Kerrisdale Capital is short shares of Plug Power Inc (NASDAQ:PLUG), a $40 billion provider of hydrogen fuel-cell solutions that’s set to generate a paltry $300 million in revenue in 2020 and trades at 40x its own aggressive revenue projection for 2024.

Q4 2020 hedge fund letters, conferences and more

We are short shares of Plug Power Inc (PLUG), a $40 billion provider of hydrogen fuel-cell solutions that’s set to generate a paltry $300 million in revenue in 2020 and trades at 40x its own aggressive revenue projection for 2024. The company’s stock has almost doubled in just the last few weeks, and has risen by 15x in the last year, on the naïve excitement of uninformed investors over the prospects of the “hydrogen economy,” or the idea that hydrogen and the fuel-cells (FCs) it can power will be a critical part of the transition from fossil fuels to “green” energy. But it’s all just a pipe dream, because “green” hydrogen is too expensive and too inefficient to produce, store, transport, and burn. That’s not because of manufacturing inefficiencies or an imaginary technology S-curve that has yet to be scaled. It’s because of the laws of physics, which we don’t expect Plug can successfully defeat.

For the time being, Plug Power has found precisely one use-case for its FCs: forklifts. That’s almost comical for a company with a market value greater than any of the oligopolists dominating the diesel truck engine market. But the material handling market, as the company calls forklifts in its presentations, is much less than meets the eye. For one thing, the FCs sold to large warehouse customers Amazon and Walmart have been linked to warrant issuance that leaves them owning close to 15% of Plug in return for virtually nothing. Hundreds of millions of dollars’ worth of fuel cell “revenue” from Amazon and Walmart over the last few years has been exchanged for ownership stakes now worth billions of dollars. The revenues from selling these forklift fuel-cell systems have also been attached to service and refueling agreements that consistently result in negative gross profits, which begs the question: if Plug can’t even provide “black” environmentally-unfriendly hydrogen at a profit, how does green hydrogen stand a chance?

More importantly, despite the $30 billion total addressable market (TAM) and 1.5 million annual forklift purchase volume that Plug Power Inc (PLUG) claims it can penetrate in the material handling market, the real problem is the same one with which the “hydrogen economy” will never be able to contend: lithium ion (Li) batteries have already demonstrated their value proposition for forklifts and are quickly coming to dominate the market. Hydrogen-powered forklifts are a small and cheap niche bet on the part of large corporations, either directly on Plug’s stock price, as in the case of Amazon and Walmart, or on the ESG bragging rights that come along with the false perception of “being green.” But aside from the reality that Li-powered forklifts, in contrast to those powered by hydrogen, can actually turn environmentally friendly over time, batteries will also almost always be more economical than fuel-cells – in any application – because electricity is much more efficiently produced and stored than hydrogen. And that’s without considering the plant-altering capital expenditures required to use fuel-cells.

Recent weeks have seen investor enthusiasm about hydrogen reach astonishing levels, aided by two strategic partnerships Plug Power Inc (PLUG) has entered. Both partnerships, though, should be seen as signs of weakness rather than strength. The first, with SK Group, is just an opportunistic capital-raise on the part of Plug from South Korea’s utility monopoly, which is struggling to find its place in a decarbonized future given the region’s lack of solar and wind resources. The other, with Renault, is a desperate attempt to stay relevant on the part of one of Europe’s weakest auto manufacturers by entering a costless JV with Plug. Renault will supposedly be making FCEV light vehicles that are already miles behind their BEV competition. Both deals contemplate finalizing actual details at a later date, but by the time that’s supposed to happen, we expect Plug’s stock price will have collapsed, along with the once-a-decade recurring myth about a “hydrogen economy.” SK and Renault might be able to afford the trifling write-off, but Plug investors are in for a shock.

I. The “Hydrogen Economy” is a Fantasy

The myth underlying Plug Power Inc (PLUG)’s 120x revenue multiple is that, as the world begins to earnestly address climate change by reducing its reliance on carbon-emitting fossil fuels, hydrogen power will play a key role as a clean source of energy. When that happens, the companies that specialize in developing and supplying the equipment necessary to extract energy out of hydrogen – including, among others, Plug Power – will be able to capitalize on the spending boom.

