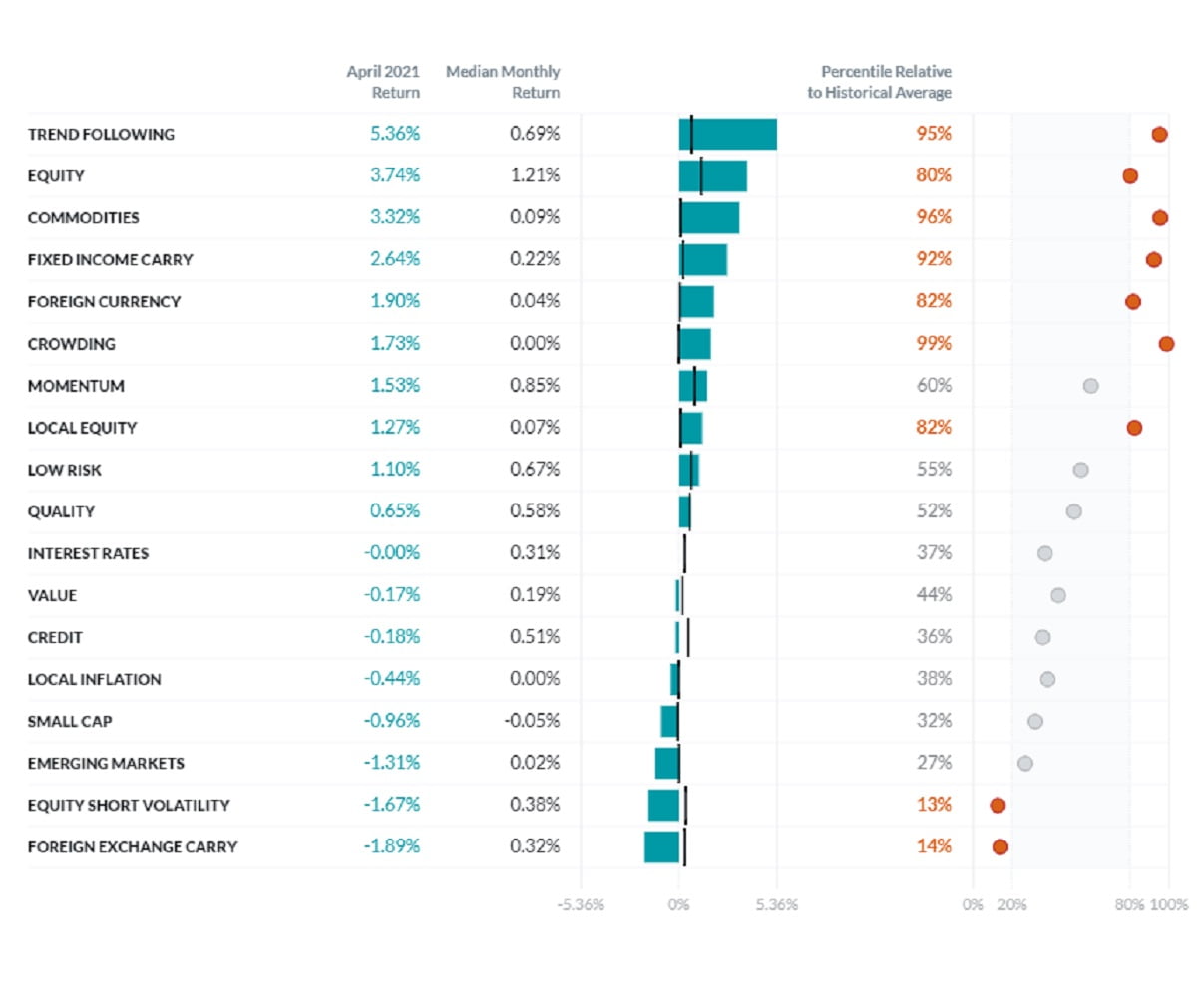

The latest Factor Performance Report from Venn, Two Sigma’s cloud-based platform that helps investors analyze and assess the risk factors in their investments and portfolios. The report contains performance data for all 18 factors in the Two Sigma factor lens in April.

Q1 2021 hedge fund letters, conferences and more

Crowding Factor Experiences Its Its Best Months Yet

Of note, the Crowding factor experienced one of its best months yet, as stocks that were heavily shorted by the hedge fund community underperformed stocks that weren’t shorted as much - a sharp reversal from January, when the Crowding factor experienced its worst month since inception due to the month’s short squeezes.

Other highlights from this month’s report include:

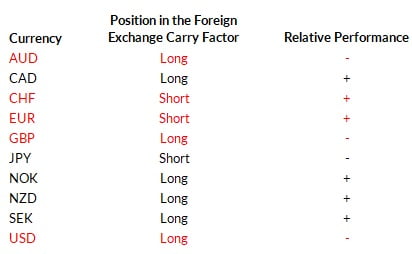

- The Foreign Exchange Carry factor was the worst performer last month (-1.89%). High-yielding currencies, such as the USD, GBP, and AUD, underperformed their lower-yielding peers, such as the CHF and EUR.

- Trend Following was the best performing factor last month (+5.36%). Following trends in all asset categories, except for fixed income, generated positive returns.

- Despite global sovereign bonds ending the month flat (as evidenced by the 0.0% return for the Interest Rates factor), the Fixed Income Carry factor, which seeks to benefit from interest rate differentials among six countries by going long and short their 10-year government bond futures, was able to earn 2.6%.

Investors are increasingly looking at factors as a critical to meeting objectives such as reducing risk, generating returns, and increasing diversification.