The risk-reward balance appears to be tipping even further against SPACs. Regulators are clamping down on them, while purchase prices are only going up for them. And yet, despite this unfavorable combination of market forces, the speculative acquisition vehicles are actually accelerating their pace of deals.

Q2 2021 hedge fund letters, conferences and more

Acquisitions By SPACs Surge In July

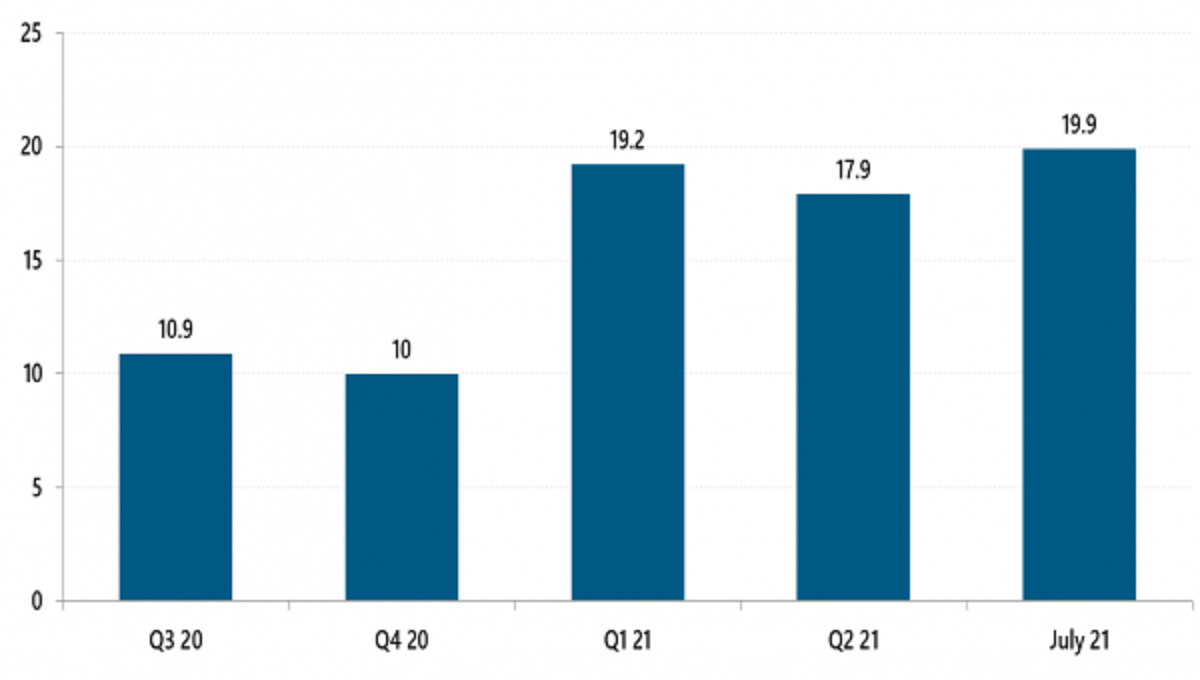

So far this month, blank check companies have announced the third-highest number of tech transactions for any month in 451 Research's M&A KnowledgeBase. The surge in July reverses a three-month slump that followed the record 'SPAC-quisition' activity earlier this year. The pickup comes as sponsors pay up:

- Our data shows that blank check deals in July have awarded targets an astronomical all-in equity value of 20x trailing sales.

- That's slightly higher than the valuation of de-SPAC deals in the first half of 2021 and more than twice the multiple from 2020, according to the M&A KnowledgeBase.

The unprecedentedly rich prices come even as market regulators have effectively made the transactions more costly by requiring target companies to disclose more of the potential problems that could undo their exceedingly bullish outlooks for their business. Some of the more speculative SPACs have lavished billion-dollar valuations onto startups that are a few years away from even having a product available to sell.

For more on special purpose acquisition companies – and the outlook for activity and valuations in the second half of the year – be sure to register for S&P Global Market Intelligence's special webinar, 'What’s next for SPACs?' on Thursday, July 29 at 11:00am ET.

Median Price/Sales Multiple For Acquisitions by SPACs

Source: 451 Research M&A KnowledgeBase; S&P Global Market Intelligence

Article By Brenon Daly, Research Director with S&P Global Market Intelligence's 451 Research