Bitcoin may be the most well-known cryptocurrency, but a vast array of alternative digital currencies, known as altcoins, offer diverse functionalities and potential for appreciation.

Altcoins tend to exhibit higher volatility than Bitcoin, allowing for significant price movements that can result in attractive returns for investors.

While altcoins can move in tandem with Bitcoin, their prices are also influenced by various token-specific factors.

In this article, we’ll reveal the 12 best altcoins to invest in for 2024 and explain everything investors need to know about buying altcoins.

This month, we added Pepe Unchained, The Meme Games, ShibaShootout and other presales, while removing some older listings.

- $PEPU is a layer-2 blockchain designed for Pepe memes.

- Lower gas fees and faster transactions than other Pepe meme coins on the Ethereum layer-1

- Staking rewards for presale buyers and holders

- ETH

- USDT

- BNB

- +1 more

- Immensely popular meme token with zero fees, AI-driven trading, and MEV protection.

- As a PoS token $WAI can be staked to earn 142% p/a passive rewards.

- WienerAI's AI-powered predictive technology gives crypto enthusiasts exclusive insights to help find the next 100x gems.

- ETH

- USDT

- BNB

- +1 more

- An upcoming play-to-earn game which combines Doge Memes with Tamagotchi-style game play

- Stake your presale tokens and earn APR though the presale period and beyond

- $PLAY is the in-game currency for transactions and unlocking special features

- BNB

- ETH

- USDT

- Shiba-themed meme coin project with Wild West-inspired challenges and perks.

- Offers 'Lucky Lasso Lottery' with big crypto prizes up for grabs.

- Buy and stake $SHIBASHOOT tokens to earn 2288% APY passive rewards.

- ETH

- BNB

- USDT

- +1 more

- Multi-chain functionality

- Generous token allocation for community rewards

- Full token audit published

- SOL

- ETH

- BNB

- +2 more

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

- SOL

- ETH

- BNB

- +1 more

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

- ETH

- USDT

- BNB

- +1 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

- ETH

- USDT

- Debit

-

- 1. Pepe Unchained (PEPU): Overall Best Altcoin, Built on the Ethereum L2 Blockchain

- 2. The Meme Games (MGMES): Meme Coin Celebrating the 2024 Paris Olympics

- 3. WienerAI (WAI): Dog-themed altcoin with AI-powered trading bot closes in on presale target with over $7.5M raised

- 4. PlayDoge (PLAY): Top play-to-earn altcoin offers in-game rewards and staking benefits

- 5. ShibaShootout (SHIBASHOOT): Cowboy-themed Meme Token Offers Storytelling Rewards

- 6. Base Dawgz (DAWGZ): Multi-Chain Meme Coin Offers Up To 1,400% Staking APY

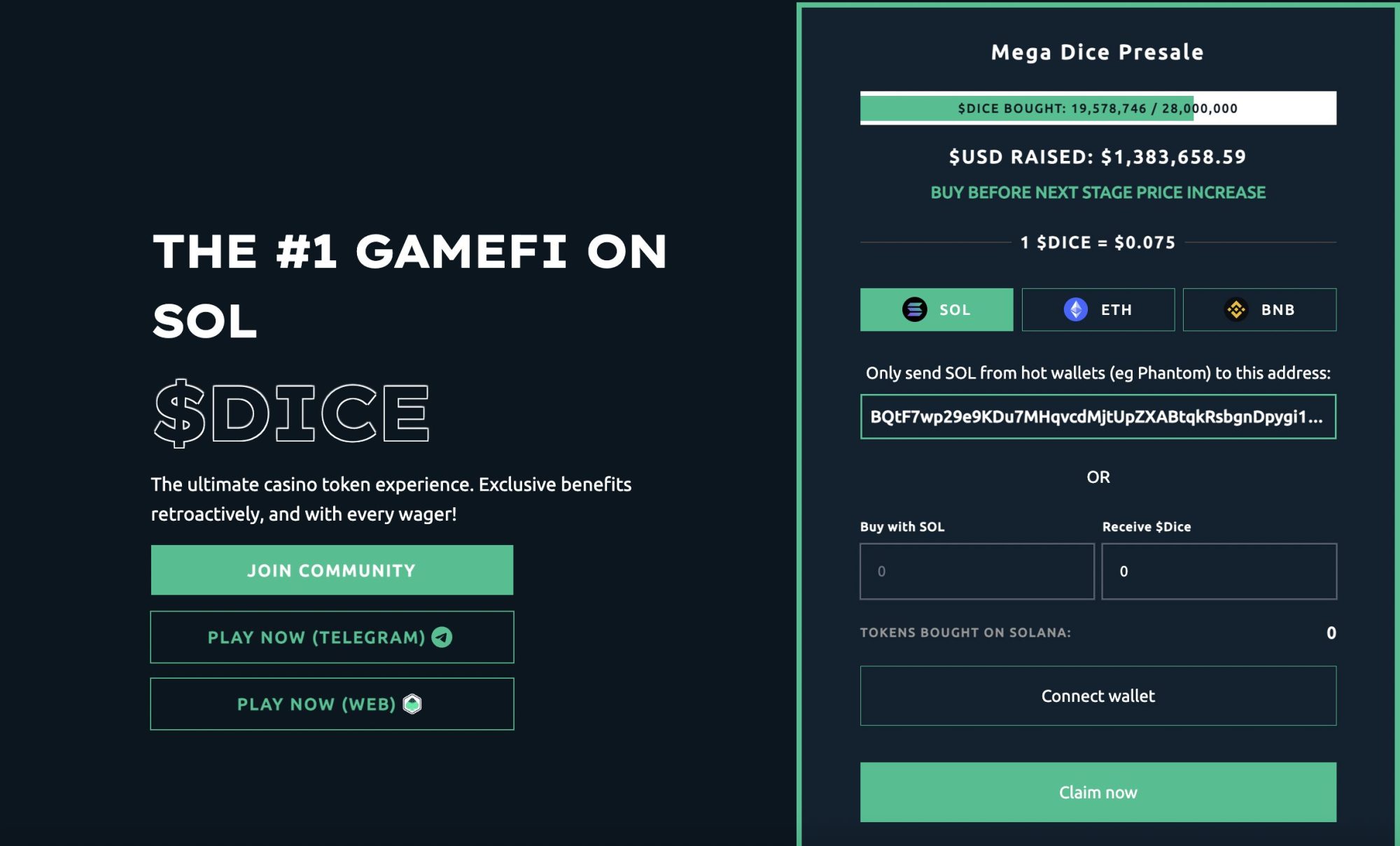

- 7. Mega Dice Token (DICE): GambleFi token $DICE sees 19.5M bought since presale launch

- 8. 99Bitcoins (99BTC): Popular crypto education platform with learn-to-earn rewards

- 9. Sponge V2 (SPONGEV2): Stake-to-bridge token transitions now include lifetime passive rewards in V2

