If you’re regularly buying and selling stocks, you’ll need a way to keep tabs on market prices. This is where stock portfolio trackers can help – they give you real-time insights on how your investments are performing.

This guide explores the 10 best stock portfolio trackers for 2024. Each tracker is ranked based on supported markets, fees, data accuracy, available device types, and other key features.

List of the 10 Best Stock Portfolio Trackers

Let’s begin with a list of the best portfolio tracker tools available today:

- Danelfin: AI-powered stock picking tool that distinguishes itself with its “Explainable AI” feature. The platform uses AI to rate stocks and identify potential trading opportunities. It allows users to easily track their portfolio by sending timely alerts when there is any change in the AI scores of stocks.

- AltIndex: Our top pick, AltIndex provides alternative data on thousands of stocks. It explores social sentiment and website analytics, ensuring investors are always one step ahead. Stocks are given an AI ranking score, which is updated daily. AltIndex also offers stock alerts, recommended buys, and price predictions. This one-stop tool offers everything investors need to stay informed.

- Stocklytics: This data analytics platform offers AI-driven tools and insights. Over 5,700 stocks are tracked, covering 11 US and international exchanges. Stocklytic’s tracker tool offers stock alerts, technical signals, and a fully-fledged stock screener. Fundamental data is also covered, including analyst ratings, market capitalization, price changes, and dividend yields.

- Sharesight: Connect your online brokerage accounts directly to Sharesight. Avoid needing to manually enter stock purchase amounts and cost prices. Sharesight gives you useful insights into your overall portfolio values, including dividends and potential tax liabilities. Tracks more than 250,000 stocks, ETFs, and mutual funds. Over 40 international stock exchanges are covered.

- Morningstar: Free portfolio management tool tracking stocks, ETFs, pension funds, and investment trusts. Receive notifications when financial news or a major price change impacts one of your investments. Premium members get additional tools, including an X-ray scanner that offers portfolio insights. Morningstar also offers research reports, stock ratings, and market commentary.

- Kubera: This portfolio management website is aimed at investors with long-term financial goals. It tracks your entire net worth in real-time – as Kubera connects with over 20,000 banks and brokers from 68 countries. Supported markets include stocks, ETFs, cryptocurrencies, and commodities. Kubera also tracks your cash balances, spending habits, and real estate valuations. However, Kubera charges $150 annually.

- Stocks Tracker: Highly rated stock tracking app for iOS and Android. Most features are free, including stock tracking, pricing alerts, and technical signals. Stocks Tracker also keeps you posted on upcoming quarterly earnings calls and relevant financial news. The app also comes with chart analysis tools, including technical indicators. Its real-time stock tracker requires a premium plan at $9.99 per month. New users get a 7-day free trial.

- Seeking Alpha: A popular stock research and analysis platform, Seeking Alpha is ideal for fundamental investors. Once stocks have been added to your portfolio, you’ll have access to quant, Wall Street, and sell-side analyst ratings. These cover five core metrics – valuation, growth, profitability, momentum, and revisions. Premium members – who pay $199 for the first year, also receive Seeking Alpha stock recommendations.

- Ziggma: Another top-rated option for investors who want to track their entire financial spectrum. Ziggma connects with over 20,000 institutions, including online brokers, checking accounts, and retirement plans. Get real-time insights on your overall financial health and spending habits. Ziggma is available on browsers and as an iOS/Android app. The free plan comes with limitations. Full functionality costs $7.49 per month.

- Stock Rover: Offers one of the best free portfolio tracking tools in the market. Free users can connect their brokerage accounts, offering portfolio syncing. Additional tools include stock analyst ratings, performance indicators, and financial news. However, free plans come with ads. Premium plans not only offer an ad-free experience but additional tools and features. Prices range from $7.99 to $27.99 per month.

- WallStreetZen: Tracks four of the most important data points – stock prices, financial news, insider transactions, and upcoming events. The latter includes dividend announcements and quarterly earnings calls. WallStreetZen alerts you when any of these data points are triggered. WallStreetZen also allows users to track Wall Street portfolios, including hedge funds.

