Stock alerts keep you updated on market prices, ensuring that you’re always prepared for a move in either direction. This investing tool is particularly important if you have a diversified portfolio of stocks and funds.

This guide reviews the 10 best stock alerts services for investors in 2024. Some of the metrics we focus on include pricing, supported markets, customization features, device types, and whether or not data is sent in real-time.

-

- 1. Danelfin - Automated stock alerts when there is a change in "Explainable" AI score

- Pros

- Cons:

- 2. AltIndex - Alternative data alerts covering social sentiment and website analytics

- Pros

- Cons:

- 3. Stocklytics - Customized stock alerts alongside analyst ratings and price predictions

- Pros

- Cons:

- 4. Stock Alarm - Advanced price alerts app for iOS and Android covering 65,000 assets

- Pros

- Cons:

- 5. Custom Stock Alerts - User-friendly stock alerts service covering 6 trigger points

- Pros

- Cons:

- 6. Kubera - Feature-rich portfolio management with stock alerts and insights

- Pros

- Cons:

- 7. Stock Alert - iOS app covering 120,000+ assets from over 70 global exchanges

- Pros

- Cons:

- 8. Stock Alerts Background - Popular stock alerts app tracking thousands of financial instruments from around the world

- Pros

- Cons:

-

- 1. Danelfin - Automated stock alerts when there is a change in "Explainable" AI score

- Pros

- Cons:

- 2. AltIndex - Alternative data alerts covering social sentiment and website analytics

- Pros

- Cons:

- 3. Stocklytics - Customized stock alerts alongside analyst ratings and price predictions

- Pros

- Cons:

- 4. Stock Alarm - Advanced price alerts app for iOS and Android covering 65,000 assets

- Pros

- Cons:

- 5. Custom Stock Alerts - User-friendly stock alerts service covering 6 trigger points

- Pros

- Cons:

- 6. Kubera - Feature-rich portfolio management with stock alerts and insights

- Pros

- Cons:

- 7. Stock Alert - iOS app covering 120,000+ assets from over 70 global exchanges

- Pros

- Cons:

- 8. Stock Alerts Background - Popular stock alerts app tracking thousands of financial instruments from around the world

- Pros

- Cons:

- Show Full Guide

The best stock market alerts listed

Let’s start with an overview of the best stock alerts services available today:

- Danelfin: An AI-powered stock analytics platform, whose transparent algorithms allow investors to understand the logic behind AI’s decisions. Investors receive alerts when a stock in their portfolio is downgraded or upgraded, enabling them to make an informed adjustment.

- AltIndex: Rather than focusing on pricing alerts, AltIndex specializes in alternative data insights. It collects data from various sources, including social media and Google trends to assess broader consumer sentiment. This helps investors discover the hottest stocks to buy before the wider market. AltIndex is also ideal for risk-management purposes. AltIndex alerts also include a stock recommendation service that AI backs.

- Stocklytics: Mainly specializes in fundamental data, offering insights on financial ratios, analyst ratings, price predictions, and stock prices. Stocklytics allows users to create custom alerts, which can be received via SMS, email, and other mediums. Some features are free, but full functionality costs $25 per month. In total, Stocklytics covers over 5,700 stocks and 2,400 ETFs from 11 exchanges.

- Stock Alarm: More than 65,000 assets are tracked by Stock Alarm, including stocks, cryptocurrencies, and forex. Apart from NASDAQ-listed companies, all other stock prices are in real-time. Stock Alarm is available as a mobile app for iOS and Android. Alerts can be sent via push notifications, SMS, email, or a telephone call. Prices range from $0 to $19.99 per month, depending on how many stocks you want to track.

- Custom Stock Alerts: One of the most basic options in the market, Custom Stock Alerts will appeal to beginners. It supports all US-listed stocks, plus ETFs and ADRs. Custom alerts can be set up in just three simple steps, but only 6 triggers are supported. Freemium plans are limited to five alerts. Full functionality costs $9.99 per month.

- Kubera: Aimed at long-term investors with an active investing strategy, Kubera offers more than just stock alerts. It provides a 360-degree overview of your financial health. In addition to real-time stock and ETF prices, you’ll receive insights on the best and worst-performing investments in your portfolio. Kubera connects with thousands of brokers and banks, so you won’t need to manually add or remove assets.

