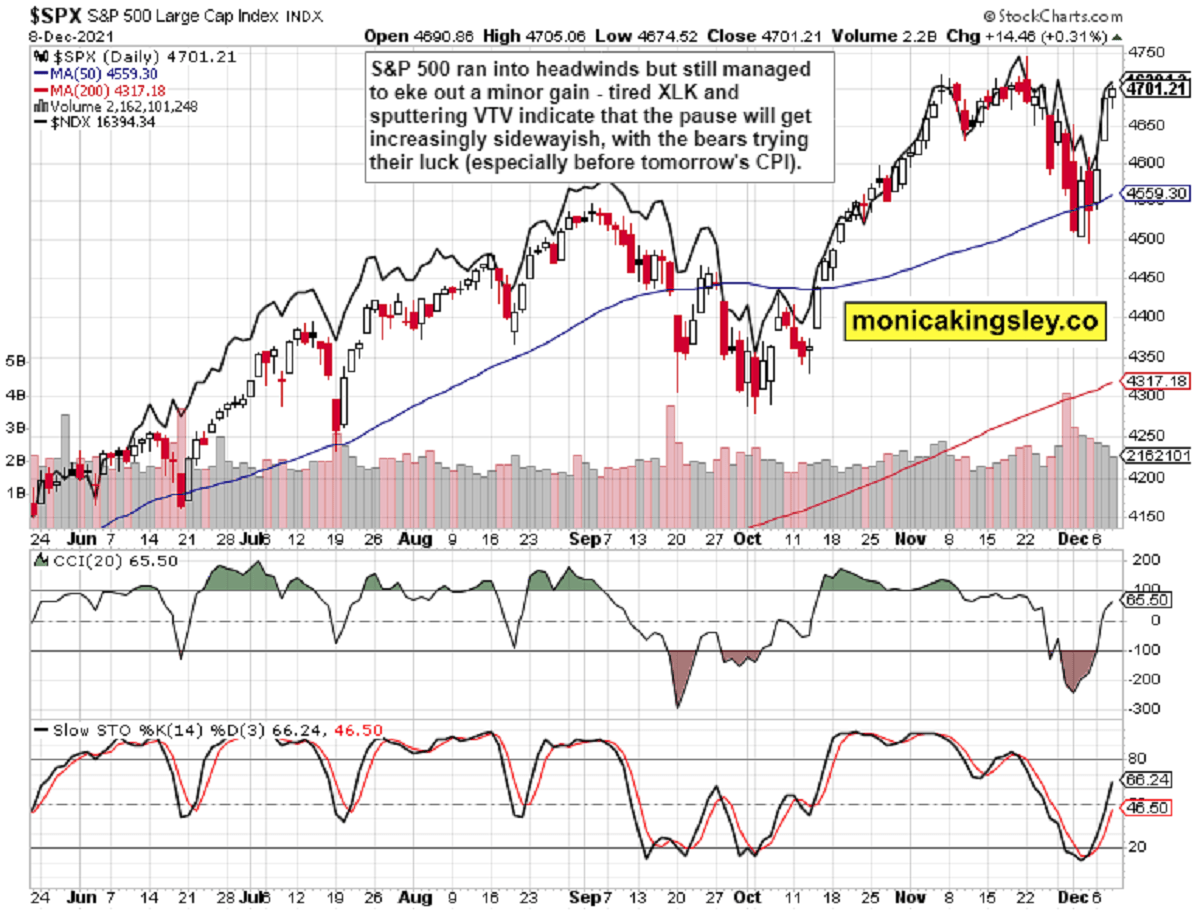

S&P 500 rose as VIX retraced over half of its recent spike, but tech and value have a short-term tired look. Cyclicals turning down while utilities with staples barely budge in spite of a surge in yields? That looks really risk-off to me, and together with commodities and precious metals going nowhere, represents your usual setup before tomorrow‘s CPI announcement. So, count on some headwinds today.