A Closer Look at the Top Stock Portfolio Tracking Tools

Read on to discover which stock tracking websites are best suited for your requirements. We’ll now review the top 10 portfolio trackers for 2024.

1. Danelfin- Explainable AI tools to track and manage portfolios

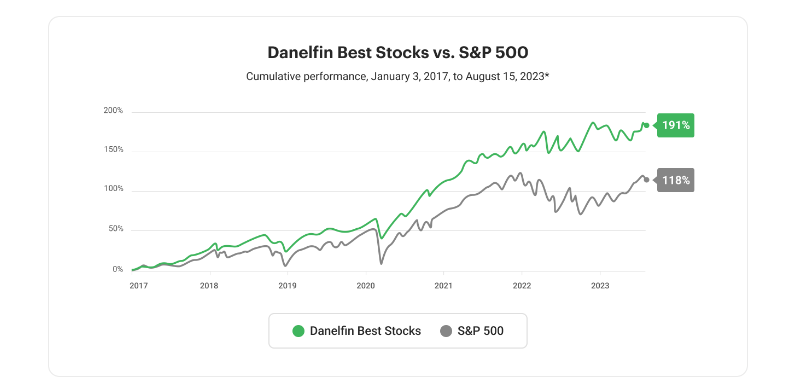

Danelfin is a stock analysis platform that uses AI to rate stocks and identify potential trading opportunities. The platform distinguishes itself with its “Explainable AI” feature, which demystifies the process behind the AI scores.

Before we discuss Danelfin’s portfolio tracking abilities, it is important to understand how it generates the AI scores. The platform analyzes 600 technical, 150 fundamental, and 150 sentiment indicators daily to gain insight into stock market trends.

Danelfin then classifies those indicators into 10,000 possible stock features to search for alpha patterns. It assigns each stock a probability of outperforming the market and uses the probability to assign scores (from 1 to 10) to each stock.

Danelfin allows its users to create one or more portfolios, depending on their plan. Users can monitor average AI scores for the stocks in their portfolio on a daily basis. The AI scores can prove very useful in deciding which stocks and ETFs to add, hold, or discard.

Moreover, with Danelfin’s “Explainable AI” feature, investors can make informed decisions by understanding the forces behind the change in AI Scores. Monitoring the evolution of AI scores can also help users better manage their portfolio risk.

Additionally, users receive daily alerts on any change in their stocks and ETFs’ AI Scores. These alerts can help users make adjustments to their portfolio and stay informed about their portfolio’s overall alpha odds. Portfolio Diversity Score is another tool that Danelfin offers its users to track their portfolios.

| Key Features | Device Type | Pricing |

| Offers portfolio tools like Average AI Score, Portfolio Diversity Score, and daily alerts to help users track and manage their portfolio. | Web-based | Free, Plus ($19 monthly) and Pro ($52 monthly) Plans. |

2. AltIndex – Top Stock Tracking Website Specializing in Alternative Data and AI Recommendations

AltIndex is a top-rated stock tracking website that specializes in alternative data. While it also covers the fundamentals – such as stock prices and market movements, AltIndex provides insights that aren’t available elsewhere. This is because AltIndex utilizes machine learning to analyze social media networks and other popular websites.

This is an unrivaled tool that helps you understand broader sentiment on thousands of stocks. For example, suppose AltIndex extracts data from Twitter, Facebook, and Reddit – specifically focused on Tesla. The data shows an increasing number of negative comments toward Tesla and electric vehicles in general.

This includes issues concerning prices, charging times, and concerns about its auto-pilot service. Crucially, this could mean that Tesla will report a rapid drop in demand for its vehicles. The majority of the market will only know about this when Tesla releases its quarterly earnings.

But you’ll get a first-mover advantage, as AltIndex is often several days or weeks ahead. This is just one example – as AltIndex covers many other data points. For example, it explores website visits, app downloads, job postings, employee satisfaction, patent filings, and financial news mentions.

