To commemorate Earth Day, the leading research, data & media platform for cryptocurrencies CoinDesk, will release an in-depth report that debunks the widely believed theory that bitcoin is bad for the environment. The report, titled, ‘Does Bitcoin Have an Energy Problem’ breakdowns the below key themes:

Q1 2021 hedge fund letters, conferences and more

- Critics claim Bitcoin is terrible for the environment - this is not true. Bitcoin uses a relatively clean energy mix, and there is a meaningful investment into renewable-powered Bitcoin mining

- Bitcoin provides a means to monetize wasted energy, improving the financial standing of energy companies, allowing for investment into clean energy production and transportation

- Bitcoin has inspired innovative uses for potential pollution to power the network, and some Bitcoin mining side effects could reduce the cost of heating and other energy-intensive uses

Introduction

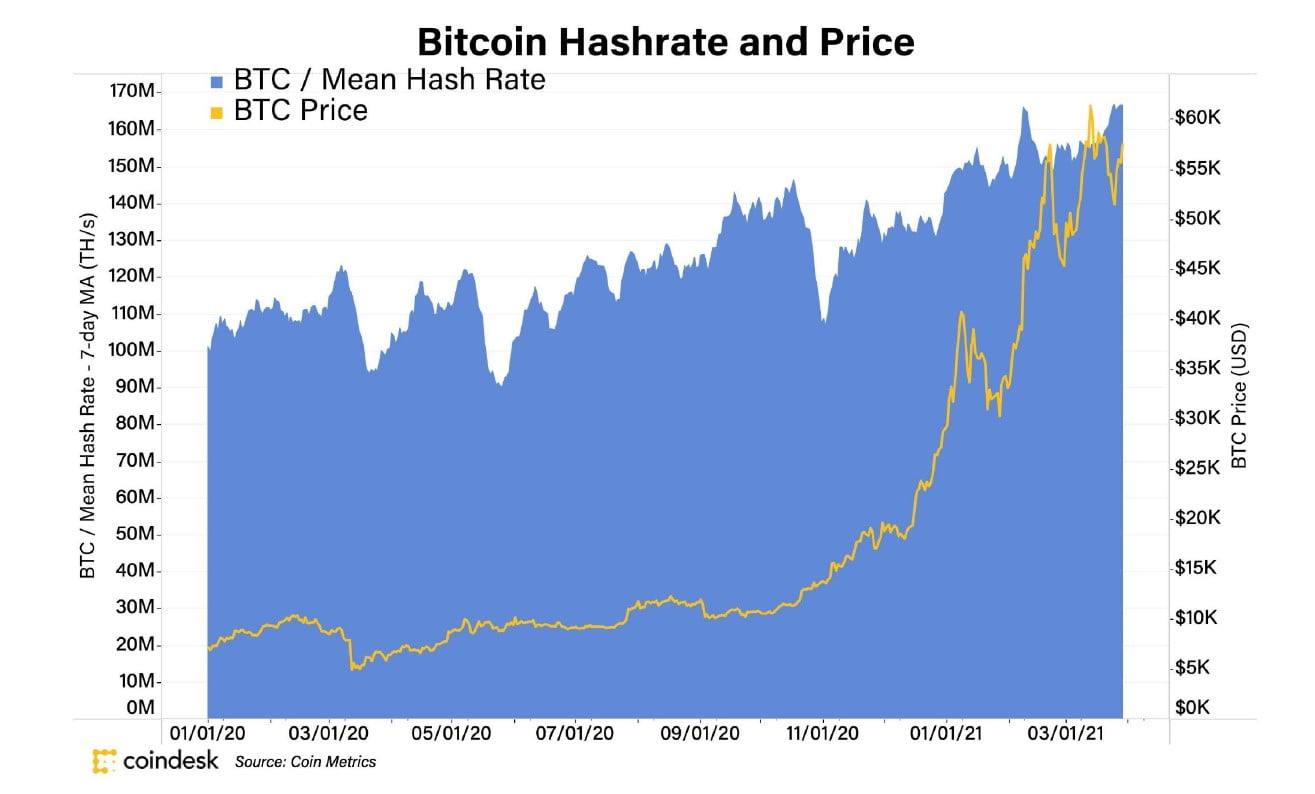

Bitcoin experienced a retail-driven meteoric price rise in late-2017, breaching $19,000 in December 2017, and a subsequently rapid price fall to ~$6,000 in February 2018. Professional investors took notice then, but few considered Bitcoin a viable avenue to responsibly grow capital while properly managing risk. Three Februarys later, Bitcoin topped $1 trillion in total market value and financial institutions are now serious about cryptocurrency. Bitcoin is no longer widely characterized as an inappropriate institutional investment.

While institutional Bitcoin investment merits may overlap with retail Bitcoin investment merits (for more on this, see our report on Bitcoin’s value proposition), institutions face different types of pressures. Institutions face performance pressure from investors, policy pressure from regulators and reputation pressure from the public. A common concern from these stakeholders is Bitcoin’s undeniable relationship with the environment and energy consumption.

While there are some headwinds to the rise of what is known as environmental, social and corporate governance (ESG) investing, a growing number of institutions have recognized the importance and have implemented internal mandates. BlackRock and JPMorgan, for example, have made their ESG commitments public. Younger investors also want their money to benefit society and the environment, providing a map to where they will direct funds as their wealth grows.

