In his Daily Market Notes report to investors, while commenting on inflation, Louis Navellier wrote:

Q3 2021 hedge fund letters, conferences and more

We were having a normal Thanksgiving week rally today, but the markets have since pulled back though tomorrow will likely be the strongest day this week.

The market is saluting any good news and rationalizing away the well-established bricks in the Wall of Worry. You have to be especially bearish to fight the tape here. Waiting for a buying opportunity looks to be expensive and probably will require a Black Swan event.

MMT On The Rocks

Today’s Wall Street Journal today about modern monetary theory is highly critical of our current monetary policy. The article is timely given Jerome Powell has been renominated for the Reserve chairman. Modern monetary theory (MMT) was pioneered by Mario Draghi, formerly head of the European Central Bank. Essentially, modern monetary theory is unlimited money printing. And it's what caused negative interest rates in Europe. And obviously giving out money is a very popular thing to do. In fact, Mario Draghi is so popular, he's now the Prime Minister of Italy.

Lifetime Inflation

But MMT also comes with inflation. And the problem with this unlimited money printing is we cannot tax our way out of it. They can tax all of us 100%, and we're still going to have an $8 trillion deficit and our Federal Reserve, despite all the inflation that's out there, cannot significantly raise rates, because right now the interest burden on the federal deficit is bigger than our Defense Department budget.

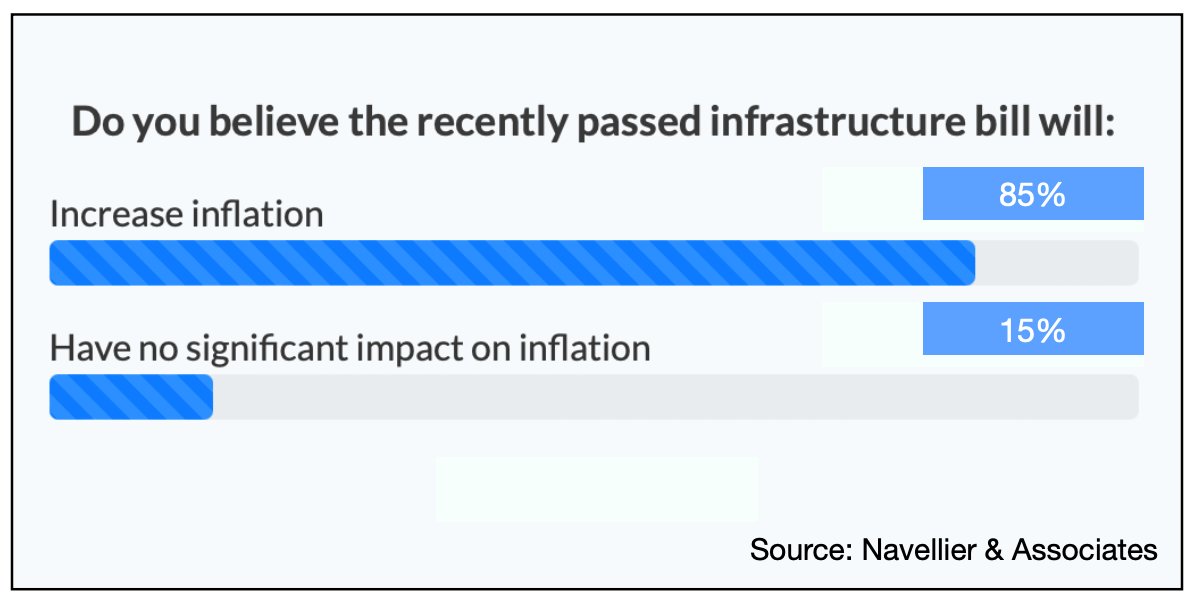

Further, our latest survey showed that 85% of retail investors believe that the recently passed infrastructure bill will increase inflation. One respondent called it "throwing gas on a fire."

So we've hit the point of no return where a lot of people are realizing we're going to be an inflationary environment, possibly for the rest of our lifetimes.

If you invest in commodities, you'll be doing okay. If you invest in real estate, you'll probably do okay. And the stock market is a great inflation hedge. Net, net millions are putting their money in the market. The bad news is that inflation is spinning out of control.

It appears inflation is moderating near term because crude oil prices have backed with China releasing some of their strategic reserves. And Furthermore, Europe looks like they're sliding lockdown because of another covid resurgence. So anytime global economic growth, slows energy prices tend to moderate.

February Correction

We're still in a very seasonally strong time for the market. November is a super strong month. December is pretty darn good too. January is phenomenal. So all major market indices, as I talk to you now are overbought, but they're going to stay overbought into February. And if we're going to have any kind of correction it will be in February.

Heard & Notable

An Alabama engineer broke the Guinness World Record for building the world's largest Nerf gun measuring 12 feet, 6 inches long - 300% larger than the original toy. The huge Nerf gun launches 12-inch darts that reach speeds of up to 50 mph and can travel a maximum distance of about 250 feet. Source: UPI