Change is rarely easy. Oftentimes it’s unwelcome. But usually, even when it’s unpleasant at first, change has the ability to teach a lesson or two that eventually leads towards positivity. And then theoretically, we take these lessons, apply them to our lives, and live happily ever after.

Okay, okay, I know this reads more like a fairy tale than an investment piece; however, that last bit about change teaching positive lessons is true.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

In this article I’ll be discussing a positive lesson that I learned (or, more accurately, was reminded of) during the market’s major shift towards volatility: the importance of an income stream as a calming force; or, an anchor even, amidst stormy seas.

I admit that there are going to be few original thoughts in this piece. I always strive to be creative, engaging, and somewhat inspirational when I write; however, sometimes I think it’s best to be reminded of the important things that we already know. It’s easy to lose track of our principles, especially when emotions get involved. It’s when we stray from the path that we’ve spent so much time developing that we tend to make mistakes.

As portfolio managers, we’ve all likely heard about the importance of staying rational in the face of fear and greed, as conservative investors, we’ve all likely spent a lot of time focusing on value instead of the market momentum, and as dividend growth investors (DGI), we’ve been told, countless times, to focus on a reliably increasing income stream rather than the speculative undulations of the value of our holdings, especially in the short-term.

Granted, it’s been easy to forget these things in recent months. 2017 was a year of historically low volatility with an upward bias that made capital gains relatively easy to come by. These high returns lead to complacency and possibly even exuberance in certain areas of the market. This was especially the case in several areas of the market that DGI investors typically cover.

Historical valuations have been somewhat disregarded in favor of reliable yields for a while now with interest rates hovering near all-time lows. The conversation around interest rates began to change its tune late last year as tax reform became a reality, but that talk, which should have been paramount amongst investors, whether you own dividend paying stocks or not, was overshadowed by the exuberance in the crypto markets. Speculators were making millions in this relatively new and little understood asset class and I think this confidence spilled over into the equity market. Needless to say, it seemed like we were living with a market where investors could do no wrong.

This cheery overflow of sentiment followed the market into the new year, which lead to one of the best Januarys of all-time. Obviously, investors couldn’t have expected January’s 5% returns to continue; on an annualized basis. However, complacency was rampant with heavy retail inflows into the market during December and January. Investors who’d been sitting on the sidelines throughout the strong bull market during the last couple of years were finally putting their cash to use.

Oftentimes, large retail inflows are used as contrarian indicators, because whether we like to hear it or not, many times retail investors are considered to be “dumb money.” I don’t think its fair to paint the mom and pop investors with such a broad brush, but then again, it appears that retail inflows did signal a market top this go around, at least in the short-term. I don’t know if this bullish retail sentiment was factored into the algorithms that are responsible for the vast majority of the trades on any given day or not, but regardless, a jobs report highlighting wage inflation (sparking fear of overall inflation), combined with the 10-year crossing a couple of “important” analyst/technical thresholds, led to record volatility.

If investors were asleep at the wheel during December and January, they were certainly woken with a start in February. There are a handful of possible reasons for the recent volatility, from overvalued fundamentals, to expectations that rates will rise faster than previously thought, to structural issues with the market itself spawning from algorithmic trading (computers tend to be programmed to act differently than value investors; they buy stock on upward momentum and sell it during downdrafts, which augments momentum shifts when they happen), and the XIV sell-off and redemptions.

I’ve heard all sorts of speculation and conjecture and I suppose that at the end of the day, little of it matters. The markets experienced one of the quickest 10% sell-offs of all-time, but in the grand scheme of things, it’s likely that that doesn’t matter much either. If history is to serve as any sort of guide, this too shall pass. Earnings have been strong, corporate balance sheets are healthy, and the consumer is getting a financial boost in the form of tax reform.

Speaking of tax reform, it’s funny that what can be so good in so many ways could also potentially be the spark that ignites the next major market downturn. When I think about actual systemic issues, I do worry about an overheating economy and the ensuing inflation and interest rates that could turn the market on end.

Unfortunately, it’s political forces that allow or disallow financial stimulus, rather than market dynamics. What I mean is, we really needed this sort of stimulus a decade ago when the economy was falling apart rather than now, when we’re at record unemployment. Stimulus now will likely help the economy, but that isn’t the concern.