As the price of bitcoin continues to climb, ESG discussions become more salient. With more mainstream attention, Bitcoin will come under increasing criticism for its environmental impact given its price growth is related to increased energy consumption and its well-documented ties to Chinese miners who use coal-fired energy.

Bitcoin’s decentralized nature and open-access ethos potentially give it a role in ESG funds. Yet concerns around its environmental impact are likely to act as a barrier for institutional investors who answer to clients, boards and mandates. This report aims to address these concerns and show that Bitcoin is not as polluting as its critics claim and that it can meaningfully contribute to progress in energy development as current industry trends become the norm.

Energy Consumption and Bitcoin Mining

As Bitcoin garners attention, respected investors, thought leaders, media outlets and critics are sounding the alarm about Bitcoin’s significant energy consumption. And it is true; Bitcoin is energy intensive. Individuals, groups and businesses known as “miners” use specialized hardware to carry out what is known as “Bitcoin mining.” Miners process transactions by grouping them into blocks and then racing to find a random variable that satisfies a pre-established protocol requirement. This enables the block to be added to the blockchain and consumes a considerable amount of energy. Miners are rewarded for the computing work expended in successfully processing blocks with the issue of new bitcoins - when the value of the new bitcoins is greater than the cost of energy expended, mining is profitable. (See Annex: “Bitcoin Mining Explained”)

Bitcoin uses a lot of energy, but does it need to? Bitcoin was created to transact value between two parties without putting trust in a third party, effectively decentralizing trust in a payment network. To achieve trust, all participants need to reach consensus or agreement as to “who owns what” with an adequate security model to maintain network integrity. Bitcoin’s energy-intensive consensus protocol is how the network achieves that consensus and integrity. If consensus were easy to achieve, then the network could be easily attacked. Mining is energy-intensive so that it is prohibitively expensive to attack the Bitcoin network.

Since Bitcoin achieves consensus through energy consumption or “work,” Bitcoin’s blockchain is typically referred to as a “proof-of-work chain.” Proof-of-work chain energy use is relatively transparent; there is only one step between energy input and bitcoin output. As such, the energy footprint for Bitcoin is fully contained by the energy consumption of Bitcoin mining. This has made criticisms of Bitcoin’s energy consumption easier than other industries, energy intensive or otherwise.

For most of its early life, Bitcoin used relatively little energy. In 2015, Bitcoin consumed just 0.02% of total global energy consumption and reached 0.16% by 2018, according to estimates by the Cambridge Centre for Alternative Finance (CCAF). Bitcoin was a rounding error in the grand scheme of global energy consumption.

With the price of bitcoin rising and the concurrent growth of the Bitcoin network, news sources, critics and supporters have correctly identified that Bitcoin now uses a meaningful amount of energy, making up roughly 0.58% of global energy consumption. If Bitcoin were a country it would be ranked 29th in energy consumption, between Ukraine and Argentina (as of April 18, 2021). Anything that uses as much energy as entire nation states will undoubtedly get attention. And it should.

For argument’s sake, we could think about Bitcoin as a simple economy that imports energy and exports the transfer, security and minting of value. Using this framework, Bitcoin the country has a population of about 1 million people (miners), successfully transfers $3 - $4 trillion of value annually (transactions), secures a digital vault worth $1 trillion (bitcoin market capitalization) and mints $20 billion of new value per year to facilitate transactions (block rewards) for 100 million unique parties (Bitcoin users). In this scenario, if Bitcoin were a country, the prosperity of 1 million people would surely not be called out so readily as wasted energy.