- 10. Mollars (MOLLARS): Truly decentralized and Web3-Integrated Ethereum token

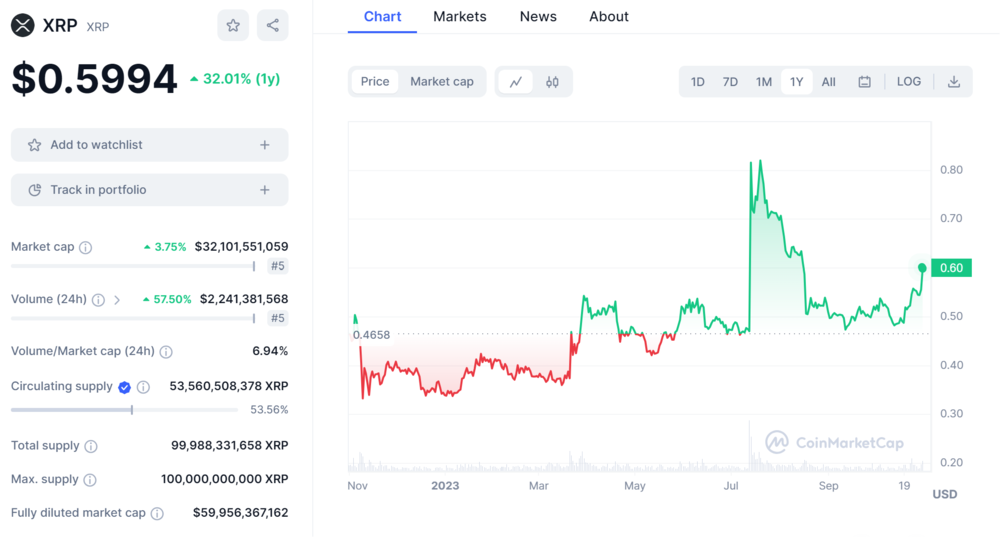

- 11. Ripple (XRP): Hot payments token rising after victory in SEC lawsuit

- 12. Chainlink (LINK): Blockchain Oracle providing data for smart contracts

-

- 1. Pepe Unchained (PEPU): Overall Best Altcoin, Built on the Ethereum L2 Blockchain

- 2. The Meme Games (MGMES): Meme Coin Celebrating the 2024 Paris Olympics

- 3. WienerAI (WAI): Dog-themed altcoin with AI-powered trading bot closes in on presale target with over $7.5M raised

- 4. PlayDoge (PLAY): Top play-to-earn altcoin offers in-game rewards and staking benefits

- 5. ShibaShootout (SHIBASHOOT): Cowboy-themed Meme Token Offers Storytelling Rewards

- 6. Base Dawgz (DAWGZ): Multi-Chain Meme Coin Offers Up To 1,400% Staking APY

- 7. Mega Dice Token (DICE): GambleFi token $DICE sees 19.5M bought since presale launch

- 8. 99Bitcoins (99BTC): Popular crypto education platform with learn-to-earn rewards

- 9. Sponge V2 (SPONGEV2): Stake-to-bridge token transitions now include lifetime passive rewards in V2

- 10. Mollars (MOLLARS): Truly decentralized and Web3-Integrated Ethereum token

- 11. Ripple (XRP): Hot payments token rising after victory in SEC lawsuit

- 12. Chainlink (LINK): Blockchain Oracle providing data for smart contracts

- Show Full Guide

Listing the best altcoins to buy in 2024

Let’s dive straight into our list of the 17 best altcoins to invest in for 2024:

- Pepe Unchained (PEPU): Ethereum L2 meme coin has raised over $4 million on presale.

- The Meme Games (MGMES): Olympics-themed meme coin offers presale gamified bonuses.

- WienerAI (WAI): New AI-powered meme crypto bot offers trading opportunities. $7.5M raised.

- PlayDoge (PLAY): Play-to-earn Doge-themed altcoin. $5.7M raised within a few months of presale launch.

- ShibaShootout (SHIBASHOOT): Wild West-themed meme token, $660K raised.

- Base Dawgz (DAWGZ): Meme token offers multi-chain compatibility. $2.5M raised.

- Mega Dice Token (DICE): Hot new GambleFi token offering daily rewards and a $2.25M airdrop.

- 99Bitcoins (99BTC): Popular crypto education platform with learn-to-earn rewards.

- Sponge V2 (SPONGEV2): Altcoin bridging to V2 after V1 saw 100x price pump, now with a P2E game.

- Ripple (XRP): Hot payments token fresh on the heels of a victory against the SEC.

- Chainlink (LINK): Blockchain oracle network powering smart contracts on Ethereum and beyond.

- Dogecoin (DOGE): The original meme coin with proven staying power offers utility for payments.

Evaluating the Altcoins with the highest growth potential for 2024

Want to know more about the best altcoins to buy now? The analysis below explains why we think investors should check out each of these 17 tokens.

1. Pepe Unchained (PEPU): Overall Best Altcoin, Built on the Ethereum L2 Blockchain

We have picked Pepe Unchained ($PEPU) as the overall best altcoin to watch in 2024. Pepe Unchained is built on the Ethereum layer-two (L2) blockchain, which provides greater scalability and faster transaction speeds to token holders.

Thus, $PEPU token holders can efficiently conduct their trades, and also benefit from lower gas fees. By offloading transactions from the main network, L2 tokens such as Pepe Unchained reduce operational costs.

Thus, the platform can promise higher staking rewards to token holders. At the time of writing, $PEPU can be staked on smart contracts to generate an APY (Annual percentage yield) of 464%.

30% of the total 8 billion token supply will be distributed through staking rewards. Currently, this altcoin is priced at just $0.0084937 on presale. In only a few months, the presale has raised over $4 million.

Another 20% of the token supply will be distributed through the presale. Stay tuned for further project updates by going through the Pepe Unchained whitepaper and joining the Telegram channel.

| Total Supply | 8 billion |

| Tokens Available in Presale | 1.6 billion |

| Blockchain | Ethereum |

| Token Type | ERC-20 |

| Minimum Purchase | None |

| Purchase with | ETH. BNB, USDT, Card |

2. The Meme Games (MGMES): Meme Coin Celebrating the 2024 Paris Olympics

The next altcoin on our list is The Meme Games ($MGMES), an innovative project that combines the spirit of the Olympics with the allure of meme coins.

To celebrate the upcoming Paris Olympics, The Meme Games gives its presale investors the opportunity to earn gamified token bonuses through its Olympics-style race.

Every time an investor purchases $MGMES on presale, they get to select a meme avatar to represent them in a 169m dash sprint. The avatars include popular meme figures such as Dogecoin, Pepe, Dogwifhat, Brett, and Turbo.

The race is completely randomized, giving you a one-in-five chance of securing the bonus. If your character wins, you are awarded a 25% bonus.

Furthermore, $MGMES can also be staked on Ethereum-based smart contracts to secure an annual yield of over 1,900%. 20% of the total 2.024 billion token supply will be distributed through staking rewards and game winnings.

In only a few days since The Meme Games presale launched, the project has raised over $158K. For more information, read the Meme Games whitepaper and join the Telegram channel.

| Total Supply | 2,024,000,000 |

| Tokens Available in Presale | 714,472,000 |

| Blockchain | Ethereum |

| Token Type | ERC-20 |

| Minimum Purchase | None |

| Purchase with | ETH, BNB, USD, Card |

3. WienerAI (WAI): Dog-themed altcoin with AI-powered trading bot closes in on presale target with over $7.5M raised

The next top altcoin in 2024 is WienerAI ($WAI). This groundbreaking meme token merges the meme world with artificial intelligence. WienerAI offers an AI trading bot and advanced trading signals to $WAI token holders.

