In 2024, the real action lies in utility tokens, the fuel powering revolutionary real-world applications. From streamlining global payments to unlocking the potential of the metaverse, these tokens are more than just investments – they’re catalysts for change.

Imagine tracking every step of your coffee bean’s journey from farm to cup with a blockchain-powered token. Or picture buying virtual land in a thriving online world; using cryptocurrency, you can also spend on in-game items. This isn’t science fiction; it’s the present powered by utility tokens.

This month, we included Dogeverse, Mega Dice Token, WienerAI, and 99Bitcoins while removing older listings.

- $PEPU is a layer-2 blockchain designed for Pepe memes.

- Lower gas fees and faster transactions than other Pepe meme coins on the Ethereum layer-1

- Staking rewards for presale buyers and holders

- ETH

- USDT

- BNB

- +1 more

- Immensely popular meme token with zero fees, AI-driven trading, and MEV protection.

- As a PoS token $WAI can be staked to earn 142% p/a passive rewards.

- WienerAI's AI-powered predictive technology gives crypto enthusiasts exclusive insights to help find the next 100x gems.

- ETH

- USDT

- BNB

- +1 more

- An upcoming play-to-earn game which combines Doge Memes with Tamagotchi-style game play

- Stake your presale tokens and earn APR though the presale period and beyond

- $PLAY is the in-game currency for transactions and unlocking special features

- BNB

- ETH

- USDT

- Multi-chain functionality

- Generous token allocation for community rewards

- Full token audit published

- SOL

- ETH

- BNB

- +2 more

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

- SOL

- ETH

- BNB

- +1 more

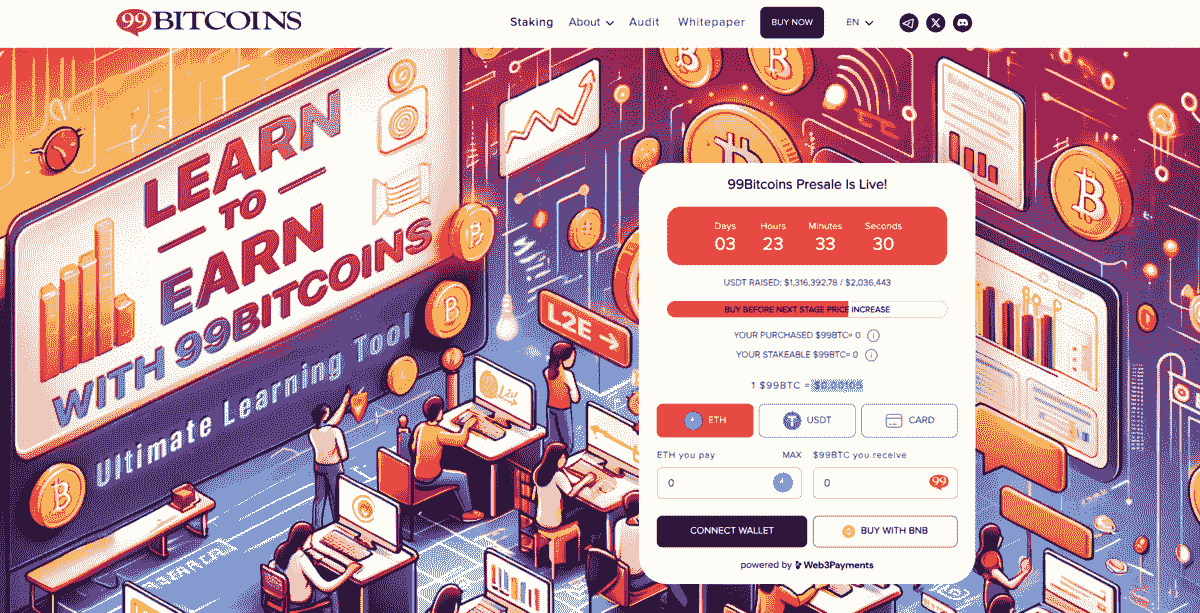

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

- ETH

- USDT

- BNB

- +1 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

- ETH

- USDT

- Debit

Join us as we explore seven of the most exciting projects changing the game, from decentralized finance to the metaverse, and discover how these tokens shape a future where value is tied to real-world impact.

Top Utility Tokens to Buy in 2024

The article explores seven (7) of the best utility tokens that offer solutions, fuel innovation, and reward investors. Follow us as we analyze their unique value propositions, roadmap potential, and investment considerations.

