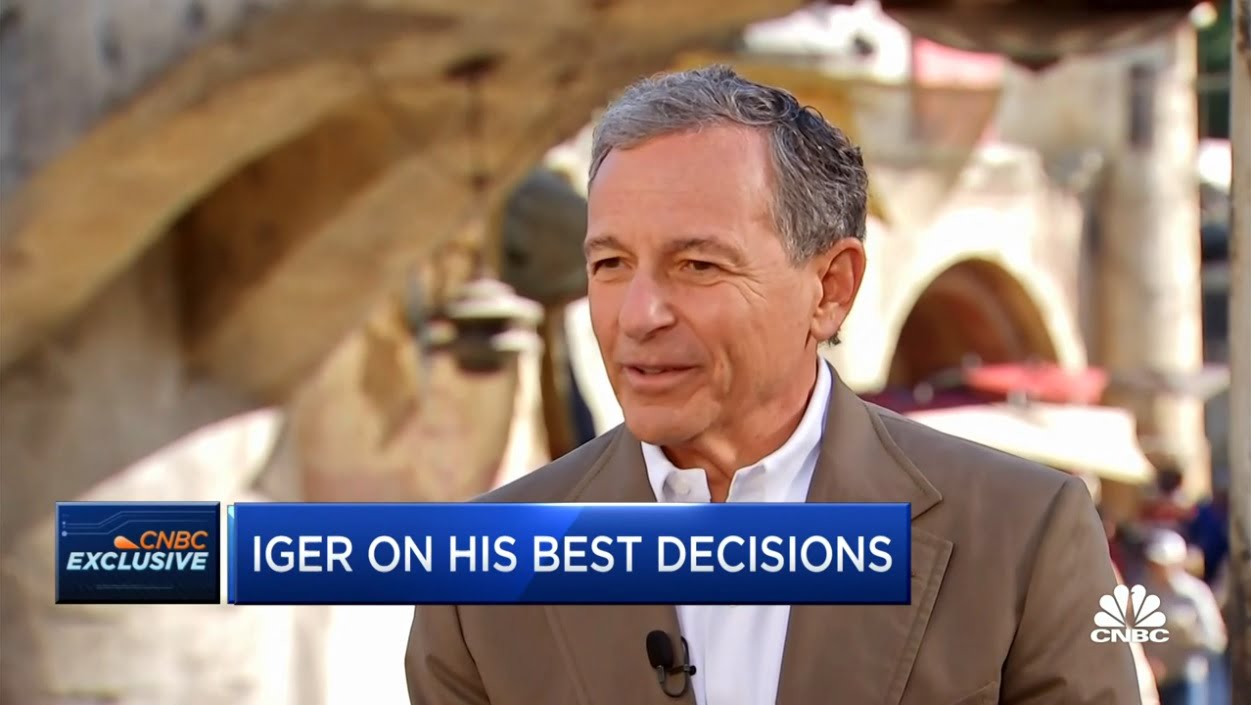

Following is the unofficial transcript of a CNBC exclusive interview with Disney CEO Bob Iger on CNBC’s “Squawk on the Street” (M-F, 9AM-11AM ET) today, Thursday, February 9th. Following are links to video on CNBC.com:

Bob Iger: We have pricing leverage when it comes to Disney+

Bob Iger: ESPN needs to find a sustainable growth path

Q4 2022 hedge fund letters, conferences and more

Bob Iger: Everything is on the table now with Hulu

Bob Iger: Everything is on the table now with Hulu

Bob Iger: Here’s why Nelson Peltz won’t be joining the Disney board

Bob Iger: Animation will continue to be an important business for us for a long time

DAVID FABER: Welcome back to “Squawk on the Street.” I'm David Faber here at the Disney lot and of course joined by the aforementioned Bob Iger, the CEO of Disney. It is nice to see you.

BOB IGER: It is nice to see you too. Welcome to Disney.

FABER: Thank you. I think it's fair to say that neither one of us could have imagined being here even a couple of months ago. It's only what 14 months since we did your exit interview, Bob. So, you know, I'd love to just start off when you got a call, maybe it was from Susan Arnold or from the board and they said, we'd like you to come back. Why did you say yes?