- Stock Alert: Offers custom stock alerts on over 120,000 financial instruments, covering stocks, ETFs, funds, indices, cryptocurrencies, and forex from over 70 global exchanges. Stock Alert offers an app-based service for iOS users. The freemium plan comes with limitations, in terms of how many alerts you can create. The pro plan costs $7.99 per month and includes real-time stock prices.

- Stock Alerts Background: Offers price-based stock alerts on thousands of assets, including stocks, bonds, indices, and cryptocurrencies. You can track up to 10 assets on the freemium plan, which also comes with 30-second pricing intervals. This is reduced to 5 seconds on the premium plan, which also offers unlimited custom alerts. Stock Alerts Background is available as an iOS and Android app.

Our reviews of the top stock alerts services

Still not sure which stock price alerts are best for you? We’ll now review the 10 providers listed above.

1. Danelfin – Automated stock alerts when there is a change in “Explainable” AI score

Danelfin has been developed to simplify stock selection and make investing easier, with “Explainable” artificial intelligence being at the core of the award-winning platform.

Danelfin provides a simple AI score ranging from 1 to 10 to rank stocks and ETFs. The higher the score, the higher the chances of the product outperforming the market. Its stock alert services are based on the same tech.

Investors receive alerts when a stock or ETF in their portfolio gets downgraded or upgraded (change in AI score). The timely and logic-based alerts allow investors to obtain information about key changes to their portfolio or potential investment opportunities, which they can use to make necessary adjustments to their portfolio.

In addition to alerts, the platform also sends a daily report to all users, irrespective of the pricing plan they select. Understandably, those who opt for paid plans get access to more data and reports.

The alerts and daily report use the same “Explainable Artificial Intelligence” for scoring. The AI scoring considers 10,000 features per stock/ETF each day, on the basis of more than 600 technical indicators, 150 fundamental parameters and 150 social sentiment metrics, to assign scores.

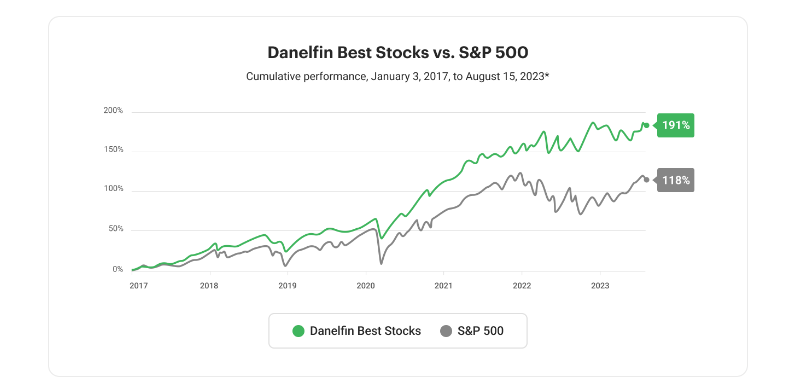

Such comprehensive analysis of data allows AI to make accurate predictions. From January 3, 2017, to August 15, 2023, Danelfin’s Best Stocks strategy generated a return of more than 191%, compared to over 118% of the S&P 500 for the same period.

| Type of Stock Alerts | Send alerts when a stock in investors’ portfolio is downgraded or upgraded. Sends daily newsletter suggesting the top 10 best stocks to buy. |

| How Are Alerts Sent? | |

| Pricing | Free, Plus ($19 monthly) and Pro ($52 monthly) Plans. |

Pros

- Analyzes 10,000 features per stock/ETF per day to send alert

- Use the same analysis to send a daily newsletter suggesting top 10 stocks to buy.

- Understandable analysis to get a grasp of alerts and newsletter.

Cons:

- No mobile app.

- Covers US and European stocks only.

AltIndex will appeal to stock investors who want to get an edge in the market. While it doesn’t offer price alerts like other services, AltIndex specializes in a more valuable commodity; alternative data. In simple terms, it analyzes social media and website analytics to assess consumer sentiment on companies and industries.