Every day, AltIndex leverages its alternative findings to generate an AI score as well as stock tips. Its tracking tool notifies you when there is a major shift in AI scoring, in terms of stocks in your portfolio. AltIndex offers many other features – including AI stock recommendations, stock price predictions, and portfolio alerts. Prices range from $0, $29, and $99 per month, depending on your needs.

| Key Features | Device Type | Pricing |

| Stock portfolio tool tracking alternative data points on thousands of stocks. Explores broader consumer sentiment, including social media metrics and website analytics. AI-driven scores of 1-100 are generated daily. Also offers price predictions, alerts, and AI stock recommendations | Web-based. Alerts are sent via email | Plans range from $0, $29, and $99 per month. Plans offer varying features based on your tracking requirements |

3. Stocklytics – Comprehensive Insights on Over 5,700 Stocks From 11 US and International Exchanges

Next up is Stocklytics – which covers high-level data on over 5,700 stocks. It tracks stocks from 11 exchanges, including the NYSE, NASDAQ, London Stock Exchange, Bombay Stock Exchange, and the Euronext. Therefore, Stocklytics is the best stock portfolio tracker if you’ve got investments in multiple international markets.

Stocklytics offers a huge range of data points, including pricing, market capitalization, dividend yields, and P/E ratios. It also offers technical ratings, covering buys, sells, and neutral. It has also developed an AI-based rating system, ranging from 1 to 100. Stocklytics also provides sell-side analyst forecasts.

This comes with low, average, and high price predictions on all supported stocks. Financial news is also included, plus advanced pricing charts. All you need to do is add stocks to your Stocklytics portfolio. Thereon, you’ll receive alerts when there’s an important market movement. Instant alerts can be received via email, WhatsApp, Telegram, and SMS.

| Key Features | Device Type | Pricing |

| Feature-rich stock portfolio tracking tool that offers fundamental and technical data. Over 5,700 stocks are tracked from 11 global exchanges. Offers custom portfolio alerts, AI ranking scores, price predictions, and sell-side analyst ratings | Web-based. Alerts are sent via email, WhatsApp, Telegram, or SMS | Free. Register an account to remove limitations. |

If you have a diversified portfolio across more than one broker, Sharesight could be the most suitable stock tracking software. In a nutshell, Sharesight connects with hundreds of popular online brokers, ranging from Robinhood and Webull to Charles Schwab and Degiro. This means Sharesight extracts portfolio values directly from your broker accounts.

This makes it seamless to know how your portfolio is performing. Especially if you’ve made lots of stock purchases at different cost prices and amounts. Not only that but Sharesight tracks over 250,000 financial instruments. In addition to stocks, this also includes ETFs and mutual funds. More than 40 global stock markets are tracked.

This includes Australia, Japan, New Zealand, France, and Germany. Seven exchanges in the US are tracked too – including the NYSE ARCA and BATS. However, Sharesight doesn’t offer real-time pricing. Stock prices are delayed from 15 minutes to one day, depending on the exchange. There are four pricing plans, ranging from $0 to $31 per month.

| Key Features | Device Type | Pricing |

| Premium stock tracking software covering over 250,000 financial instruments and 40 global markets. Connects to hundreds of popular online brokers to provide valuable portfolio insights. Keep track of your investments in one place. | Web-based | Four pricing plans, depending on your required features. Prices range from $0 to $31 per month |

5. Morningstar – Web-Based Portfolio Management Software With Optimization Tools

Morningstar also ranks high on this list of stock portfolio tracking websites. This established research platform offers a significant amount of data, including expert analysis, reports, and stock ratings. Its 5-star rated stocks are considered ‘Strong Buys’, allowing you to find undervalued companies that could go on a prolonged upward trajectory.

Its portfolio management tool is web-based and suitable for all investor profiles. First, you’ll need to add stocks to your Morningstar portfolio. In addition, Morningstar also supports ETFs, investment trusts, and pension funds. Thereon, you’ll get a 360-degree overview of how your portfolio is performing. However, Morningstar doesn’t connect to online brokers.

