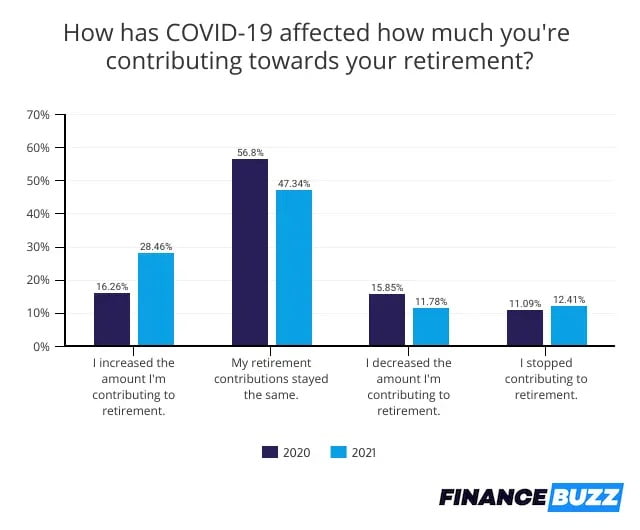

COVID challenges combined with long-standing issues, including student loans, high medical bills, and low wages, all affected people’s ability to save. With the unpredictable nature of returning to the workplace and office during a time when COVID-19 variants are becoming more prevalent, many have decided it’s time to leave the workforce which takes some of the decision making out of the question.

Q2 2021 hedge fund letters, conferences and more

So just how prepared are people to retire?

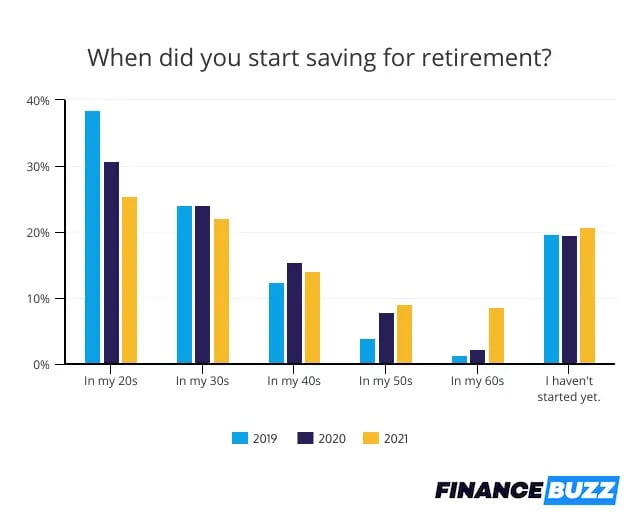

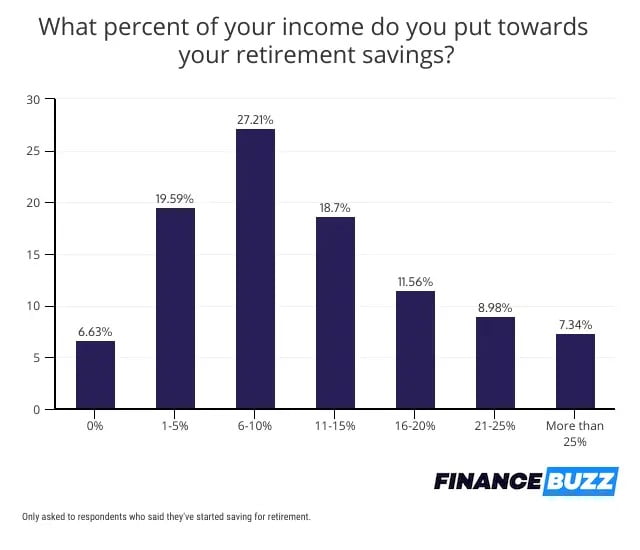

A new survey about saving for retirement in 2021 by FinanceBuzz explores how people are preparing for retirement in a post-pandemic future and what hinders them from actually putting money away. As part of an annual survey series, the survey highlights the changes in saving strategies, as well as what has stayed the same in terms of blockers of building a nest egg through the last few years.

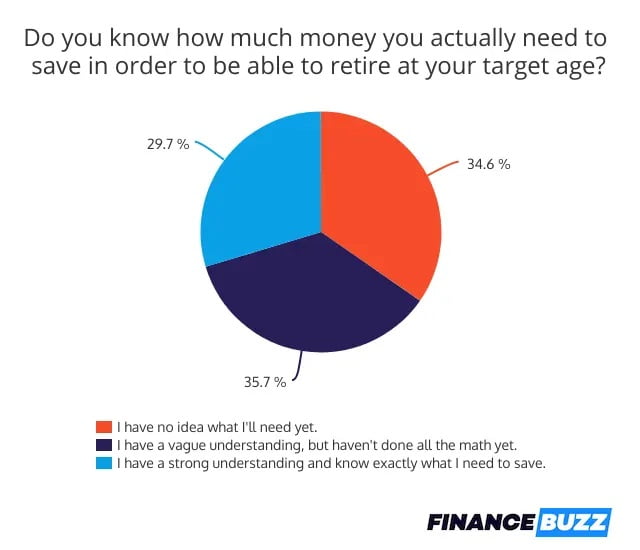

More Than 35% Of People Don’t Know What To Save For Retirement

In a largely unpredictable world, it’s difficult to know exactly what you should be putting away to retire at a given age. But it’s important to determine, because starting to save for retirement earlier in life is far more effective than putting off a retirement savings strategy. Over 35% of the survey respondents admitted that they didn’t know how much money they should be saving for retirement at this point in time based on their target retirement age.