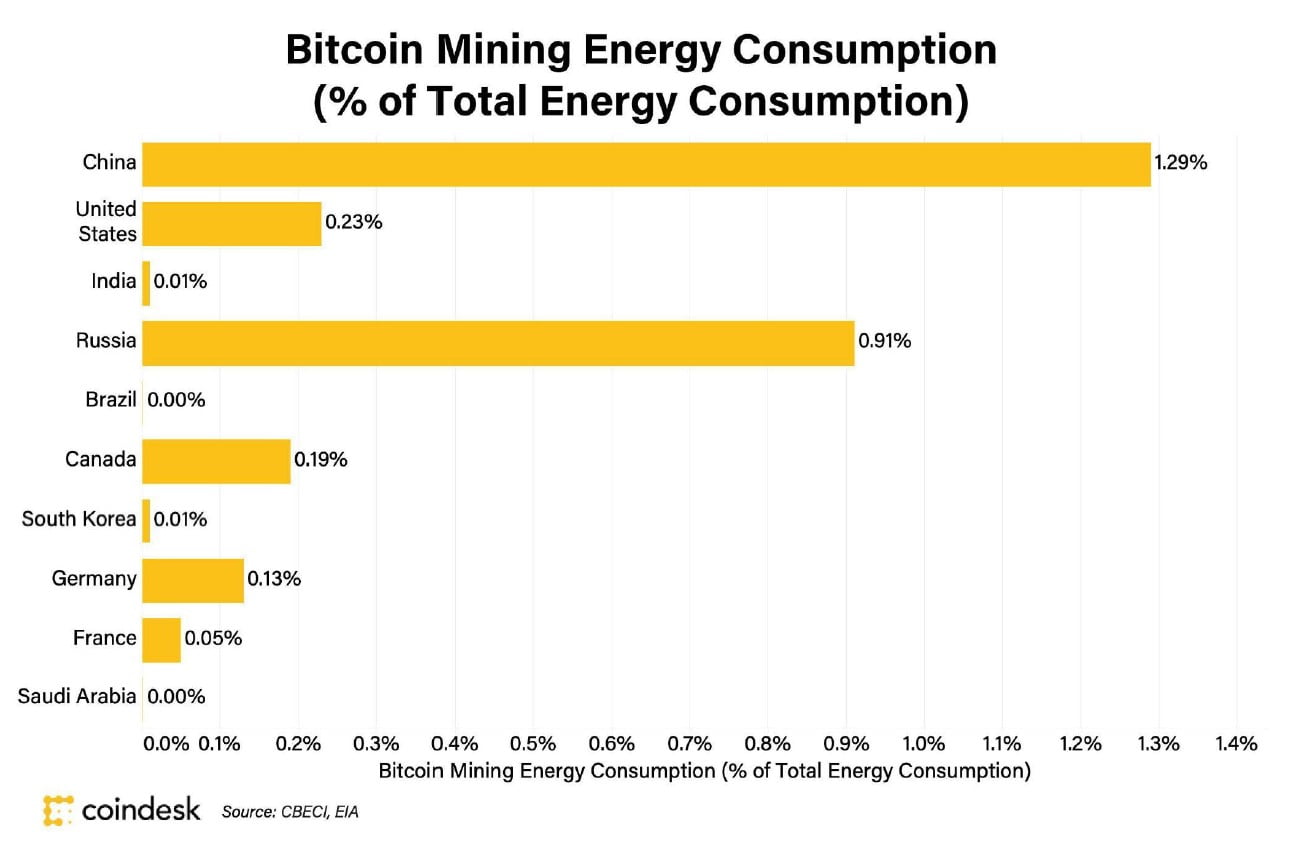

Of course, Bitcoin is not a country. Comparing its energy consumption to countries does not accomplish much beyond giving a reference point to the amount of energy that is being used. If we consider the top ten countries in the world by energy consumption that have mining operations, Bitcoin at most makes up 1.29% of any one country’s total energy consumption. Using the United States as a reference point, video game consoles make up ~0.25% of energy consumption, while construction (~2.2%), commercial cooling (~2.7%), commercial ventilation (~2.9%) and commercial lighting (~3.0%) each make up roughly 2 - 3% of energy consumption, respectively.

While this may seem intentionally misleading to the reader, it is important context. Charts that show national energy use with Bitcoin as its own country are leaving out that Bitcoin mining energy consumption is distributed among various countries as a subset of each country’s total energy consumption. With this in mind, comparisons between the energy consumption of Bitcoin and countries are largely useless. Countries spend energy on a lot of things. A lot of those things are really important. A lot of those things are far less important. However, what countries do not directly spend energy on is a global, trustless, permissionless payment settlement network and a digital, aspirational store of value.

Energy Production and Clean, Green, Renewable Bitcoin

While Bitcoin’s energy consumption is certainly front of mind, we should consider that the goal of environmentally conscious investing and policy is not about energy consumption. Policing what people can spend energy on would be a complicated ideological battle rife with subjectivity. Instead, environmentally conscious investing is focused on increasing industry use and improving production of “green,” “clean” renewable energy. The goal of ambitious environmental projects and policy declarations, mostly notably the Paris Agreement (see sidebar), is to curtail or completely neutralize the emission of greenhouse gases, namely carbon, given their damaging effects on the environment. The use of coal and fossil fuels for energy production is a source for greenhouse gas emissions and, as a result, there has been a push to move towards renewable energy production as renewables do not emit greenhouse gases. The environmental pledges of some of the world’s largest companies reflect that reality. Their goals are to be “net carbon neutral” and, as such, the environmental investment thesis around Bitcoin should also focus on relative carbon emissions.