The WienerAI platform will offer a beginner-friendly, instant, and predictive trading bot. Token holders can enter their queries on the trading bot, which then uses predictive analytics, helping you search for top investment opportunities in the cryptocurrency space.

To offer the best possible trades, WienerAI also provides the top prices available across some of the best decentralized exchanges. The $WAI token gives you access to these features. Notably, WienerAI does not charge any fees on trading $WAI.

This top altcoin also offers passive income through its staking mechanism. At the time of writing, you can stake $WAI on the smart contract and generate an APY (Annual percentage yield) of 142%. Over 6 billion tokens have already been staked on the smart contract.

From a total supply of 69 billion tokens, WienerAI is allocating 30% for the ongoing presale. At press time, $WAI is priced at $0.00073 per token. Since the presale launched, this altcoin has raised over $7.5M.

WienerAI is currently in its final presale stage, so investors eager to buy $WAI should do so until July 31.

For more information, use the WienerAI whitepaper and join the Telegram channel.

| Total Tokens | 69 billion |

| Tokens Available in ICO | 20.7 billion |

| Blockchain | Ethereum |

| Token type | ERC20 |

| Minimum Purchase | None |

| Purchase With | ETH, USDT |

4. PlayDoge (PLAY): Top play-to-earn altcoin offers in-game rewards and staking benefits

PlayDoge ($PLAY) is a mobile-based play-to-earn (P2E) meme coin that has recently launched on presale. On the P2E mode, players can win $PLAY tokens as an in-game reward and stake the altcoin to generate passive income.

PlayDoge combines the allure of Doge-themed meme coins with real utility through its P2E mode. On the P2E game, players can adopt their virtual Doge pets, and are required to feed and look after them. The P2E mode will feature mini-games through which players can collect HP points.

An online leaderboard will be set in place to determine the best performers. The top individuals will be rewarded with $PLAY tokens. To increase your returns, PlayDoge allows token holders to stake this altcoin on smart contracts to generate a high APY (Annual percentage yield).

At press time, $PLAY can be staked to generate an APY of up to 150%. Currently, $PLAY is priced at $0.0052 per token.

In just a few months of the presale launch, this new altcoin has raised more than $5.7 million. Join the PlayDoge Telegram channel and follow PlayDoge on X (Formerly Twitter) for more information.

| Total Tokens | 9.4 billion |

| Tokens Available in ICO | 4.7 billion |

| Blockchain | Binance Smart Chain |

| Token type | BEP-20 |

| Minimum Purchase | None |

| Purchase With | BNB, ETH, USDT |

5. ShibaShootout (SHIBASHOOT): Cowboy-themed Meme Token Offers Storytelling Rewards

ShibaShootout ($SHIBASHOOT) is a cowboy-themed meme token that is inspired by the world of the Wild West. In this digital world, players take the form of Shiba-themed cowboys, with endless earning possibilities.

One can take part in ‘Lassos Lotteries’ and leverage their $SHIBASHOOT tokens to buy tickets and win more tokens. Through ShibaShootout’s ‘Campfire Stories’ mode, players can share their meme coin journies in an engaging storytelling format and win $SHIBASHOOT tokens.

A community-driven project, ShibaShootout is all about giving back to the people. Therefore, holding this altcoin also grants token holders access to voting rights.

Another benefit of $SHIBASHOOT is the passive income, which can be generated through the ‘Cactus staking’ mode. At press time, tokens can be staked to earn an APY of up to 1,400%.

Since the ShibaShootout presale launched, the platform has raised more than $660K. Currently, $SHIBASHOOT is priced at just $0.0196 per token.

To learn more, go through the ShibaShootout whitepaper and join the Telegram channel.

| Total Tokens | 2.2 Billion |

| Tokens Available in Presale | 770 Million |

| Blockchain | Ethereum |

| Token Type | ERC20 |

| Minimum Purchase | N/A |

| Purchase With | ETH, USDT, Card |

6. Base Dawgz (DAWGZ): Multi-Chain Meme Coin Offers Up To 1,400% Staking APY

Base Dawgz ($DAWGZ) is a new altcoin that offers multi-chain compatibility, staking returns, and airdrop rewards.

$DAWGZ, the native token, is built on the Base chain. However, Base Dawgz leverages Wormhole and Portal Bridge technology to offer multi-bridge utility.

Therefore, $DAWGZ token holders can seamlessly navigate from Base to other popular blockchains such as Ethereum, Avalanche, Solana, and Binance.

The $DAWGZ token can also be staked on smart contracts to earn an annual yield of more than 1,400%. In the long-term, 20% of the total 8.453 billion token supply will be distributed through staking pools.

Base Dawgz also hosts an airdrop round, through which early investors can win further $DAWGZ tokens. After purchasing tokens on presale, investors can start earning points by creating and sharing Base Dawgz-related content on social media.

Once the presale ends, the points can be redeemed as $DAWGZ tokens via airdrops. Currently, the Base Dawgz presale has raised more than $2.5 million.

To learn more about this meme coin, read the Base Dawgz whitepaper and join the Telegram channel.

| Total Tokens | 8 Billion |

| Tokens Available in ICO | 1.6 Billion |

| Blockchain | BASE, ETH, BSC, SOL and AVX |

| Token type | Multichain |

| Minimum Purchase | N/A |

| Purchase With | BASE, ETH, BSC, SOL and AVX |

7. Mega Dice Token (DICE): GambleFi token $DICE sees 19.5M bought since presale launch

Mega Dice Token ($DICE) is next on our list of best altcoins. It’s a popular crypto casino that combines the fun of two exciting trends: GambleFi and DeFi. The casino’s native token, $DICE, gives players exclusive rewards like airdrops, cashback at the casino, and NFT bonuses.

Mega Dice is already a successful and profitable casino with over 10,000+ active monthly players. As a result, its recently launched $DICE presale raised over $1.3 million in just a few weeks of launch.

Investors think $DICE has the potential to recreate the success of similar tokens like Rollbit and TG.Casino.

It’s worth noting that the platform offers a 10% referral commission. This means you can earn 10% of the amount your friends invest with no upper cap.

The casino plans to distribute more than $2.25 million in airdrops to its presale participants. For updates, join their Telegram channel or follow them on X.

| Total Tokens | 420 million |

| Tokens Available in ICO | 147 million |

| Blockchain | Solana |

| Token type | SPL |

| Minimum Purchase | None |

| Purchase With | SOL, BNB, ETH |

8. 99Bitcoins (99BTC): Popular crypto education platform with learn-to-earn rewards

Next on our list of best altcoins is 99Bitcoins Token. This well-known platform has provided education about Bitcoin and cryptocurrencies for many years.

The platform already has a large audience, with over 700,000 YouTube subscribers and more than 2 million registered users for its online courses. To further its vision for crypto education, 99Bitcoins launched its own cryptocurrency token, $99BTC. This token will reward users for engaging with 99Bitcoins’ educational materials on cryptocurrencies.