This means regular investors will need to manually add any new stock purchases. The features discussed are completely free. Morningstar also offers premium plans. This comes with an X-Ray tool that scans your portfolio to generate insights. For instance, Morningstar will inform you if your portfolio is overexposed to a specific industry.

| Key Features | Device Type | Pricing |

| Free stock portfolio tracker also supporting ETFs, investment trusts, and pension funds. Add stocks to your portfolio to receive insights, including current valuations and price percentage changes. Premium members get additional tools, including a portfolio scanner and the option of exporting data | Web-based | Most features are free. For premium tools, you’ll pay $34.95 per month or $249 annually |

While Kubera is considered expensive, it offers one of the most advanced portfolio trackers in the market. Not only does Kubera track your investments but you’re overall net worth. This takes into account cash savings, real estate, and tax liabilities. Everything on Kubera is completely automated, as it connects with over 20,000 brokers and financial institutions.

Once you’ve connected your accounts, Kubera will automatically update your portfolio values. We also like that Kubera tracks multiple asset classes. This includes everything from stocks and ETFs to cryptocurrencies and commodities. Crucially, Kubera offers real-time data, so you won’t witness pricing delays like other investment trackers.

Another popular tool is the future net worth estimator. This analyzes your current investment and spending habits to predict your overall net worth in years to come. This can help you stay on track. In terms of pricing, Kubera doesn’t offer any free plans. You’ll need a personal plan at $150 per year. There’s a 14-day trial for $1, offering full functionality.

| Key Features | Device Type | Pricing |

| Advanced portfolio tracking tools aimed at investors with long-term financial goals. Connects with over 20,000 banks and brokerages from 68 countries. Tracks stocks, ETFs, cryptocurrencies, and commodities. Also tracks real estate valuations, checking accounts, and spending habits. | Web-based | $150 per year. New customers get a 14-day trial for $1 |