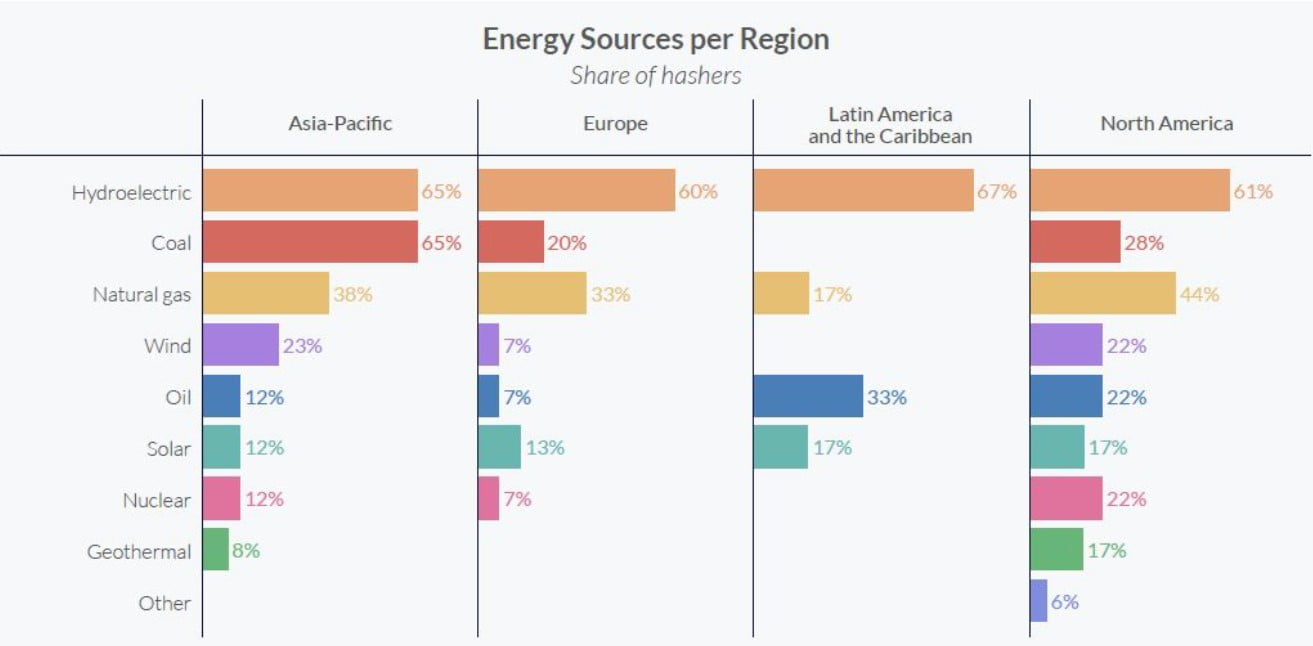

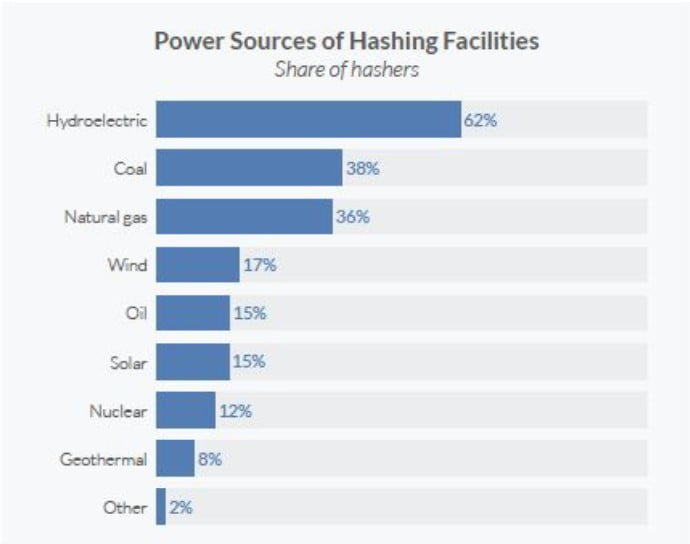

While Bitcoin mining uses a substantial amount of energy, a good percentage comes from renewable energy. According to a 2020 study carried out by the CCAF, 39% of total energy for Bitcoin mining came from renewable sources in 2019 (compared to 28% in 2018) with 76% of miners using renewable sources as part of their energy mix. This upward trend and meaningful renewable energy penetration should be encouraging. The power sources reported by miners is shown on page 7.

Source: CCAF, 3rd Global Crypto Asset Benchmarking Study

While the trend is promising, there are a handful of factors that investors need to consider.

The first is the type of renewable energy that is being used. Hydroelectricity is far and away the most common source of renewable energy for bitcoin miners. While hydroelectricity is a renewable energy source that does not pollute the water or air, it is sometimes characterized as a less desirable form of renewable energy given the damage to the local ecology mismanagement may cause and the potential emission of methane, a greenhouse gas stronger than carbon, from dammed reservoirs. It is important that a dependence on any renewable energy source does not become an overdependence. There is no perfect energy source. Wind energy is cost-effective, but has suffered from intermittency and wind turbines can damage local wildlife. Solar energy, while an immense source of potential energy, suffers from possible pollution from the photovoltaic cells that convert sunlight into electricity, intermittency, conversion inefficiency and current storage technology shortfalls.