$99BTC will initially operate on the Ethereum blockchain but will soon be transferred to the Bitcoin blockchain using a new token standard called BRC-20. This transfer can help the token be more secure and potentially increase its utility.

Moreover, early buyers can also get high staking rewards. At the time of writing, the platform offers an over 863% APY.

The platform also buzzed around its token launch by giving $99,999 worth of tokens to 99 lucky users via an airdrop.

You can also read 99Bitcoin’s whitepaper to learn more about the platform’s long-term vision and goals. Interested users can follow 99Bitcoin on X and enter its Telegram channel to get the latest updates.

| Total Tokens | 99 billion |

| Tokens Available in ICO | 14.85 billion |

| Blockchain | Ethereum (Will Bridge to Bitcoin) |

| Token type | ERC20 |

| Minimum Purchase | None |

| Purchase With | ETH, BNB, USDT, Card |

9. Sponge V2 (SPONGEV2): Stake-to-bridge token transitions now include lifetime passive rewards in V2

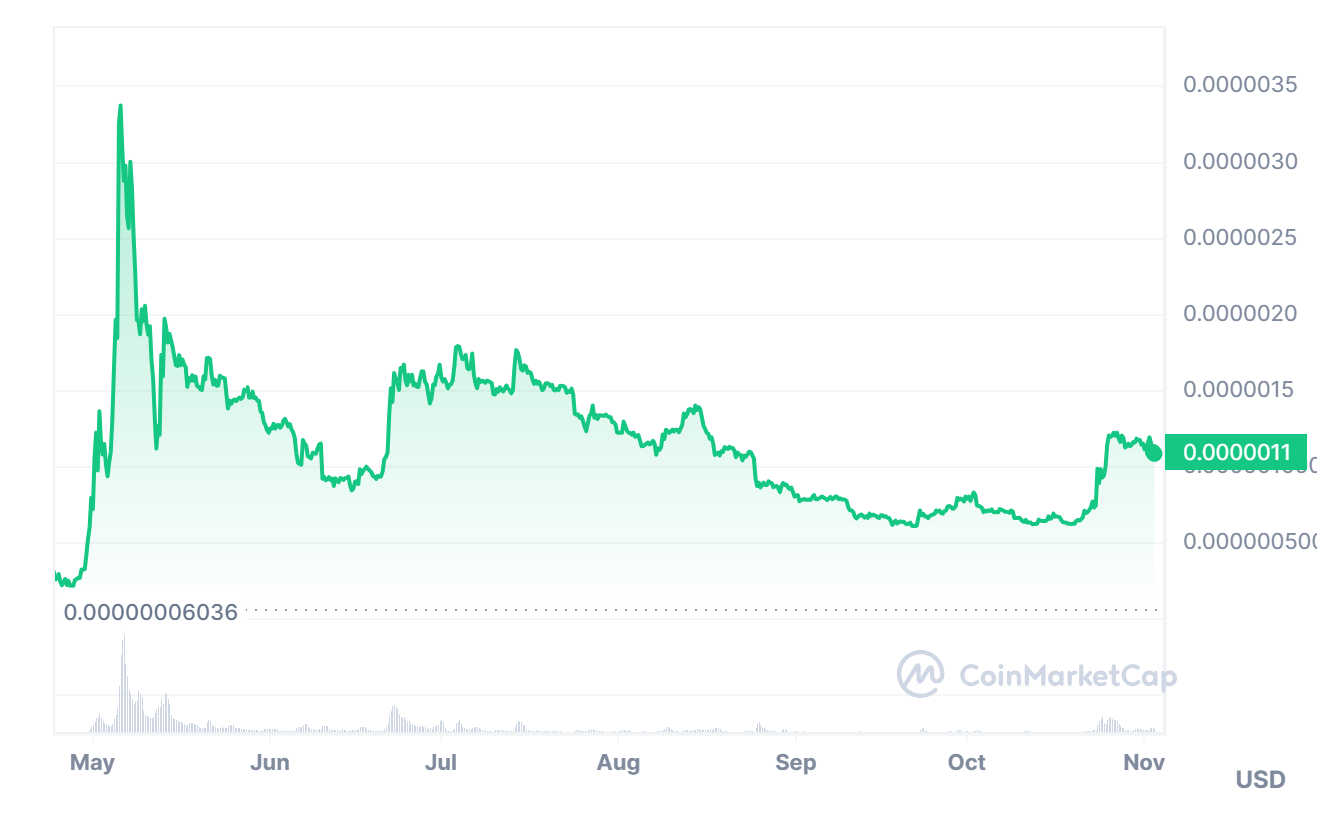

Launched in May 2023, the Sponge meme coin gained immense popularity. Its market cap increased by 100 times, from under $1 million to almost $100 million.

With a market cap exceeding $16.5 million (as of publication), over 11,500 holders, and large, passionate communities on Telegram and X – it’s clear Sponge is a market favorite.

Based on this success, the team is looking to grow their token and ecosystem further by bridging existing tokens, SPONGEV1, to an upgraded version, Sponge V2.

This token will feature more utility and can be used in a play-to-earn game, Sponge Racer, that is soon to enter development—per the Sponge V2 whitepaper.

To bridge the tokens, the team has deployed a stake-to-bridge smart contract. Holders of $SPONGE V1 can lock their tokens to receive an equivalent in $SPONGEV2 tokens. These are automatically staked to begin earning a variable APY for the user.

If you do not have $SPONGE V1 tokens, you can still participate in the presale by purchasing tokens at the current market price of $SPONGE V1.

Those who contribute to the presale will receive SPONGEV1 tokens, which will be automatically locked to generate SPONGEV2 tokens. These $SPONGE V2 tokens will also be automatically staked to earn the same variable APY.

Note: $SPONGE V1 has been officially discontinued.

Those who participate in the presale or stake their SPONGEV1 tokens will receive staking rewards for the next 4 years on their locked SPONGEV1 tokens, giving presale participants the opportunity for long-term, hassle-free passive income.

This staking and passive income utility, along with the release of a play-to-earn game, are why Sponge is considered by many to be a candidate for a Binance listing and why it’s on our list of the best altcoins to invest in right now.

| Total Tokens | 150 billion |

| Tokens Available in ICO | N/A |

| Blockchain | Ethereum |

| Token type | ERC20 |

| Minimum Purchase | None |

| Purchase With | ETH, USDT, Card |

10. Mollars (MOLLARS): Truly decentralized and Web3-Integrated Ethereum token

Ethereum token Mollars remains faithful to cryptocurrency’s original philosophy by shielding it from inflationary pressures in a centralized economy.

This is accomplished first and foremost by promising “true decentralization.” In other words, unlike Bitcoin, the founders of Mollars have committed to not retaining any ownership of the token supply without purchasing it.

As a result, the value of the token cannot be manipulated.

The project’s tokenomics are designed to support its mission, with a 1% burn rate and 3% transaction tax reinvested into the ecosystem to help maintain the stability of the coin’s value.

In addition, $MOLLARS offers a more cost-effective option for buying and selling compared to Bitcoin, as the Ethereum network boasts an average trade value of $8, which is approximately 80% cheaper than the Bitcoin blockchain.

Furthermore, the creators of Mollars have teased the upcoming release of a mysterious Web3 offering and have confirmed that the native token will be compatible with it, providing an exciting additional utility for the project.

