Of the components that make up ESG investing, the environmental factor is the one gathering most of the attention from the financial sector, regulators, and investors. With wildfires and a heat dome over the US’s Pacific Northwest, the tragic flooding in China, Germany, the Philippines, and Turkey, and the melting of Russia’s permafrost, the urgency of climate change and the threat it poses to societies across the globe are clear and undeniable. The concurrent mobilization of societies and capital is needed now to confront this existential challenge.

Q2 2021 hedge fund letters, conferences and more

Individual investors will play a critical role here.

Achieving Net-Zero Emissions

By placing their savings in firms and funds committed to being carbon neutral and engaging with firm directors and fund managers, retail investors may form an additional column bringing about the critical mass needed to achieve an orderly transition to net-zero emissions.[1]

In the first article we talked about some of the challenges for the ordinary investor when it comes to looking at and investing in companies and funds that are moving more and more to include ESG impacts and attendant performance measurements.

However, we should not be naïve and think that companies involved in some of the biggest sectors affecting the climate can suddenly switch overnight to new technology, renewable energy, and become as close to net zero emissions as possible. They will continue to need to be funded and encouraged to evolve otherwise they risk becoming bogged down with what is known in the financial world as “stranded assets.”

Stranded assets are resources, natural or industrial, that have value and generate income for a firm, but may lose both due to various externalities, such as technological change, market demands, or governmental policy and regulation. The challenge for firms and investors is understanding how to price this risk.[2]