Q3 2021 hedge fund letters, conferences and more

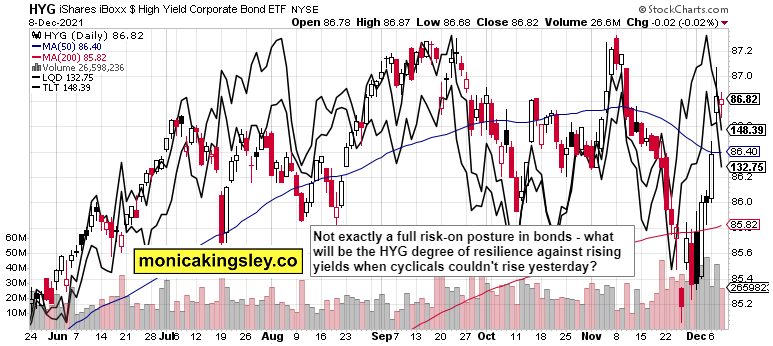

A reasonably hot inflation figure is expected tomorrow – inflation expectations have risen already yesterday. The fears are that a higher than what used to be called transitory figure, would cut into profit margins and send value lower. Even if inflation (which certainly hasn‘t peaked yet as I‘m on the record for having said already) isn‘t yet strong enough to sink stocks, the Fed‘s reaction to it is. The dynamic of tapering response messing up with the economy would take months to play out – so, the bumpy ride ahead can continue. If only the yield curve stopped from getting ever more inverted...