- Dogeverse ($DOGEVERSE) – Top utility token that works on multiple blockchains, raised $15 million+ in presale.

- WienerAI ($WAI) – AI-powered trading platform with no fees, MEV protection, and high staking rewards. Raised $2M+

- Mega Dice Token ($DICE) – Popular casino token offering cash back, airdrops, and NFT perks. Raised $1M+

- 99Bitcoins Token ($99BTC) – Learn-to-earn crypto platform with high staking APY and Bitcoin airdrop.

- 5th Scape (5SCAPE) – Offers immersive VR experiences with high passive rewards for users.

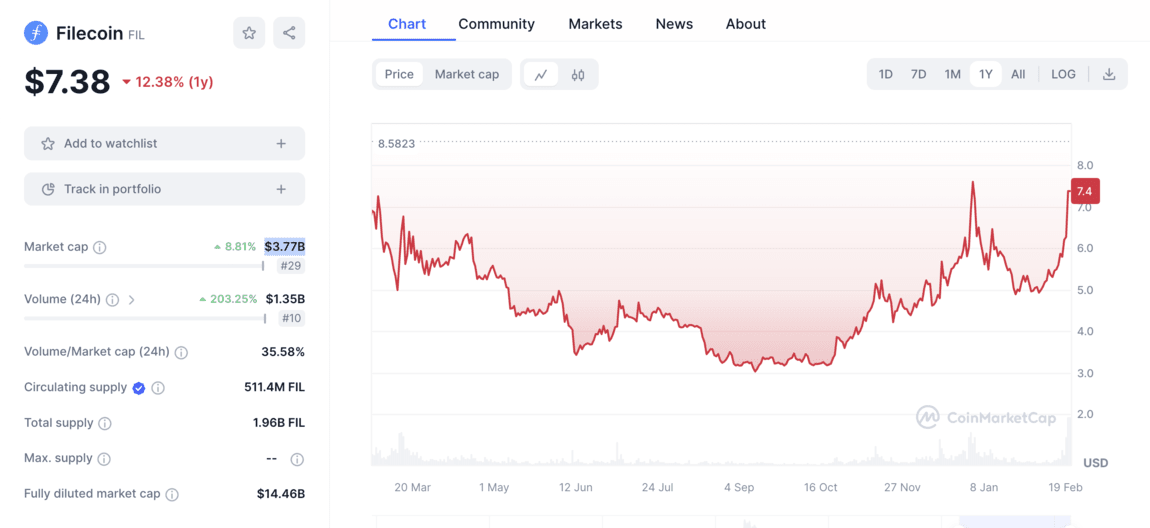

- Filecoin ($FIL): A storage marketplace that is resilient and incentivized, thanks to a peer-to-peer network built on blockchain technology.

- Worldcoin ($WLD): Designed to become the world’s largest digital network for identity and finance, Worldcoin aims to provide ownership to everyone.

