In his Daily Market Notes report to investors, while commenting on inflation, Louis Navellier wrote:

Q3 2021 hedge fund letters, conferences and more

Inflation Diverts Investment

The psychology of selling high P/E multiple stocks in the face of higher inflation/ higher interest rates came to roost midday yesterday. The correction was relatively modest in view of Indexes being so near all-time highs, and there is further follow through on the open this morning, but "Value" names had their best day versus "Growth" names had their best relative performance yesterday since March.

Stepping back you'll see gold is weaker, crude oil is lower, and just announced PMI is lower than expected. The concerns about inflation should fade somewhat today for these reasons. Also, note that the 10-year US Treasury yield remains lower than 1.7% and the 30-year below 2%. These gyrations are most likely traders positioning for the long holiday weekend and not a major shift in market sentiment.

The primary risk to further new highs into January is a Black Swan event, something that will never go away, and if it comes will most likely turn out to be yet another buying opportunity.

Retail sales surged 14.8% for the past 12 months ending October according to the Commerce Department. This is despite product backlog. As I have been saying all year, consumers are not that picky. Put money in their pocket and they will buy things. The Commerce Department reported on Tuesday that retail sales surged 1.7% (month over month) in October and have surged 14.8% in the past 12 months.

Again The Employment Mandate

When continuing unemployment claims crack the 2 million level (they came in at 2.08 million in the latest report), it will likely be big news and convince the Fed that they have fulfilled their employment mandate. Even though more than four million jobs have disappeared since the beginning of the pandemic, it appears that many workers decided to retire early. As soon as the Fed decides it has done enough to stimulate job creation, it can turn its attention to inflation.

Inflation is all over the news. Even though economic growth remains strong, the University of Michigan’s consumer sentiment index recently fell to a 10-year low as both inflation and product shortages are making folks angry.

Transitory It Ain’t

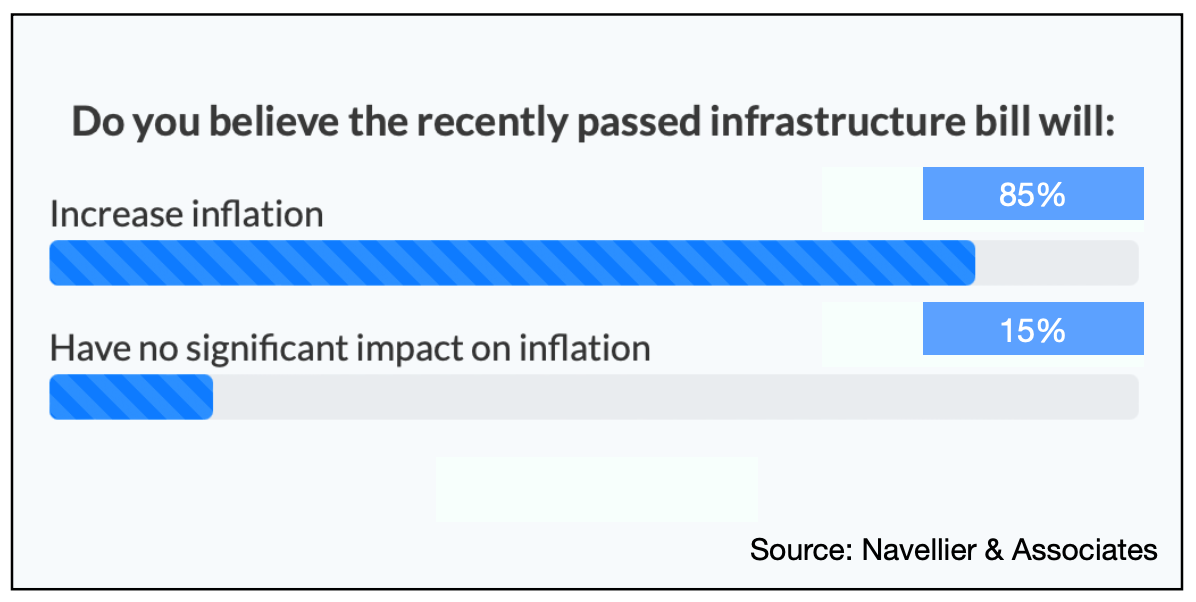

Our latest survey showed that 85% of retail investors believe that the recently passed infrastructure bill will increase inflation. One respondent called it "throwing gas on a fire." Inflation may be “transitory” as the administration claims, but these charts demonstrate it is not transitory enough for retail investors. Inflation, notwithstanding, I am expecting a robust holiday season.

The Atlanta Fed’s GDP Now model shows the U.S. economy’s GDP growth is accelerating from an estimated 2% annual pace in the third quarter to a whopping 8.7% annual pace in the fourth quarter. Although the Atlanta Fed tends to be too optimistic early in a quarter, there is no doubt growth is back. It is very odd for a President’s popularity to be plunging when economic growth is reported to be “resurging,” but that is exactly what is happening.

The Fed saw that inflation rates decelerated some last summer, so they could argue that inflation would be “transitory.” However, that argument ended in October, when inflation resurged and spooked politicians, but the Fed and other central bankers are experts in “kicking the can down the road” and I suspect that they will now claim that inflation may be transitory until 2023 or later.

In defense of the Fed, the U.S. dollar is now at a 16-month high relative to emerging market currencies, according to The Financial Times. A strong dollar will help suppress inflation somewhat, because most commodities are priced in dollars. However, a stronger dollar makes goods even more expensive for emerging markets, so worldwide GDP growth may stall, especially due to China’s domestic problems.

I anticipate a big leadership change in Congress next November. It will be interesting if the Biden Administration tacks to the center, like Bill Clinton did after 1994, which boosted his popularity. Wall Street likes a more “balanced” government, so the latest political developments are being well received, thereby boosting investor confidence.

In this inflationary environment, millions of Americans are pouring more money into the stock market seeking higher yields and protection from inflation. Also notable is that gold is now at a five-month high. Internationally, the Chinese economy is now in disarray and Europe is struggling with another Covid-19 outbreak. The truth is that as you look around the world, the U.S. is looking more like an oasis, due to higher interest rates, a capitalistic culture, and 50 states that compete with each other for business.

Heard & Notable

British cyclist Anthony Hoyte, nicknamed the "pedaling Picasso," covered a distance of 66.48 miles on the streets of London and used a GPS tracking app to create a massive image of a man with a mustache. The record-breaking ride was completed in 8.5 hours. Source: UPI