These factors have culminated in a strong start for $MOLLARS. It has sold around 1.5 million tokens in three months of presale, with $700,000 raised. If the project hits the $2m milestone before the presale ends in May, it will list at $0.62, equating to more than 200% ROI for early investors.

Considering all of this, Mollars comfortably makes our list of the best crypto to buy now in 2024.

| Total Tokens | 10 million |

| Tokens Available in Presale | 4 million |

| Blockchain | Ethereum |

| Token Type | ERC-20 |

| Minimum Purchase | N/A |

| Purchase With | SOL, USDT, Credit/debit card |

11. Ripple (XRP): Hot payments token rising after victory in SEC lawsuit

Ripple has long been one of the most controversial altcoins on the market, largely because of its tangle with the US Securities and Exchange Commission (SEC). The SEC sued Ripple in 2020, alleging that its $XRP token was an unregistered security.

That lawsuit was recently resolved in Ripple’s favor and found that $XRP is not a security. That has paved the way for widespread adoption of the token, which is used to coordinate international payments with significantly lower fees than traditional payment networks.

The price of $XRP is up 72% since the start of the year when it became increasingly clear that Ripple would win the suit, and 15% in the last month. It’s one of the best altcoins to watch, although it remains more than 80% below its all-time high. So, this could be an opportunity for investors to buy $XRP at a discount.

With the lawsuit behind it, more banks will likely sign on to try Ripple’s payment network and increase demand for $XRP.

A major US bank partnering with Ripple could be a huge positive catalyst for the token. Ripple’s general counsel told CNBC in July that he believes American banks will start working with Ripple, although it could take a year or more for new partnerships to be announced.

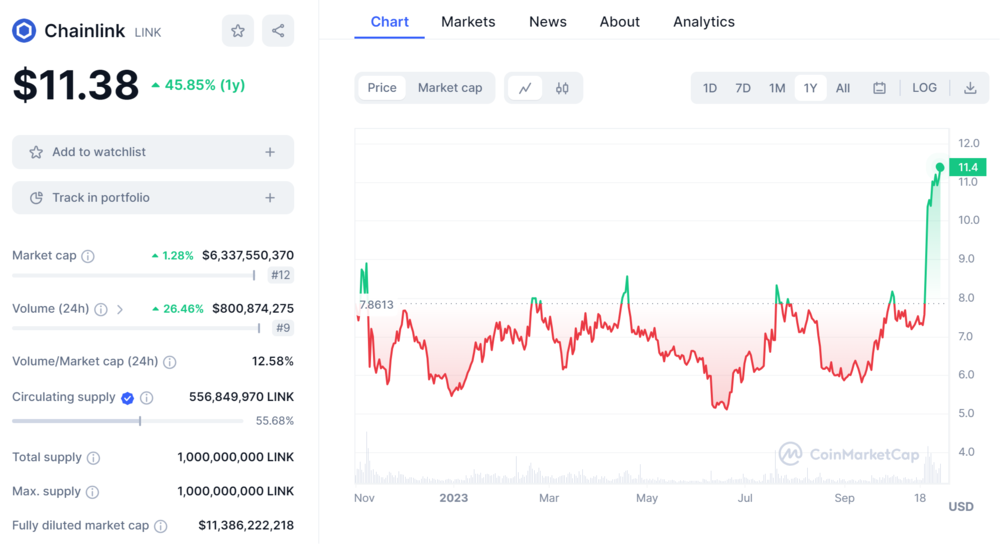

12. Chainlink (LINK): Blockchain Oracle providing data for smart contracts

Chainlink is essential in the blockchain ecosystem, providing data from off-chain data sources to on-chain smart contracts.

Say a smart contract on Ethereum governs a bet on a basketball game. That smart contract works through a unique consensus mechanism to determine which team won the game and gets that data from Chainlink.

Chainlink uses a decentralized network of nodes to ensure its data is accurate and can’t be easily manipulated. Its trustworthiness is a huge part of why many Ethereum dApps and smart contracts rely on Chainlink.

Chainlink collects a fee every time it provides data, which adds up to a massive treasury that backs up the value of its $LINK governance token. The $LINK token has been hugely successful, up 38% in the last month of trading alone.

In the long term, $LINK could move even higher. Chainlink is the Oracle network for other blockchains, including Solana, Cardano, Avalanche, and more. It’ll also play an essential role as cross-chain transactions increase, and blockchains must share both off-chain and on-chain data.

What is an Altcoin?

An altcoin is any cryptocurrency other than Bitcoin. It’s not a size classification since Ethereum, the second-largest cryptocurrency by market cap, is also considered an altcoin. Still, most altcoins have much smaller values than Bitcoin.

The vast majority of altcoins are either forked from Bitcoin or built on Ethereum using smart contracts. However, some altcoins have no relationship to either of these tokens. For example, Solana is a completely distinct blockchain protocol.