IGER: It was from Susan Arnold. She called me on the Friday before the Sunday that it was announced. And much to my surprise, I was not looking for a job and I was not anticipating that I would be asked back. But this is a company that I worked for for almost 50 years. I have a huge passion for the company, tremendous respect for the people.

And she made it very, very clear that it was a time of need, they decided to make a change at the CEO level. And I felt that I guess I had a sense of obligation. And I also wanted to help them not only transform the company during a pretty critical time, but I wanted to help them succeed at succession, which is quite important to me too.

FABER: You know, you mentioned both of those things transforming and obviously we're going to get to a lot of the news that came out yesterday after the close. But I've talked to a number of executives in the business who think two years isn't enough time for you to do that. That, you know what, you're back.

You're gonna be here for five, you're gonna be here for more than two years. It just the things you began just yesterday with the announcements that we're obviously going to get into can't see fruition in two years. How do you respond to that?

IGER: Well, my plan is to stay here for two years. That's what my contract says, that was the agreement with the board. That would be my preference as well.

FABER: Why your preference?

IGER: Well, look, I'm I'm going to be 72 years old tomorrow, I’ve put in almost 50 years. There are other things in life that I'd like to do. I also am confident that the board will be able to identify an able successor and I'd love to have an opportunity to help that person be successful.

And right now, it would be premature to even speculate there are no plans right now for me to stay any longer. As it relates to two years in the sense that maybe that's too short a period of time, you can get things done very quickly.

You obviously have to know what you want to do and show incredible resolve in terms of accomplishing those things and, you know, get buy in from key people. And I think we've already demonstrated in what has been just over two months since I came back that you can make a lot of changes very quickly.

FABER: So your belief is two years is enough time for you to see through some of the things you announced yesterday, the cost cuts, obviously, the reorganization that has taken place. And you know, any number of other efforts that are underway?

IGER: Well, I don't think you should look at it in terms of accomplishing everything in a period of time. It's setting the company up for long term success and what happens thereafter. So my goal is in talking about a transformation is to set it on the right course for what could be many years. Years beyond my tenure. That's the goal.

FABER: I'm curious when you got that call and then you went to work not long after.

IGER: I went to work, I got the call on Friday. I was working on Monday.

FABER: On Monday.

IGER: Yes.

FABER: Yeah, and not the you had you know, obviously that was a change for you a significant one. You were kind of retired you were busy. I know. You seem to be enjoying your life by the way.

IGER: I had a great life. I figured out a way to have plenty of stimulation and zero stress.

FABER: So then you decided to take this job?

IGER: Well, again, it was a sense of obligation. It was a, it was the love that I have of this company and the appreciation that it was a time that the board really needed me to come back and help them in deal with certain issues that were very important not just to them but to shareholders.

FABER: The company that you found when you did return, was it as expected? Was it worse than you expected?

IGER: Look, I was aware of some of the issues that the company was dealing with. It's a challenging time for many companies, particularly given the global pandemic and the macroeconomic issues and of course, as it relates to these businesses all the disruption. I would say it was as expected.

FABER: It was?

IGER: Yeah, there were there were you know, I watched closely. I was close enough in terms of my my observer status being out to have a sense of what was going on. I knew. There were no surprises.

FABER: There were no surprises.

IGER: No.

FABER: Well, you moved pretty quickly though to change things fairly significantly, haven't you?

IGER: Yes, because I felt it was essential to do that right away.

FABER: Why?

IGER: Well, the structure of the company that had been changed by my my I guess my successor, my predecessor by Bob, and he had a reason why he wanted to do that and he articulated that but it created a huge divide between the creative side of the company, the content engines, movies and television.

And the monetization, distribution side of the company and while I think he again he had certain, maybe valid reasons why he wanted to do that at that time, it was very, very apparent to me both while I was out and when I came back, that that was a mistake.

That there had to be a direct linkage that the people making the content had to be fully accountable for how it performed in the marketplace and have some say in how it was brought to market, timing to market, pricing, marketing very, very important.

