With inflation surging and Powell praying for a “transitory” miracle, the troubles confronting the Fed are accelerating, not decelerating.

Q3 2021 hedge fund letters, conferences and more

“I got the blues, Got those inflation blues” -- B.B. King

How The Fed Can Control Inflation

To explain, I wrote on Sep. 24:

I’ve warned on several occasions that the only way for the Fed to control inflation is to increase the value of the U.S. dollar and decrease the value of commodities. However, with commodities’ fervor accelerating on Sep. 23 – a day when the USD Index declined – the price action should concern Chairman Jerome Powell. As a result, FOMC participants’ 2022 inflation forecast is likely wishful thinking and they may find that a faster liquidity drain (which is bullish for the U.S. dollar) is their only option to control the pricing pressures.

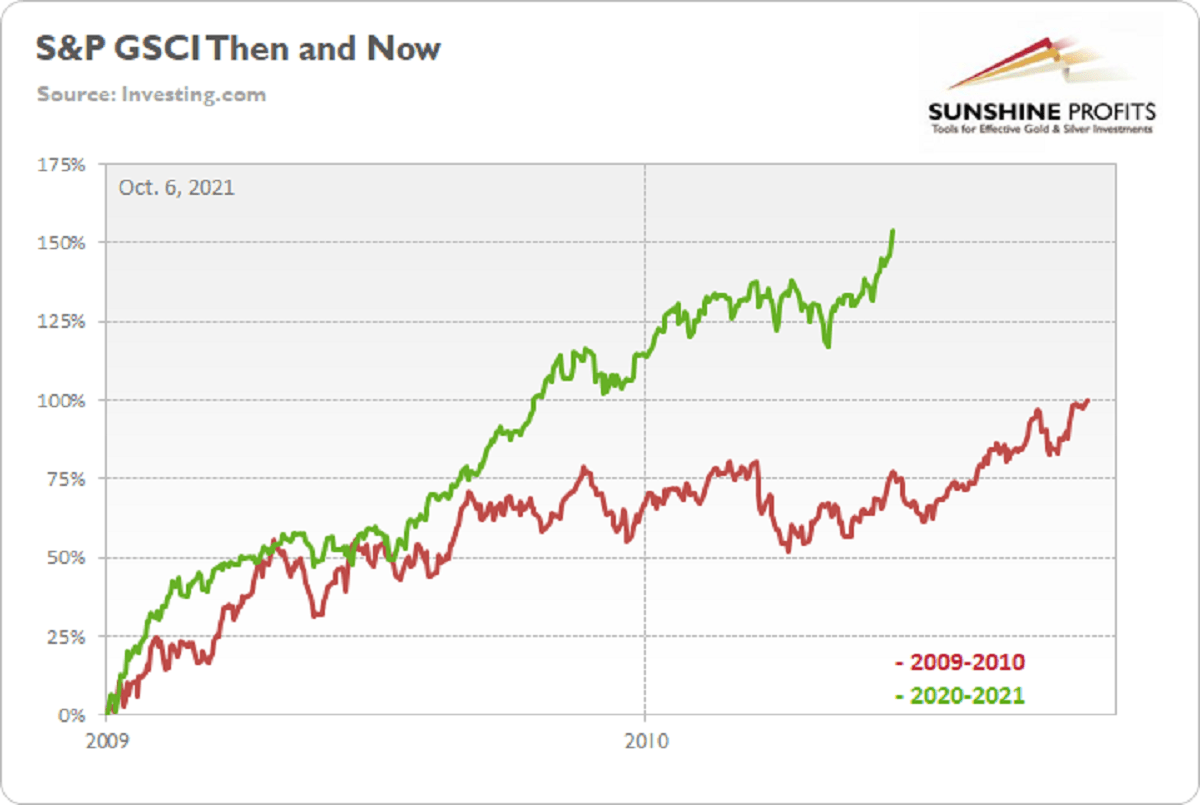

To that point, with energy prices increasingly unhinged and WTI on pace for its seventh-straight week of weekly gains, the S&P Goldman Sachs Commodity Index (S&P GSCI) has been on fire recently. For context, the S&P GSCI contains 24 commodities from all sectors: six energy products, five industrial metals, eight agricultural products, three livestock products and two precious metals. However, energy accounts for roughly 54% of the index’s movement.

Please see below:

To explain, the green line above tracks the S&P GSCI’s current rally off of the bottom, while the red line above tracks the S&P GSCI’s rally off of the bottom in 2009-2010 (following the global financial crisis). If you analyze the middle of the chart, you can see that the S&P GSCI has completely run away from the 2009-2010 analogue. For context, at this point in 2009-2010, the S&P GSCI had rallied by 77% off of the bottom. However, as of the Oct. 5 close, the S&P GSCI has now rallied by 154% off of the April 2020 bottom.