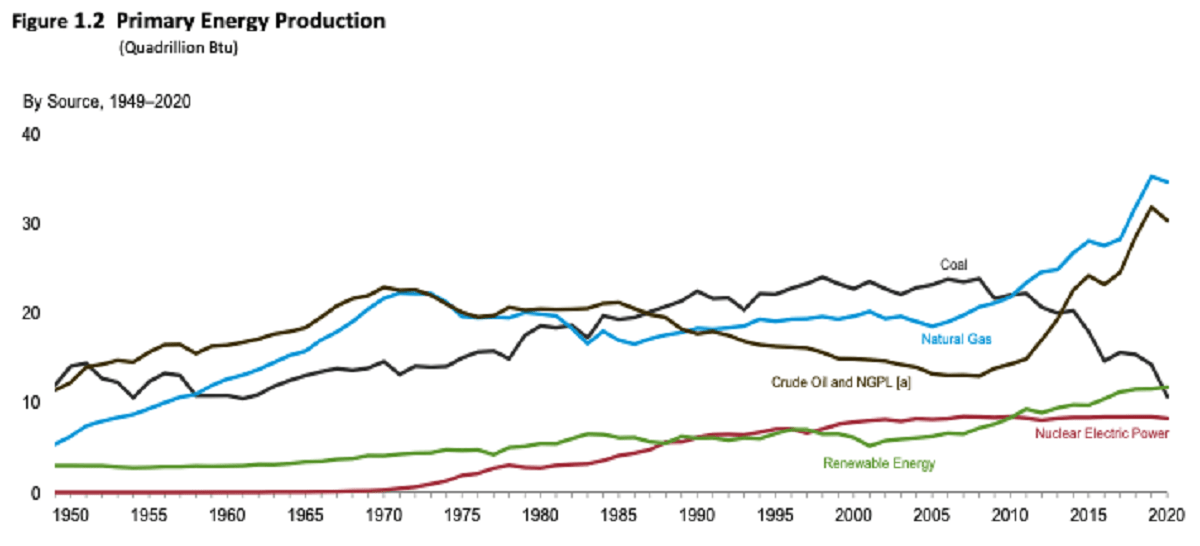

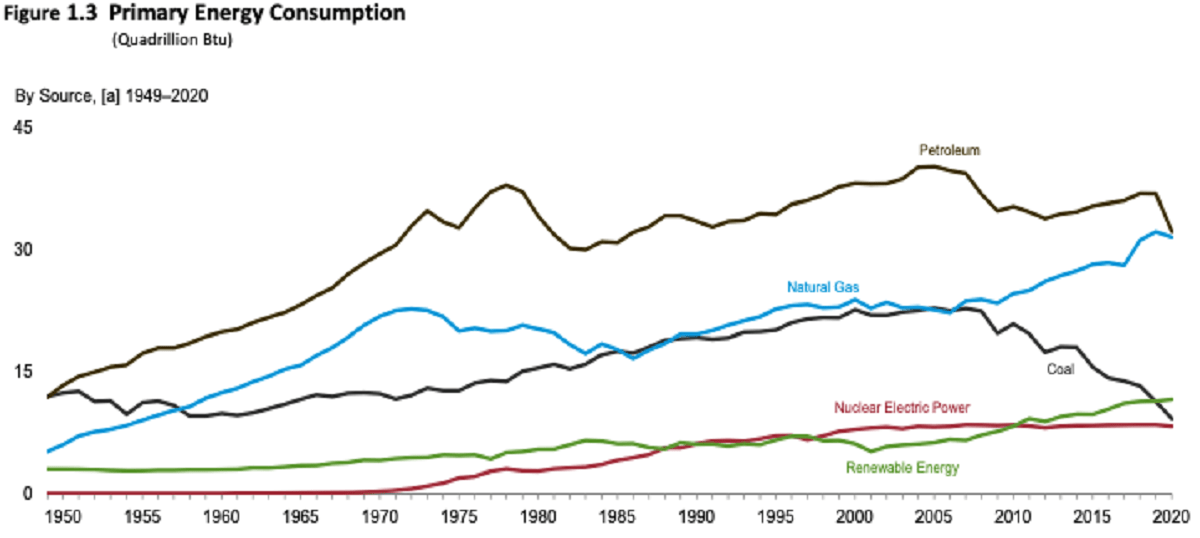

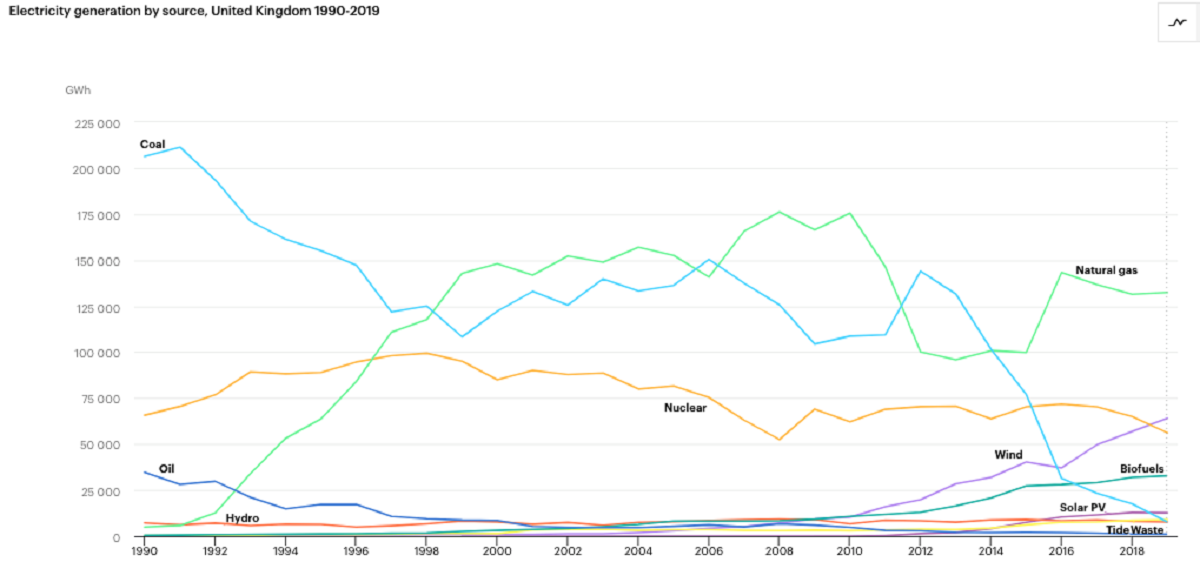

The case of coal and natural gas is a useful illustration. For the world to achieve the targets outlined in the 2015 Paris Agreement, 80 percent of existing coal reserves must remain in the ground, as must one-third of oil and half of gas.[3] These social and environmental realities are paired with the massive increase of the natural gas supply and the accelerated technological progress and deployment of renewable energy assets. For the latter, costs are falling too. Solar panel prices have dropped 90 percent since 2009 and wind turbine prices have fallen by more than half since 2010. Furthermore, 60 percent of existing coal plants produce electricity at a higher cost than renewables.[4]