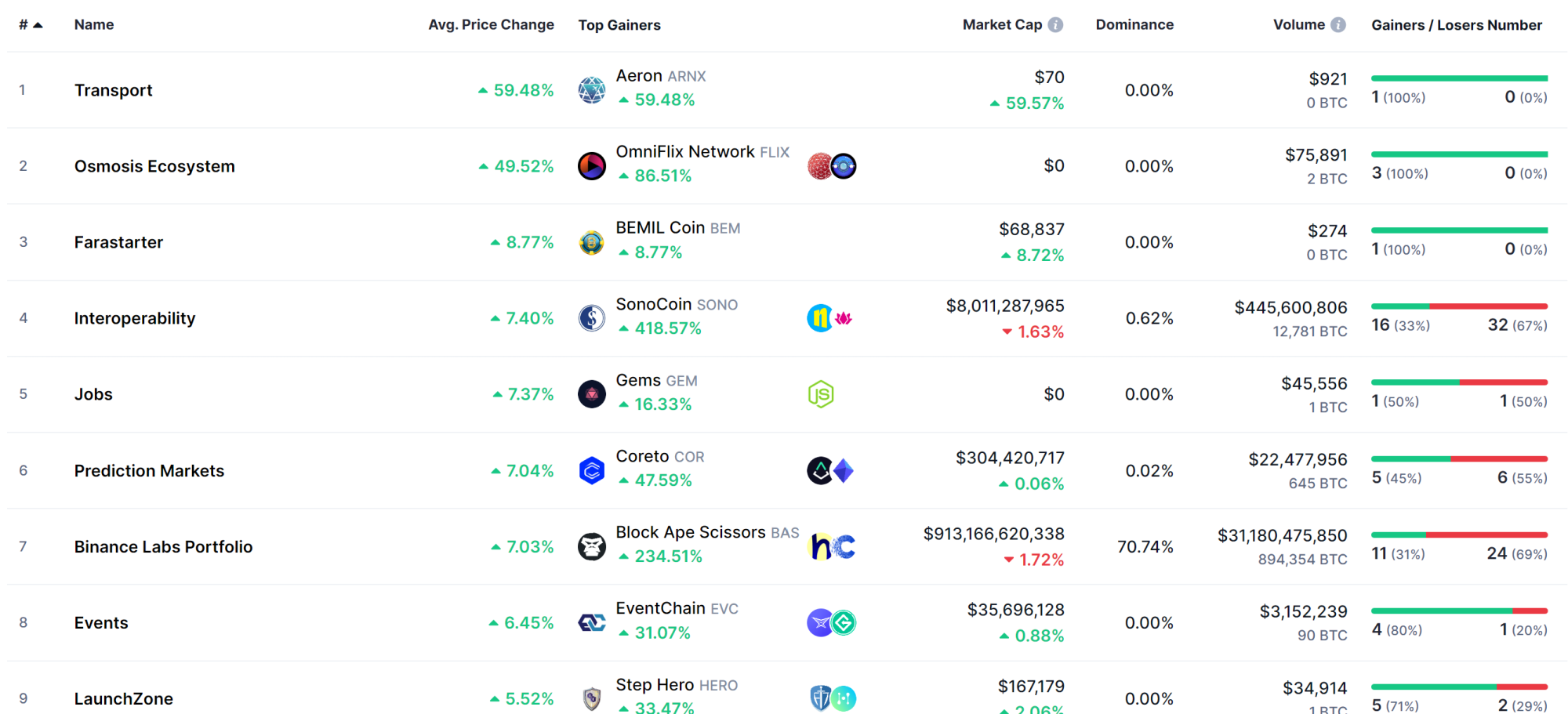

Altcoins serve a wide variety of different purposes. Some broad categories of altcoins include:

- Meme coins

- DeFi coins

- Stablecoins

- Governance tokens

- Metaverse coins

- Play-to-earn coins

One of the neat things about these digital assets is that if one doesn’t solve a problem or need in the crypto market well enough, another can attempt to solve the same problem. Crypto users and investors can signal which altcoins are needed by voting with their money.

Why invest in Altcoins?

There are many reasons why investors may want to buy some of the best altcoins for 2024.

Seeking potential price appreciation

One of the biggest reasons investors buy altcoins is to seek opportunities for investment returns. Compared to Bitcoin, altcoins typically experience more volatility.

This means that they can have greater price gains when they go up. However, altcoins can also suffer greater losses when they go down. So, altcoins should be considered a high-risk, high-reward investment class.

For example, let’s compare potential price gains in Bitcoin and an altcoin like Dogecoin. In 2021, when the crypto market was historically bullish, Bitcoin gained 60%. Dogecoin gained 23,000%—an almost unheard-of single-year gain for a major asset. Many investors remember 2021 as the ultimate altcoin season.

Not all altcoins are equally volatile. Major cryptos like Ethereum, for example, are typically less volatile than meme coins like Dogecoin.

Emerging cryptocurrencies tend to be the most volatile since they can either explode upward after launch or lose all of their value. Investors in new crypto altcoins, including ICO coins, often speculate in search of huge gains.

For example, the meme coin $PEPE gained more than 4,500% after its launch in April 2023. But many other meme coins launched after $PEPE’s success found little traction and investors lost their money on these tokens.

Building a diversified crypto portfolio

Some investors use altcoins to build a more diversified crypto portfolio.

Divergence can exist between different coins in different project categories. For example, DeFi coins may move in different ways than meme coins. Altcoins like Ethereum can be relatively stable even when volatility among other altcoins is high.

That said, it should be noted that the crypto market as a whole tends to move in the same direction. So, diversifying across multiple altcoins isn’t the same as diversifying across multiple asset classes, such as crypto, stocks, and bonds.

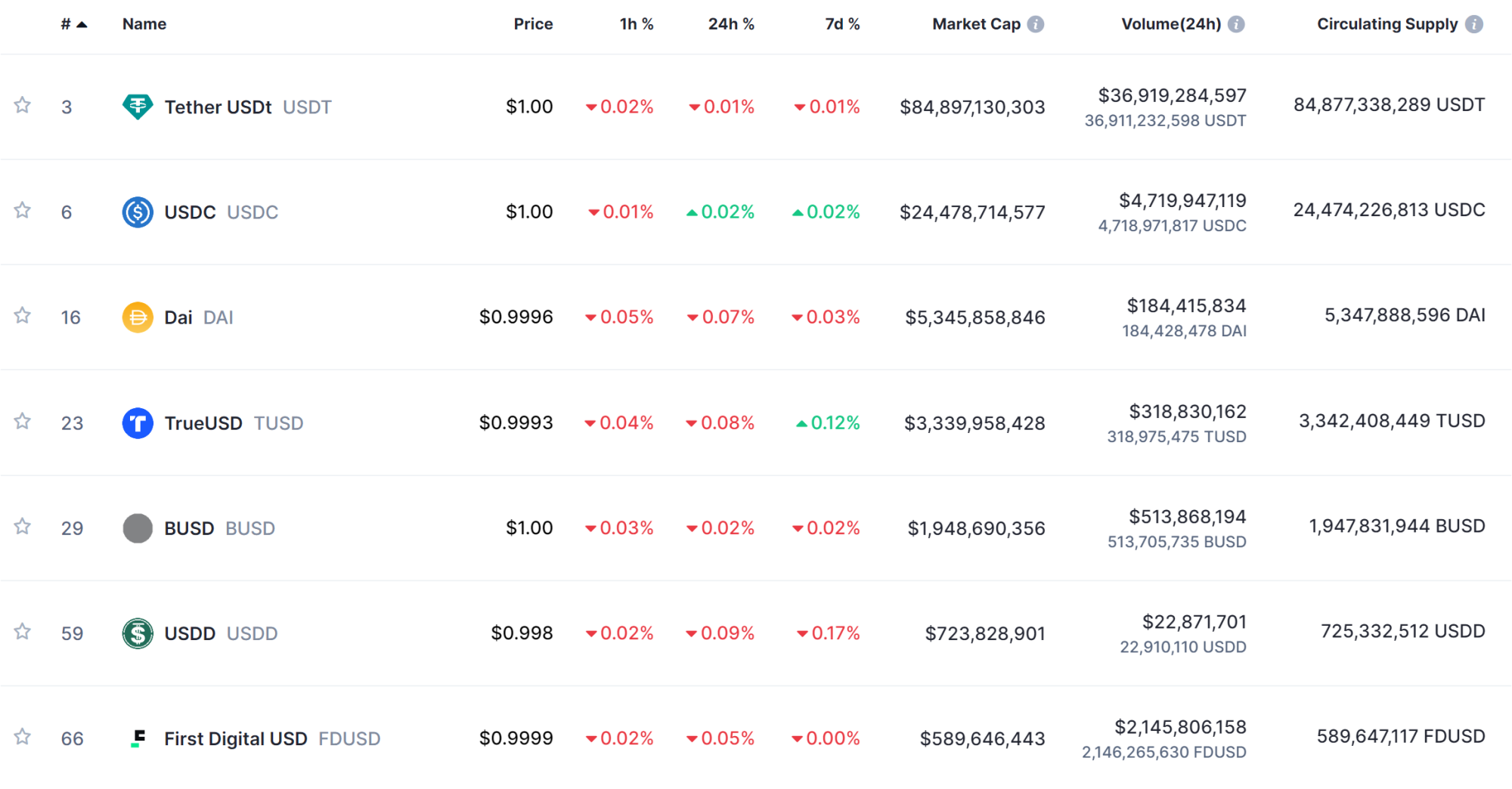

Investing in stablecoins

Stablecoins like $USDT, $DAI, $USDC, and others are pegged to a specific value, usually $1. They’re not typically thought of as “investments” since their value doesn’t change over time, and thus there is no potential for price appreciation.