7. Stocks Tracker – All-in-One Stock Tracking App for iOS and Android With Signals and Alerts

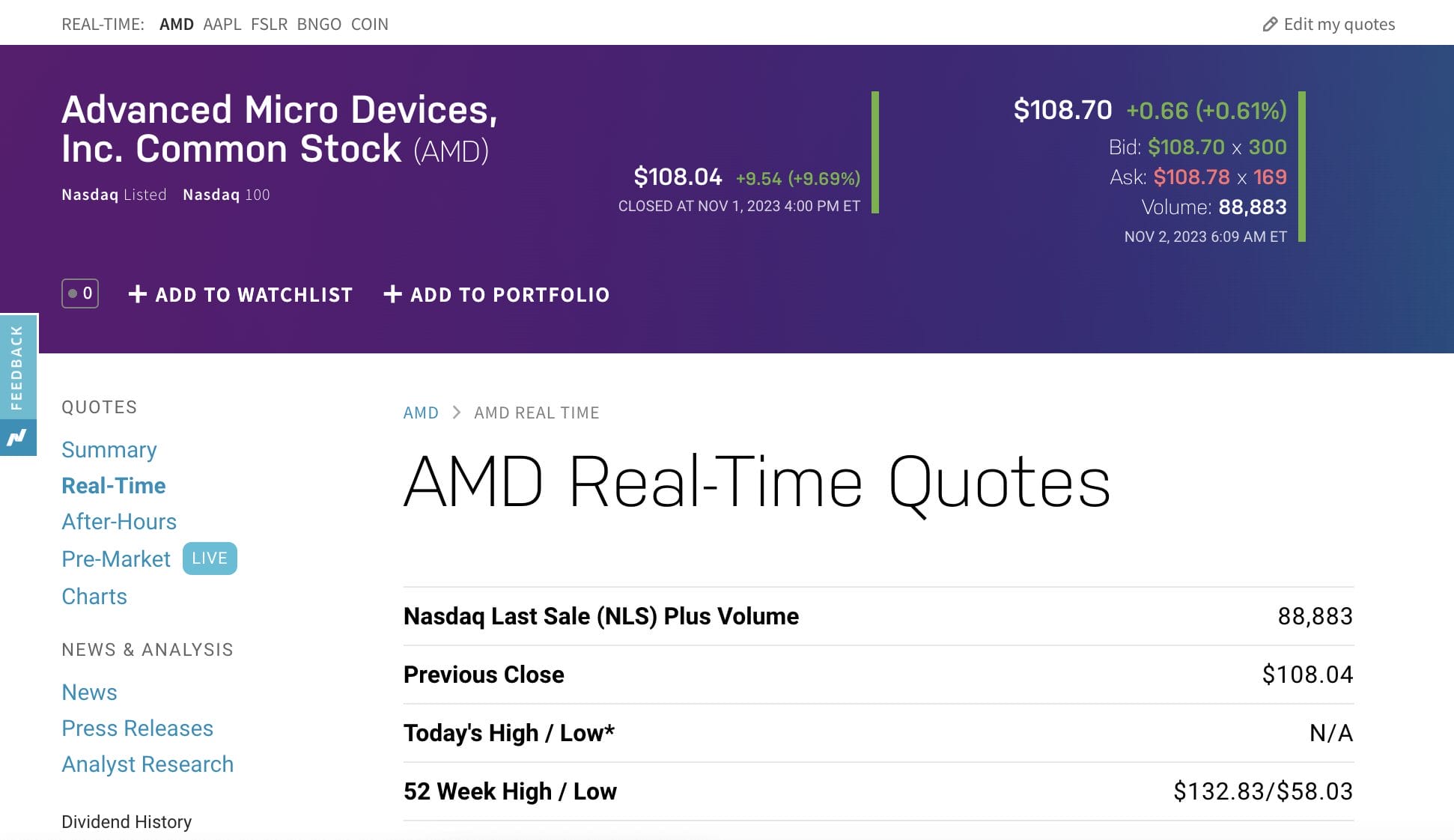

Stocks Tracker has developed a mobile app for iOS and Android that gives you comprehensive insights and real-time alerts. Thousands of stocks are supported, including technical and fundamental data. This includes the opening and previous close prices, trading volume, 52-week highs, and market capitalization.

Stocks Tracker also provides alerts on upcoming earnings reports and financial news. The app also offers advanced charting tools with various timeframes and indicators. Once you’ve added stocks to your portfolio, Stocks Tracker provides overall realizable gains and losses. It also breaks your portfolio down across different periods.

For example, which stocks performed the best in the prior 24 hours. The Stock Tracker app is free to use, but some features are restricted. For $9.99 per month, you’ll get full functionality – including real-time stock prices. Stocks Tracker is highly rated – with a 4.5/5 rating on the App Store. Its rating is based on over 55,000 reviews.

| Key Features | Device Type | Pricing |

| Proprietary stock tracking app for iOS and Android. Set up alerts for your portfolio, covering stock price movements, technical indicators, and upcoming earnings reports. Also offers charting tools, including technical indicators. | iOS and Android app | Most features are free. Premium plans – costing $9.99 per month, come with additional features |

8. Seeking Alpha – High-Level Portfolio Software With Quant and Sell-Side Analyst Ratings

Seeking Alpha offers the best stock portfolio tracker for fundamental investors. Like many trackers, Seeking Alpha enables you to manually add your stock investments. You’ll then receive alerts on key price movements, financial news, and upcoming earnings calls. However, Seeking Alpha offers many advanced features that are available to premium members.

This includes access to sell-side analyst ratings on all of your stocks. Not only does this include the consensus rating (e.g. Buy, Strong Sell, etc.) but price predictions for the next 12 months. Your stocks will also benefit from Wall Street and quant ratings, broken down by valuation, growth, profitability, momentum, and revisions.

