In his Daily Market Notes report to investors, while commenting on the U.S. dollar’s dive, Louis Navellier wrote:

Q1 2021 hedge fund letters, conferences and more

The Market’s Fairy Godmother

This is a good time to remember when Janet Yellen was the Fed Chair, she was called the “fairy godmother” of the stock market by Ed Yardeni and other economists. I, for one, am extremely comfortable with Janet Yellen as Treasury Secretary and believe that she will be sprinkling “fairy dust” on both the stock and bond markets in the upcoming months and years in office.

The latest example of this fairy dust is the 10-year Treasury bond yield, which has been meandering lower in recent days. Last week, I said that someone (most likely the Fed) is clearly intervening to keep 10-year Treasury bond yields low (under 1.6%), but I also admitted that 10-year bond yields could rise to the 2% level as inflationary pressures heat up.

The labor market dominated the news last week. As usually happens in the first week of the month, the ADP report on private payrolls comes out on Wednesday, followed by the Labor Department’s more comprehensive jobs report on Friday. Notably, and presumably forgotten, on Wednesday, ADP reported that a whopping 742,000 private sector jobs were created in April, which was the largest monthly job increase in seven months.

Payroll Jobs Creation Falls Short Of Expectations

But the shocking news was that the Labor Department reported on Friday that only 266,000 payroll jobs were created in April, which was barely one-fourth the one million payroll jobs that some economists expected. Clearly, some economic forecasters cannot hit the broad side of a barn!

When it comes to any big conflict between the ADP jobs report and the Labor Department, I tend to side with ADP, since they compute from hard data – payroll checks – while the Labor Department is based on reports which trickle in at various speeds, subject to massive revisions in future months. I think we can ignore the April payroll report, since I think it will likely be revised upward next month.

The most shocking EV news last week was that Stellantis (formerly Chrysler Fiat & France’s PSA before merger) announced it will no longer need to buy Tesla CO2 credits due to PSA’s technology that would allow it to meet all European Union CO2 goals. Since 2019, Chrysler Fiat snd PSA have spent about $2.4 billion buying CO2 credits from Tesla. Tesla reported $2.365 billion in regulatory credits and posted earnings of $1.407 billion since 2019. So now, without Stellantis’ CO2 credits, Tesla’s future earnings are in doubt – unless it boosts its manufacturing efficiency.

[Navellier & Associates does own Tesla (TSLA), for one client, per client request in managed accounts. We do not own Stellantis (STLA). Louis Navellier does not own Tesla (TSLA), or Stellantis (STLA) personally.]

The U.S. Dollar Dives

Not much attention has been given to the rather sudden 3% dive in the dollar index (DXY) since March 31 (from 93.3 to 90.2). That makes for a drop of over 10% in the DXY over the last 12 months.

Currency prices are moved by many factors, including politics, interest rates, speculation, and economic growth. More specifically, since economic growth and exports are directly related to a country’s domestic industry, it is natural for some currencies to be heavily correlated with commodity prices.

Some forex traders are attributing the greenback’s latest fall to specific commodity-linked currencies outperforming their European rivals against the American dollar. That would include Brazilian reals, Australian dollars, and Canadian dollars as the most sensitive currencies to price swings in commodities.