The concern is that the economy overheats, creating inflation and forcing the FED’s hand with regard to rising interest rates. Outsized GPD growth would be great, but I think the market would fearfully ignore it in the face of rising rates; we’ve been investing in a low rate, easy money economy for so long now that investors, large and small, are surely going to be hesitant to put money at risk in a rising rate environment.

This is my largest concern regarding the economy and broader markets. I’m still not expecting a recession in the near-term, but I admit that the risk of one is rising due to the White House’s willingness to leverage debt in hopes of spurring economic growth. Generally, I’m opposed to excess debt loads. I’m nervous as I watch the once debt-averse Republican party changing its tune here. This is yet another example of change inspiring fear.

Time will tell if my concerns are well placed or not, but I am being more conservative with my capital due to fears revolving around higher corporate & government debt loads in the face of a hot economy and rising rates. I’m always concerned when we strive to increase growth in the present by borrowing it from the future with debt; with that said, that seems to be the name of the game in American politics and monetary policy so it’s just something I need to come to terms with as an investor.

A Prescient Look in The Mirror

So, how do we best deal with the fear that change creates? Once we understand ourselves, it becomes relatively easy to predict our own downfalls and protect ourselves from ourselves. However, reaching this level of personal understanding is not easy as it necessitates close analysis of the worst aspects of our being.

When the recent sell-off began, I had two initial reactions. One, I knew I needed to make sure that my shopping list was up to date with new company guidance factoring in the recently passed tax reform. And two, I knew that I needed to have cash available to take advantage of any attractive weakness that I saw.

These two decisions seem responsible and prudent to me, especially after a couple of years where my portfolio posted strong, double digit growth. Taking profits at the top (or even near it) is never a bad thing. Paper gains can easily transform into paper, or worse, actual losses. Profits taken can never be anything but that: profits.

So, that’s exactly what I did. I locked in strong gains in a handful of companies with high valuations and sub-par growth prospects moving forward and put some of this cash to use in beaten down, high quality REITs currently offering yields that we haven’t seen in years and my largest and favorite defensive investment: Apple (AAPL).

The speed of the sell-off was unexpected and I have to admit that the speed of the recovery has taken me by surprise too. It’s starting to look like investors need to throw historical models in terms of time lines out of the door. We all know that the past isn’t an accurate representation of the future and in the new digital age that we’re living in, this is becoming more and more apparent.

I’m happy with the trades I made and I feel that I’ve improved the strength of my overall portfolio (it’s worth noting however, that I’m only talking about very small percentages of my portfolio changing; I think I sold positions with a ~2.5% weighting and thus far, I’ve put cash to use that represents ~1.5% of my portfolio). I never move too quickly in the markets. This is to protect myself from myself, in case I’m feeling particularly rash one day and don’t recognize it.

Generally, it’s only with hindsight that we’re able to really understand whether or not our decisions were sound ones. I take a lot of pride in my perceived mental strength/intestinal fortitude. Even so, I’m oftentimes amazed by how quickly my own sentiment, or at least, quick, emotional reactions, will change when looking at the markets. One day I will be happy to have cash on hand, looking forward to taking advantage of further weakness…and then the next day it will make me nervous as the market turns upward and I think about opportunity cost. I’ve always been a competitor and my first reaction is always to maximize my returns. However, chasing results like this oftentimes leads to mistakes which in turn, hurt returns over the long run.

Over time I’ve developed effective practices which allow me to quickly analyze my short-term reactions to acknowledge the levels of fear/greed involved in them. Once I acknowledge this truth, I am able to adjust my train of thought and act in a more reasonable manner. Understanding one’s own shortfalls is an important aspect of managing money; no one is perfect, especially in the moment, but if we’re willing to look into the mirror and acknowledge these flaws, it’s likely that a lower percentage of our decisions will be irresponsible ones.

However, even with all of this philosophical rhetoric in mind, it’s probably most important to realize that we’re all flawed beings and it is important to continue to take steps to protect ourselves. To me, there are several easy ways to do this is the market.

Diversification is one. I make sure that I spread my risk out across a wide variety of sectors, industries, and individual companies within each. The level of concentration within your portfolio will come down to personal preference and risk tolerance. I’ve set a “full” position, meaning my target allocation, at a weighting around 1.5-2%. I own 75 positions or so, meaning that the time/energy that I must dedicate towards monitoring my holdings is much greater than what someone would likely spend with more concentrated holdings; however, to me, the effort is worth it in terms of the risk/reward regarding individual equity holdings.

