Crescat Global Macro Fund and Crescat Long/Short Fund performance update for the month of November 31, 2018.

Performance and Profit Attribution

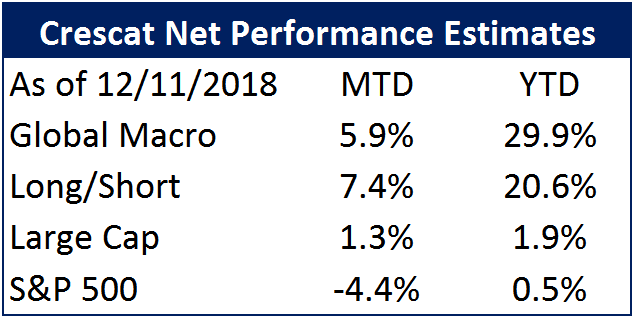

In December through yesterday’s close, Crescat Global Macro Fund (CGMF) is up an estimated 5.9% month to date and 29.9% year to date and Crescat Long/Short Fund (CLSF) is up approximately 7.4% month to date and 20.6% net year to date. Through the same period, the S&P 500 is down 4.4% month to date and up 0.5% year to date.

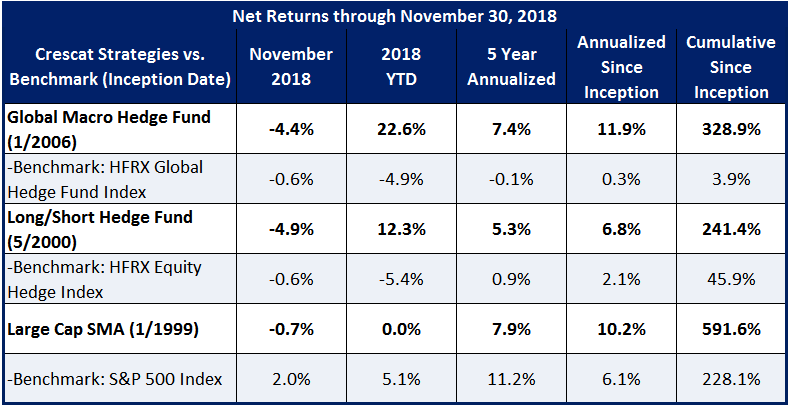

Crescat’s hedge funds were up 22.6% (CGMF) and 12.3% (CLSF) through November year to date. In comparison, the global hedge fund industry was down 3.6% year to date through November according to data from the Bloomberg Hedge Fund Database. As world economic and corporate earnings growth rates expectations for next year have been declining significantly, 2018 has turned into a challenging year for global financial markets and for many money managers and investors. Crescat has been able to capitalize on this environment in its hedge funds.

Q3 hedge fund letters, conference, scoops etc

After posting industry-leading net gains in October in both of Crescat’s hedge funds, 17.1% and 16.3% in CGMF and CLSF respectively, Crescat pulled back in November, giving back 4.4% net in CGMF and 4.9% net in CLSF. Financial markets can be fickle, but Crescat is steadfast in our firm wide global macro investment process. We have gained all of November’s losses back in our hedge funds in December month to date by staying grounded in our themes and positions. Both funds have hit new high-water marks intra month as we approach year end.

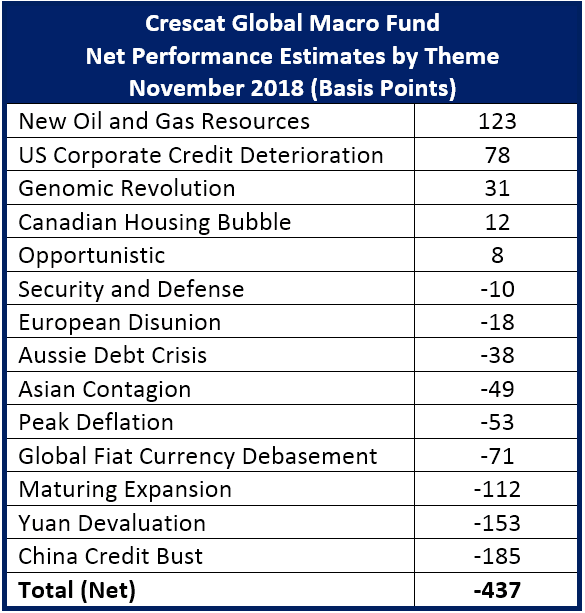

Crescat’s November pullback was primarily caused by short positions in our China credit bubble and yuan devaluation themes as hopes for a US-China trade deal worked against those positions ahead of the Trump/Xi meeting in Buenos Aires. US equity shorts in our maturing expansion theme also detracted from our performance in November. The good news is that 10 of our 14 themes in CGMF are producing gains this month while the Chinese economy continues to deteriorate on its own accord due the natural unwinding of its historic credit bubble. While global financial markets may continue to rally on hopes of trade deal between the US and China, we think those rallies will be selling opportunities. In our analysis, the US has already entered a new cold war with China driven by bi-partisan deep factions within the US government, including its military and intelligence arms. As such, we believe the US is unlikely to reach any major new trade deal with China despite intermittent optimism over such by the Trump administration and Chinese officials.