Insights are not readily available in the public domain, as AltIndex extracts data in real-time. For example, it will analyze social media comments, likes, and shares. This in itself translates to billions of data points. It also explores patent filings, app downloads, website visits, and job postings.

All of these metrics are evaluated by AI to generate a stock rating from 1 to 100. According to AltInidex, companies with a high rating have a strong chance of producing stock gains in the coming months. Therefore, AltIndex alerts give you a huge time advantage over other data sources, such as news articles and financial reports.

You can choose only to receive alerts about companies you’re invested in. This helps you manage your investments effectively, as you’ll only be notified when an important social shift occurs. To take things to the next level, you might also consider its stock recommendation service. This alerts users when a ‘Strong Buy’ or a ‘Strong Sell’ is identified.

AltIndex claims to have made average 6-month gains of 22% on its stock picks. In contrast, the S&P 500 has grown by just 8.4% in the prior 6 months. In terms of markets, AltIndex covers most stocks on the NYSE and NASDAQ. It also tracks digital assets, helping investors choose the best new cryptocurrencies to buy.

| Type of Stock Alerts | Alternative data alerts linked to social sentiment analysis and consumer trends. Get an edge in the market by discovering consumer shifts before the general public. Premium members receive AI stock picks on ‘Strong Buy’ and ‘Strong Sell’ recommendations. Also offers one of the best portfolio trackers. |

| How Are Alerts Sent? | |

| Pricing | Plans range from $0 to $99 per month |

Pros

- Best stock alerts service for alternative data insights

- Discover broader trends before they become mainstream

- Thousands of US-listed stocks are tracked

- Also covers the best cryptocurrencies to buy

Cons:

- The freemium plan only comes with 2 stock alerts each month

3. Stocklytics – Customized stock alerts alongside analyst ratings and price predictions

Stocklytics offers the best stock alerts service for fundamental research. At its core, it allows users to set up customized alerts based on their preferred strategy. If you simply want to focus on pricing, Stocklytics offers several options. You can set a price target (e.g. $45.50) or be alerted when a stock moves by a certain percentage (e.g. 4%).

You can also set a custom movement, such as $1.50 in either direction. That said, Stocklytics offers lots of other triggers in addition to pricing. This includes recurring time alerts. For instance, receiving a price update once a day. You can also set alerts based on trading volume, earnings, 52-week highs and lows, and technical patterns.

Custom inputs are also supported. For instance, you might want to receive an alert if trading volume increases by 25% and the stock moves by at least 5%. What’s more, Stocklytics also imports sell-side analyst ratings and price predictions. It tracks thousands of stocks and ETFs from 11 exchanges. The free plan covers most features, but limitations will apply.

| Type of Stock Alerts | Custom alerts covering many different triggers, including stock price movements (percentage, target price), technical patterns, recurring time updates, and indicators. |

| How Are Alerts Sent? | Email, SMS, or via the online dashboard |

| Pricing | The freemium plan comes with limitations. Full access costs $25 per month. |

Pros

- Over 5,700 stocks and 2,400 ETFs are tracked from 11 exchanges

- Set up custom alerts on a variety of triggers

- Receives alerts via email, SMS, or online

- Huge range of fundamental data, including analyst ratings and price predictions

- Also offers one of the best free stock screeners for beginners

Cons:

- You’ll need to upgrade to remove limitations – which costs $25 per month

4. Stock Alarm – Advanced price alerts app for iOS and Android covering 65,000 assets

Stock Alarm is one of the best stock alerts services for mobile users. Its iOS and Android app tracks more than 65,000 assets. This includes stocks from around the world, covering North America, Asia, Europe, and Oceania. It also supports cryptocurrencies like Bitcoin and Ethereum, not to mention the most traded forex pairs.

Stock Alarm also offers one of the widest ranges of triggers. This includes technical readings, such as the EMA, MACD, and SMA. It also covers stock price targets and percentage changes. These can be customized to your liking. Moreover, Stock Alarm also supports fundamental data. This includes alerts on incoming earnings reports for companies in your watchlist.