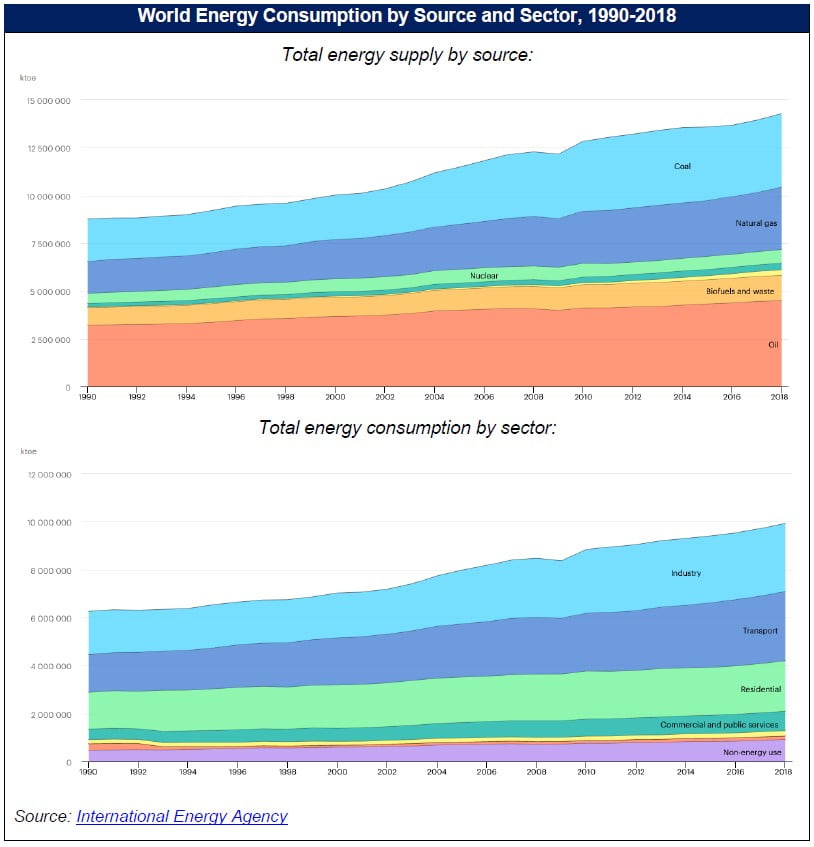

But the “hydrogen economy” will never happen. Electrolyzers will never be sold at scale to power vehicles or industrial processes. And hydrogen fuel cells (FCs) will never be used beyond the niche applications we consider below. To understand why, it’s worth delineating exactly what fossil fuel energy is primarily used for, and whether hydrogen-powered energy production can plausibly substitute fossil fuels in these applications. As the top graph on the previous page shows, according to the International Energy Agency (IEA), world energy consumption is dominated by oil, natural gas, and coal. The data also indicates that the end uses of this energy are almost entirely comprised of electricity production, transportation, heating, manufacturing, and construction.

Can hydrogen be used as the primary energy source for any of these applications? Answering that question requires a basic understanding of how energy is extracted from hydrogen and how it can subsequently be transported and consumed by the end user. To produce pure hydrogen, electrolysis – the process of passing an electric current through, in this case, water – is used to separate water into hydrogen and oxygen. Electrolysis presupposes an external power source to produce the electric current which, in the green future, will ostensibly be wind- and solar-powered electricity. Given the low density of pure hydrogen gas, the hydrogen produced is then compressed, and either stored or transported via pipeline to the end user as is now done with natural gas. The end user can’t just burn the hydrogen, though, and so a fuel-cell is required, the purpose of which is to convert the energy of the hydrogen into electricity through a pair of redox reactions.