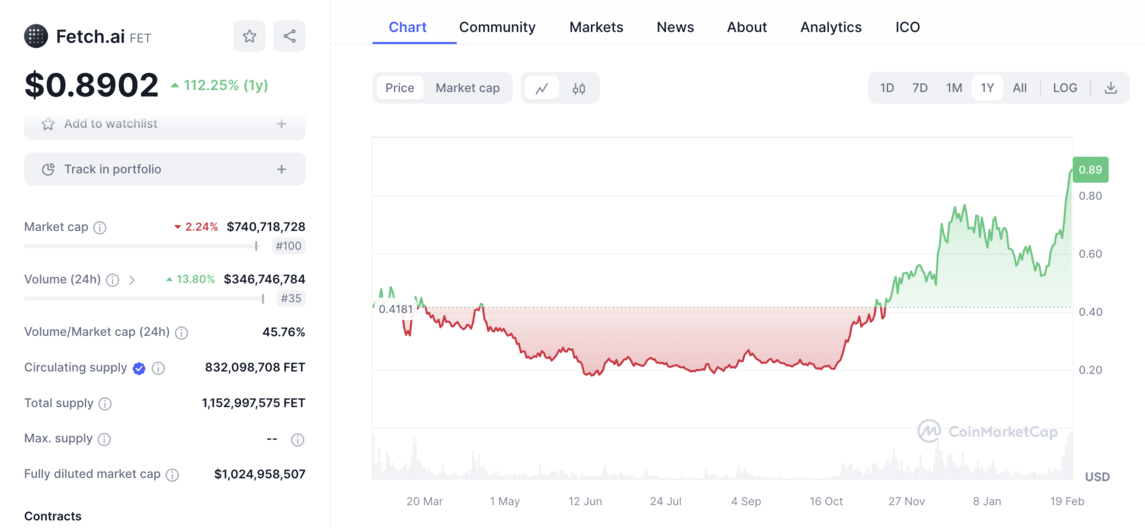

- Fetch.ai (FET): Uniting blockchain and AI to provide decentralized, customizable AI and Machine Learning models.

-

- 1. Dogeverse ($DOGEVERSE): Multi-blockchain utility meme coin project

- 2. WienerAI ($WAI) - AI-powered Trading Platform with High Staking Rewards

- 3. Mega Dice Token ($DICE) - Popular Casino token with Airdrops and NFT Perks

- 4. 99Bitcoins Token ($99BTC) - Learn-to-Earn Crypto Platform with High Staking APY

- 5. 5th Scape: A Glimpse into the Future of Immersive Experiences

- 6. Filecoin: Robust Marketplace for Data Storage

- 7. Worldcoin: Paving the Way for Proof-of-Personhood

- 8. Fetch.ai: Democratizing AI Through a Decentralized Network

-

- 1. Dogeverse ($DOGEVERSE): Multi-blockchain utility meme coin project

- 2. WienerAI ($WAI) - AI-powered Trading Platform with High Staking Rewards

- 3. Mega Dice Token ($DICE) - Popular Casino token with Airdrops and NFT Perks

- 4. 99Bitcoins Token ($99BTC) - Learn-to-Earn Crypto Platform with High Staking APY

- 5. 5th Scape: A Glimpse into the Future of Immersive Experiences

- 6. Filecoin: Robust Marketplace for Data Storage

- 7. Worldcoin: Paving the Way for Proof-of-Personhood

- 8. Fetch.ai: Democratizing AI Through a Decentralized Network

Show Full Guide

Why Search for Utility Tokens?

Unlike traditional cryptocurrencies, utility tokens don’t primarily derive value from speculation or investment. Instead, their worth stems from their functional benefits within specific platforms or ecosystems.

Here’s why you might be interested in exploring utility tokens:

Access exclusive products and services: Utility tokens can unlock unique features, discounts, or early access to products and services within a platform.

For instance, you can use a token to get priority boarding on a decentralized airline or gain exclusive access to data on a blockchain-based research network.

Potential for value appreciation: As the demand for this platform’s utility tokens increases, so does its value, providing investors with an opportunity to profit from its growth.

Diversification and innovation: Utility tokens allow you to expand your investment portfolio beyond traditional assets and participate in innovative blockchain projects.

Participate in a growing ecosystem: When you hold tokens, you become part of a community with a stake in the platform’s success. This can grant you voting rights on governance decisions, the ability to shape the platform’s future, and the potential to benefit from its growth.

Efficient and transparent transactions: Blockchain-based utility tokens facilitate secure and transparent transactions within their ecosystem, resulting in faster settlements, lower fees, and reduced reliance on traditional intermediaries.

Reviewing the Best Utility Tokens in 2024 (Review & Analysis)

Let’s embark on a journey through the world of utility tokens, where we’ll delve into the complex web of cryptography that binds innovation and practicality.

Together, we’ll explore the top performers and the unsung heroes redefining the very fabric of decentralized utility.

1. Dogeverse ($DOGEVERSE): Multi-blockchain utility meme coin project

Dogeverse ($DOGEVERSE) is currently #1 on our list of best utility tokens. It’s a hot new meme token with real use cases that works on multiple blockchains.

The platform’s main character is Cosmo, a Doge who hops between different chains. Cosmo represents freedom to explore across different blockchain networks, such as BNB Chain, Polygon, Ethereum Solana, Avalanche, and Base.

The platform’s native $DOGEVERSE token is currently in the presale phase, where buyers can grab each token for just $0.00031 at the time of writing. This price, however, will increase at the time of exchange listings soon.

Dogeverse uses cutting-edge tech like Wormhole and Portal Bridge to make sure transactions between different blockchains are safe and quick.

The project wants to unite crypto communities through a shared love of Doge memes and the idea of a connected crypto verse.

