Was the adage “buy the rumor, sell the news” also verified with that new trading position?

Q3 2021 hedge fund letters, conferences and more

Crude Oil Prices Picking Up Momentum

It was Thursday (Nov. 4) that the following rumor had flourished: a possible coordinated action which was supposed to consist of drawing on the strategic reserves of several countries, including the United States, which were leading the dance.

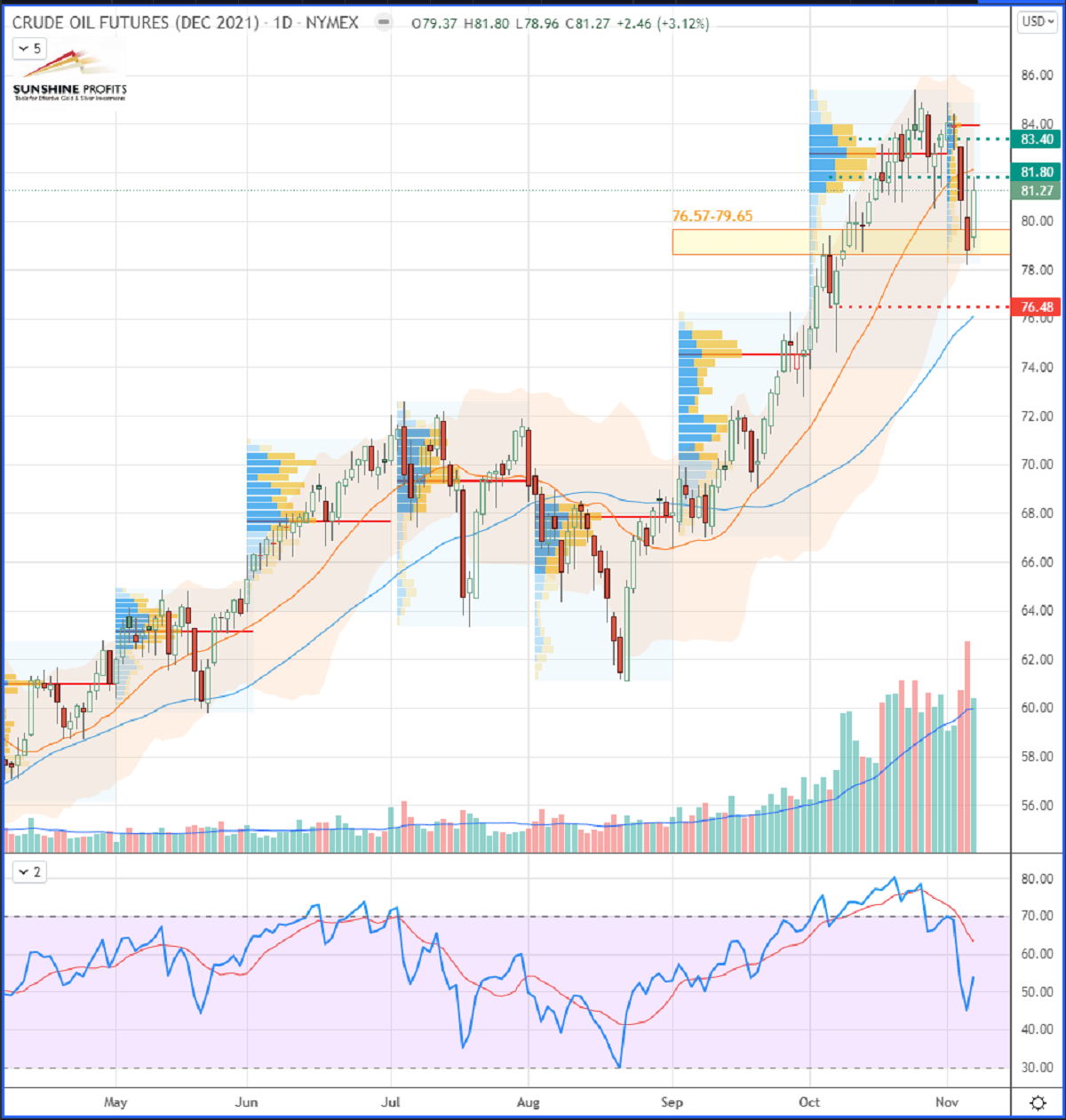

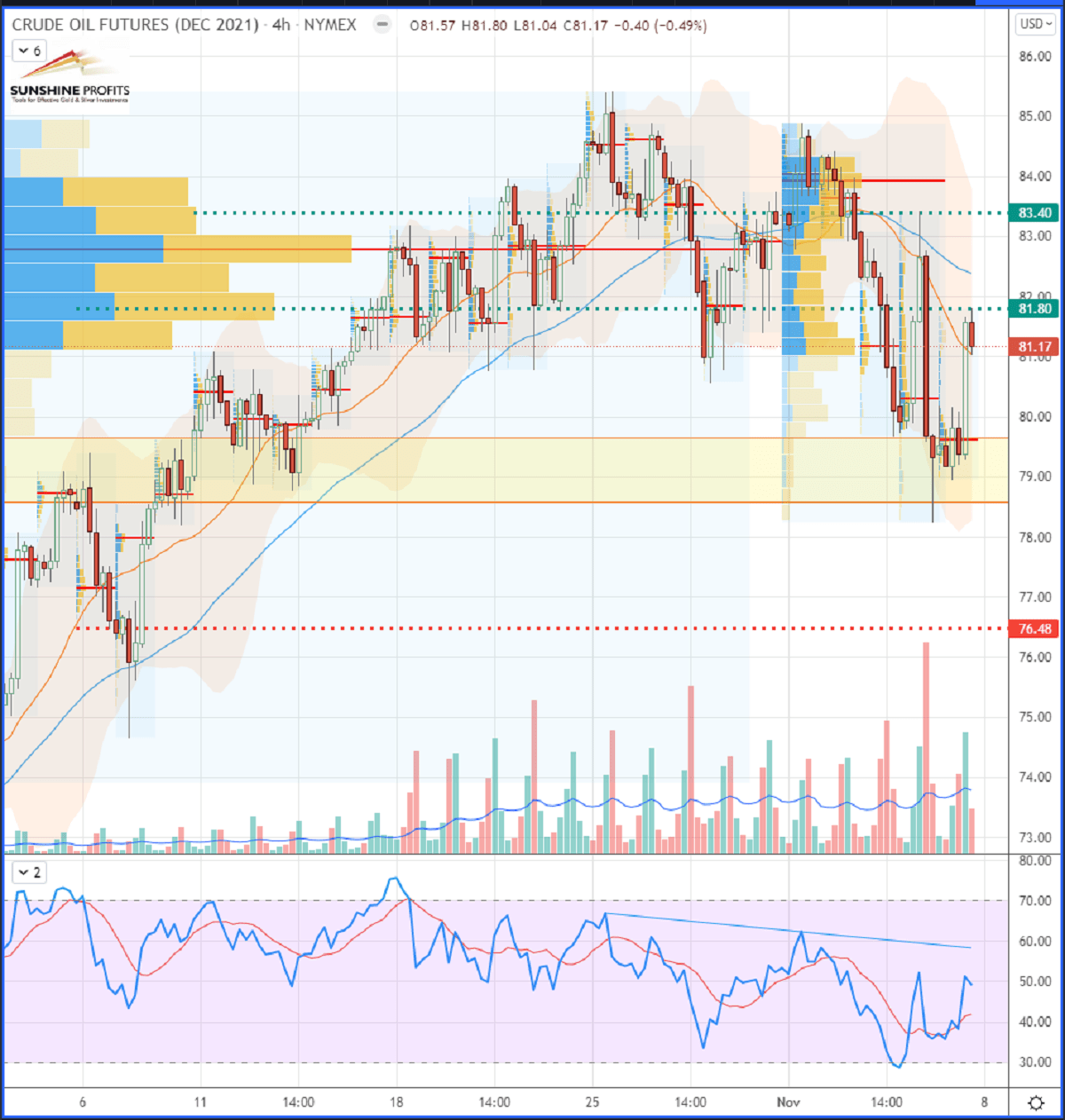

Meanwhile, our subscribers were just getting ready to go long around the $76.57-79.65 support zone (yellow band), with a stop placed on lower $76.48 level (red dotted line) and targets at $81.80 and $83.40 (green dotted lines).

As a result, oil prices had contracted in stride (trading just into our entry area), just before the rumor effect faded shortly on Friday (Nov. 5), to push them back up.

In fact, with oil prices picking up momentum on Friday, once again settling firmly above $80 per barrel, and with a market still showing doubts on the possible use of strategic crude reserves, the proposed trade entry on the black gold, triggered on Thursday – following my last post – was thus profitable since it already turned into a partial profit-taking at the end of the week.

Then, on Saturday, Joe Biden said that his administration had the means to cope with the rise in energy prices, in particular after the OPEC+'s decision not to raise their production to more than 400,000 barrels per day. in a context of global imbalance between supply and demand.

In addition, Joe Biden also insinuated that the organization (and its allies) might actually not do its best to pump enough volume of crude oil.

Trading Charts

Chart – WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

Now, let’s zoom into the 4H chart to observe the recent price action all around the above-mentioned levels of our trade plan:

Chart – WTI Crude Oil (CLZ21) Futures (December contract, 4H chart)

In summary, my trading approach has led me to suggest some long trades around potential key supports, as this dip on crude oil offered a great opportunity for the bulls to enter long whilst aiming towards specific projected targets. If you don’t want to miss any future trading alerts, make sure to look at here. . Moreover, for those interested in Forex trading, please note that I am currently preparing some new series about the co-existing links and relationships between commodities and currencies.

Stay tuned – happy trading!

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.