Source: CCAF

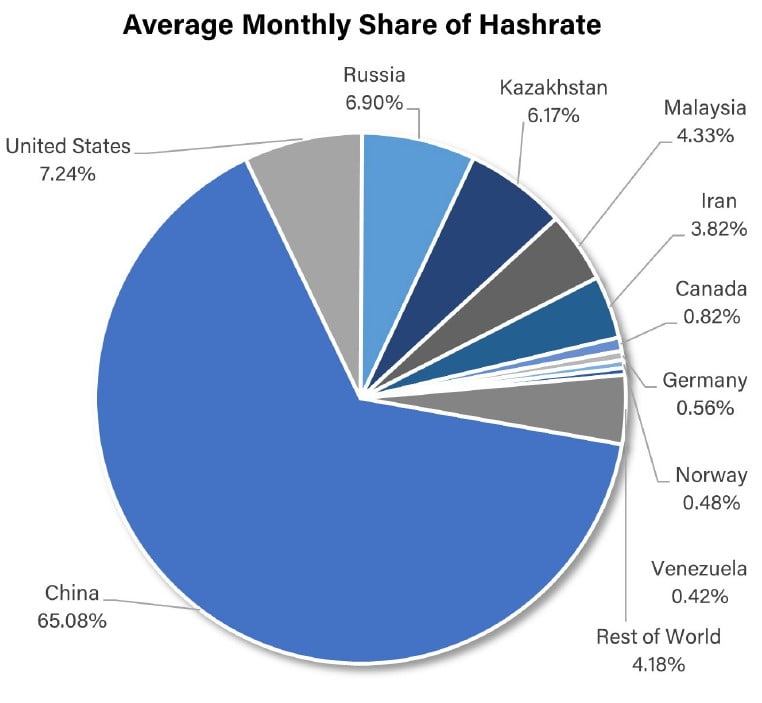

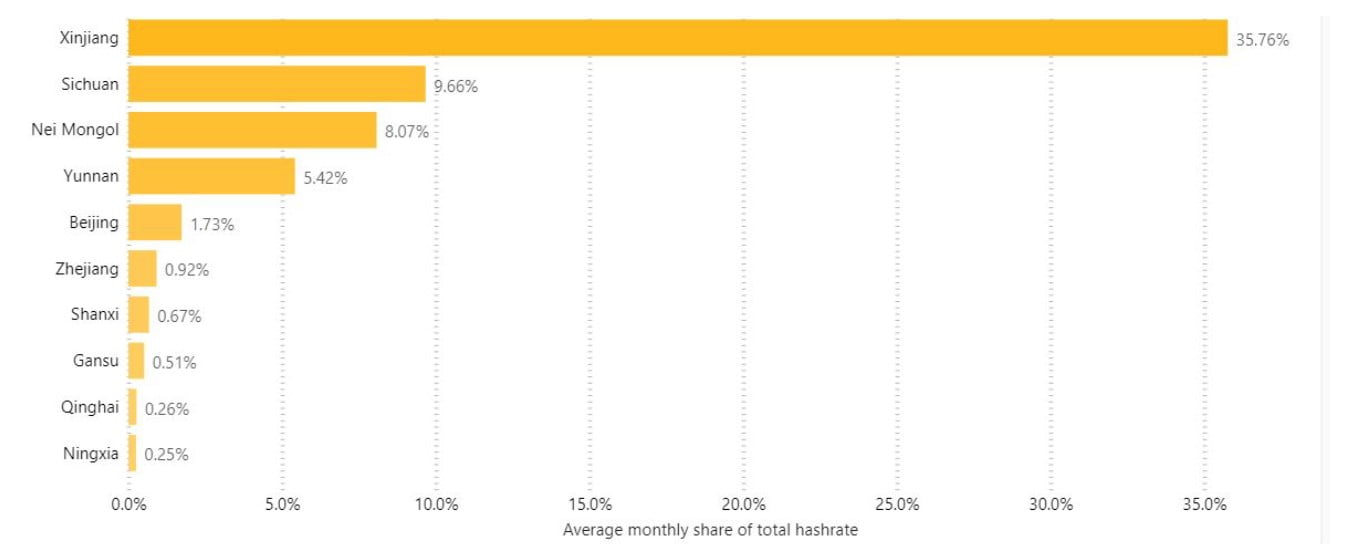

The second factor to consider is geography. The CCAF estimates that 65% of hashrate is in China, whose energy generation mix has historically skewed heavily towards coal.

To understand the potential implications of this going forward we should zoom in on the regional breakdown of Bitcoin miners in China (see page 9). 15% of mining occurs in Sichuan, Yunnan and Qinghai where the energy mix is mainly renewable (Sichuan, >85%; Yunnan, >90%; Qinghai, >80%).

However, Xinjiang and Inner Mongolia make up a meaningful portion of hashrate (see sidebar) and both have historically used cheap, plentiful coal power for energy production. In recent years, although mired in controversy for human-rights abuses (even tied to the renewable energy industry), Xinjiang has made meaningful strides towards renewable energy production. In Inner Mongolia, Bitcoin mining has been shut down. Under a scenario where miners relocate, miners will either settle in areas with excess hydroelectric capacity (given China has overbuilt its hydroelectric production capabilities) or in areas that mainly use coal energy, at risk of being relocated again if continued Chinese Bitcoin mining shutdowns occur.

Source: https://cbeci.org/mining_map

Source: https://cbeci.org/mining_map. Note: Use of VPNs to hide location may distort distribution

On its path to energy independence, China recognized the need to build out hydroelectric production capabilities since its coal reserves did not suffice. Building hydroelectric dams was also an effective means for bringing electricity to poor rural areas not connected directly to the power grid. China quickly and impressively overbuilt its hydroelectric production to the point where China is now worried about electricity surplus in certain locations. In fact, provinces in China reportedly waste a lot of potential hydroelectric power, especially during the wet season. Some 30 TWh goes unused in Yunnan and Sichuan hydroelectric production capacity more than doubles the capacity of its energy grid. This sets the stage for Bitcoin miners to come into these areas and use otherwise wasted energy.

China committed to lead the world in renewable energy development through its 2016 - 2020 Five Year Plan and planned to cap coal use to less than 58% of energy consumption; the United States depends on coal for ~19% of energy consumption as a reference point. While it remains to be seen if China will succeed in this, China is the world’s biggest investor in renewable energy and has consistently brought on the most new annual renewable energy capacity in the world since 2019. China’s most recent 2021 - 2025 Five Year Plan, strengthened the commitment by setting a 18% reduction target for carbon intensity and Chinese President Xi Jinping committed to achieve carbon neutrality by 2060.