Production of renewable energy has overtaken coal production in the U.S., Source: E.I.A. Monthly Energy

The Decommissioning Of Coal-Powered Power Plants

As a result, coal developers across the globe risk $600 billion in assets becoming stranded. But as renewable energy increasingly comes online, gas too will suffer the fate of coal. The decommissioning of coal-powered power plants is underway; however, there are significant investments and plans for gas still in the works, ranging from pipelines to port infrastructure. These projects, which often fly in the face of public commitments to minimize the carbon footprint, create a heightened risk for investors.[5]

Consumption of renewable energy in the U.S. has also surpassed consumption of coal, Source: E.I.A. Monthly Energy Review

Europe is facing a $104 billion risk for natural gas infrastructure that may be obsolete before some of the projects are completed. Consumers in the U.S. states of North Carolina and South Carolina risk being stuck with a $4.8 billion bill to pay for stranded natural gas facilities retired before their costs are completely depreciated. These same consumers are footing 75 percent of the $4 billion bill to clean up the coal-ash polluting the state’s rivers. Only in January did electricity provider Duke Energy relent, meaning its investors will be paying $1 billion towards the clean-up. Another movement is afoot to securitize the decommissioning of Duke’s brown assets in the Carolinas, pushing the burden of payment onto investors.[6]

Source: www.iea.org

Combatting Climate Change

These risks will only increase and compound in the years to come as climate change forces the issue. The key for all stakeholders – directors, investors, policymakers, consumers, and regulators – will be managing the transition, trying to ensure it is orderly and tending to those likely to be most affected – so-called stranded workers.[7] To do so will require creativity, courage, and conviction. It is no small task.

It becomes increasingly important for companies that have a large carbon footprint to demonstrate what they are doing to combat climate change and make a business model that is resilient to, and profitable in, the low carbon, resource-efficient economy of the twenty-first century. Accurate carbon reporting will be key, and governments must improve the current inadequate voluntary system.[8]

With the U.S. returning to the Paris Agreement and the promise to achieve net-zero emissions by 2050, big oil and gas players are writing off tens of billions of dollars’ worth of investment which are thought to be unviable while at the same time cutting production and increasingly putting their focus on renewable businesses.[9]

The large investment banks are also responding to the challenge and looking to move to be carbon neutral by 2050, which also means their supply chains will be carbon neutral. It is a huge undertaking and involves them talking and working with all their customers and clients to ensure this happens. As an example, Bank of America has set aside $1 trillion to finance moving to carbon reduction over the next decade. As Anne Finucane, Vice Chairman at Bank of America says, she believes this is conservative.[10]

As an investor and potential shareholder, it is important to understand what these companies are doing to change their technologies and policies as we become more aware of the ESG impact firms carry. As small-scale shareholders have demonstrated in the UK, individual and collective action can force firm directors to address shareholder concerns and formulate policies and actions to change behaviour and operations. With such zero-commission platforms as Robinhood and eToro to purchase shares and investor education organizations like Share Action, the opportunity for positive involvement and positive returns is here for individual investors.[11]

So while large investment banks and institutional investors contribute large sums of money towards sustainable investments, the smaller amounts supplied by large numbers of ordinary investors can help steer the ship from the shoals of environmental ruin to safer waters.

About the Author

Over a career spanning 30 years, Jane Duscherer has utilized her strong understanding of financial markets, credit risk, technology and infrastructure to meet clients’ needs, most recently as Director of Product Management at IHS Markit. Steven Hyland Jr., Ph.D. teaches in the Department of History and Political Science at Wingate University. Please connect with Jane and Steven on LinkedIn.