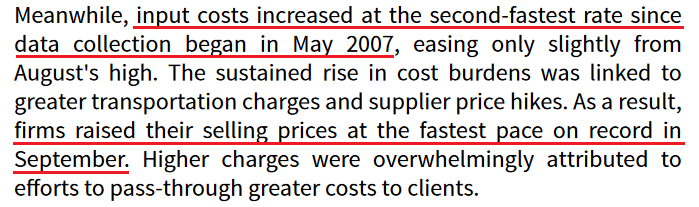

Furthermore, with higher energy and materials prices exacerbating the cost-push inflationary spiral, signs of stress remain abundant. For example, IHS Markit released its U.S. Manufacturing PMI on Oct. 1. And while the headline index declined from 61.1 in August to 60.7 in September, Chris Williamson, Chief Business Economist at IHS Markit, said that “prices charged for those goods leaving the factory gate also surged higher again in September, rising at a rate exceeding anything seen in nearly 15 years of survey history.”

Please see below:

Source: IHS Markit

Singing a similar tune, the Institute for Supply Management (ISI) released its Services PMI on Oct. 5. For context, the U.S. service sector has suffered the brunt of the Delta variant’s wrath. And though pricing pressures aren’t as feverish as they are in the U.S. manufacturing sector, the report revealed that inflation increased at a “faster” pace and that “all 18 services industries reported an increase in prices paid during the month of September.”

PepsiCo 3Q21 Earnings

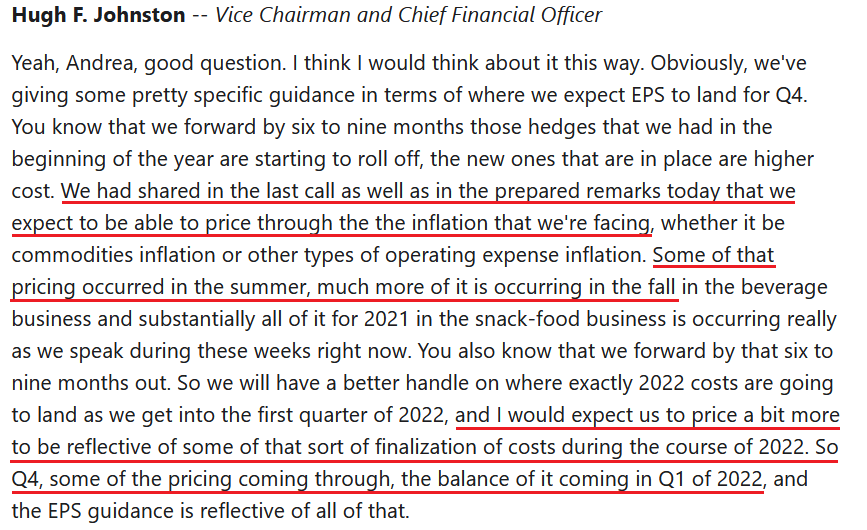

In addition, PepsiCo, Inc. (NASDAQ:PEP) released its third-quarter earnings on Oct. 5. And after beating analysts’ estimates on both the top and bottom lines, the beverage giant raised its full-year guidance. However, while demand remains resilient, 11.6% year-over-year (YoY) consolidated net revenue growth coincided with a 3% decline in diluted earnings per share (EPS).

Despite that though, CEO Ramon Laguarta told analysts during the company’s Q3 earnings call that “what we're seeing across the world is much lower elasticity on the pricing that we've seen historically,” and as a result, price hikes are scheduled to commence in the coming months. For context, ‘elasticity’ attempts to quantify the change in demand that results from a change in price. And with CFO Hugh Johnston expecting charge inflation to outpace cost inflation going forward, “lower elasticity” is materially problematic for the Fed.

Please see below:

Source: PepsiCo/The Motley Fool

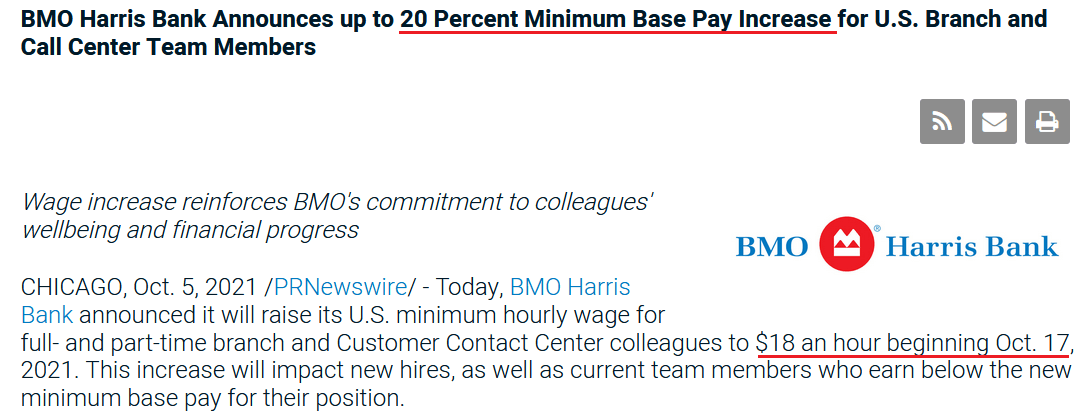

If that wasn’t enough, BMO Harris Bank announced on Oct. 5 that it will increase its minimum hourly wage for all branch and call-center employees by a “20 Percent Minimum” to $18 an hour. For context, BMO Harris Bank has more than 500 branches and more than 12,000 employees in the U.S.

Please see below:

Source: BMO Harris Bank

Powell’s Inflationary Conundrum

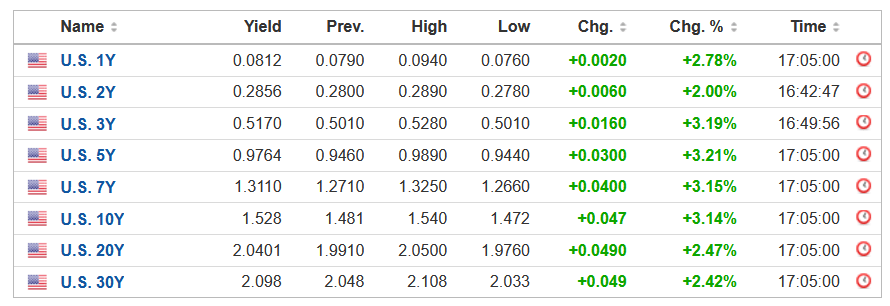

More importantly, though, with Powell’s inflationary conundrum helping swing the double-edged sword that’s been fundamentally slashing the PMs, the USD Index rallied by 0.20% on Oct. 5 and U.S. Treasury yields strengthened across the board.

Please see below:

Source: Investing.com

As it relates to the dollar story, the USD Index’s fundamental strength is underwritten by the ‘dollar smile.’ To explain, when the U.S. economy is trudging along, the U.S. dollar tends to underperform. However, when the U.S. economy craters and a safe-haven bid emerges, the U.S. dollar often outperforms. Conversely (and similarly), when the U.S. economy is booming and higher interest rates materialize, the U.S. dollar also outperforms.

By the way, I’ve discussed the situation in the USD Index at length in today’s video.

For context, I indicated on Sep. 22:

The USD Index and U.S. Treasury yields can move in the same direction or forge different paths. However, while a stock market crash is likely the most bearish fundamental outcome that could confront the PMs, scenario #2 is next in line. When U.S. economic strength provides a fundamental thesis for both the USD Index and U.S. Treasury yields to rise (along with real interest rates), the double-edged sword often leaves the PMs with deep lacerations.

To that point, with a mix of both playing out in the present, Sebastien Galy, senior macro strategist at Nordea, signalled clients that the dollar smile remains alive and well:

“The dollar should continue to be supported by expectations of an eventual series of Fed rate hikes and the value of the dollar as a safe haven against a potential equity correction…. The downward trend in EUR/USD is likely to return in the coming weeks and months, suggesting EUR/USD around the 1.10 handle and potentially below that before moving higher.”

As for the yield story, Lindsey Piegza, chief economist at Stifel Financial, told clients that “markets appear increasingly jittery as the realization of a higher sustained level of inflation eventually resulting in a higher level of rates appears to be finally sinking in.... Against the backdrop of elevated inflation and rapidly rising energy costs, many market participants are skeptical the FOMC will be able to maintain these low rates for another year, let alone two.”

The bottom line? With inflation running away from the Fed, suppressing commodity prices (by strengthening the U.S. dollar and/or raising interest rates) is the only way to calm the inflationary pressures. If not, surging commodity prices will likely further suppress consumer confidence, upend corporate profit margins, culminate with demand destruction and the stock market should suffer mightily (which is also bullish for the U.S. dollar). As a result, with Powell creating an even larger inflationary wildfire the longer he waits, the PMs could confront immense volatility over the medium term.

In conclusion, the PMs were mixed on Oct. 5, though trouble looms large in the months ahead. With the USD Index and U.S. Treasury yields ripe for upward re-ratings, the Fed’s “transitory” narrative hasn’t aged well. And with the PMs’ main villains doing a lot of their fundamental damage since Powell turned hawkish, more upside catalysts should emerge over the medium term. As a result, the PMs’ outlook remains profoundly bearish over the next few months.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and silver that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.