While Chinese Bitcoin mining dominance has consistently trended down each quarter since 4Q2019, China still boasts two thirds of total hashrate, so substantial investment in mining equipment in other countries will need to occur to take market share from China.

That investment has revealed itself as of late as Bitcoin mining operations have sprung up or announced expansion with a focus on North America-based mining. In practice, Bitcoin miners typically participate in mining pools in order to smooth out income. Mining pools allow a lot of different miners to contribute to generating a block and the reward is then split among them according to their processing contribution. North American miners have historically used mining pools based in China, but this is changing as new mining pools emerge in North America.

North America too has historically depended on non-renewable energy sources, with 62% of energy generation coming from fossil fuels. To that end, North America has trended towards using more clean energy since 2010 and in 2016 the United States, Canada and Mexico announced the North American Climate, Clean Energy, and Environment Partnership Action Plan and committed to achieve 50% clean energy generation by 2025.

In the United States, the election of Joe Biden as President shifted the nation’s climate target in alignment with President Obama’s goal to achieve net zero greenhouse gas emissions by 2050. Biden also brought the United States back into the Paris Agreement after President Trump quite unpopularly filed for withdrawal in 2019. The administration’s policy commitments are ambitious which bodes well for sustainability efforts around the world given the size of the United States, both from an economic and energy consumption standpoint.

From a sustainability and environmental perspective, there is also commitment from industry participants to utilize clean energy for Bitcoin mining.

Argo Blockchain and DMG Blockchain Solutions, for example, launched a mining pool exclusively powered by clean energy. Gryphon Digital Mining recently raised $14 million to establish renewable energy-driven Bitcoin mining operations in the United States.

More broadly, the Crypto Climate Accord was launched by three non-profit organizations (Energy Web, Rocky Mountain Institute, Alliance for Innovative Regulation) in conjunction with 25+ corporate and NGO supporters, including some Bitcoin miners.

The Crypto Climate Accord is a private sector-led initiative focused on decarbonizing the cryptocurrency industry. Its goal is to transition all mining to 100% renewables. The Accord is not itself law, but it plans to engage with key policymakers to encourage the decarbonization of mining and has laid out a path forward for market participants to join.

While the Accord’s goals are lofty, its launch is certainly evidence that the industry is aware of its impact on the environment. Given the partnership with Bitcoin miners themselves, it is clearly not lost on anyone that mining will need to continue its move towards more sustainable energy production practices.