The entire chain starts with electricity and ends with electricity, which begs the question: why not just store the initial renewable-generated electricity in a battery, especially given the rapid improvements in lithium ion (Li) battery technology in recent years? Other considerations include:

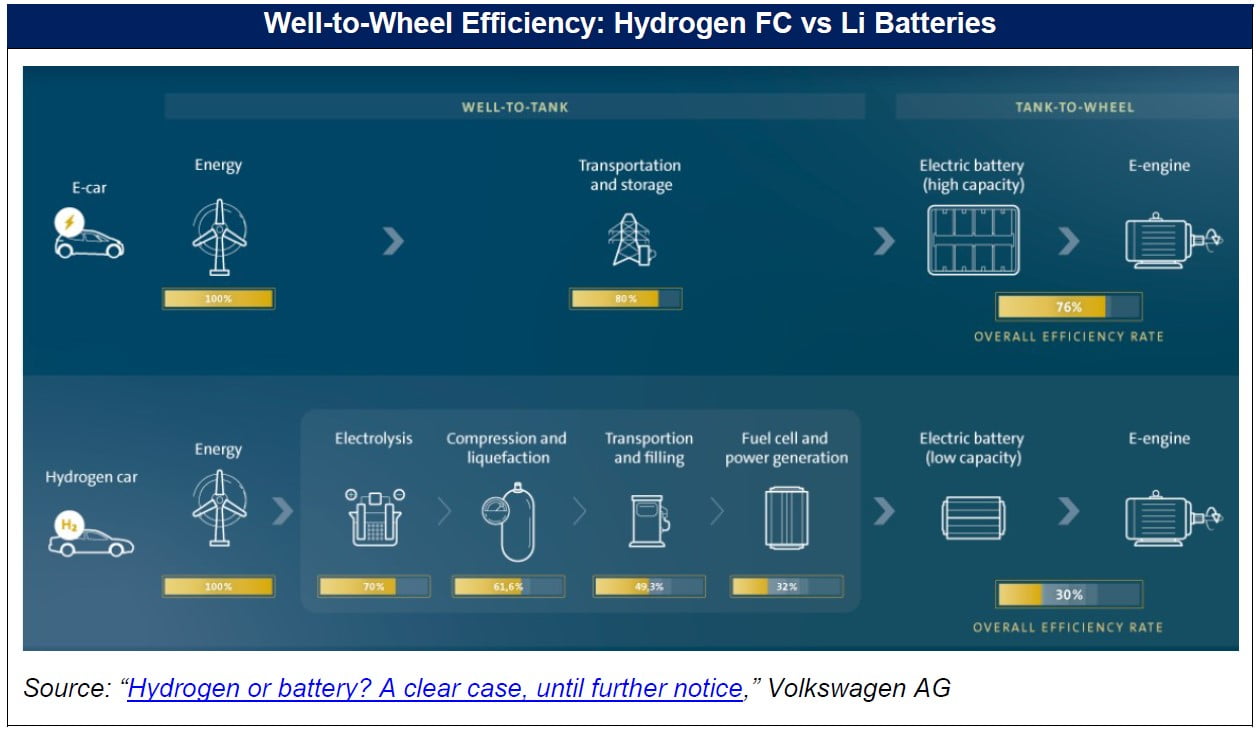

- Inefficiency – Every step of the hydrogen energy process results in efficiency losses and energy leakage. A kilogram of hydrogen theoretically contains 39 kWh of energy, but the electrolysis process is only 70% efficient, at best, due to heat leakage. Compressing the hydrogen requires some of the energy stored in that hydrogen, which results in further inefficiencies (anywhere on the order of 1-30% losses, depending on how long the hydrogen needs to be compressed and at what pressures). Finally, the FC reactions converting the hydrogen back into electricity and water are also only approximately 50% efficient due to the heat leakage. The result is that, even without any energy leakage in the course of hydrogen transportation, each initial kWh of electricity results in only about 0.3 kWh to the end user. By contrast, the “well-to-wheel” efficiency of storing electricity in an Li battery is about 75% (a comparison between the battery and fuel-cell supply chain efficiency dynamics is shown in the diagram on the next page, courtesy of Volkswagen, which has had extensive experience trying – and quitting – to fit FCEVs into their long term plans).