We believe we are facing the end of a long global economic expansion with record corporate, household, and government debt levels compared to GDP and only-recent record valuations for many global securities markets, including US equities and US corporate fixed income. By the way, US corporate credit deterioration is a new theme at Crescat. In this theme, we have held put options on two corporate high yield bond ETFs in CGMF since early October. Formerly, these positions were part of our maturing expansion theme. We see more opportunities ahead that make this worthy of an entire theme. As a global-macro focused and value-driven manager, we believe today’s markets present extraordinary opportunities for all Crescat’s strategies.

See all Crescat’s returns year to date, including Crescat Large Cap, in the charts and tables below.

December 2018 MTD and YTD Estimates

Official Performance through November 2018

November Profit Attribution by Theme

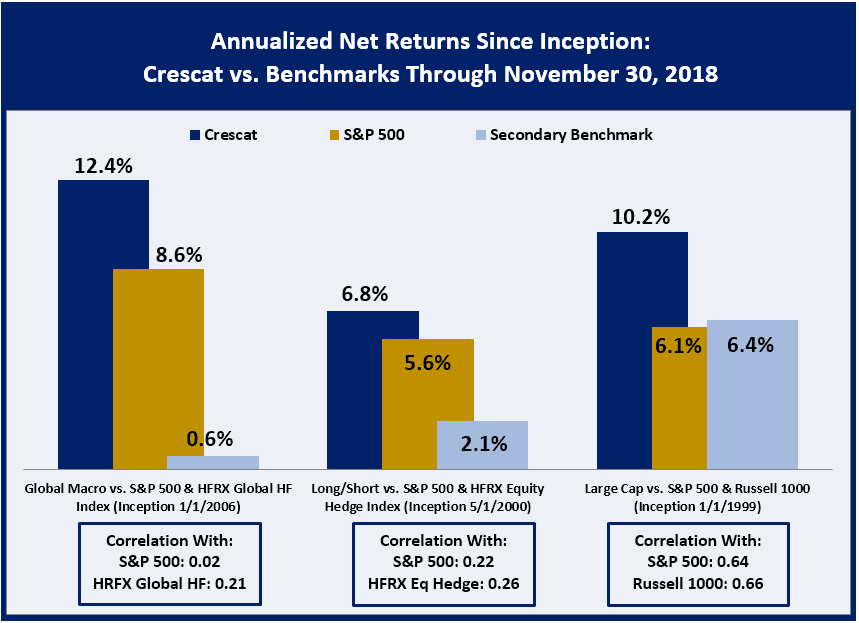

Why Crescat?

Crescat’s global macro and value-driven approach has led to significant long-term outperformance compared to passive benchmarks and active manager peers through a variety of market environments. By staying grounded in our macro themes, valuation models, and risk controls, Crescat’s strategies have persevered to deliver strong absolute and risk-adjusted outperformance over the long term. By deploying a macro thematic investment process across all our strategies, we have historically demonstrated a low correlation to equity benchmarks and the ability to generate profits in market downturns.

Crescat’s strategies are designed for long-term investors who believe in Crescat’s investment process. They are not designed for short-term investors who are likely to be shaken out by one of Crescat’s inevitable drawdowns.

Given our valuation approach to entering and exiting positions, we are confident that our portfolios are worth substantially more than public markets are quoting them at any given time. Such conviction is necessary to withstand inevitable, short-term, mark-to-market losses in Crescat’s strategies due to erratic market behavior. We never view drawdowns as a permanent loss of capital. We are always confident in our ability to realize the much greater intrinsic value of our portfolios. While we can never be right on all our themes and positions, when we are wrong, we are happy to recognize that and move on. We know that the markets will constantly present us with substantial new themes and opportunities for future strong performance and that our models will guide us to them.

Crescat’s long-term returns demonstrate that adding Crescat’s global macro-oriented strategies to a portfolio mix of traditional asset classes can reduce overall volatility and improve returns over complete economic cycles. We believe this is the secret to earning industry-leading long-term performance: (1) commitment to a robust global macro investment process grounded in valuation; and (2) the fortitude to withstand inevitable short-term drawdowns while adhering to risk controls.

In Closing

With the performance across many asset classes throughout global financial markets in 2018, many investors are contemplating the end of a long macroeconomic cycle and considering new ways to protect and preserve their assets. Moving to cash will not offer opportunities to make meaningful money during a global macro downturn. At Crescat, we are determined to capitalize on bear markets as well as bull markets. We develop tactical investment themes based on proprietary value-driven models. Our mission is to grow and protect wealth by capitalizing on the most compelling macro themes of our time. We aim for high absolute and risk-adjusted returns over the long term with low correlation to benchmarks. We ask that you consider making an investment allocation to Crescat today. As always, we stand ready to answer questions or discuss themes.

For more on our investment themes and outlook, please stay tuned for our extensive quarterly research letter that will be coming out soon. For brief, more frequent research updates, please follow Crescat Capital, Kevin Smith, and Tavi Costa on Twitter.

Sincerely,

Crescat Capital

This article first appeared on ValueWalk Premium