However, investors can hold stablecoins in their crypto portfolio similar to how they might hold cash in a stock portfolio. Holding stablecoins keeps investors in the crypto market, allowing them to move quickly when an investment opportunity presents itself. In the meantime, they’re not exposed to the ups and downs of Bitcoin or most altcoins.

Earning staking rewards

One of the major features of the crypto market that is only available for altcoins, not Bitcoin, is staking. Staking is available for blockchains that use a proof-of-stake validation mechanism, while Bitcoin uses a proof-of-work validation mechanism.

Staking enables investors to lock up their altcoins for some time and earn rewards, usually in the form of more of the same token. Many altcoin projects publish their staking rate as an APY, making staking rewards similar to interest rates for cash.

Staking can be extremely lucrative for investors. For example, Meme Kombat currently offers a 112% APY for staking its $MK token. That means investors who stake $MK now would more than double their $MK token holdings in a year. TG.Casino currently offers a 321% APY for staking its $TGC token.

Staking lock-up periods

Investors should check lock-up periods for staked tokens. Some altcoins can be staked and unstaked at any time. However, staking for most altcoins requires a fixed lock-up period ranging from several days to several months. During this lock-up period, investors cannot transfer or sell their tokens.

Accessing specific functions in the crypto market

Many altcoins give investors access to specific functionality or benefits that investors may want.

There are many more examples of altcoins built to serve a specific purpose. Often, the more of a token that an investor owns, the greater their benefits or access within the context of that specific crypto project.

How many Altcoins are there?

According to CoinMarketCap, there are currently around 22,900 cryptocurrencies. All of these except Bitcoin are altcoins.

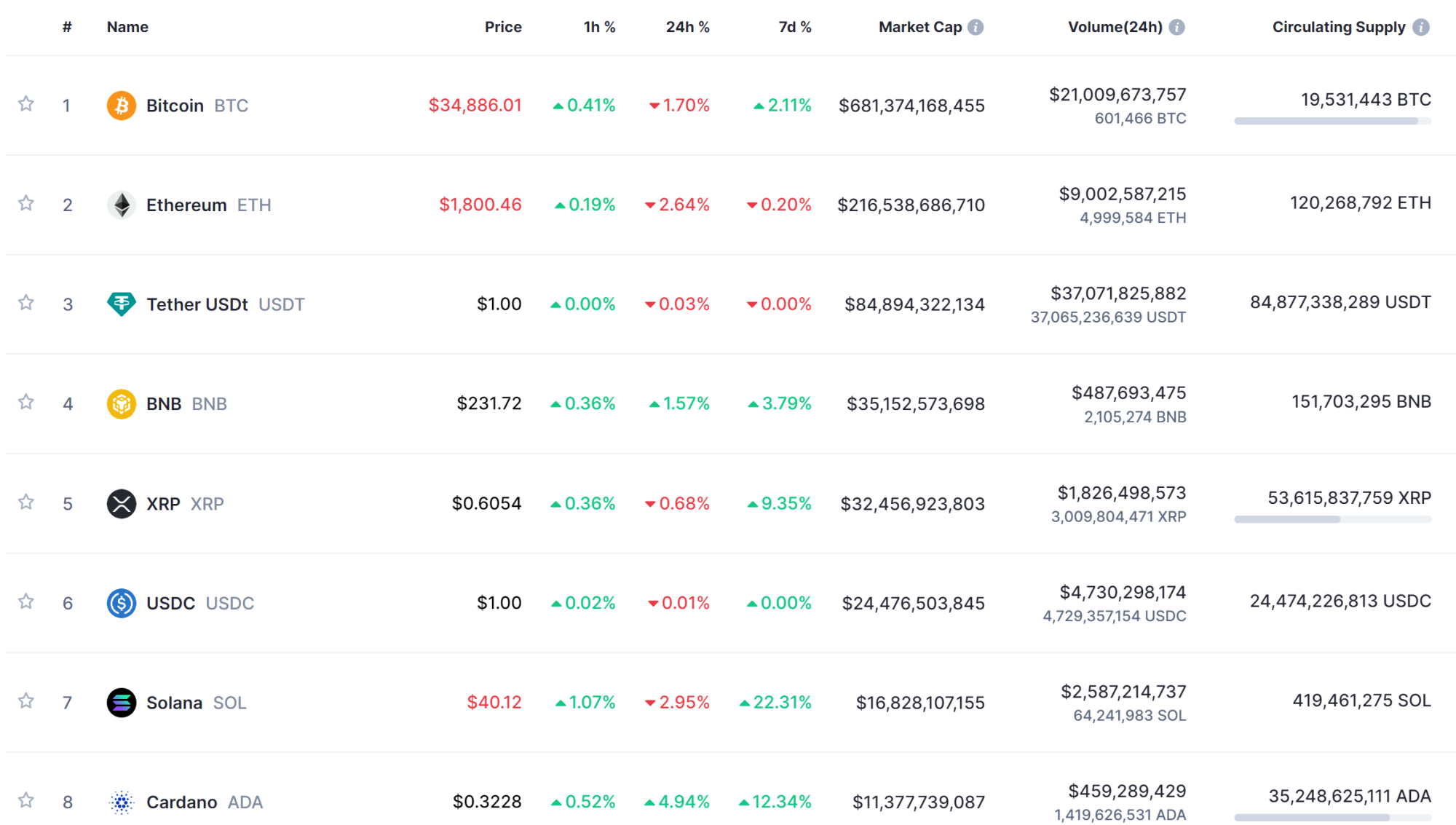

Notably, Bitcoin still dominates the crypto market. BTC has a market cap of $675 billion, Ethereum has a market cap of $219 billion, and all other altcoins combined have a market cap of approximately $386 billion.

Keep in mind that not all of these 22,900 cryptocurrencies are active. CoinMarketCap tracks all cryptocurrencies that have ever been created. Since many tokens are created using smart contracts, they continue to exist even after the project creators and all investors have left.

Estimates vary, but most trackers consider there to be around 8,000-9,000 active altcoins.

How to find the best Altcoins to buy

There’s a lot to consider when choosing the best altcoins with the most potential. Here are some of the most important factors investors should consider when evaluating what altcoin to buy now.

1. By growth potential

Many investors buy altcoins in search of greater returns than they can get by investing in Bitcoin or other asset classes. So, it’s essential to consider the growth potential of a specific crypto token.

Some factors to consider include:

- How have other altcoins in this token category performed?

- What is the expected market value of the niche the token addresses?

- What market cap does a token already have or will launch with?

The best altcoins are often characterized by having well-defined use cases and a substantial addressable market. Additionally, these cryptocurrencies tend to have a relatively small market capitalization at present, but with the potential to increase by tenfold or more in the future.

2. By value

Investors can explore established altcoins in search of undervalued tokens. In today’s market, numerous opportunities exist to purchase undervalued altcoins, as the crypto winter has significantly affected many tokens.

