At last, something is happening! Rising oil and gas prices sparked inflation worries among investors. However, gold hasn’t benefited so far…

Q2 2021 hedge fund letters, conferences and more

Living In The World Of Elevated Inflation

It took Wall Street a while to find out about inflation above 5%, but it seems that investors have finally noticed that we live now in a world of elevated inflation. I have always known that only the smartest minds work on Wall Street! So, right after they finally learned how to operate a computer and found the BLS website, they got scared and started selling equities. As a consequence, the U.S. stock index futures declined yesterday morning.

All right, I was a bit mean to the Wall Street traders. They panicked not because of the CPI rates but because of soaring oil prices. As the chart below shows, the WTI crude oil has recently approached $80 per barrel, while the price of natural gas has more than doubled in recent weeks (left axis). A propos, if you want to know more about oil, gas and the energy sector, as well as keep track of all price moves happening there (and possibly profit from them!), I can recommend a great place to do so - Oil Trading Alerts.

The rising oil prices triggered inflation worries, as higher energy prices could translate into higher consumer inflation, and higher consumer inflation could trigger a more hawkish Fed’s action than previously anticipated. In particular, the US central bank could taper its quantitative easing faster than expected, especially if September nonfarm payrolls turn out to be decent. After all, good news is right now bad news for stocks, not to mention gold.

I’ve been warning for a long time now that inflation could be more lasting than the pundits claim. And here we are, the high inflation readings couldn’t be downplayed any longer, so the IMF admitted yesterday in its flagship report World Economic Outlook that elevated inflation could last by mid-2022:

Headline inflation is projected to peak in the final months of 2021, with inflation expected back to pre-pandemic levels by mid-2022 for both advanced economies and emerging markets country groups, and with risks tilted to the upside.

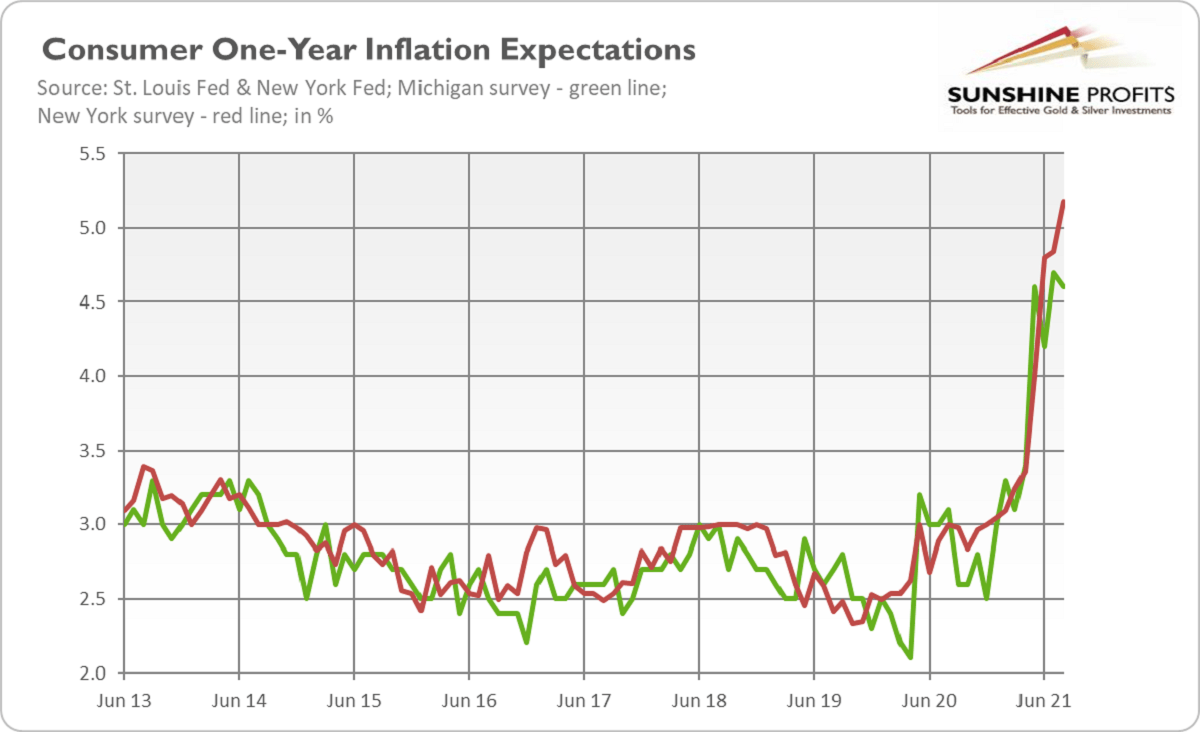

However, the baseline scenario assumes that inflation expectations remain anchored. And although the IMF is right that market-based measures of long-term inflation expectations have stayed relatively anchored so far, the measures based on surveys of consumers have clearly de-anchored recently, as the chart below shows.