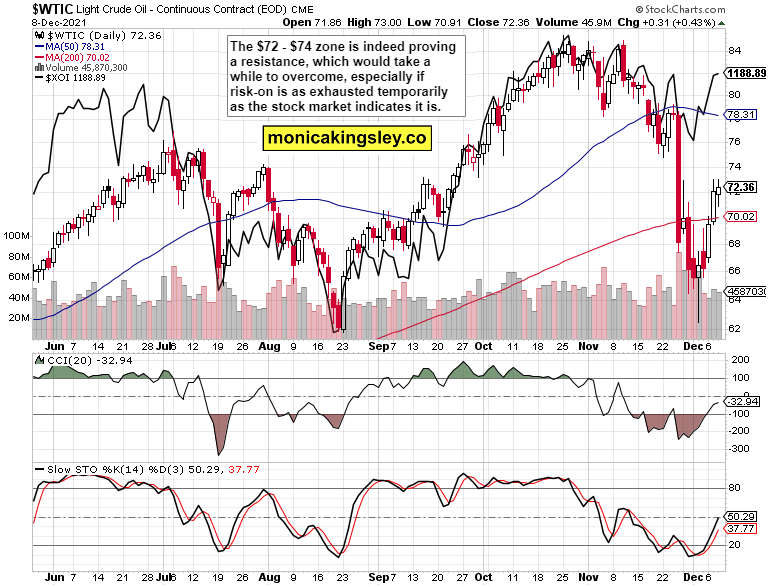

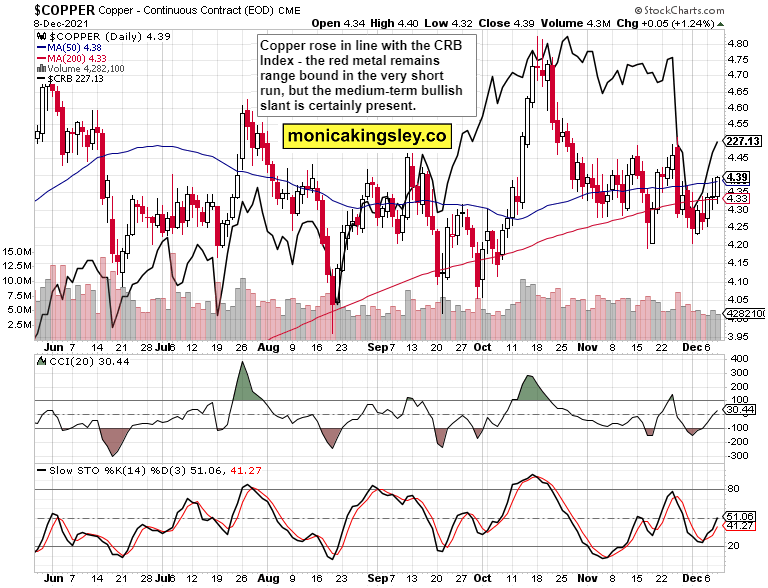

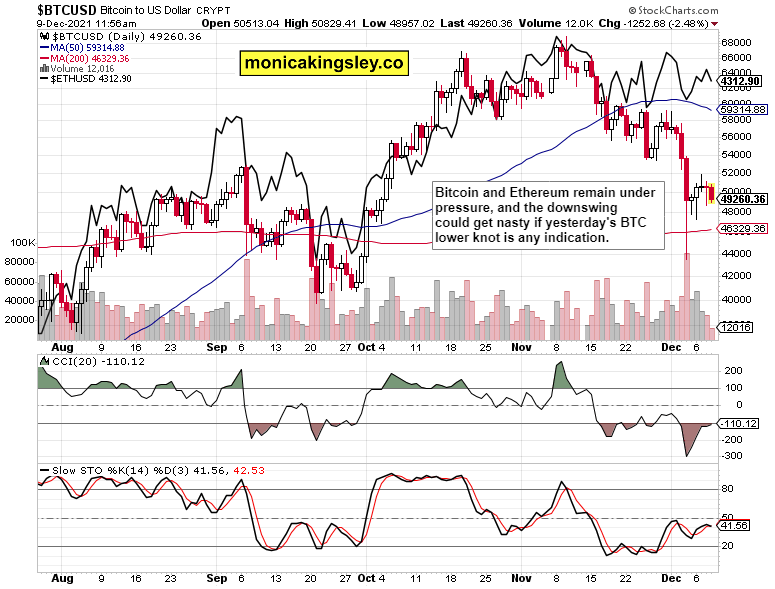

Markets keep chugging along for the time being, and the warning signs to watch for talked in Monday‘s extensive analysis, aren‘t flashing red. While I would prefer to see more copper strength for confirmation (almost as much as no question marks creeping into the crypto land), this is what we have – and it indicates that the path higher won‘t be steep. Neither in stocks, commodities or precious metals – as I wrote yesterday:

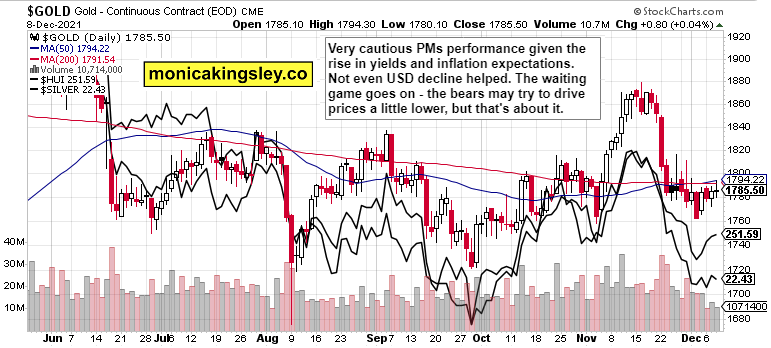

(…) The copper weakness remains the only watchout in the short term, and silver sluggishness reflects lack of imminent inflation fears. As if the current prices accurately reflected above ground stockpiles and yearly mining output minus consumption. It‘s the same story in the red metal, by the way.

Patience in the precious metals – it‘s about Fed either relenting, or placing inordinate amount of stress on the real economy, which would take time. Spring 2022 most probably would bring greater PMs gains than 2021 with its fits and starts – aka when inflation starts to bite the mainstream narratives and stocks, some more.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 upswing looks ripe for a brief breather – the volume is drying up, and consolidation in the vicinity of ATHs shouldn‘t be unexpected.

Credit Markets

HYG held up quite well on the day, but the stock market mood it translated into, was risk-off one as rising yields couldn‘t help cyclicals.

Gold, Silver and Miners

Precious metals are still basing, positioned for the coming brief decline that has pretty good chances of being reversed right next. The countdown to higher prices and Fed mistake is firmly on, and the risks of being out of the market outweigh the patience now required.

Crude Oil

Crude oil upswing is running into predictable headwinds, which I look to be resolved to the upside perhaps as early as tomorrow‘s regular session (I‘m not looking for CPI to send real assets down).

Copper

Copper is still quite lukewarm, and doesn‘t indicate a commodities surge right ahead. Some consolidation wouldn‘t be surprising now that half of the CRB Index downswing has been erased.

Bitcoin and Ethereum

Bitcoin and Ethereum keep looking vulnerable – the yesterday discussed downswing possibility looks to be progressing, unfortunately for the bulls.

Summary

S&P 500 is still likely to consolidate recent strong gain, and at the same time not to tank on tomorrow‘s inflation data. The (almost classical, cynics might say) anticipation is playing out in commodities and precious metals today, but I‘m looking for the downside to be reversed tomorrow as the yields vs. inflation expectations duo hint at. Fed fears this early in the tapering cycle will likely look to be a blip on the screen in the topping process hindsight.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.