How much to make, how much to spend, and that distance that was created by that structure, I don't think was healthy for this company at this time. And so, my first step was to say that I was going to change that. And it took me a couple of months to actually design with the senior team. You know what we would change it to and that's what we announced yesterday.

FABER: Right. That announcement, that reorganization and what is it we have four people, right?

IGER: Yes.

FABER: Who are—

IGER: Four people, three key divisions.

FABER: Three key divisions. Is anyone a priority for you over the other?

IGER: Well, I said yesterday on our calls streaming is a priority, you know, as you look at the businesses that we've been in both movies and television put parks aside for a minute, it’s very, very clear that the disruptive forces created by technology have had a real impact on those businesses particularly the legacy part of those businesses.

And streaming is the future. It's not the only future but if it looms large in terms of the future, eventually it will grow to the point where it is not only profitable, but it turns into a growth business for the company. And so we must make that transition. Look, we've already transitioned to it. Now we have to transition it into a growth business.

FABER: Yeah,I, you know, uh, you and I obviously sat down together in April of 2019 when you announced the streaming business, Disney+, and I wonder, we had this conversation then Bob which is can you ever fully replace the profitability of the linear cable business with direct to consumer. You know, three years in, almost four, it would seem perhaps the answer's no.

IGER: Well, I don't agree with that. Obviously, that has not happened to date. But if you think about it, in the last since we sat down in 2019, we've seen consumption of television and movies actually increase globally. So, if consumption is increasing, we're in the business basically of serving those consumers that want to obviously watch what we make.

And streaming is for them, I think a very pro-consumer method or means of doing that. So, you've got a consumer base that's growing and avid in terms of its, its interest in what we make. You have a technology that is serving them well and actually serving us well too. It's very great. It's a great technology to distribute content on as we proved.

Going back for a minute, it’s just interesting when we sat down in April of 2019 to talk about the launch of Disney+, our goal was not publicized, but our goal at the time was to sign up 4 million subs in a year. We signed up 10 million subs in 24 hours in one day.

FABER: I remember.

IGER: That's an incredibly successful launch, but it speaks volumes about what we're just talking about. People, one, they want our content. Two, they want it that way. So, if you have that much demand and we have the ability to essentially serve the consumer well using that technology, then profitability in my opinion is inevitable.

You have to manage it well. You have to spend appropriately, you have to price appropriately. You have to time it to market appropriately, but it will work. It is working. Look there's tremendous consumption.

FABER: You have 104 million subscribers, there's no doubt about that. I wonder though, going back to that time, you know, 6.99, I remember the gasp in the room at the time because the price was so low. Some would say streaming is not a business that’s structured with, to make money with that low a price. Given churn, do you think that you priced it too low to begin with?

IGER: No, not at all.

FABER: And that has been part of the problem even though you grew subscribers so substantially, that ultimately you didn't really give it a chance to become profitable in any near term time?

IGER: I was very focused at the time on achieving three things by basically by pricing it that low. One was I was convinced that the investment community, the street would measure us first on how many subs we achieved. Think I was right about that by the way. I also felt because Disney is what it is that accessibility was I think an important brand attribute.

I wanted was the first time we're putting almost everything that Disney's ever made in one place, let's make it as accessible as possible to as many people as possible. And then I thought about the competitive landscape. I knew that Paramount was was cooking something up. We knew that your company NBCUniversal was and Comcast was cooking something up.

Netflix has been in the marketplace. Mindful of what they were doing, I thought if we priced low, it would actually one make it a little bit more difficult for them pricing wise. And secondly, it would give us a bit of a competitive advantage in terms of signing subs. I also was well aware that we were launching with very little original content “The Mandalorian” was and “High School Musical” were two of them.

think we had five original pieces of content and it would take time. As it turns out, it took more time because of the pandemic to fill that pipeline with enough original content to justify more pricing.

As I said yesterday on the earnings call, the price was taken up by $3 from 7.99 to 10.99 just recently, and we had a de minimis, de minimis churn in subs, which says that now that we fuel that pipeline with more original content.