The meme project will start on Ethereum because it’s secure and widely used, but it will expand to other blockchains later. This makes the platform relatively more flexible and inclusive, helping it reach the goal of creating a user-friendly platform with a truly multichain spirit.

Interested users can join the Dogeverse Telegram group and follow it on X (formerly Twitter) to get the latest updates.

| Project | Dogeverse |

| Ticker | $DOGEVERSE |

| Blockchain Platform | Ethereum |

| Inception | 2024 |

2. WienerAI ($WAI) – AI-powered Trading Platform with High Staking Rewards

WienerAI ($WAI) is another promising token with real utility. It blends the fun of memes with advanced AI trading to offer a utility-focused platform for crypto traders.

The platform’s AI interface offers users real-time market analyses to help them find profitable trades quickly. It’s quite user-friendly for beginners to use.

WeinerAI also lets you trade on decentralized exchanges at the best prices. Buyers can grab $WAI for just $0.000707 at the time of writing. However, this price will increase in the next presale round.

It’s worth noting that WienerAI includes protection against MEV (Miner Extractable Value) bots, which means users won’t get front-run and can trade safely. This adds an extra layer of security and trust to the trading experience.

One of the main features of WienerAI is that it doesn’t charge any trading fees, attracting even more traders.

WienerAI has a total of 69 billion tokens. 30% of these tokens are set aside for the presale, 20% for staking, 20% for community rewards, 10% for liquidity, and 20% for marketing.You can join WienerAI’s Telegram channel and follow its X (Twitter) handle to get the latest news and updates.

| Project | WienerAI |

| Ticker | $WAI |

| Blockchain Platform | Ethereum |

| Inception | 2024 |

3. Mega Dice Token ($DICE) – Popular Casino token with Airdrops and NFT Perks

Another utility token to watch out for is the Mega Dice ($DICE) token. It combines two of the most popular trends in crypto right now: Gaming with DeFi.

Unlike many new tokens, Mega Dice Token is native to already a successful and growing global crypto casino with over 50,000 players and $50 million in monthly bets. This large user base provides a strong foundation for the token’s success.

$DICE token holders can benefit like cash back from the casino, airdrop rewards, and many NFT perks. This utility gives real rewards to its token holders and makes it more than just a speculative token.

At the time of writing, early buyers can buy $DICE for just $0.075. But this price will increase in the next presale round.

The platform has plans to give away $2.25 million worth of token airdrops across three seasons to its active users. Players who bet at least $5,000 within 21 days can qualify for these airdrops.

Mega Dice also offers a 10% referral bonus on investments made by friends you refer (with no upper limit on earnings). You can join the Mega Dice Token telegram channel and follow it on X (Twitter) to get the latest updates.

| Project | Mega Dice Token |

| Ticker | $DICE |

| Blockchain Platform | Solana |

| Inception | 2024 |

4. 99Bitcoins Token ($99BTC) – Learn-to-Earn Crypto Platform with High Staking APY

The 99Bitcoins Token ($99BTC) is a utility-focused project that rewards users for learning about crypto via its unique ‘learn-to-earn’ model.

99Bitcoins is a trusted platform with over 700,000 YouTube subscribers and 2 million registered users. It recently launched the presale for its native $99BTC tokens, where early buyers can grab the tokens for just $0.00105.

Users can earn rewards by learning about crypto through fun lessons, quizzes, and tutorials. The token integrates with 99Bitcoins’ existing platform and gives users special access to premium content and crypto trading signals.

At press time, $99BTC token holders can earn a high staking APY of over 1,250%. However, this rate will decline once more people enter the staking pool. Over 837 million $99BTC tokens have already been staked, showing strong investor trust and confidence.

99Bitcoins has plans to bridge $99BTC to the BRC-20 token standard on the Bitcoin network. This can help the token capitalize on Bitcoin’s security and increase its utility over time.The project also has an airdrop planned to give away $99,999 worth of Bitcoin to 99 lucky community members. Interested buyers can join the 99Bitcoins Token Telegram channel and follow it on X (Twitter) for the latest updates.

| Project | 99Bitcoins |

| Ticker | $99BTC |

| Blockchain Platform | Etheruem |

| Inception | 2024 |

5. 5th Scape: A Glimpse into the Future of Immersive Experiences

5th Scape (5SCAPE) aims to be more than just a VR gaming platform; it’s a gateway to a fully immersive virtual reality experience. By intertwining cutting-edge technology, a diverse content library, and exclusive access through its native token (5SCAPE Coin), 5th Scape promises to reshape the online VR landscape.