I don’t know on which planet IMF economists live, but in my world such a graph shows anything but well-anchored inflation expectations. So, I would say that upside risks to the IMF’s baseline scenario are more probable than the authors are willing to admit. In fact, even they acknowledge that risks remain tilted slightly to the upside over the medium term:

Sharply rising housing prices and prolonged input supply shortages in both advanced economies and emerging market and developing economies, and continued food price pressures and currency depreciations in the latter group could keep inflation elevated for longer.

Implications for Gold

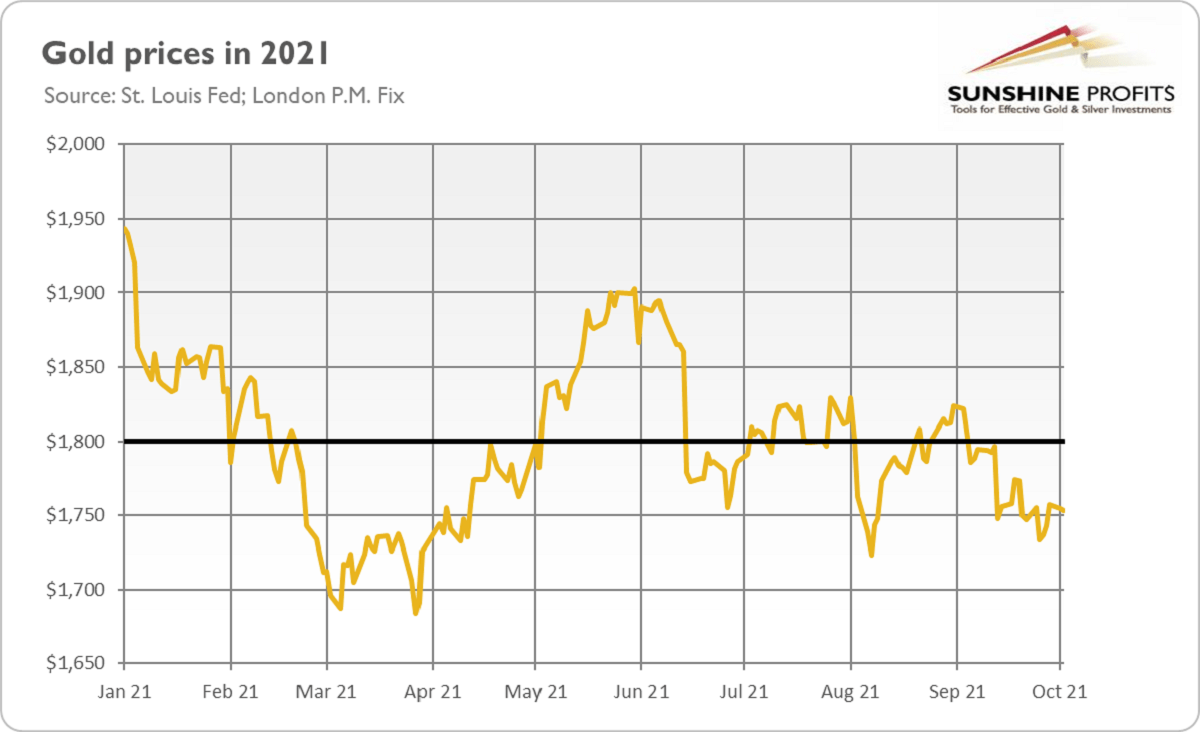

What does it all imply for the gold market? Well, as usual, I’m obliged to say that, theoretically, higher inflation should be positive for gold, which is considered to be an inflation hedge. However, theoretical links, which we can analyze in isolation, in reality work together with other forces, as economy is a complex system. In our case, gold is not getting much benefit from strengthening inflation worries as bond yields are rising in tandem, supporting the real interest rates. Gold’s disappointing performance in the inflationary environment (see the chart below) is also caused by the prospects of the Fed’s tightening cycle.

So, it seems that gold could remain in the downward trend in the near future, especially if the Employment Situation Report, which is scheduled to be released on Friday, doesn’t disappoint. However, the Fed will have to reverse its course at some point –they will not hesitate whether they should fight with the overheating or stimulate the economy during a crisis. And this will allow gold to shine again.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care