And the consumer is also I believe getting more used to using streaming as as a primary source of material that there is pricing leverage and we have pricing leverage, particularly as we continue to invest in our—

FABER: But you have moved away, I mean, when it started, as you said, you were very focused on obtaining subs as quickly as possible. You did that. You seem to be moving away from that now not seem to you are I mean, you're not talking about sub growth in the same way that you were certainly two years ago or three years ago. You're talking now about profitability, and about cutting costs to get to that profit.

IGER: Well, I think one of the things that happened was we we got a little bit maybe intoxicated by our own sub growth, we said 60 to 90 million subs in five years—

FABER: Well so did your investors Bob.

IGER: We blew through that—

FABER: That took the stock up enormously when you kept exceeding those until suddenly everybody starts saying is this business ever really going to generate cash.

IGER: Well, but before that we blew through that in a year. And suddenly everybody was on board with this meteoric sub rise, and that it would continue—

FABER: Right. Others followed you into the market as well though at fairly low price points.

IGER: And we leaned into that because it seemed like that was the primary metric that we'd be measured by. Now, we also said at the time, we'd be profitable in five years, which coincidentally is the end of 2024.

We reiterated that yesterday on the call. So now as we've looked to basically becoming profitable and figured out how do we do that, it's clear to us that we do have to continue to grow subs, but it's not just about that.

We have to, we have to have the right pricing. I talked yesterday about promotion, we have to have the right marketing, we have to have the right content. And if you go back to the structure that we put in place which is a direct linkage between the creative side and the distribution side, there, there is more a greater likelihood that we will have the right content. They'll make choices because they're accountable for delivering that profitability.

FABER: Right. All understood. I want to, I want to actually ask a couple of questions specific to that that you discussed yesterday. You said on the call you're going to lean into franchises. You've been too aggressive in promotion. What does that mean?

IGER: Well, sitting in front of this lovely poster, this company possesses and has made some of the all-time great franchises. The five highest grossing movies of all time came from this company. Two of them by the way from Jim Cameron, “Avatar” and obviously Marvel has contributed to that as well.

These are stories I guess you'd call them that are very valuable globally, that are leverageable across multiple businesses of ours, that have have a long life they, “Avatar” one was just on Disney+ did extremely well.

You look at the movies that we made years ago that are still performing extremely well in new platforms because there's a we say that they're evergreen in some form but because of the audiences that we make them for and that audience is constantly being regenerated literally new generations—

FABER: Totally, but do you pull away from general entertainment though under this new guise where you're trying to obviously save some money?

IGER: Look, I like general entertainment in the sense that there's a lot of quality there and in fact, we make a lot. “The Bear” is a great example of that or “Old Man,” what FX makes for us, what Searchlight makes for us with the just look at the Academy Awards. We want to curate that more aggressively.

When I say that, that's primarily because in order for us to be more profitable as a company in this business, we have to reduce our expenses. We talked about that yesterday in order to do that you have to make some choices.

I happen to believe because general entertainment is not as differentiated. And look, there are seven or eight platforms in the streaming business alone that are in general entertainment. That's a tough business to be in competitively and it's it's not our strongest suit, our strong suit—

FABER: But do you worry about churn going up as a result of not providing perhaps as broad an array of programming?

IGER: Well, I think there's a way to balance that. We're gonna lean even more into Disney and Marvel and Pixar and “Star Wars” and “Avatar” of course, and we've had higher returns on those businesses over the years anyway, so that makes a lot of sense. Adding to that, augmenting that with some form of I’ll call it more curated general entertainment is what we would likely do.

FABER: Yesterday, you know, you talked about, sorry for all my different notes here, 3 billion in non-sports content.

IGER: You get to take notes. I don’t have to.

FABER: You just have to give me the answers. That’s all you get to do. 3 billion in non-sports content cuts. So that's a lot, what what is that? Where does those cuts come from and how do you maintain quality when you're cutting 3 billion in non-sports content?

IGER: We can achieve that. I'm confident of that. First of all, we talked about volume, some in general entertainment, we have to look really hard at how much we've made and what's really worked. And now that we are even more focused on delivering profitability, we have to be I think more discerning in terms of basically what we say yes to.

In addition, you know, technology is interesting in when it as a tool, and I'll call it the creator's hands or the artist’s hands, extremely powerful. You look at what Jim Cameron has been able to do with technology and “Avatar” or what Pixar has been able to do over the years, special effects by Marvel.

