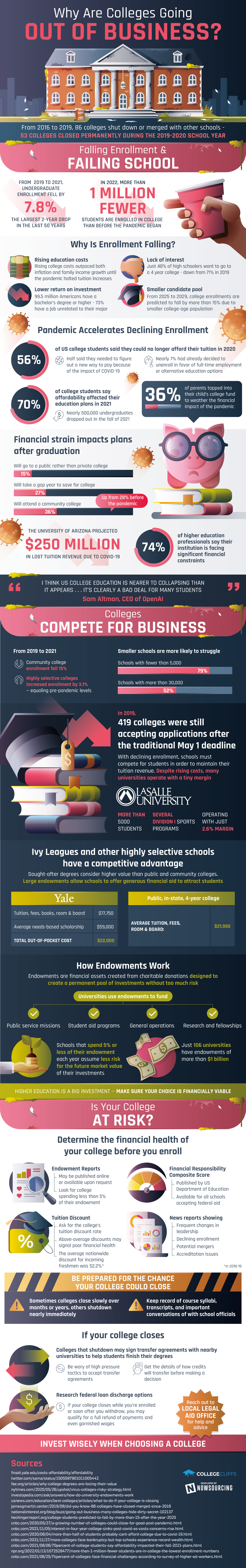

Several colleges have struggled to stay running the past few years, and the pandemic has further strained the situation. With at least 53 colleges shut down permanently during the 2019-2020 school year, what are the factors causing colleges to go out of business?

The cost of college has increased beyond the rate of inflation and income growth for families until COVID-19 halted increases in tuition. More than 70% of Americans with a bachelor’s degree or higher get a job unrelated to their college major, which is another reason for some to not be as invested in college. What’s more, it’s predicted that college enrollments will fall by more than 15% due to a smaller population of college-aged individuals in just three years’ time as well as a continuing decrease in high schoolers who are interested in going to a 4-year college.

Q1 2022 hedge fund letters, conferences and more

The pandemic has also contributed to the falling rate of college enrollment. 56% of college students in the U.S. have admitted they could not afford their tuition anymore, causing them to figure out a different way to pay for tuition or unenroll to find full-time jobs or other education options. In the 2021 fall semester, 70% of college students have said that their education plans changed due to financial reasons.

More high schoolers are choosing less expensive college options like community college, public college, or taking a gap year due to the significant financial strain caused by the pandemic. At least 74% of people working in higher education say their institution is facing serious financial constraints. The University of Arizona has actually projected a loss of $250 million in tuition revenue due to the pandemic.

Colleges Are Going Out Of Business

However, colleges have been affected disproportionately with smaller schools typically struggling more than bigger schools. Also, between 2019 and 2021, community college enrollment decreased by 15% while enrollment at highly selective colleges saw enrollment increase by 3% to ultimately match pre-pandemic levels. Schools now have to compete for students so they can maintain their tuition revenue, which is probably one of the motivating factors for 419 colleges to accept applications even after the typical May 1st deadline in 2019.

Ivy Leagues and other selective schools typically have a competitive advantage compared to public and community colleges as degrees at these schools are higher in value. Selective schools are also able to get greater endowments that can be used for financial aid which is an attractive incentive for students. In fact, schools that are able to use less than 5% of their endowment yearly experience less risk with their investments in the future, however, just a little over 100 universities have a sufficient amount of endowments.

Conducting proper research before enrolling for college can make the investment worth it. Looking through endowment and news reports as well as going over the tuition discount and financial responsibility composite score can help you make an informed decision. It is also beneficial to anticipate the possibility of your college closing. If this unfortunately does happen, understanding next steps and researching if a full refund of payments is possible can help with making a successful transition.

Are you confident with your choice in college?

Infographic source: College Cliffs