The premium plan also includes Seeking Alpha stock recommendations. Seeking Alpha charges $199 for the first year – there are no monthly plans. After that, the annual fee increases to $239. Although pricey, Seeking Alpha has a great reputation in the investment scene. More than 250,000 members use its premium plan, which speaks volumes.

| Key Features | Device Type | Pricing |

| Standard features include portfolio tracking and alerts on price movements, earnings calls, and financial news. Premium members have access to Wall Street, quant, and sell-side analyst ratings. The premium plan also comes with stock recommendations | Web-based, iOS and Android app | Full functionality requires a premium plan at $199 for the first year. From year two, the annual fee increases to $239 |

9. Ziggma – Combines Investment and Net Worth Tracking With Algorithmic Stock Research

Another stock portfolio tool aimed at serious long-term investors is Ziggma. Available online or via its native app for iOS and Android, Ziggma connects with over 20,000 financial institutions. This includes the most popular online brokers, allowing you to automatically import portfolio data.

Ziggma also connects with checking and savings accounts, not to mention retirement plans like Roth IRAs and 401 (k)s. Once your portfolio is set up, you’ll know exactly how your investments are performing at the click of a button. Moreover, Ziggma provides insights into potential tax liabilities, should you decide to cash out a particular investment.

Each stock comes with various algorithmic research scores. This includes profit and revenue growth, the Beta risk factor, and dividend income. Ziggma also has a proprietary scoring system that rates stocks from 1 to 100. Ziggma offers a free plan, which limits the number of external accounts that you can link. Full functionality costs $7.49 per month, which is billed annually.

| Key Features | Device Type | Pricing |

| Track your entire financial spectrum, including stock investments, checking and savings accounts, retirement plans, and tax liabilities. Real-time insights extracted from your accounts – over 20,000 institutions are supported | Web-based, iOS and Android app | The free plan comes with limitations, such as the number of connected external accounts. Full functionality costs $7.49 per month – billed annually. Free 7-day trial for new users |

10. Stock Rover – Free Portfolio Management Dashboard Covering Over 8,500 Stocks and 4,000 ETFs

Stock Rover offers one of the best stock portfolio trackers for free users. It tracks more than 8,500 stocks, 4,000 ETFs, and 40,000 mutual funds. That said, only US and Canadian exchanges are covered. Nonetheless, the free plan also includes brokerage integration, meaning your portfolios will automatically sync with Stock Rover.

Its portfolio dashboard is user-friendly, covering key metrics like performance, analyst ratings, and market news. You’ll also have access to fundamental data, including financial ratios and quarterly earnings reports. Stock Rover also offers three premium plans which come with various features and tools.

This includes over 700 additional research metrics covering five years of historical data. Premium users also get an ad-free experience. What’s more, premium plans also include ETF and stock screeners, valuation charts, and priority customer support. Premium users pay between $7.99 and $27.99 per month, depending on the preferred plan.

| Key Features | Device Type | Pricing |

| Free plans offer many features, including portfolio syncing with brokers, analyst ratings, and financial news. Premium plans come with additional tools, such as stock screeners and priority customer support. | Web-based | Monthly fees range from $0 to $27.99 per month, depending on what features you require. Discounts are available when paying for a 1 or 2-year plan upfront |

11. WallStreetZen – Tracks 4 Core Data Points Covering Stock Prices, News, Insider Transactions, and Events

According to WallStreetZen, investors need access to four key data points when tracking their portfolios. And WallStreetZen offers them all. First, this includes stock price movements. You’ll receive alerts when one of your investments rises or falls by a certain amount. Second, WallStreetZen tracks financial news.

As soon as a relevant news story breaks, you’ll be the first to know. Third, WallStreetZen also covers insider transactions. This is when company executives buy or sell their own shares – a crucial indicator of management sentiment. Fourth, WallStreetZen also tracks important events – such as upcoming earnings calls or dividend announcements.

These four data points will ensure you’re always up to date with your investments. WallStreetZen also allows users to track external portfolios – including hedge funds and institutional investors. This means you can see which stocks and funds the best-performing investors are trading. WallStreetZen offers a free plan, but full functionality costs $59 per month.

| Key Features | Device Type | Pricing |

| Tracks four important data points, including stock price movements, financial news, insider transactions, and upcoming events (e.g. dividend announcements). Also offers insights into hedge fund portfolios, allowing you to follow the best-performing investors | Web-based | The free plan comes with limitations. Full functionality costs $59 per month or $234 annually |

How do Stock Tracker Apps Work?