When you see “Ant-Man,” you'll be blown away by it for instance. That's great because we're adding more quality to the screen. It's also added a lot of expense and I think we have an opportunity to really look at what it costs us to produce everything and reduce particularly in not only a more challenging time, but in a time where we owe our shareholders better returns on that business.

FABER: Yeah. Well then when you said though, for example, that linear channels and movie theaters can provide monetization capability, again to this point, are you going back to the older model where you're actually going to produce things for other for other distribution models, other distribution schemes? Is that something that perhaps should never have not had been pushed aside?

IGER: I think we've all including me spent a lot of time the last four years essentially, you know, writing the obituary of sorts of linear television. I you know, I plead guilty to that and movies. Now movies had significant displacement because of the pandemic.

But, you know, recent data will show you or recent experience will show you that it's not those platforms are not gone. They actually still are somewhat relevant. “Avatar” over $2.1 billion in global sales, billion dollars. That's from a legacy platform. So it says to us that, you know, maybe we were leaning a little bit away from that too much.

Now, again, a lot of it was done because of the pandemic. Now that people are going back to movie theaters, we have to look carefully at how we're bringing movies to market with an eye toward still using what is a valuable platform for this company.

Same thing in linear TV. We can put programming on ABC and on FX and on the Disney Channel and on our streaming service and have a completely different attract a completely unduplicated audience so we're gonna use those platforms. I'm not suggesting that linear television is not imperiled.

FABER: I mean, no.

IGER: I think it is. The numbers speak for—

FABER: The numbers speak for themselves. You’re down 5% in revenues in the linear cable business.

IGER: Right.

FABER: 16% in earnings. Obviously I assume there's fewer ESPN subs this quarter than they were last quarter or last year?

IGER: Well, I don't know. I don't know about this quarter by the way.

FABER: Year over year though. We know where it’s going.

IGER: The recent sub we're experiencing at ESPN has been fairly decent, but yes, it's gone down since we started. When you started interviewing me it's—

FABER: We've had this conversation for a very long time.

IGER: It's still profitable, still important. And look, I think—

FABER: But you’re not going to get ESPN, you're not going to you're not going to spin it off. You made that very clear yesterday.

IGER: I did. I did.

FABER: You see it as part of this company.

IGER: I did.

FABER: And yet—

IGER: By the way, as long as it continues to be profitable, and it too needs to find a path that basically enables it to continue to deliver the kind of results that we'd like it—

FABER: When you said you're going to be more selective in terms of sports rights. What does that mean?

IGER: Well, again, it means saying no to things that don't deliver the value and saying yes to things that do. We're very grateful and pleased that we have a new long term NFL deal. Extremely important with more basically more product than you had before.

You know, more games postseason, the SuperBowl, for instance. We've got great, great rights, license agreements in college sports. We have an MBA negotiation coming up.

FABER: How’s that going to go? You’re at 1.4 billion I think a year, people say that could double.

IGER: It's a very, very valuable property for this company. It's a great sport. And not only is there a lot of volume, there's a lot of quality and it would be a priority of ours to extend our deal with them.

FABER: But with sports rates going up, Bob as they seem to and with the number of people paying you each month for the linear product, I mean, at what point does it get out of balance and you say, “you know what, we've got to take this thing fully over the top.”?

IGER: Well, I think the model ultimately will change. It will become an over the top model. I said yesterday, I don't know when that will be. We've had conversations about it. I actually think as a so-called over the top model, a streaming model, it will be a phenomenal product for the sports fan. So it will give them more flexibility.

FABER: And they will pay a lot for it.

IGER: Well, I think pricing is obviously something we have to look at very carefully and you know, a combination of – or balance of pricing and how many subs do you need to have it make sense in terms of the bottom line.

FABER: So one day ESPN will be sort of largely a streaming service?

IGER: One day.

FABER: But that day is not here.

IGER: No.

FABER: Do you know when that day comes? Does whoever succeeds you going to know? Like when did you just see it come in like “okay, that's it. We can't afford this anymore. We've got to try something else.”?