5th Scape goes beyond traditional games. It offers a comprehensive suite of VR experiences, including premium animations, educational content, movies, and more. This diversity fosters a dynamic community where users can not only play but also learn, explore, and connect.

At the core lies the 5SCAPE Coin, a utility token that unlocks exclusive access to premium content and devices. Imagine entering a virtual world with cutting-edge visuals and precise tracking, made possible by the 5th Scape VR headset. This headset, coupled with its ergonomically designed chair, ensures maximum comfort during extended VR sessions.

Each experience within 5th Scape is meticulously crafted for immersion. Games like MMA Cage Conquest transport players to virtual training grounds and arenas, complete with dynamic combat systems and strategic training options. This level of detail extends to all content, blurring the lines between reality and virtuality.

5th Scape presents a compelling vision for the future of VR. Its focus on diverse content, community building, and dedicated hardware sets it apart from many token-based VR projects. However, a balanced review requires acknowledging potential challenges.

The project is still in its early stages, and the success of its content library and hardware offerings will be crucial for its long-term viability. Additionally, competition in the VR space is fierce, and 5th Scape will need to find ways to differentiate itself from established players.

While the potential is undeniable, cautious optimism is warranted. For tech-savvy individuals and early adopters interested in shaping the future of VR, 5th Scape might be worth exploring.

| Project | 5th Scape |

| Ticker | $5SCAPE |

| Blockchain Platform | Ethereum |

| Inception | 2024 |

6. Filecoin: Robust Marketplace for Data Storage

In utility tokens, Filecoin (FIL) stands out as a pioneer in decentralized storage. This open-source project aims to build a robust marketplace for data storage, leveraging blockchain technology and economic incentives to ensure reliable and secure file preservation.

Reliable Data Storage

Filecoin’s network is a peer-to-peer marketplace where users can pay for secure data storage. Providers equipped with storage capacity compete to offer reliable and long-term storage solutions. The system employs a unique combination of proof-of-replication and proof-of-spacetime mechanisms to verify the integrity and persistence of stored data. This cryptographic approach guarantees that files are stored and not tampered with, fostering trust and accountability within the network.

Interestingly, Filecoin builds upon the InterPlanetary File System (IPFS) protocol, a decentralized storage network renowned for its content-addressing capabilities. This integration allows for permanent data references, independent of specific devices or cloud servers, further enhancing accessibility and resilience.

$FIL Token Summary

Filecoin’s potential is multifaceted. It caters to diverse use cases, from storing Web3 native assets like NFTs and metaverse/game data to incentivizing permanent storage of valuable datasets and archives.

This flexibility attracts various users, including renowned institutions like the Internet Archive. Additionally, its support for diverse data formats expands its applicability beyond Web3 applications, attracting platforms like Audius and Huddle01 for music streaming and video conferencing.

However, it’s crucial to acknowledge potential challenges. The network’s complexity and reliance on economic incentives might present initial hurdles for newcomers. Additionally, the project’s long-term sustainability and scalability remain areas of active development and discussion within the community.

Overall, Filecoin presents a compelling vision for a decentralized storage future. Its innovative approach, diverse applications, and established partnerships make it a noteworthy player in the utility token landscape.

| Project | Filecoin |

| Ticker | $FIL |

| Market Cap (Feb, 2024) | $3.77B |

| Blockchain network | Filecoin blockchain, BSC |

| Inception | 2017 |

7. Worldcoin: Paving the Way for Proof-of-Personhood

Buyer beware

Worldcoin (WDC) and Sam Altman’s Worldcoin (WLD) are entirely different projects.

Recent price spikes in WDC might be fueled by confusion with the more prominent Worldcoin (WLD), which uses iris scanning for identification. Do your due diligence before investing in any cryptocurrency, especially WDC, which has a low market cap, low volume, and a history of limited development since its 2013 launch.

The crypto landscape boasts numerous utility tokens, each vying to solve unique issues. Among them, Worldcoin (WLD) stands out by attempting to tackle a fundamental question: what does it mean to be human online? This ambitious project aims to establish a “proof-of-personhood” system, empowering individuals and potentially shaping the future of digital identity.