- Infrastructure – the logistics required to generate energy from renewables, convert it to electricity, and subsequently store it in batteries already exists. For many applications – heating and most electricity generation, for example – the storage element isn’t even necessary. The ability to generate and transmit electricity at mass scale already exists. Using hydrogen at mass scale, on the other hand, would require trillions of dollars of investment in electrolyzers, fuel cells, and completely redesigned and rebuilt pipeline networks, and even then we’d be wasting a huge proportion of the electricity produced at the electrolyzer power plant due to the aforementioned inefficiencies.

- Safety – Hydrogen flames are invisible to the naked eye and spread quickly (its flame velocity is 8x that of methane). Hydrogen also has no natural odor and odorizing it like we do with natural gas would contaminate the FCs that are supposed to harness the hydrogen energy. None of these safety issues are insurmountable, but they would likely lead to even more expense and inefficiency and would result in a less safe energy source being at scale.

We’ve seen and heard hydrogen evangelists talk about the inefficiencies of the hydrogen power chain and the relative expense of hydrogen-power equipment as resulting from the lack of R&D or the lack of scale in manufacturing hydrogen-power equipment. Given time and scale, the argument goes, the hydrogen-power supply chain will get both more efficient and cheaper. The problem is that electrolyzers and fuel cells are actually relatively mature technologies, with over 100 years’ worth of R&D embedded in them. Scale might bring down the cost a bit, but it won’t be by the orders of magnitude necessary to make infrastructure investment remotely worthwhile. Meanwhile, the energy leakage at each stage of hydrogen production and transport has nothing to do with the inefficiency of the equipment, and everything to do with the basic laws of physics: heat leakage into water vapor is not reclaimable, and gas compression requires energy.

The downside of direct electrification is that, with respect to storage, Li batteries are heavy. For large stationary energy use cases – heating, cooking, household and commercial electrification, for example – this isn’t really an issue. Electricity is delivered directly from the power plant to the end-user with little energy leakage. For electricity produced via solar or wind, which might be variable, batteries are already being used to help with peaking capacity, while base-load generation has much simpler and cheaper solutions than hydrogen electrolysis, including pumped hydro storage or the rapidly advancing redox flow batteries. At the same time, the vast majority of mobile applications – including light vehicles, short-range delivery, materials handling, urban-distance aircraft, and the vast majority of freight transport – are either unconstrained by the limits of Li batteries, or will require some level of recharging infrastructure to build out, which will be exponentially more economical than building out the “hydrogen economy.”

So, what’s left? If an enormous multi-trillion-dollar world hydrogen infrastructure will not be built (and it won’t), hydrogen energy will have only very niche use cases where range is critical and refueling impossible, or where the hydrogen produced from electrolysis can be used on-site. The only applications that fit into the former category are long-distance overseas-shipping and long-haul flight. In the case of shipping, it’s still likely that the incremental weight of batteries will not hinder their use on large intercontinental vessels, while in the case of long-haul flight, a simple calculation suggests that a single transatlantic flight requires as much energy as its passengers will consume in their automobile over the course of a year, and given the low energy density of hydrogen, that problem has yet to find a realistic solution.1

