Retail share trading has taken off in the past year and shows no signs of slowing down. Micro-investment apps are paving the way for more accessibility, making it easier than ever for people to enter the market, writes Finder’s investment editor, Kylie Purcell.

Q3 2021 hedge fund letters, conferences and more

The global pandemic changed a lot about the way we interact with the world. From Zoom meetings to socially distanced dining, the world just started acting differently. Retail investing was no different – with retail investors flooding the market in the past year. Credit Suisse estimates that at times in 2021, retail investors made up about a third of all share trading in the US. Meanwhile, research from Deutsche Bank suggests almost half of all US retail investors were new to the market this year.

And the rise of retail share trading has only just begun, according to Finder’s Global Investing Adoption Survey. Globally, an average of 34% of people across 16 countries own shares and 29% invested in the last year. Not only that, but an additional 18% who haven’t already invested plan to do so by the end of the year.

The Rise Of The "Small-investor"

What was particularly interesting about Finder’s survey wasn’t that people have invested – we know that extra stimulus in the economy and global lockdowns meant part of the population had more disposable income to invest in 2020 than in previous years. However, what is interesting is that so many retail investors were investing on a smaller scale.

In fact, in all the countries Finder surveyed, the majority of retail investors said they’d invested a small amount. For example in Hong Kong, which saw the highest prevalence of share traders at 57%, a quarter of the adult population said they’d bought less than HKD$20,000 (USD$2,570) worth of shares. Meanwhile, just 6% said they’d invested HKD$80,001-HKD$160,000 (USD$10,290-USD$20,580) and 14% had invested in the highest bracket at more than HKD$160,000. We saw a similar split in countries like South Africa, where 20% had invested less than ZAR8,500 (USD$596), and in the US, where 19% had invested less than USD$2,000.

The rise of micro-investment and fractional stock trading apps like Acorns and Robinhood have played a big role in this shift. A generation ago, it was still costly to buy shares, which meant you needed a large sum of money to start investing in the stock market. These days, there are plenty of low-cost online brokers that allow you to invest just a few dollars at a time into stocks.

We’re seeing this play out in the industry, with newcomers turning to apps that provide this service. Micro-investing apps all over the world are reporting a surge in their customer base, with Freetrade in the UK reportedly seeing their customers grow 6-fold from 50,000 people in early 2021 to 700,000 by the middle of this year.

Robinhood added 3 million customers in 2020 and eToro added 5 million people. More broadly, Bloomberg Intelligence data suggests that retail investors accounted for 23% of all US equity trading in 2021 – which is more than double what we saw in 2019.

In a handful of countries, we’re seeing this correlate with age, where young people (those aged 18-24) are most likely to have invested on a smaller scale. They’re also set to lead the next wave of share trading growth, with young people most likely to say that if they haven’t yet invested, they plan to by the end of the year. Globally, 24% of people aged 18-24 who don’t currently own stocks say they plan to invest by the end of the year. Meanwhile, just 12% of those aged 55-64 and 65+ said the same.

With so many young people now investing and many investing just a small amount, this tells us share trading is no longer just for older people or the well-heeled. With the barrier to entry lower than ever, younger people are able to get their foot in the door and start investing earlier.

It’s not just the age gap that’s closing, we could also see a rise in share trading in markets that typically don’t have a lot of activity or are more likely to have an unbanked population. For example, Mexico has the smallest percentage of share traders overall of the countries surveyed at just 13%, but they’re expected to see some of the biggest growth over the next year. In fact, 27% of Mexican adults who haven’t already invested say they plan to buy shares by the end of the year – almost 10 percentage points higher than the global average of 18%. Only Italy is expected to see more people enter the market, with 28% planning to buy shares by the end of the year.