However, this feature only covers US-listed stocks. Economic data is also supported, such as CPI data and central bank meetings. The freemium plan offers 3 tracked stocks and 100 monthly push notifications. This is in addition to 25 market scans and 1 premium alert. The silver and gold plans offer higher limits, costing $9.99 and $19.99 per month, respectively.

| Type of Stock Alerts | Custom alerts on over 65,000 assets, including US and international stocks, cryptocurrencies, and forex. Triggers include technical, fundamental, and economic data points. |

| How Are Alerts Sent? | Email, SMS, push notifications, and call alerts |

| Pricing | The freemium plan comes with limitations. Premium plans cost $9.99 (silver) or $19.99 (gold) per month. |

Pros

- More than 65,000 assets are tracked

- Supported markets include stocks, forex, and cryptocurrencies

- Create custom alerts across technical, fundamental, and economic triggers

- Rated 4.6/5 on the Apple App Store

Cons:

- NASDAQ stock prices are not in real-time, even on premium plans

5. Custom Stock Alerts – User-friendly stock alerts service covering 6 trigger points

Custom Stock Alerts is a user-friendly platform that will appeal to beginners. It enables users to set custom alerts in three simple steps. First, you’ll need to choose which company you want to create an alert for. Custom Stock Alerts support all US-listed stocks, plus ETFs and ADRs. Next, you’ll need to choose your alert type from the drop-down list.

There are six alert types available, covering prices, 52-week highs and lows, dividend yields, P/E ratios, daily price percentage change, and 50/200 moving averages. Finally, you simply need to type in your trigger point. For example, you might want to receive an alert if the Tesla stock price hits $240.

Although a mobile app for iOS and Android is in development, Custom Stock Alerts is currently only available on web browsers. That said, you can receive alerts via SMS or email. The freemium plan permits up to 5 custom stock alerts and basic email support. The premium plan costs $9.99 per month and comes with unlimited alerts and priority support.

| Type of Stock Alerts | Custom alerts covering six basic triggers. Alerts can be set up in three simple steps. Only US-listed stocks, ETFs, and ADRs are supported. |

| How Are Alerts Sent? | Email or SMS |

| Pricing | The freemium plan comes with limitations. Premium plans cost $9.99 per month. |

Pros

- One of the best stock alerts services for beginners

- Easily create custom alerts in just three steps

- All stocks, ETFs, and ADRs from the US markets are covered

Cons:

- Doesn’t track non-US stocks or other asset classes

- Not advanced enough for experienced investors

6. Kubera – Feature-rich portfolio management with stock alerts and insights

Although Kubera doesn’t offer a free plan, it’s worth considering if you’re looking to build long-term wealth. Kubera connects with thousands of brokers, meaning you won’t need to manually add or remove assets. Instead, any changes you make in your brokerage account will be reflected in your Kubera portfolio.

What’s more, Kubera also connects to banks. This means you’ll also receive insights into your spending habits. In addition to stock alerts, Kubera also offers portfolio management tools. It helps you identify which stocks are performing well, and which aren’t. This can help you rebalance your portfolio accordingly.

Kubera is also ideal for investors with diversified portfolios; it tracks dozens of stock markets. In the US, this includes the NYSE, NASDAQ, NYSE American, and the OTC exchanges. Overseas, it tracks stocks in Canada, Portugal, Germany, the UK, Australia, Saudi Arabia, and many other countries. Kubera charges $150 per year, albeit, there’s a 14-day trial for $1.

| Type of Stock Alerts | Portfolio management tools, including stock alerts, insights, and rebalancing suggestions. Connects with thousands of brokers and banks, so you won’t need to manually add or remove assets. |

| How Are Alerts Sent? | Within the Kubera account dashboard |

| Pricing | $150 per year. 14-day free trial costs $1. |

Pros

- One of the best investment tools for evaluating financial health

- Connects with thousands of brokers and banks

- One of the best penny stocks alerts for tracking OTC markets

- Get real-time portfolio insights and suggestions on rebalancing

Cons:

- Only offers an annual plan at $150 per year

7. Stock Alert – iOS app covering 120,000+ assets from over 70 global exchanges

iOS users might consider Stock Alert a good option, especially those seeking app-based notifications. The Stock Alert app tracks more than 120,000 assets from more than 70 global exchanges. Not only does this include stocks but also forex, commodities, funds, and indices. Stock Alert also tracks digital assets.

