Customer experience (CX) is now “everything,” according to PwC and other retail analysts. CX is the factor that drives shoppers to pay more in some stores and avoid others altogether—and one of the elements that has a huge impact in CX is convenience. That’s especially true in eCommerce, where checkout friction keeps the cart abandonment rate hovering around 70%, year after year. One way that merchants can make their online shopping experience more convenient—and drive more cart conversions—is by giving customers digital wallet payment options.

Q3 2021 hedge fund letters, conferences and more

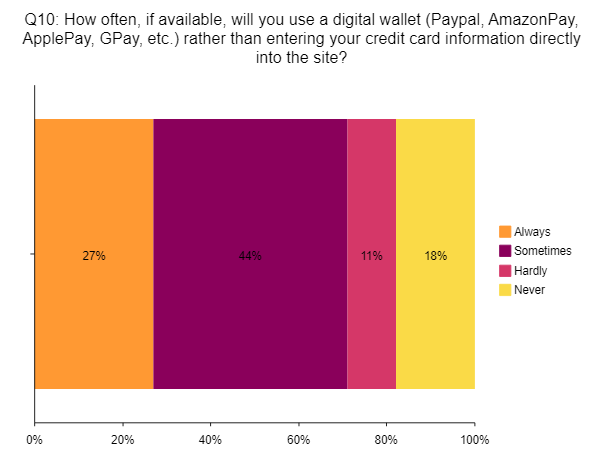

Digital wallets are increasingly popular. ClearSale’s 2021 survey of online shoppers in the U.S., Canada, Mexico, the U.K. and Australia found that 71% prefer to pay with digital wallets instead of credit cards when they shop online. Twenty-seven percent say they always pay with a digital wallet, and another 44% do so sometimes.

Let’s look at some of the reasons why digital wallets already have so much appeal to online shoppers, and how merchants can benefit by adding them.

Digital Wallets Are More Convenient Than Cards

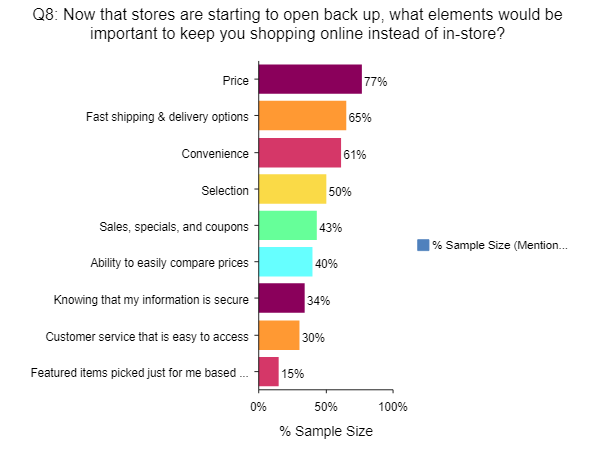

Shoppers rated convenience among their top three reasons to keep shopping online rather than returning to stores. Digital wallets make online shopping easier because they eliminate the need for customers to key or tap in their payment data to complete a purchase.