There are many stock tracker apps in the market, each offering various features and tools. At its core, stock trackers allow you to keep tabs on your investment portfolio. They ensure you never miss a market beat, in terms of pricing, financial news, and other important metrics. Most providers initially require you to build your portfolio.

This means manually adding your stock investments. This can be a cumbersome process if you’re a regular investor. After all, you’ll need to state the cost price and investment amount for each stock purchase you’ve made. For instance, suppose you’ve been dollar-cost averaging Tesla stock. You’ve made 10 investments at various cost prices.

The only way to accurately receive portfolio insights is to add each individual purchase. That said, some of the best stock portfolio trackers can integrate with online brokers. This means the tracker can extract all of the investments you’ve made. And thereon, any changes made to your brokerage portfolios will be reflected by the portfolio tracker.

Either way, once your tracker portfolio is set up – you’ll stay informed at all times. You can see how your investments are performing, such as the overall portfolio value. This can normally be broken down into useful data bites. For instance, the best and worst-performing stocks. Some portfolio trackers come with alerts.

This means you’ll receive a notification when a specific metric is triggered. This could be one of your stocks increasing by more than 5%, or upcoming earnings calls. The alerts you receive will only be related to stocks in your tracker portfolio. Additional features can include pricing charts, technical indicators, and sell-side analyst ratings.

It’s also worth checking out AltIndex, which offers alternative data insights. This keeps you updated on broader consumer sentiment, with data extracted from social media and other popular websites. AltIndex also offers stock recommendations, allowing you to find new investment opportunities and offload underperformers.

Choosing the Best Stock Tracking App: Top Tips

While there are many portfolio trackers to choose from, not all providers offer the same features and tools. Read on for more information on how to choose the best stock tracker app for your requirements.

Stock Covering and Other Asset Classes

You’ll need to know what stocks the tracking app covers. If it doesn’t track all of the stocks you currently hold (or plan to buy in the future), then it won’t be suitable. After all, you won’t have an accurate overview of your investment portfolio if certain stocks are missing.

All of the stock portfolio trackers discussed today support the two primary US exchanges – the NASDAQ and NYSE. According to Statista, this covers just under 6,000 stocks. If you’re investing in international markets, check whether they’re supported.

Sharesight, for example, supports stocks in over 40 global markets, covering most continents. If your investment portfolio also contains other asset classes, check whether the tracking tool supports them.

For example, AltIndex also supports cryptocurrencies like Bitcoin, Dogecoin, and Litecoin. Kubera is also popular with multi-asset investors. In addition to stocks and cryptocurrencies, it also covers ETFs and commodities.

Real-Time or Delayed Pricing

According to the popular brokerage firm TD Ameritrade, investors usually need to pay a subscription fee to access real-time stock quotes. This means that if you’re using a free portfolio tracker, you’re likely not seeing real-time prices. Instead, there’s usually a delay of about 15 minutes.

Non-US exchanges – especially those in emerging countries, will likely come with even bigger delays. Whether or not this is an issue depends on your investment strategy. For example, suppose you typically make investments once a month. In this instance, price delays of 15 minutes will not have a noticeable impact.

In contrast, if you’re an active trader who enters multiple positions each week, stock price delays will be an issue. Therefore, you’ll need to choose a stock tracker tool that provides a real-time data subscription.

If you’re choosing a premium plan, this is often included. Some providers allow you to pay for real-time quotes individually. This usually costs about $10 per month.

Brokerage Synchronization

Some of the best portfolio trackers can be integrated with your online brokerage accounts. This means that your stock portfolio will be synced with the tracking app.

This is a crucial feature if you have a lot of different investments made at different times. After all, each stock purchase would have been made at a different price.

- Through synchronization, the tracker tool will provide accurate performance metrics.

- And, whenever you make adjustments in your brokerage accounts, this will automatically synchronize.

In addition, some stock portfolio tracks can connect with banks and other financial institutions. This will appeal to investors who want a broader overview of their financial health.

This can include checking and savings accounts, meaning you’ll also get snapshots of your spending habits. Some trackers can even connect to retirement plans, such as 401 (k)s and IRAs.