Yield diversification is another. By owning a variety of high yielding names that give me more buying power via selective dividend re-investment in the present, traditional aristocrats offering stability, and low yielding names that offer high dividend growth prospects moving forward, I’ve covered my bases and created an optimal atmosphere for reliable dividend growth over the long-term.

And a final protection is one that I’ve already touched on before: regular dollar cost averaging. This practice spreads out risk over the time horizon. Investing in regular intervals also helps to reduce emotion with regard to market timing.

I don’t dollar cost average (DCA) with the majority of my investments because I track the market full time and have confidence in my ability to spot value/control my emotions; however, for those who don’t have the time/energy to monitor the market each and every day can still benefit from the wealth creation capabilities of the markets by accumulating high quality assets over time with a DCA system. I do however DCA with my passive income. These regularly scheduled purchases ensure that I’m building exposure to the markets, regardless of my personal sentiment, which is a great hedge against potential irrationality of my part.

Using Your Income Stream as an Anchor

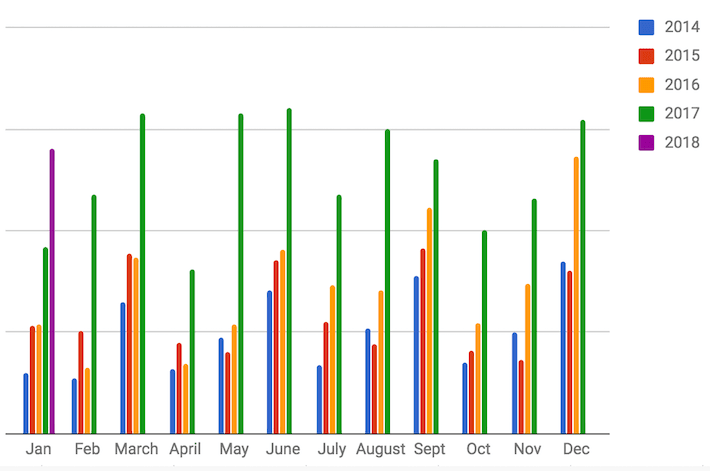

And this last bit leads me back to my original thesis: the importance of a reliable dividend income stream. When I see the value of my holdings falling precipitously, it helps me to ignore the fact that I’ve “lost” thousands of dollars when I focus on the fact that my income stream is intact. I keep track of my income stream on a monthly basis and looking at the stair step pattern progression am able to calm my nerves and refocus on the fundamentals and long-term goals that inspired my decisions in the market in the first place.

When you look at the reliability of a properly constructed income stream you realize that so much of the noise surrounding the markets is inconsequential. Much more often than not, this noise is short-sighted and based upon sentiment rather than fundamentals. I create market-related content for a living so I don’t want to bash the talking heads too much, but I’ve always said that investors need to take these opinions with a grain of salt.

What you shouldn’t take with a grain of salt are the numbers that a company produces. Numbers don’t lie. And it’s these fundamentals that trickle down to dividend payments, which are also tangible benefits of equity ownership. As I said before, paper gains can easily become losses, but a dividend is cash money in your pocket (or more likely, brokerage account). What’s more, while it’s true that any dividend could be cut at any moment, generally, when you’re monitoring the fundamentals of the companies you own, it’s fairly easy not only to determine whether or not a dividend is sustainable, but also how much a management team is likely to increase it over the short-term.

Organic portfolio growth via dividend re-investment is the easiest growth for me to track. It’s growth that I feel confident that I can count on, regardless of the direction that the market is heading. The very best part of organic portfolio growth via dividend re-investment is that when the market goes sour, I’m getting better value with the new shares that I purchase. These shares purchased at lower prices come with higher dividend yields, meaning that my purchasing power moving forward is increased. This is a virtuous cycle and one that steadies my mind and calms my fear in a market that is amidst a tailspin.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Nicholas Ward, Sure Dividend

The world’s best investors have trounced the market decade-after-decade. The course Invest Like The Best uses actionable cases studies from investors like Warren Buffett, Peter Lynch, Seth Klarman (and more) to teach you the tools and techniques of super investors. Click here to enroll today and save $100.