This article is the second in a series examining sustainable finance and ESG investing for individual investors

Footnotes

[1] Jasmin Melvin, “Narrow path to net-zero means less fossil fuels, bus some room for gas: IEA chief,” S&P Global, 19 May 2021, https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/051921-narrow-path-to-net-zero-means-less-fossil-fuels-but-some-room-for-gas-iea-chief. [2] Joel Makower, “The growing concern over stranded assets,” GreenBiz, 10 September 2019, https://www.greenbiz.com/article/growing-concern-over-stranded-assets. [3] Christophe McGlade and Paul Ekins, “The geographical distribution of fossil fuels unused when limiting global warming to 2 ºC,” Nature 517 (8 January 2015), 187-190. [4] “Costs,” International Renewable Energy Agency, https://www.irena.org/costs [Accessed 26 July 2021]; “Coal developers risk $600 billion as renewables outcompete worldwide,” Carbon Tracker Initiative, 12 March 2020, https://carbontracker.org/coal-developers-risk-600-billion-as-renewables-outcompete-worldwide/. [5] “Coal developers risk $600 billion,” Carbon Tracker Initiative; Rachel Morison, “Gas Is the New Coal With Risk of $100 Billion in Stranded Assets,” Bloomberg, 17 April 2021, https://www.bloomberg.com/news/articles/2021-04-17/gas-is-the-new-coal-with-risk-of-100-billion-in-stranded-assets. [6] Morison, “Gas Is the New Coal”; “Duke stranded gas assets could cost customers $4.8B, report finds,” Utility Dive, 16 January 2021, https://www.utilitydive.com/news/duke-stranded-gas-assets-could-cost-customers-48b-report-finds/593939/; “Securitization: a way to fairly finance coal plant retirements,” Sierra Club North Carolina, 9 October 2020, https://www.sierraclub.org/north-carolina/blog/2020/10/securitization-way-fairly-finance-coal-plant-retirements; Richard Craver, “Duke Energy customers will pay about 75% of coal-ash cleanup costs instead of 100%. Settlement reached Monday,” Winston-Salem Journal, 25 January 2021, https://journalnow.com/news/local/duke-energy-customers-will-pay-about-75-of-coal-ash-clean-up-costs-instead-of/article_d22763ee-5f12-11eb-a602-2f0fb45e9ad1.html. [7] Madeleine Cuff, “We should worry as much about ‘stranded workers’ as stranded assets,” GreenBiz, 6 June 2018, https://www.greenbiz.com/article/we-should-worry-much-about-stranded-workers-stranded-assets; Tom Nelson and Sahil Mahtani, “‘Stranded workers’ risk being casualties of environmental push,” Financial Times, 27 September 2019, https://www.ft.com/content/05bdfed2-df7d-11e9-b112-9624ec9edc59; Jake Higdon, “To fight climate change, strand fossil fuel assets, not workers,” The Hill, 2 September 2020, https://thehill.com/opinion/energy-environment/514800-to-fight-climate-change-strand-fossil-fuel-assets-not-workers. [8] Akshat Rathi, “The Dirty Secret of Carbon Accounting That Underpins Climate Goals,” Bloomberg, 3 August 2021, https://www.bloomberg.com/news/articles/2021-08-03/carbon-accounting-isn-t-as-rigorous-without-strong-regulations. [9] Dimitri Zenghelis, “Why the transition to net zero is business’s business,” Cambridge Institute for Sustainability Leadership, 9 April 2021, https://www.cisl.cam.ac.uk/news/blog/why-the-transition-to-net-zero-is-businesss-business; Jillian Ambrose, “Seven top oil firms downgrade assets by $87bn in nine months,” the Guardian, 14 August 2020, https://www.theguardian.com/business/2020/aug/14/seven-top-oil-firms-downgrade-assets-by-87bn-in-nine-months. [10] Alan Murray and David Meyer, “Our global problems demand radical collaboration,” Fortune, 21 July 2021, https://fortune.com/2021/07/21/global-problems-demand-radical-collaboration-ceo-daily/. [11] Michael Kind, “Shareholder activism allows people to power change in the financial system,” Share Action, 21 July 2020, https://shareaction.org/people-power-change-through-shareholder-activism/.