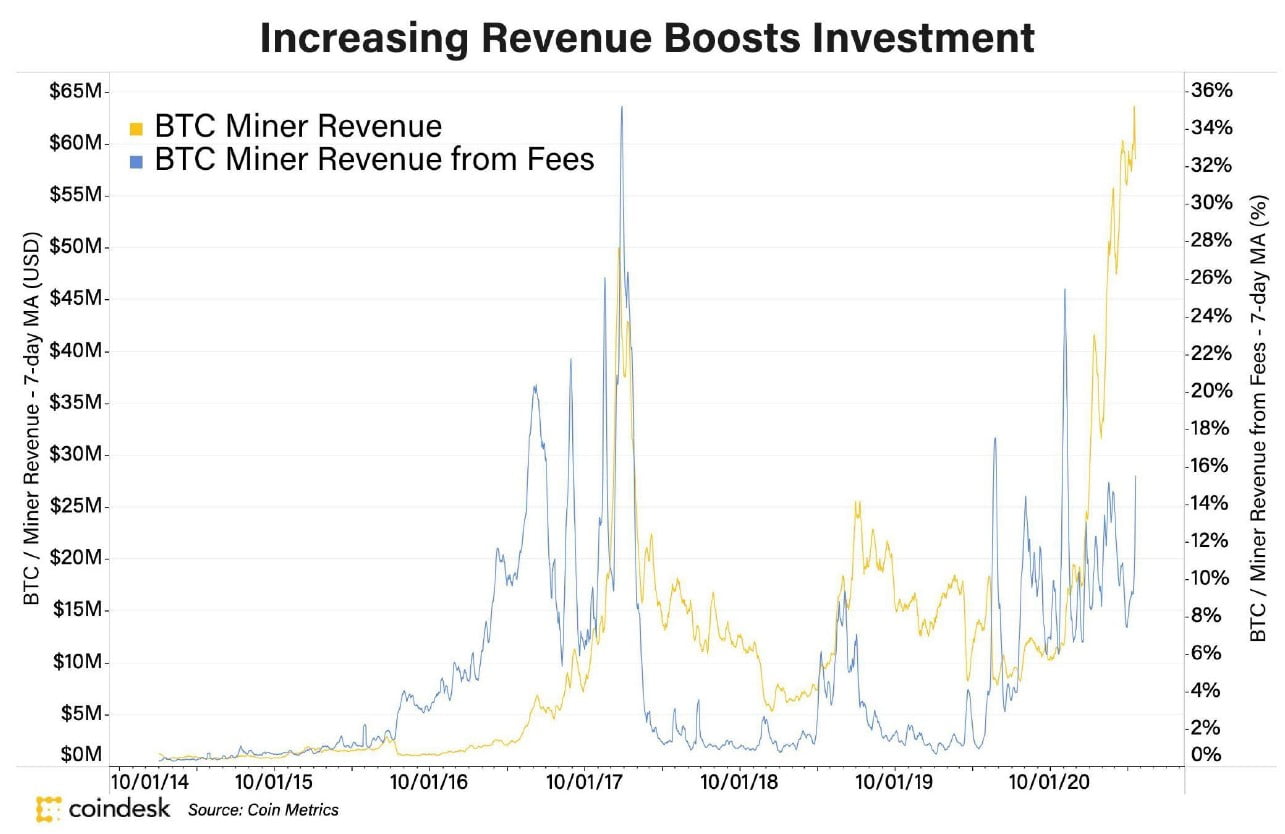

From an investment perspective, mining revenue reached an all-time high in March 2021 due to rising total fees as well as the bitcoin price (see chart below). Increasing revenue could lead to a couple of things. The first is more external industry investment, which in turn leads to improvements across all facets of Bitcoin mining. Second, increased miner income means miners are flush with cash reserves which could be utilized to improve miner efficiencies, grow footprint or expand clean energy use capabilities.

From a policy perspective, policy makers will act accordingly to make the energy mix cleaner, if they so choose. By way of example, a Bitcoin mining operation in Missoula, Montana was shut down at the request of the county commissioner since the miners could not meet a request to use a 100% renewable energy mix. Implementation of strong, sweeping policies in cooperation with industry participants would invariably lead to cleaner Bitcoin mining.

Bitcoin Mining Mobility & Bitcoin as a Battery

Another critical characteristic of Bitcoin mining is that miners only need access to electricity and the internet in order to set up a successful mining operation. Bitcoin mining is mobile.

For example, a miner could mine Bitcoin in a remote area with access to relatively cheap renewable energy that cannot be transported for use elsewhere. In this instance, the miner is using a stranded energy source. This could be economically impactful to communities near these stranded energy sources as they are able to monetize their proximity to cheap energy sources.

Given this, a mental model that is sometimes used among professionals in the industry is to call Bitcoin a battery.

At first blush, calling Bitcoin a battery may seem misleading. Bitcoin is not physically capable of storing energy. However, miners can take unused energy and convert it into bitcoin. Bitcoin stores value. Bitcoin is acting as a value battery since it is taking trapped energy and converting it into value. Bitcoin does not make energy transferable, it makes value transferable.

We can take “Bitcoin as a battery” a bit further. To set the stage, we need to acknowledge two realities.

First, Bitcoin mining is a free business to enter. Any innovation in mining that might make a miner more efficient than the rest will be short-lived. Bitcoin miner profitability is subject to the whims of the difficulty adjustment and price volatility. As such, the best way to stay consistently profitable is to control what you are able to control.

In this case, that is electrical and operational costs. Bitcoin mining margins are, as a result, relatively “capped.” As the price of bitcoin rises, the number of miners that want to enter the market to mine bitcoin increases. As miners enter the market, more energy is expended and the Bitcoin protocol adjusts and makes it more energy-intensive to mine bitcoin. If the price of bitcoin does not rise enough to offset, previously profitable mining operations must shut down as costs rise. As the market moves the other way, the opposite happens.

Second, Bitcoin mining occurs all day. Due to technology limitations and lack of insight into energy demand, energy companies are left estimating how much they need to produce for their customers. As such, there are periods when there is more energy available than is needed and supply outstrips demand. To compensate, companies vary the price of their electricity at different periods. Since Bitcoin miners run with capped margins, Bitcoin miners are a good candidate to use otherwise wasted or low-demand off-peak energy.

With these realities in mind, Bitcoin miners can act as a load-balancer by using excess electricity, that is relatively cheap, to mine bitcoin in order to purchase electricity for whatever use later whenever there is an energy supply and demand imbalance. Again, taking “Bitcoin as a battery” literally would again make Bitcoin a poor battery. Bitcoin does not store a unit of energy for use of the same unit of energy later. Rather, it is storing the value of a unit of energy for later use.

In this way, we can take the likeness further and call Bitcoin a load-balancing value battery. In the United States, in particular, there is an acute need for investment in the transmission and distribution (T&D) energy grid. As regulated utilities, energy companies are typically limited in both their means of generating revenue and the price they can charge consumers for energy. If energy companies build out a new revenue stream by setting up Bitcoin mining operations, then there will be more available capital to invest into grid and infrastructure improvements. As Bitcoin mining expands, so does the demand for off-peak energy and available investment for electrical grids.

Greenidge Generation in Dresden, NY is an example of a power plant that took advantage of this by expanding into Bitcoin mining as a means for an additional revenue stream. Greenidge transitioned from coal-fired power generation to natural gas in 2017. In 2019, it set up 7,000 Bitcoin miners and used its energy production capabilities to mine Bitcoin with its excess energy. Given the price of bitcoin was ~$5,000 when Greenidge began the mining operation, the company now markets itself as a Bitcoin miner with its own power plant and even merged with a public company in March 2021.