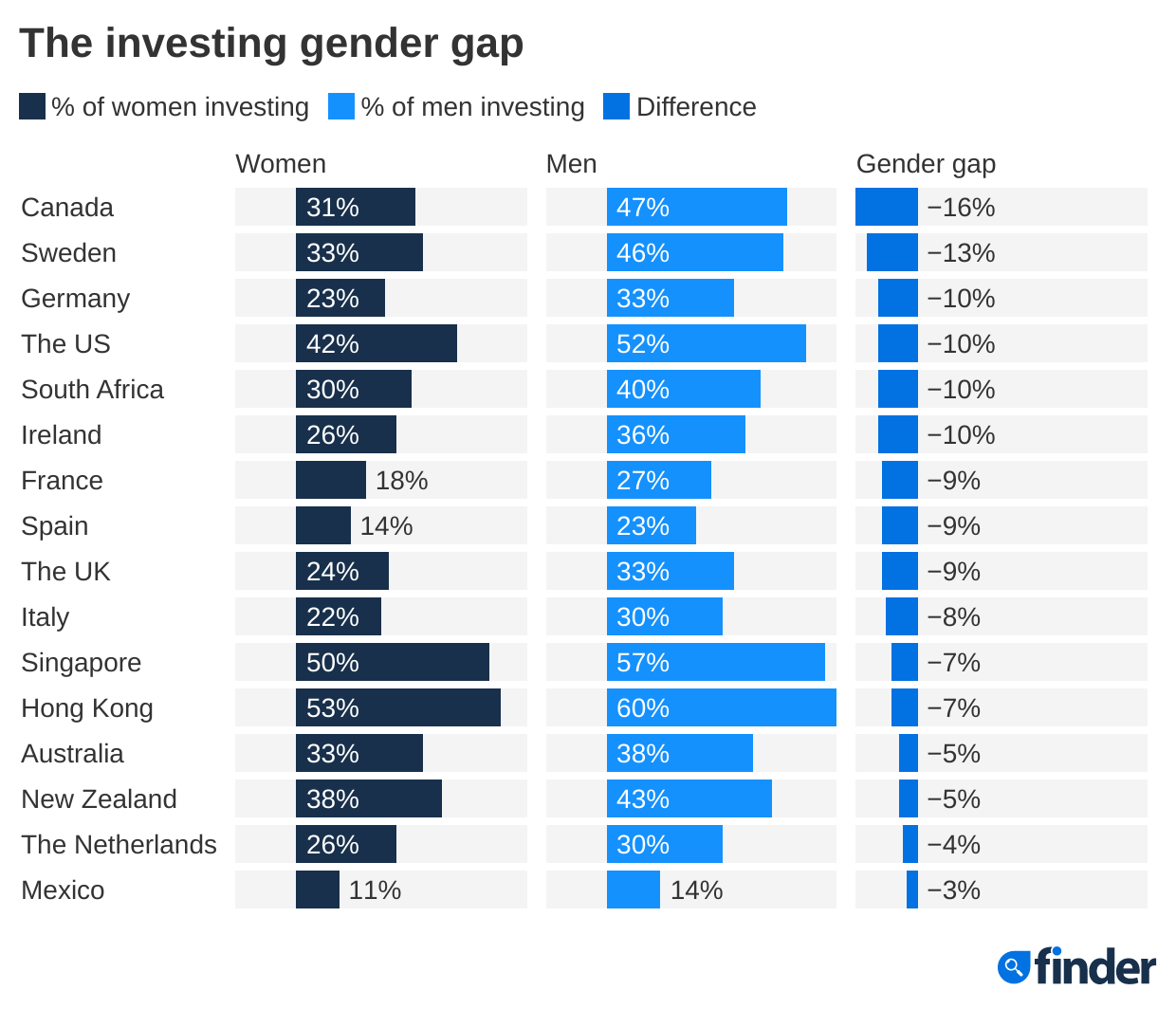

However, inequality still prevails, particularly between men and women. Finder’s research found that in every country surveyed, men are more likely than women to hold shares. The gap was particularly large in Canada, where 47% of men own shares compared to 31% of women – amounting to a gap of 16 percentage points. Mexico and the Netherlands have the smallest gaps, at just 3 and 4 percentage points, respectively. This, of course, is nothing new and studies show a similar gap exists in other parts of the investing industry, like digital currencies, or the wealth gap.

What's Next For The Industry?

Retail investing has undeniably changed in the past year, and at an incredible pace. The obvious next steps for the industry would be to see these trends only further accelerate, with micro-investing apps bringing equality to the industry across more demographics. While a lot has changed, there’s still a ways to go, especially for the gender investing gap. However, research from the CFA institute suggests the gap is closing, in part thanks to technology and new apps that are making it easier for women to partake in share trading. It’s likely what we’ve seen so far is only just the beginning.