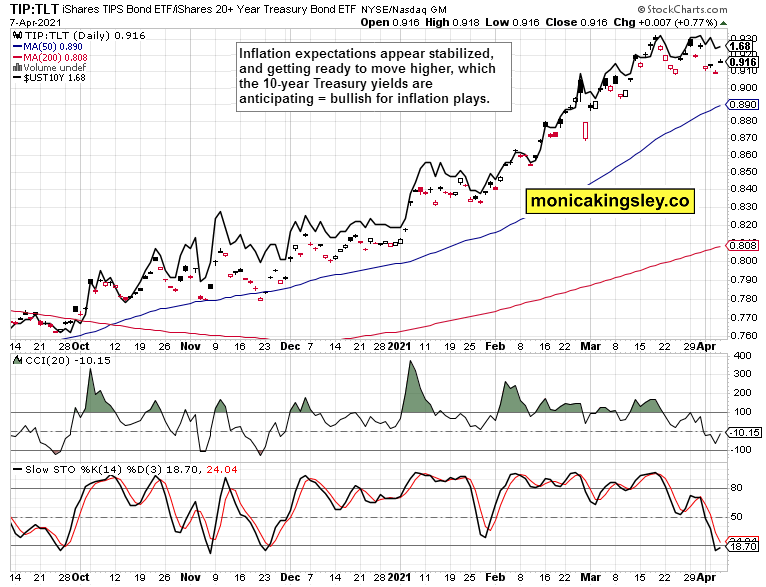

Inflation Expectations

The Treasury inflation protected securities to long-dated Treasuries (TIP:TLT) ratio appears ready to move upwards, and the rising yields are clearly doubting its recent dip.

Gold in the Spotlight

Gold miners compared to gold, don‘t paint a daily picture of strength. Jumping to conclusions on account of the hanging man formation in gold, would be premature though.

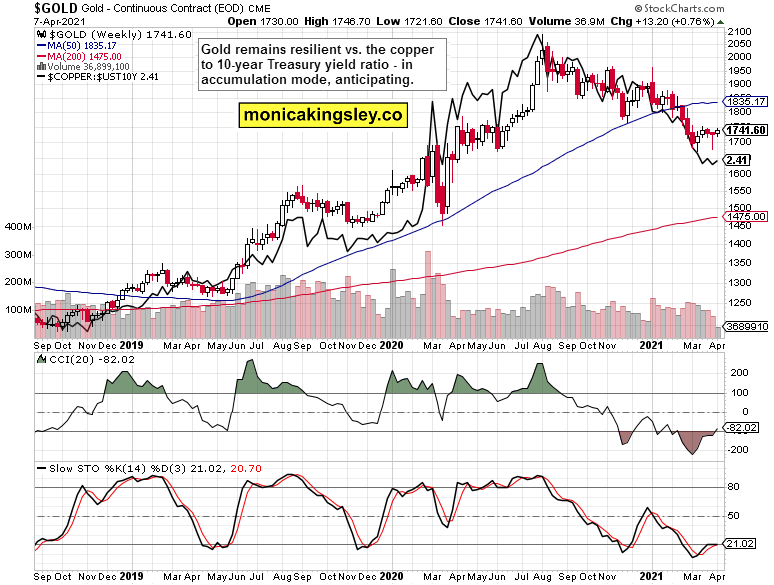

Zooming out, the weekly gold chart with overlaid copper to 10-year Treasury yield, paints a picture of (bullish) turnaround and decoupling. Gold has been clearly attempting to move higher lately, and that will reflect upon the precious metals complex positively as it undergoes its own rotations lifting gold, silver or miners at different stages and magnitudes.

Summary

S&P 500 is likely to keep consolidating gained ground, and (shallow) bear raids wouldn‘t be unexpected here – in spite of the strong market breadth. We‘re witnessing VIX trading well below 20 for four sessions in a row while the put/call ratio has risen to the approximate midpoint of its usual range – the bull market is intact, and a breather wouldn‘t be surprising here.

Miners moving higher again is the first step to power gold upwards sustainably again, but the shifting currency winds would help here as strengthening yen would facilitate beating the next major set of resistances above $1,760s.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.