IGER: I think if you do the math – you’ve obviously done the math.

FABER: Yes.

IGER: I should turn the question back to you. If you do the math, you have to – there’s an inevitability to it I believe. But I can't say when. It will – and we're not going to do something that's either precipitous or reckless in any way. We'll time it right.

FABER: Speaking of math, I want to get to some numbers. I mean, the company has not been generating a lot of free cash flow. In fact, your negative free cash flow is a significant amount recently, you only did 1.5 billion last year. Is that a concern to you at all?

IGER: Well, most of it has to do with Covid. Look at what happened in March of 2020. Other than streaming, every one of our businesses basically shut down – no live sports, no movie going on, our parks shut down. Our cash flow basically stopped –

FABER: Although this year you’re not going to generate a lot of free cash either.

IGER: We’re still recovering from that and we're still obviously losing money on streaming. And obviously that's one of the reasons why we have to turn that around. But as we said on the call yesterday, we're going to get to a point where we're going to recommend to the board a dividend at the end of the year, that suggests some confidence in our cash flow directory. And how we not only generate capital but how we allocate capital –

FABER: How do you have confidence and you know when you put out a number of 5.5 billion in cost cutting, a billion of which is already underway, what gives you the confidence you'll get there to the extent you can say, “hey, we are going to reinstate a dividend.”?

IGER: Well, not all the 5.5 billion in cost cutting will hit us right away because some of the content is baked in. We've made commitments to it. But we're starting today to achieve that number and to achieve the number that we set on what we call SGNA general expenses. So combination of that, a combination of continued recovery from the pandemic.

We talked about our parks and resorts results as a for instance, phenomenal business for us. Higher margins. I think real growth potential in the future, including our cruise ship business where we launched the new ship and that business has been fantastic. When you look at recovery by the way, it’s an amazing story.

FABER: I know, I mean, we have so many things we haven't yet gotten to including the parks, but –

IGER: The only thing – look, we obviously have confidence in our ability to grow free cash flow over the – we'll call it next five years or so. Some of that will come with obviously turning a business that has not been profitable into a business that's profitable –streaming.

FABER: Right, which again by the end of 2024, it will be.

IGER: That’s what we said yesterday.

FABER: I heard you.

IGER: I haven't changed my opinion on that yet today.

FABER: Good I’m glad that less than 24 hours hasn't changed. In 2024, though, there's something else coming up and that's Hulu. You didn’t get any questions about it yesterday on the call, but that could be a $9 billion bill to you if my parent company puts their interest to you as they are able to.

If you were to buy that that would take your leverage up significantly. Some question whether that would be a good strategy, how do you view it?

IGER: Well, first of all, our leverage is not a huge concern to us right now. Not the concern that others would suggest that it is. That said, we are intent on, over time, reducing our debt.

FABER: Well you have a lot of fixed costs. I mean, you get up to leverage or four times let's say people do get concerned. You have a high fixed costs business.

IGER: I would imagine that would be the time when our other businesses starting to generate more free cash flow. But I'd rather not get more specific about that. Because we're not really prepared to give any forward statements in that regard, for instance. But I've talked about general entertainment being undifferentiated.

Hulu, by the way, is a very successful platform and I think a good consumer proposition. But we're – everything's on the table right now. So I'm not going to speculate about whether we're a buyer or seller of it, but I obviously have suggested that I'm concerned about undifferentiated general entertainment, and particularly in the competitive landscape that we're operating in. And we're going to look at it very objectively and expansively.

FABER: If there's an opportunity, for example, then to potentially sell your interest to Comcast if Brian Roberts were interested, that's a conversation you would have?

IGER: You’re leading the witness there a little bit. I said we're open – we will be open minded.

FABER: I just want to make sure because I think the assumption has been that you guys will buy what you don't already own of Hulu.

IGER: And I think I'm suggesting that isn't necessarily the case.

FABER: Okay. It's not that far away from kind of starting to make a decision, right?

IGER: Why it's on my mind.

FABER: Understood. Something else that I don't know if it's on your mind or not is Nelson Peltz. We obviously had him on some time ago, taking a lot of shots at the company, although you seem to have met some of his objectives even very recently with your announcements. But I wonder Bob, why engage at all? You've got so much on your plate, a proxy fight is distracting by its very nature. Why not just say, “hey he’s one guy, put him on the board and over with.”?