This can help you monitor the best altcoins, whether that’s Ethereum, XRP, or Litecoin. Users can create custom alerts that align with their investing goals. This includes target stock price movements and percentage changes. You can also add assets to your Stock Alerts watchlist, allowing you to track specific instruments.

Stock Alert also enables users to create custom notification sounds. Like many providers, Stock Alert offers a freemium plan. Although this offers full functionality, users are capped at 10 active alerts. The pro plan removes this barrier and also comes with real-time pricing. You’ll pay $7.99 per month for the pro plan or $34.99 annually.

| Type of Stock Alerts | Custom alerts on over 120,000 assets, including stocks, funds, cryptocurrencies, indices, and forex. |

| How Are Alerts Sent? | iOS app notifications |

| Pricing | Freemium plan offers full functionality but is capped at 10 active alerts. The pro plan costs $7.99 per month or $34.99 annually. |

Pros

- Free stock alerts app for iOS

- Freemium users get full functionality with up to 10 active alerts

- Tracks more than 120,000 assets and more than 70 global exchanges

- Supported assets include stocks, funds, cryptocurrencies, forex, and indices

Cons:

- A pro plan is required to get real-time stock prices

8. Stock Alerts Background – Popular stock alerts app tracking thousands of financial instruments from around the world

Available on iOS and Android, Stock Alerts Background is a popular stock pricing app that covers a wide range of assets. This includes all US-listed stocks, plus indices from around the world. This includes the CAC 40, Shanghai Composite, and the IBEX 35. Stock Alerts Background also tracks cryptocurrencies, commodities, ETFs, mutual funds, and bonds.

Therefore, this is the best stock alerts service if you’re currently invested in many different asset classes. Stock Alerts Background largely focuses on price-based notifications, such as percentage changes and price targets. It doesn’t cover economic meetings, technical patterns, and financial ratios.

As such, the app is only suitable if you’re looking for an overview of market movements. Freemium users can create up to 10 alerts and stock prices change in 30-second intervals. The premium plan comes with limitations and price intervals are reduced to just 5 seconds. However, Stock Alerts Background does not display pricing on its website.

| Type of Stock Alerts | Price-centric alerts on thousands of US-listed stocks, plus cryptocurrencies, ETFs, funds, forex, indices, and bonds. |

| How Are Alerts Sent? | iOS/Android app notifications |

| Pricing | Freemium plan permits up to 10 alerts and comes with 30-second intervals. The premium plan removes limitations, but pricing is not displayed. |

Pros

- Simple iOS and Android app that tracks stock price movements

- Also supports indices, cryptocurrencies, bonds, ETFs, and funds

- The free plan is sufficient for tracking market movements

- Create unlimited watchlists

Cons:

- Does not publish premium plan prices

What are stock price alerts?

Stock alerts are a broad term to describe investment insights. Some stock alerts are merely pricing notifications. This means you’ll be alerted when a pre-defined metric has been triggered.

- For example, suppose you’re considering buying Block stock, which is currently priced at $58.67.

- However, you feel that at current prices, Block stock is overvalued.

- Instead, you’d rather invest when Block stock drops to $53.

- Therefore, you can set up a stock alert that notifies you if and when this price point is triggered.

- Depending on the provider, the alert might be sent via email or SMS.

Some investors use stock alerts to keep tabs on existing investments. For instance, you’d likely want to know if one of your stocks declines by more than 5% in one day. Similarly, you might also want insights on upcoming earnings calls.

Some alerts services also cover technical readings, such as the simple moving average and relative strength index. We also came across stock alerts services that specialize in alternative data insights.

This includes AltIndex, which alerts users when a new social sentiment shift has been discovered. For instance, if there is increasing positive sentiment on social media about a specific stock or industry. AltIndex also offers alerts on its AI-backed stock picking service. This alerts users when a strong buy or sell stock trading signal has been triggered.

What to consider when choosing the best stock alerts service

We’ll now run through some of the considerations to make when researching stock trading alerts.

What stock alerts do you need?