Although people aren’t sure what to start saving for retirement, there are a variety of tools that can help. The calculation to determine what you should save for retirement includes factors like your age, pre-tax income, and what your current savings are. Calculators are useful because they also factor in cost of living salary raises, inflation, and a possible return in investments.

On the other hand, just under 30% of people have a “strong understanding” of what they need to do in order to retire when they would like to. In order to build a retirement fund that can support retirement, more education about how to prepare your savings for retirement is needed. In addition to that education, it’s likely there are societal changes that need to be made to allow people to begin saving for retirement sooner in life.

Most Americans Aren’t Earning Enough Money To Save

The numbers from the survey indicate that the majority of Americans, who aren’t saving for retirement, don’t put money away because they don’t make enough money to spare. 28% of people said their insufficient earnings were the main reason they were unable to start saving for retirement. This is a decrease from last year where, according to the 2020 FinanceBuzz retirement survey, over 33% of people weren’t able to save for retirement due to their salary.

Another difference between 2020 and 2021 is that the second most common reason people aren’t saving for retirement right now is due to healthcare expenses. Whereas in 2020, kids and family expenses were burdensome enough that 30% of people cited this as a reason they weren’t saving for retirement.

Another common reason people aren’t saving for retirement at the current moment is that their employers don’t offer any kind of retirement savings plan.

Many People Don’t Have An Employer-Sponsored Retirement Plan

The workplace has been a hot topic over the last year and a half, especially when COVID-19 was influential in how many Americans were laid off, furloughed, or fired from their jobs for any number of reasons. While less jobs were lost in 2021 so far than 2020, it’s still a hindrance for some Americans and their savings.

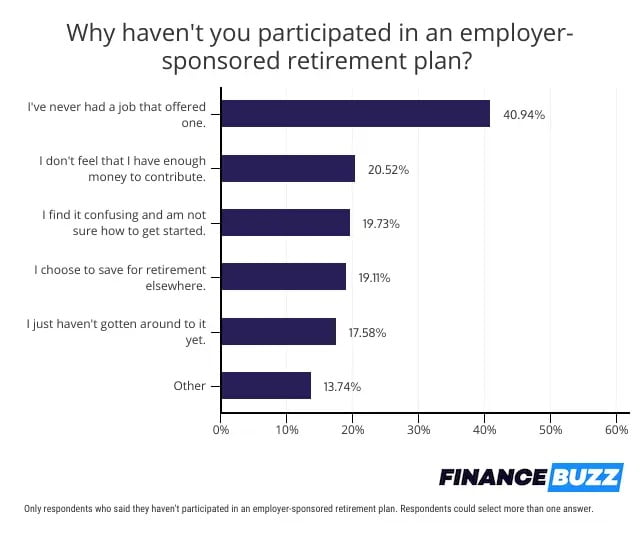

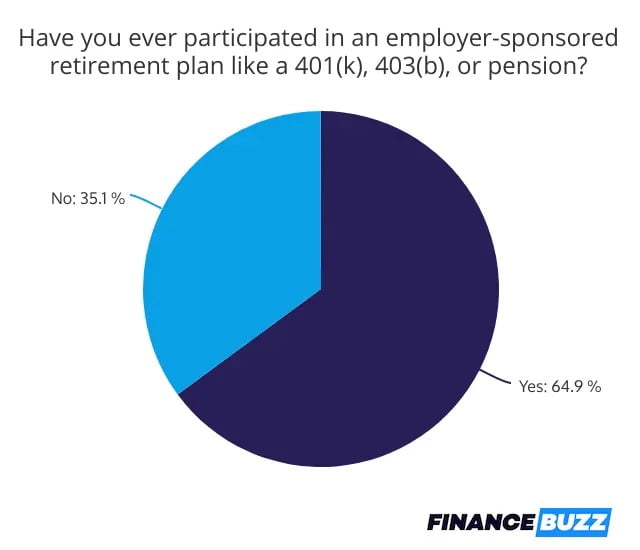

For others who are employed, saving for retirement can still be complicated without support or guidance. In fact, 35% of people mentioned that they have never participated in an employer-sponsored retirement plan like a 401(k)! Of those 35% who haven’t had the chance to funnel funds to retirement savings, 40% of them have not held a job where their employer offered a 401(k) or a similar plan.

It’s difficult to invest for retirement on your own, especially if you’re unsure where to start which is likely the case for most individuals. Almost one in four people who haven’t participated in a 401(k) plan or started saving for retirement aren’t doing so because they don’t know how.

401(K) Isn't The Only Way To Save For Retirement

One of the most surprising parts of the survey analysis shows that 44% of people who have already started saving for retirement include either a small or large portion of cryptocurrency investments within their retirement portfolio. Some people are even turning to BitcoinIRA to fund their retirement instead of relying on social security.. Although cryptocurrency has become more mainstream, not everyone is prepared to invest in Bitcoin or a similar crypto coin. Fortunately, there are other ways to begin preparing for retirement or simply increasing your wealth.

Real estate has become one of the most prominent ways to create a passive income to help your retirement portfolio. Investing in real estate is a fantastic place to start, especially as the housing market has been white-hot in different parts of the country. There are a few different ways to invest in real estate, none of which are limited to becoming a landlord. While real estate investments may not be the future of retirement planning in a post pandemic world, they can certainly help.

All in all, most Americans aren’t prepared to retire in a post-pandemic world. However, with more effective education on retirement savings strategies and encouragement to diversify investment portfolios, more and more Americans will find themselves able to fund their retirement.