Rewriting the Rules of Digital Identity

Spearheaded by Sam Altman, CEO of OpenAI/ChatGPT, Worldcoin aims to create a global digital identity and financial network based on “proof-of-personhood.” This novel system utilizes iris scans to verify users’ uniqueness, ensuring they’re not bots or Sybil attacks. In return for participating, users receive WLD tokens, offering financial access and a stake in the network.

The core components of Worldcoin are:

- World ID: A privacy-preserving network enabling individuals to prove their humanness online using zero-knowledge proofs. This could offer secure access to online platforms, fair airdrops, and protection against malicious bots.

- Orb: A custom biometric device that scans irises to generate cryptographic proofs without revealing personal data.

- WLD Token: A native token distributed to users for network participation. However, it’s essential to note that currently, WLD is not publicly traded and has no official market value.

$WLD Summary

Worldcoin’s strengths lie in its attempt to address fundamental issues plaguing online spaces. Proof-of-personhood stands as a critical hurdle for online security and democratic processes.

Additionally, the project prioritizes user privacy through zero-knowledge proofs, a promising approach for protecting sensitive data. This focus on privacy is commendable, especially in an era of growing data concerns.

WLD aims to bridge the digital divide by providing financial access and identity verification regardless of location or background. If successful, this inclusive approach has the potential to empower individuals and foster global participation in the digital world.

Despite its strengths, Worldcoin faces several challenges that need careful consideration. Privacy concerns linger, even with the use of zero-knowledge proofs. The reliance on biometric data, specifically iris scans, raises questions about data security and potential misuse.

Scaling this iris-scanning system globally presents logistical and technical hurdles that need to be addressed. Additionally, the ethical implications of rewarding individuals simply for being human deserve scrutiny. Questions arise regarding social equity and potential exploitation within such a system.

| Project | Worldcoin |

| Ticker | $WLD |

| Market Cap (Feb, 2024) | $896.64M |

| Blockchain network | Ethereum |

| Inception | (Founded) 2019, (Launched) 2023 |

8. Fetch.ai: Democratizing AI Through a Decentralized Network

The burgeoning field of artificial intelligence holds immense potential, but access to its sophisticated models remains restricted for many. Fetch.ai ($FET) aims to bridge this gap by leveraging blockchain technology to create a decentralized platform for AI and machine learning.

This unique project fosters a collaborative ecosystem where anyone can contribute and benefit from the power of distributed artificial intelligence.

Harnessing the Potential of Decentralized AI

Fetch.ai’s infrastructure revolves around autonomous economic agents capable of interacting independently on the network. These agents, powered by machine learning models, can learn, adapt, and collaborate to solve complex problems in various domains. The platform utilizes the Cosmos SDK, enabling seamless interoperability with other blockchains and fostering a broader reach.

The project operates through its native token, FET. It fuels various actions within the ecosystem, including agent creation, training, and communication. Additionally, staking FET allows users to participate in network governance and earn rewards.

Fetch.ai builds its ecosystem on three core pillars:

- Decentralized Machine Learning: The platform allows anyone to train and deploy AI models without relying on centralized entities. This fosters innovation and empowers users to own and control their data.

- Collective Intelligence: The network leverages the combined intelligence of all participating agents, leading to more efficient and robust solutions than individual models.

- Autonomous Agents: Fetch.ai creates “digital twins,” AI-powered agents representing individuals, organizations, or even physical assets. These agents can interact autonomously within the network, executing tasks and making decisions based on predefined rules.

$FET Summary

Fetch.ai’s vision holds immense potential, particularly in sectors like supply chain management, finance, and the Internet of Things (IoT). Its decentralized approach offers several advantages, including increased transparency, security, and resistance to censorship.

The recent surge in FET’s price following OpenAI’s launch of Sora further emphasizes the growing enthusiasm for AI-powered projects. Additionally, the involvement of established players like Bosch and Deutsche Telekom as partners lends credence to the project’s viability and potential for real-world adoption.

However, Fetch.ai is still in the early stages of development, and its long-term success hinges on several factors. The complexity of the technology and the need for widespread adoption pose significant challenges. Additionally, the competitive landscape within the AI space is intense, and Fetch.ai needs to carve out its unique niche to establish itself as a leading player.