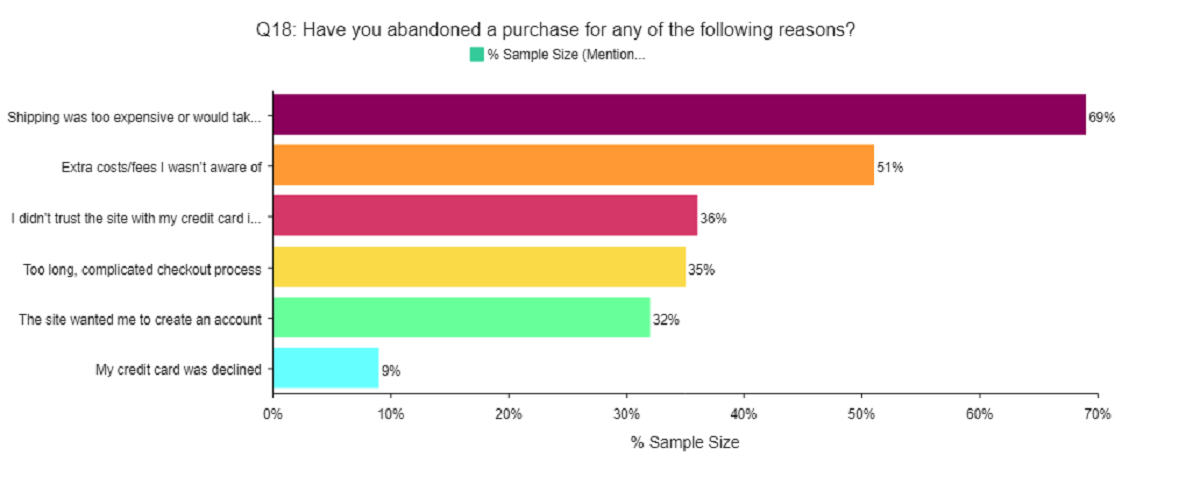

That matters because only 28% of consumers said they always have their credit card within easy reach while they’re shopping online. Requiring them to enter card data can cause them to switch to a merchant that takes their digital wallet instead. In fact, 35% of the surveyed shoppers said they’ve abandoned online purchases because of long, complicated checkouts.

Letting customers pay with a digital wallet can remove another common obstacle that prompts them to ditch their carts: account creation. Thirty-two percent of surveyed shoppers said they’d left before completing checkout when the site required them to create an account. With a digital wallet, the merchant can automatically receive relevant customer contact and shipping information without forcing shoppers through a multistep account creation process.

Digital Wallets Support Card And Loyalty Program Rewards

Many digital wallets let users add their retail rewards cards so they can earn and spend points on their digital purchases. Some credit card issuers offer bonus points to cardholders when they make digital purchases through specific digital wallets. For example, one Chase card offered users 5% cash back on card purchases made through PayPal in Q4 2020.

Merchants can capitalize on these benefits by offering rewards cards that digitally integrate with customers’ wallets, so that customers automatically earn points and perks without having to enter a rewards account number. Merchants can also partner with card issuers to offer special deals to cardholders who shop with them.

Making it easy for customers to spend and earn loyalty points enhances their shopping experience. It can also increase loyalty. McKinsey found in 2020 that loyalty program members are 30% more likely to spend more after signing up. That likelihood rises to 60% if they have to pay to participate in the loyalty program.

Fraud prevention, CX and digital wallet payments

One more convenience that digital wallets give customers is peace of mind. More than a third of consumers (36%) said they’d abandoned online purchases because they didn’t trust the site with their credit card information. When customers pay with their digital wallet, their card data is never exposed to the merchant.

Digital wallets are built with security features to protect users’ data, but like any online account, these wallets are susceptible to account takeover fraud (ATO) if someone steals or cracks their login credentials. ATO has been on the rise since the start of the pandemic, and digital wallets are often a target.

That risk of ATO fraud via digital wallet—plus the challenges that some merchants report in disputing digital wallet chargebacks--means merchants should screen digital wallet orders for fraud risk, paying attention to order recency, velocity, location and AI-driven analysis of the customer’s behavior on the site during the current shopping session compared to past behavior.

Digital wallet orders that raise flags should be reviewed by a fraud analyst, not automatically rejected. A quarter of the consumers in our 2021 survey reported getting declined at least once while shopping online, and 40% agreed that they would never order from the same merchant again as a result. An experienced analyst can sort actual fraud attempts from good orders that don’t fit the typical profile, so your good customers can complete their purchases without any breaks in their experience.

Adding digital wallet payment options to your online store can improve customer experience by making checkout simpler and faster, reducing customers’ concerns about the security of their payment data and making it easier for customers to earn and spend credit card rewards points in your store. That’s the kind of experience that drives loyalty, repeat visits, and more potential revenue for your business.

About the Author

David Fletcher serves as Senior Vice President at ClearSale, a card-not-present fraud prevention operation that helps retailers increase sales and eliminate chargebacks before they happen. As a serial entrepreneur, he understands the particular pain points that affect business owners today, and how fraud management can provide real-world solutions to those problems. At ClearSale, he spearheads business development, sales, partnerships and alliances with top e-commerce organizations. Follow on LinkedIn, Facebook, Instagram, Twitter @ClearSaleUS, or visit https://www.clear.sale.