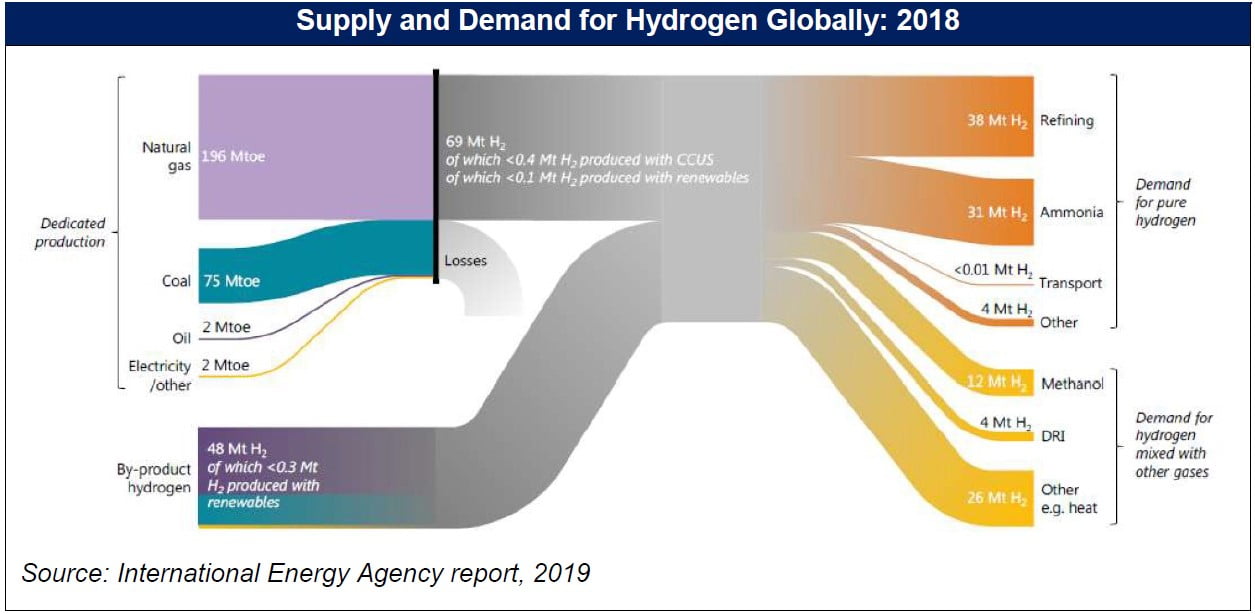

There are current uses of hydrogen power though, where the hydrogen is produced through steam reformation of natural gas or coal gasification and used on-site in the production of ammonia and methanol, oil refining, or as a heat source for a variety of industrial processes where hydrogen is a byproduct of the early parts of the process (see the diagram on the next page). Generally, producing hydrogen this way is extremely carbon-intensive, and renewables-driven electrolysis would be a welcome alternative if it would make economic sense, though a “decarbonized” future would ostensibly lack methanol production or oil refining at the scale they currently exist. Either way, there’s not much in these use-cases for Plug Power Inc (PLUG) or its FC-manufacturing peers. That’s partly because the hydrogen for these industrial uses would be more economical if produced with a Chinese-made alkaline electrolyzer that’s a lot cheaper than the more high-tech Polymer Electrolyte Membrane (PEM) electrolyzers sold by Plug Power, and also capable of larger single-site industrial deployments. These industrial processes would also have no use for the fuel cells needed to convert hydrogen back to electricity, because the hydrogen used in these processes is consumed directly rather than converted to electricity.

In sum, Plug Power Inc (PLUG)’s incredible share-price performance recently is entirely predicated on a future in which hydrogen energy is ubiquitous, replacing fossil fuels across the range of humanity’s energy needs. In this hypothetical future, electrolyzers made by hydrogen-energy-equipment manufacturers harness wind and solar energy to produce hydrogen from water, and that hydrogen is converted back to electricity by hydrogen fuel-cells (HFCs), which are also conveniently sold by these same manufacturers. For the reasons elaborated above, this hypothetical future is a fantasy that will undoubtedly remain hypothetical, in a repeat of the “hydrogen economy” delusions propagated in the 1970s in the wake of the oil crisis, in the 1990s in the early stages of the global warming debate, and in the early 2000s as emissions requirements were stepped up due to fears of peak oil. This time though, Li batteries and renewables-generated electricity mean that hydrogen power has a real green alternative that is more economical and actually works without any grand trillion-dollar cooperation among the world’s major energy consumers. Widespread hydrogen energy, and the electrolyzers and FCs Plug Power would sell to harness it, are as far from reality as they’ve ever been.

Read the full report here by Kerrisdale Capital