Overall, Fetch.ai presents a compelling proposition for those seeking exposure to the burgeoning AI space. Its innovative approach and strategic partnerships offer a glimpse into a future where decentralized AI empowers individuals and organizations alike.

| Project | Fetch.ai |

| Ticker | $FET |

| Market Cap (Feb, 2024) | $793,898,353 |

| Blockchain network | Fetch.ai blockchain (based on Cosmos protocol) |

| Inception | (Founded) 2017, (Launched) 2019 |

Finding the Best Utility Tokens

The cryptocurrency landscape is teeming with diverse assets, each vying for investor attention. While some tokens serve purely speculative purposes, utility tokens offer a compelling alternative, promising value beyond price appreciation. However, navigating this dynamic space requires a keen eye and a measured approach.

This guide equips you with the tools to identify promising undervalued utility tokens, ensuring you approach your investment journey confidently.

Utility Promotes Growth

Unlike their speculative counterparts, utility tokens are designed to serve specific functions within their respective ecosystems. Imagine a token fueling a decentralized exchange, powering a play-to-earn gaming experience, or granting access to exclusive features within a decentralized storage platform. The success of these tokens hinges on real-world adoption and demonstrable use cases.

Seek projects with clear, well-defined utilities that address genuine industry needs. A robust and engaged community actively utilizing the token is a strong indicator of potential.

Look Closely and Objectively, Going Beyond the Hype

Resist the allure of flashy marketing or promises of astronomical returns. Instead, delve into the project’s whitepaper, roadmap, and team composition. Assess the technical feasibility of the proposed solution and the team’s track record. Are they experts in their fields with a successful history of completing projects?

Exercise Caution When Proceeding With Presales

Presales offer early access to tokens at potentially discounted prices, but their allure comes with inherent risks. Approach them with extreme caution. Not all presales are created equal. Meticulously scrutinize the tokenomics, vesting schedules, and lock-up periods. Be wary of projects with unrealistic promises, unclear roadmaps, or anonymous teams. Remember, if it seems too good to be true, it probably is.

Utility Tokens Have the Potential to Be More Sustainable

Unlike purely speculative tokens, utility tokens can potentially develop intrinsic value derived from their real-world use cases. Increased adoption within their ecosystems can lead to organic price appreciation. While price volatility remains a factor, the underlying utility can offer a degree of stability compared to purely speculative assets.

Remember:

- Do your own research (DYOR): Never base investment decisions solely on external recommendations.

- Embrace diversification: Spread your investments across promising projects to mitigate risk.

- Maintain realistic expectations: Focus on long-term potential and invest only what you can comfortably afford to lose.

Utility Tokens Compared

| Project | Token | Total Supply | Chain | Staking |

| Dogeverse | $DOGEVERSE | 200B | Ethereum | Yes |

| WienerAI | $WAI | 69B | Ethereum | Yes |

| Mega Dice Token | $DICE | 420M | Solana | Yes |

| 99Bitcoins Token | $99BTC | 99B | Ethereum | Yes |

| 5th Scape | $5SCAPE | 5,21B | Ethereum | Yes |

| Filecoin | $FIL | 1.96B | Filecoin | Yes |

| Worldcoin | $WLD | 10B | Ethereum | No |

| Fetch.ai | $FET | 1,152,997,575 | Fetch.ai | Yes |

Our Verdict on the Top Utility Tokens

The reviewed utility tokens showcase the wide range of possibilities in this space. Choosing the “best” depends heavily on your individual needs and priorities.

Consider the specific problem each token solves, its real-world adoption, and the strength of its underlying project before making your decision. The utility token market is dynamic, so stay informed and conduct thorough research before investing.

No single token dominates the competition. Each caters to a unique niche, offering exciting possibilities in their respective fields. Ultimately, the “best” utility token for you depends on your specific needs and goals.

FAQs

What is a utility token?

Are utility tokens more sustainable?

Which crypto has the most utility?

Is Bitcoin a utility token?

What is the biggest utility token?

What is the most popular utility token?

What distinguishes utility tokens from security tokens?

How do utility tokens differ from governance tokens?

What is the value of a utility token?

References

- https://spectrum.ieee.org/worldcoin

- https://docs.filecoin.io/basics/what-is-filecoin

- https://u.today/sol-founder-reflects-on-solanas-original-vision-details

- https://cointelegraph.com/news/worldcoin-increases-wld-supply-over-next-six-months

- https://www.xm.com/research/markets/allNews/reuters/deutsche-telekom-collaborates-with-bosch-and-fetchai-foundation-to-advance-ai-53763629