Conducting a thorough examination of a token’s all-time high can be a powerful tool in determining its potential undervaluation. However, it’s crucial to note that not all inexpensive altcoins may regain their previous peak levels, underscoring the importance of comprehensive research.

It’s important to carefully assess what a token will likely be worth in 12-24 months compared to its current price. While consulting price predictions for altcoins from professional crypto analysts can be valuable, it’s essential to approach them cautiously.

3. By staking rewards

Altcoins that offer staking rewards can generate returns for investors regardless of price appreciation. Investors simply have to stake their tokens and earn rewards.

When assessing staking rewards, a higher APY is usually preferable, but it is not the only factor to consider. It is crucial to ensure that an altcoin’s staking rewards are sustainable. Consider the source of the reward tokens and whether it is renewable.

Investors also need to consider that while staking can provide returns if a token’s price remains flat, they can still lose money if it falls by a greater amount than staking returns.

4. By utility

Utility coins can provide crypto investors with specific benefits. For example, investors in $BNB can get significant discounts on altcoin trading at Binance. This could make owning $BNB worthwhile for some investors even if they don’t believe the price of $BNB will go up.

When investing in utility tokens, consider the opportunity cost of buying that token instead of another altcoin. Most investors have limited capital to deploy, so they have to pick and choose which utility tokens provide benefits that outweigh the opportunity cost of holding that specific token.

5. By investor sentiment

One of the best indicators of whether a cryptocurrency will increase in value is whether investors are positive or negative about the project. Many crypto analytics tools, such as Launchpad XYZ, enable investors to check sentiment around specific tokens on social media.

Investor sentiment can be wrong, particularly over long timescales. However, it usually tracks buying and selling activity, so it’s good to check when identifying entry points into a new altcoin investment.

6. By roadmap

When evaluating new altcoins to buy, particularly those being sold through a presale, look at the project’s roadmap. This should lay out what the project hopes to achieve and when.

New altcoins often surge when a project hits a roadmap milestone. So, keeping track of what milestones are coming up and when they might be reached can be very helpful for making investment decisions.

Where to buy Altcoins

Investors can buy altcoins in several ways. One of the simplest is through centralized exchanges, which allows new crypto investors to buy the most popular altcoins with fiat.

Investors who currently hold cryptocurrency also have the option to purchase alternative cryptocurrencies, known as altcoins, through decentralized exchanges. These types of exchanges usually have lower fees compared to centralized ones.

Additionally, some newly launched altcoins are exclusively available through cryptocurrency presales.

To participate in these presales, investors need to acquire tokens such as $ETH, $USDT, or $BNB. Typically, investors purchase these tokens during the presale and then claim the altcoins once it period concludes.

Potential risks of investing in Altcoins

While picking the right altcoin can be extremely lucrative, there are risks to these cryptocurrencies. Here are some of the most important risks investors should be aware of.

a. High volatility

As discussed above, altcoins typically have higher volatility than Bitcoin and other asset classes. This volatility makes altcoins potentially high-return, but investors also need to be careful when holding highly volatile tokens.

Even if investors find a promising altcoin to buy, they could be knocked out of an investment if they aren’t prepared for significant, temporary downside swings. For example, if an investor trades on margin, they could face a margin call if an altcoin drops steeply in value temporarily.

Volatility on its own is not necessarily a bad thing, but it is a risk that investors need to recognize and manage.

b. Scams and rug pulls

Investors need to look for scams, particularly when investing in new altcoins. While many altcoins are legit, the crypto industry has been plagued by scam tokens designed to take investors’ money.

A rug pull is one of the most common types of scams that investors face. This occurs when a new crypto project raises money, such as through a token presale, and then the project team takes the money and never delivers the promised project.

The biggest rug pull in crypto history, the OneCoin scam, stole an estimated $4 billion to $15 billion in investors’ funds.

Strategies to protect yourself from falling victim to crypto scams

Investors can avoid scams by doing their due diligence on projects before investing. Here are a few steps that investors can take to ensure the altcoin they want to buy is legit:

- Look for third-party smart contracts audits by trusted auditors such as Certik

- Read projects’ whitepapers carefully and ensure the project makes sense

- Evaluate the tokenomics to ensure the value of the token is tied to the success of the project

- Check whether the project team has been doxxed (it is common practice for the developers of meme coins to remain anonymous)

Impacts from regulation

It’s important to remember the following information: Most alternative cryptocurrencies, or altcoins, have been operating without much oversight from regulators, leaving doubts about whether many altcoins may be considered unregistered securities. There is also uncertainty about whether regulators might take action against specific altcoins, particularly stablecoins.

In the United States, the Securities and Exchange Commission (SEC) has recently made efforts to designate certain altcoins as unregistered securities, putting the entire cryptocurrency industry on notice that it may face increased scrutiny. Additionally, the SEC is working on implementing new anti-money laundering regulations that could impact the functionality of certain altcoins.

Investors need to stay informed about proposed regulations and laws, as they can significantly impact specific tokens and could even lead to project closures. New regulations and legal actions can arise with little warning, posing additional risks for investors.

Conclusion

Altcoins include all cryptocurrencies other than Bitcoin, and they have many different purposes in the crypto market. There are DeFi coins, meme coins, stablecoins, and much more. All of these different coins can present opportunities for investors.

Based on our analysis, the best altcoin to buy for 2024 is Pepe Unchained – an Ethereum layer-two meme token. This platform offers fast transaction speeds while charging low gas fees from $PEPU token holders.

FAQs

What are Altcoins, and why should I consider them?

How do I choose the best Altcoins to invest in?

Are Altcoins a safe investment?

Where can I buy Altcoins?

What are some of the risks involved in investing in Altcoins?

References

- www.statista.com/statistics/234038/telegram-messenger-mau-users/

- www.sec.gov/news/press-release/2020-338

- news.bloomberglaw.com/crypto/ripple-token-is-a-security-in-institutional-sales-judge-rules

- www.cnbc.com/2023/07/17/ripple-hopes-judge-ruling-in-sec-case-will-lead-to-us-banks-using-xrp.html

- www.reuters.com/technology/standard-chartered-bumps-up-bitcoin-forecast-120000-2023-07-10/

- www.coindesk.com/policy/2023/09/11/ftx-holds-116b-in-sol-200m-in-bahamas-real-estate-court-filing-says/

- www.cnbc.com/2023/06/05/sec-sues-binance-and-ceo-changpeng-zhao-for-us-securities-violations.html

- fortune.com/crypto/2023/10/30/ethereum-spot-etf-grayscale-bitcoin-january/

- www.treasurers.org/hub/treasurer-magazine/cryptocurrencies-why-some-more-volatile-than-others

- coinmarketcap.com/currencies/pepe/

- coinmarketcap.com/academy/article/the-onecoin-scam-the-dazzling-story-of-the-biggest-crypto-ponzi-in-history

- www.washingtonpost.com/business/2023/06/09/why-crypto-flinches-when-sec-calls-coins-securities-quicktake/84dd58ee-06d8-11ee-b74a-5bdd335d4fa2_story.html

- www.polymersearch.com/blog/chatgpt-statistics

- www.productplan.com/glossary/minimum-viable-product/