Investment Insights

The best stock tracking apps not only ensure you stay informed but also help you discover new investment insights. This enables you to become a better investor without needing to put in hours of legwork.

AltIndex is ideal for investors who want to receive stock recommendations. It offers AI-backed stock picks based on alternative data – such as social media sentiment and website metrics. Subscribers receive an email when a new stock recommendation has been generated.

AltIndex also informs subscribers when it’s time to sell. Its stock-picking service has performed very well since its inception. Especially when compared to industry benchmarks like the S&P 500. On average, AltIndex recommendations have made 6-month returns of 22%. This is based on investors following each and every stock pick.

Ziggma is another good option if you’re looking for investment insights. Once stocks have been added to your Ziggma portfolio, you’ll receive financial news, performance indicators, and a proprietary rating score of between 1 and 100.

Seeking Alpha is also worth considering – premium plans come with quant and sell-side analyst ratings, not to mention price forecasts for the best 12 months.

Alerts

Another feature to look for when choosing a stock portfolio tracker is alerts. Put simply, you’ll receive a notification when a relevant event impacts one of your stock investments. This could be anything from a significant price movement to an abnormally large increase in trading volume.

You can also receive technical alerts related to the MACD, RSI, 52-week high, and other indicators. Alerts are also important for staying abreast of financial news stories and earnings reports.

For example, as reported by the Financial Times, Estée Lauder stock dropped 18.9% in the prior 24 hours. The reasons cited were worse than expected quarterly earnings and weak revenue forecasts for 2024.

If you were holding Estée Lauder stock and had adequate alerts set up, you would have been notified straightaway. This means you could have sold the stock long before it capitulated.

Pricing

Most stock portfolio trackers offer a freemium service. This means that while some features are free, a premium plan is required for full functionality.

Whether or not you should pay a subscription fee depends on what you’re looking to achieve.

For example, if you’re only looking for stock price alerts and a general overview of how your portfolio is performing, free tools should suffice. Just remember that free plans rarely offer real-time pricing, so expect delays.

On the other hand, if you’re looking to get the most out of your portfolio, a premium plan could be worth considering.

- For instance, AltIndex charges $29 per month, which gets you 10 stock recommendations. Or $99 per month to increase this to 50.

- Considering its historical performance (6-month average gains of 22%), these fees are justified.

- AltIndex offers flexible plans, meaning you can cancel at any time.

We found that some stock tracker tools only accept annual purchases. If the tool doesn’t meet your expectations, you likely won’t get a refund. This is why it’s best to start with a free trial, as you can test the tracker tool without risking any money.

Device Type

Investors should also consider how they want to manage and track their portfolios. For example, most tracker tools are available through web browsers. This is a convenient way to stay informed, as you won’t need to download or install any software.

Some tracker tools also offer a mobile app for iOS and Android. If you prefer managing your money on a desktop device – check if the provider offers software for your operating system.

Conclusion

We’ve covered the best stock portfolio trackers for investors in 2024. AltIndex is our top pick, which offers a wealth of features and insights to help you stay informed.

In addition to alerts, alternative data metrics, and price predictions – AltIndex offers AI-backed stock recommendations. This means you’ll be the first to new when a new Strong Buy has been generated.

FAQs

What is the best way to track my portfolio?

The best method is to sign up with a stock tracker tool that covers all your investments. This gives you a 360-degree overview of how your stock portfolio is performing.

How can I track my stock portfolio for free?

Stocklytics offers a free stock tracking service that covers portfolio insights, technical indicators, and sell-side analyst ratings. It’s compatible with email, Whatsapp, Telegram, and SMS.

Is there an app that tracks your stock portfolio?

Yes, Stocks Tracker is a popular stock-tracking app for iOS and Android. Most features are free, but you’ll need a premium plan for real-time data quotes.

What is the best stock portfolio tracker?

We rank Danelfin as the best stock portfolio tracker. Once stocks are added to your portfolio, you’ll receive alternative data insights, pricing alerts, and AI-backed recommendations.