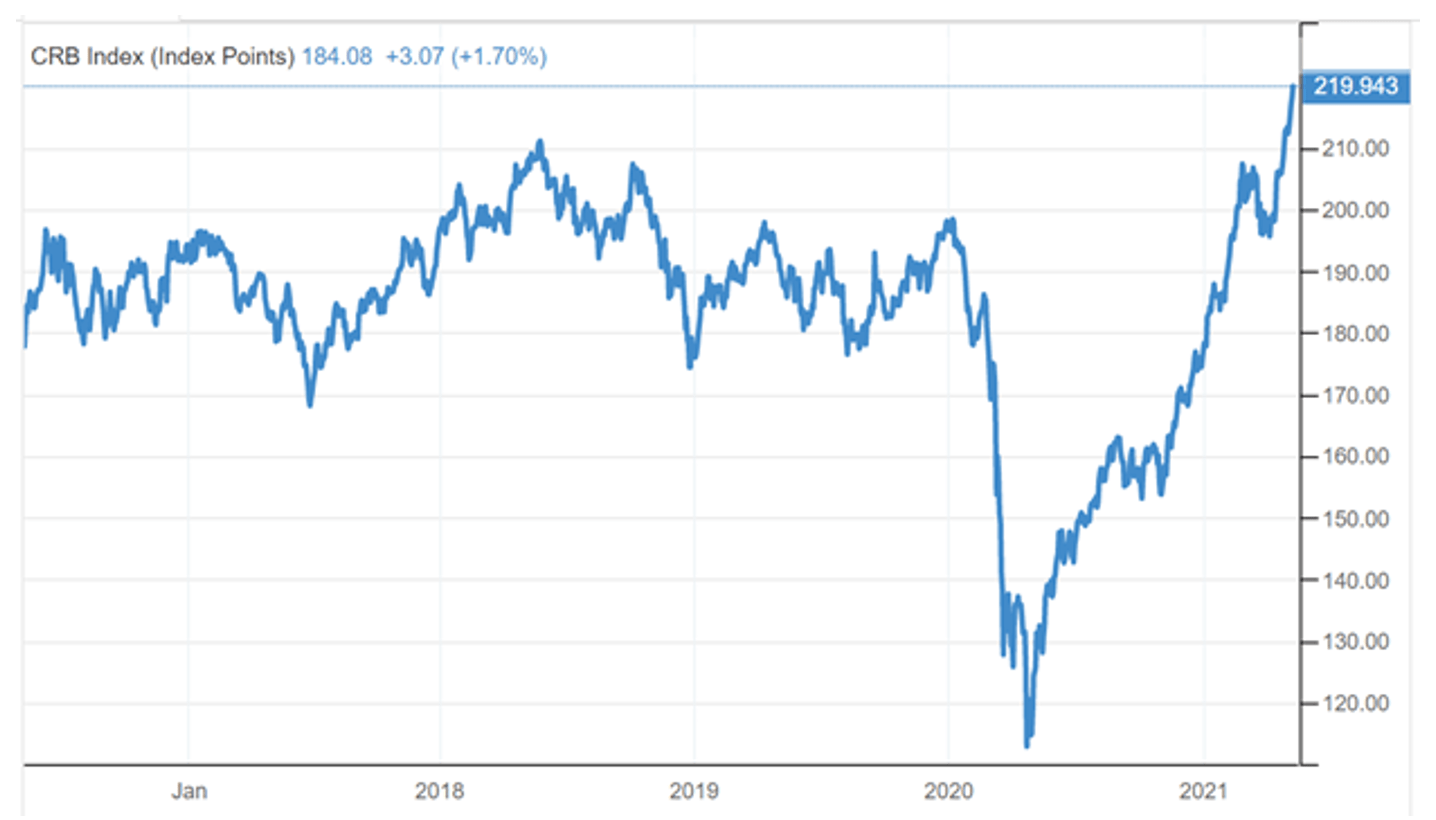

This chart of the Commodity Research Bureau Index (CRB) shows the powerful move of commodity prices since last December. Most are now trading above their pre-pandemic levels. Global shortages of most hard and soft commodities are coming at a time when domestic and global economic growth is accelerating, meaning that inflation is looking anything but “transitory,” as the Fed would have us view it.

Don’t fear big corrections . . . . they ususlly engender even bigger recoveries. What’s your worst market fear? A big correction, a crash of 20% or more? Long-term investors have nothing to fear. Nearly every major downturn has been followed by an opposite but equal upturn. Call it “reversion to the mean” or “Newton’s law of Thermodynamics” or simply “a return to our senses.”

In early May 2009, we published a piece titled, “The Worst Crash Since 1929 Implies the Best Recovery since 1932.” That headline was so controversial that it prompted USA Today’s financial markets editor Matt Krantz to ask, “How can you be so sure?”

Shorter Doubling Times

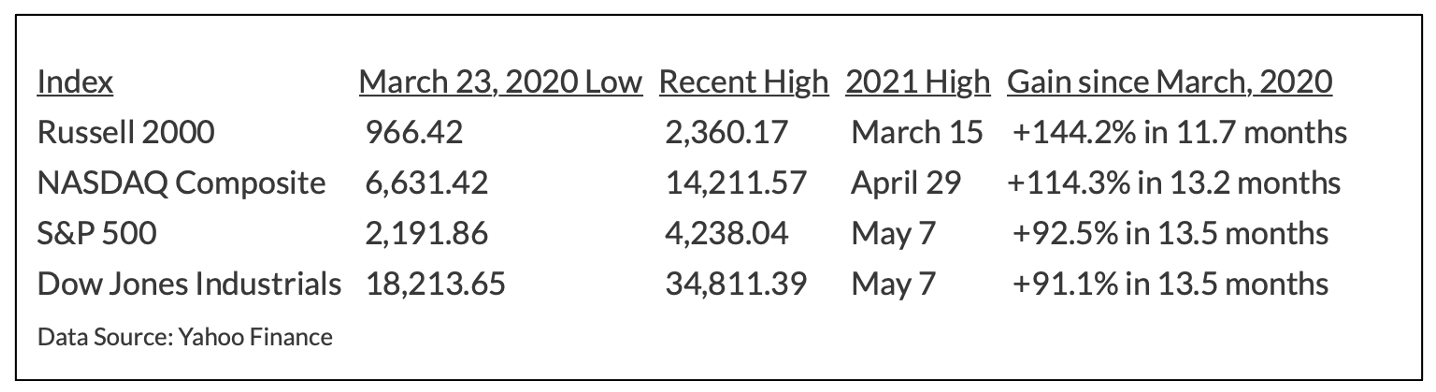

Back in 2009, it took almost two years for the S&P 500 to double from its low. In the latest recovery, some indexes have already doubled in the 13.5 months since March 23, 2020, while the Dow and S&P 500 are up over 90%.

Why such a rapid rebound? The first look at first-quarter GDP came in at +6.4%. The Atlanta Fed sees second-quarter GDP at 11%, but that is a rapidly changing real-time estimate. Economists surveyed by IHS Markit see a more realistic target of 8.3%. The highest full-year growth rate of the last 70 years was 7.2% in 1984. If we exceed that, 2021 could be the best year in 70 years.