The most important consideration is the type of stock alerts that you’re after. For instance, some investors simply want daily insights into how their portfolio is performing. Similarly, some want alerts when a stock rises or falls by a certain amount. Or when a price target has been triggered.

Alternatively, you might be interested in more advanced tools. For example, although Kubera charges $150 per year, its portfolio management tools are unrivaled. It connects with the leading stock brokers, meaning your portfolio is automatically imported.

Kubera also offers ideas on how to maximize returns and reduce risk. Therefore, investors looking to build wealth long-term might find that the $150 price tag is justified. You might also consider stock news alerts. You’ll receive a notification when a news article is published about one of your stock investments – allowing you to act accordingly.

Another premium option is AltIndex, which is one of the best alternative data providers. It collects, scans, and analyzes billions of data points from social media networks like Facebook and X. Its AI protocol can then assess whether sentiment on particular stocks is positive, neutral, or negative. These insights are invaluable, considering that AltIndex has a 75% win rate when recommending stock picks.

What stock markets do you need to track?

The next step is to assess which stock markets you’re looking to track. The best stock alerts services not only cover US exchanges but also the international markets. For instance, Kubera tracks companies from North and South America, the Middle East, Europe, and Asia.

You might also want alerts on other asset classes. AltIndex is a good option for digital assets, as its AI scoring system can help you find the next cryptocurrency to explode. If you’re invested in currencies or commodities, Stock Alarm has you covered.

Importantly, you’ll want to track all of the assets within your portfolio. If one or more assets aren’t supported, you won’t get a full overview of how your investments are performing.

Are there price delays when receiving stock alerts?

Not all stock alerts services offer real-time pricing quotes. In most cases, there is a delay of about 15 minutes. This isn’t exclusive to stock alert services, but in the broader investment space.

For example, when you view stock prices with your online broker, there is likely a 15-minute delay too. Real-time pricing usually comes at a premium, so don’t expect it if you’re using a freemium plan. We found that on average, you’ll pay around $10 per month for real-time quotes.

That said, real-time data isn’t a necessity. For instance, if you’re a long-term investor deploying a dollar-cost averaging strategy, you certainly won’t need it. In reality, real-time stock alerts are only required if you’re intraday trading.

How much does the stock alerts service cost?

Although many providers offer free stock alerts, this usually comes with limitations. To access all features with full functionality, you’ll need to pay. This is usually charged as a monthly subscription, but some stock alerts services only accept annual purchases.

For example, Kubera charges $150 per year and there is no option to pay monthly. Rather than focusing on the price itself, consider what value you’ll get by becoming a premium member.

- For instance, as a freemium user, you’ll get just one AI stock recommendation from AltIndex each month.

- Paying $29 or $99 per month increases the number of AI stock recommendations to 10 and 25, respectively.

- Most importantly, AltIndex’s AI stock picks have a historical win rate of 75%, so they offer great value for money.

Ultimately, if you’re only looking for free stock alerts, you should be prepared for a sub-par service. This often means increased pricing delays, ads, and limited support for international markets.

How will you receive the stock alerts?

Don’t forget to check how the provider distributes its alerts. The best stock alerts services usually opt for email or SMS.

If the provider has a native mobile app, alerts will likely come through as push notifications. Just make sure the alert type aligns with your preferences.

Conclusion

The best stock alerts services not only help you maximize investment returns but also mitigate risks. Overall, our research found that AltIndex is a great option for getting an edge in the market.

AltIndex offers proactive alerts, rather than simply updating you when a stock price change has already occurred. It specializes in alternative data insights and social sentiment, so you’ll always be one step ahead of your market peers.

FAQs

How do stock alerts work?

What is the best app for stock price alerts?

Are stock market alerts in real-time?

References

- https://www2.deloitte.com/us/en/pages/financial-services/articles/alternative-data-perspectives-and-insights.html

- https://www.thestreet.com/retirement-daily/saving-investing-for-retirement/reduce-risk-while-seeking-maximum-return

- https://www.barrons.com/market-data/stocks/sq

- https://www.schwab.com/stocks/understand-stocks/otc-stock

- https://www.nasdaq.com/market-activity/quotes/real-time