Cisco Systems, Inc. (NASDAQ:CSCO) is the market leader in networking hardware and software. Cisco returns cash to its shareholders through stock repurchases and a growing dividend. The company is now a Dividend Challenger having raised the dividend for 9 consecutive years. The current yield is approximately 3.75%. The company is highly profitable, generates prodigious cash flow, and has net cash position on the balance sheet. It is unlikely that Cisco will cut or suspended its dividend. The stock price is down due to customers deferring capital expenditures. But the economy will eventually recover, and networking demand is high now due remote working and virtual school. I view Cisco as a long-term buy.

Q2 2020 hedge fund letters, conferences and more

Overview of Cisco Systems, Inc.

Cisco is world’s largest Internet Protocol networking company. The company was founded in 1984. Cisco operates in three business segments: Infrastructure Platforms Group, Security Segment, and Services. Today, the company sells hardware and software for switching, routing, data centers, and wireless applications. Cisco also sells software for networking, analytics, collaboration, and security and firewalls. Cisco is ranked 15th in the 2019 Interbrand’s Best Global Brand list. Cisco had $49,301 million of revenue in 2019.

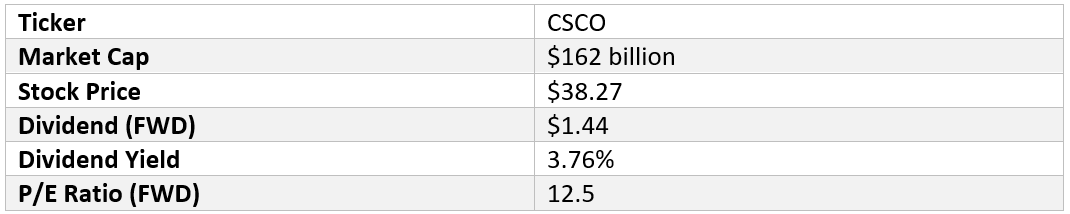

Selected Data for Cisco Systems, Inc. (NASDAQ)

Source: Data from Seeking Alpha (as of October 5, 2020)

Cisco Dividend and Safety

For investors interested in income and dividend growth Cisco pays an annual forward dividend of $1.44 per share and is yielding approximately 3.75% as of this writing. This is a decent yield and much higher than the roughly 1.8% offered by the S&P 500 index. Cisco’s dividend safety metrics are excellent in context of earnings, free cash flow, and the balance sheet.

From an earnings perspective, the dividend was safe in fiscal year 2020 (fiscal year ended July 25, 2020). The payout ratio was about 45%. From a forward earnings perspective the payout ratio is still decent at about 47% based on the forward dividend and consensus fiscal 2021 earnings per share of $3.07. This is below my threshold of 65% and suggest that the dividend is safe. Granted, revenue and earnings will likely be depressed in FY 2021 due to COVID-19. But the payout ratio is still relatively low and seemingly the worst is behind is for COVID-19 at this point.

The dividend is also safe from the perspective of cash flow. In fiscal 2020, free cash flow was $14,656 million. The dividend required $6,016 million giving a dividend-to-FCF ratio of roughly 41%. This is below my threshold of 70% and reinforces that Cisco’s dividend is safe.

What I like the most about Cisco’s dividend safety is the net cash position on the balance sheet. Total debt was $15,585 million at end of FY 2020. This was offset by $29,425 million in cash, equivalents, and short-term investments. The net cash position means that the dividend is probably safe even if COVID-19 hits the top and bottom lines in FY 2021.

Cisco's Competitive Advantage, Risks, and Valuation

Cisco’s main competitive advantage is its brand, long-term customer relationships, hardware market dominance, and balance sheet. The company is positioned as one-stop solution for networking requirements, which is unlike most of its peers.

Cisco faces some near-term risks with COVID-19 that has likely reduced capital expenditures at customers who are trying to preserve liquidity. This has resulted in a weak outlook for FY 2021. Over the longer-term Cisco is in very competitive end markets and faces significant competition in hardware and software. Major hardware and software competitors include Arista Network (ANET), Juniper Networks (JNPR), Aruba Networks [Owned by Hewlett Packard Enterprises (HPE)], Huawei, Palo Alto Networks (PANW), Checkpoint Technologies (CHKP), and Fortinet (FTNT).

Cisco Systems, Inc. is undervalued at the moment based on consensus FY 2021 earnings of $3.07 per share. At the current stock price Cisco trades at a forward price-to-earnings ratio of about 12.5X. The stock price is still down over -20% year-to-date. A fair value multiple is about 15X giving a price target of $46 based on flat or reduced earnings in fiscal 2021. The Gordon Growth Model gives a price target of $48 assuming 8% return and 5% dividend growth rate. Dividend growth investors should certainly be interested in Cisco. The combination of a growing dividend, solid yield, dividend safety, and undervaluation makes it a long-term buy in my opinion.

Disclosure: Long CSCO.

About the Author

Dividend Power is a blogger on dividend growth stocks and financial independence. Some of his writings can be found on Seeking Alpha, ValueWalk, The Money Show, Forbes, and leading financial blogs. He also works as a part-time freelance equity analyst with a leading newsletter on dividend stocks. He was recently in the top 10% out of over 7,575 financial bloggers as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.