IGER: Well I have to ask – the question really why and why not. A number of people suggested like why not, why not just let him on the board. I think you have to start with our board. Which he has been quite critical of. In fact he has been critical of one member of our board. We have a very diverse board.

Diverse in gender, diverse in ethnicity, diverse in business background. And each one of those board members comes to the boardroom with very relevant business background. You look at Mary Barra and Mark Parker and Safra Catz running big companies, global brands, complex companies in a complex world.

You're looking at Calvin McDonald from Lululemon, you know, an upstart of sorts retail brand, Amy Chang and Carolyn Everson and Francis Desouza come out of the tech world. Maria Lagomasino, who is in private wealth management probably manages more money than Nelson Peltz wakes up every morning thinking about her investors for instance. She brings that into the boardroom. And then there's Michael Froman, who Nelson has come after –

FABER: Yes, he has come after him specifically because of the universal proxy that kind of is the easiest way to do. Give me more votes than him.

IGER: But let's look at Michael Froman as a Disney board member. His experience at Citibank, he's the vice chairman of MasterCard. He was US Trade Representative in the Obama administration, someone that I spoke with during that period of time about global trade initiatives, global regulation, a number of other issues that were extremely relevant to us at Disney and continues to be.

So we have a good board. We have a board by the way that holds us accountable, that represents shareholder interest well, that challenges us all the time, that actually – and served me very well when I was CEO in my prior tenure with good ideas, with input that had real value to the shareholders of this company.

So you start with there is not a need. Plus, he has not articulated either a vision or even ideas that are of particular value to us. Now some he has, but we were already working on those. And when I came in, we talked about cost cutting right away. We reorganized the company, we've recommitted to profitability and streaming.

So where's the need? And by the way, just from a shareholder perspective, where's the need? In addition, obviously, I have a big job right now to contend with. And focusing my time, my energy and the time and energy of the entire team is extremely important. Disruption from a force like that is not something that would be healthy to the shareholders of this company.

FABER: You surprised that Ike Perlmutter –somebody obviously, I mean, you bought Marvel – has been so involved with trying to get Peltz on the board. Is there a feud between the two of you perhaps that is fueling this?

IGER: Well, I think that's a curious dynamic that I think you know, our filings indicate that both Ike and Nelson were working together to try to encourage the board or convince the board to put Nelson on the board.

They have a relationship that dates back quite some time. We bought Marvel in 2009. I promised Ike the job that he would continue to run Marvel after that. Not forever, necessarily. But after that. And in 2015 he was intent on firing Kevin Feige who was running Marvel's studio, the movie making at the time, and I thought that was a mistake and stepped in to prevent that from happening.

I think Kevin is an incredibly, incredibly talented executive that you know, the Marvel track record speaks for itself. And so I moved the moviemaking operation of Marvel out from under Ike into the movie studio under Alan Horn.

FABER: So that created some ill will you think.

IGER: Well, you'd have to ask Ike about that. But let's put it this way. He was not happy about it. And I think that unhappiness exists today. And you know, what the link is between that and Nelson, his relationship. I think that's something that you can speculate about. I won't.

FABER: I want to end on a couple of quick questions, Bob. Because there's things we haven't gotten to. The animation business which has been so key to the success of this company for so long, the creative engine.

I mean, the Pixar deal which sort of reignited that, do you feel like that has fallen off? I can't remember the last Pixar movie that really generated a lot of conversation, perhaps because some gone direct to consumer, but also others that have just not done as well.

IGER: Well, it's interesting because Turning Red would be the last one that did well. But it was a direct streaming – direct to consumer film. Nominated for an Academy Award by the way, and it's interesting because I looked at numbers recently, it's one of the most streamed movies of the last year.

So I think there has been success, it's just not the kind of success generated when a movie is taken at the box office. By the way, Encanto from Disney Animation, also very, very successful film. We actually won an Academy Award.

FABER: Right. So you don’t feel like the animation businesses is not up to par?

IGER: No, I think we had a couple of creative misses I'll say. That's the nature of the business. One at Pixar, one at Disney Animation. You know, we've all learned for those of us who have been in the creative side of the business a long time.

You know, you have to move past that you got to process failure successfully. I love the slate that we have coming up. I spent a day at Pixar a week and a half ago and reviewed a number of projects.

Talked yesterday on the call about a Toy Story 5, a Toy Story sequel. They have great original movies in development and including one called Elemental, which is coming out which is brilliant. Same thing at Disney Animation, but they're also going to make a Frozen sequel and Zootopia sequel. And they were actually working on a Moana television series for Disney Plus.

So I think we've got talent, we've got the talent that we need. And we've got a pipeline that I think is really creative. And I'm confident that animation will continue to be an important business for this company for a long time.

FABER: I have to wrap up but I do want to come back to succession. You've obviously indicated it is your intent to stay the two years that was outlined when you joined. How involved are you going to be in this succession process? Are the four people who are now running the key businesses here the logical potential successors?

IGER: Well, first of all, it's a board-led process. Mark Parker, who's the incoming chairman of the board is chairing a succession committee like we have a meeting tomorrow on that. Their work is already underway. I will be involved with them. But again, it's a board-led process.

FABER: Well, what is your role going to be?

IGER: Well I think, obviously having had the job for quite a long time I think my input is valuable to them about one, what are the qualities that are necessary that the CEO of The Walt Disney Company should have for instance, we've already talked about that. I'll help them assess candidates, obviously, but it'll be their decision. I have one vote as a board member.

FABER: Right. Are you going to look outside? Do you think they will look outside as well?

IGER: They are going to be expansive –

FABER: You guys don’t typically go outside.

IGER: Well look, when I was in the process in 2004, 2005, the board looked inside at me and outside. We considered outside candidates when we made the decision about Bob. And I'm certain they will do that again.

FABER: Back to that decision about Bob. Do you regret it? Are there things that have informed that decision that will help you in terms of making the next decision on your successor?

IGER: This is a big complex company and a hard company to run even in good times. We thought we made the right decision when we chose Bob back in 2020. The board obviously decided recently in November, that he was not the right person for the job and they made a change.

I think there are some – with anything, that any big decision that you make, particularly if it doesn't work out right, you should learn from, you know, what went wrong. And that's something the board has discussed, but I'm not going to get into those.

FABER: Not going to get into what went wrong or what you may not have seen properly? I mean, the guy was working at the company for a long time. He shadowed you, you took endless trips to China together, for example.

IGER: We did. No, I'm not going to get into that.

FABER: All right. Doesn't seem like a great place to end but I think we've got to.

IGER: You can change the subject. I mean, you have the right.

FABER: I do. Well, all right. One final question because it has come up.

IGER: Uh oh. That might have been a mistake on my part.

FABER: It was probably a mistake. Our exit interview. You were talking about the reasons why you were leaving. And one of them you said to me, “I wasn't listening, as well as I used to, you know, I was coming to the conclusion before I listened.” And I thought of that a few times because people had mentioned it to me and said, “well is Bob working on his listening?”

IGER: We should put that in context. I said, and I was serious about it that I felt over time because of all the experience I gained over those years and the fact that it was relatively successful run that I got overconfident in my own instincts, my own decision making and then I thought it caused me to be a little bit more dismissive of other people's ideas. And I think that was a healthy what do you call it, self analysis of some sort.

FABER: It was. People enjoyed hearing that.

IGER: I had the benefit of being gone for 11 months, it was a great 11 months. It was a refreshing, rejuvenating 11 months. I sound like I long for those – that time again in my life, which maybe there's some truth to that. I come back with a lot of energy, a lot of passion. I think a lot of self awareness right now.

I have a great team of people in place and you know extended some of their responsibilities yesterday. I'm obviously confident in their ability to take on more. I'm an optimist at heart. I feel great about being here. I feel great about where the company is today and where I believe we'll be able to take it.

FABER: Perfect place to end. Much better, much better.

IGER: Better place to end.

FABER: All right, ending but not over. I hope we'll do this again soon. Bob, thank you for having us. Thank you for being here.