An additional benefit of Bitcoin mining’s mobility is the use of natural gas, which is primarily methane, at oil field sites to mine bitcoin. Part of the process of extracting oil leads to natural gas emission that needs to be removed in some way. It is usually not economically viable to transport the natural gas somewhere to be used. As a result, these gases have been historically burned (flared), or - even more environmentally damaging - released directly into the atmosphere (vented).

ESG policies directly target the amount of natural gas that can be emitted at oil fields. When natural gas is flared, the methane in the natural gas is broken down into carbon. Unfortunately, flaring operations can be inefficient at breaking down methane and, as we touched on earlier, methane is more polluting than carbon.

Companies like Crusoe Energy Systems, EZ Blockchain, Great American Mining and Upstream Data are taking advantage of an oversaturated natural gas market, the mobility of Bitcoin mining and the desire to reduce pollution by installing modular generator setups at oil fields which take otherwise flared or vented natural gas and efficiently turn it into electricity to mine bitcoin. This strategy makes energy producers more revenue-efficient and reduces their pollution footprint.

Lastly, a side effect of all this energy use that we have not touched on in this report is the amount of heat that mining operations emit. Bitcoin mining operations have popped up in Iceland, Russia and other cold climates to curtail the cooling cost associated with mining. It is currently possible, and may become practical, to decrease HVAC costs and reduce the price of heating homes in cold climates using the heat emitted by bitcoin mining. There are even reports of miners using heat emissions to warm greenhouses and chicken coops. We can look towards these innovations for a glimpse into future applications of Bitcoin mining activity.

Payment Processors & Bitcoin - Addressing a Potential Alternative

At the outset, we outlined why likening Bitcoin to countries was not particularly useful.

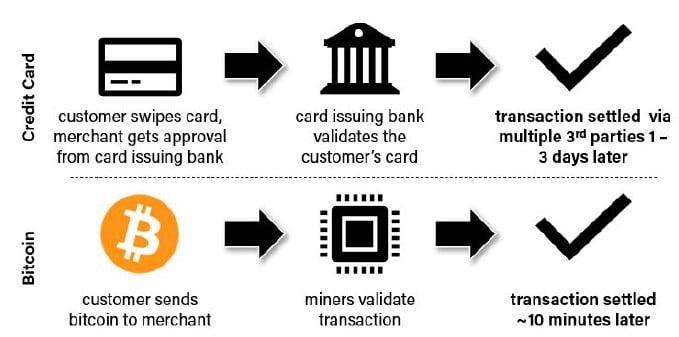

Similarly misleading are statements comparing third-party payment processors to Bitcoin. The argument is that third-party payment processors, like Visa, spend far less energy than Bitcoin does while also facilitating far more transaction volume. Visa uses a small fraction, ~0.25TWh versus ~125TWh, of the energy Bitcoin does and handles an average of 150 million transactions every day and is capable of handling more than 24,000 transactions per second, opposed to Bitcoin’s ~300 - 400 thousand. As with Bitcoin’s comparison to countries, this is incomplete due to two important factors: The actual energy used by Visa and the transaction scalability of Bitcoin.

First, the Visa payment rails are held up by much more than just the Visa technology stack. It is difficult to directly allocate how much energy Visa depends on to facilitate transactions since the currencies it transacts in are government-issued currencies. Visa’s success depends on the success of separate systems. Visa’s “token” is not native to its network. Without diving into the “war-machine” or “petrodollar” argument of U.S. dollar stability that is thrown around on social media, it is certainly the case that the Visa system is predicated on a lot more than just the system itself. If we could consider the energy use of various institutions and industries, the true cost of Visa makes up some parts of “Paper Currency and Minting”, “Banking System” and “Defense” energy consumption. Where Bitcoin diverges from that, and why proponents are so excited about it, is that Bitcoin’s payment network transmits native bitcoin tokens to settle transactions with finality, governed by the same rules and protocol. Bitcoin is more than the payment network.

Bitcoin is also the money that is transmitted.

Second, one transaction on the Bitcoin blockchain does not equal one payment. As Nic Carter puts it in a CoinDesk article titled The Frustrating, Maddening, All-Consuming Bitcoin Energy Debate:

“Bitcoin offers fast, high-assurance, final settlement. This means transactors can trust that value transfers are absolutely final within a short period of time. This permits Bitcoin to scale to enormous size – billion-dollar transactions are common and settle without incident… Bitcoin is therefore best understood as a high-integrity utility-scale settlement network, similar to Fedwire…”

The finality of Bitcoin’s settlement mechanism has served as a “first layer” on which to build a thriving, decentralized financial ecosystem.

Although the specifics of near-chain, side-chain, “second layer” and off-chain transactions are outside the scope of this report, the important takeaway is that one Bitcoin transaction might represent hundreds, thousands or millions of related transactions. Simply counting transactions at the “block level” or “first layer” of Bitcoin is an incomplete picture. Bitcoin is a simple system of value exchange that can transfer $10 billion of value just as easily as

$100 billion of value. The mechanism and system remain the same regardless of scale.

Conclusion

In this report, we outlined the environmental considerations for an investment in Bitcoin. Conversations around decarbonization and Bitcoin need to continue. On the surface, Bitcoin looks like a potential stumbling block to sustainability mandates simply due to its energy usage. Suggestions, however, that Bitcoin is plainly good or bad for the environment are misplaced.

Our overarching goal was to highlight that Bitcoin and ESG investment mandates are not diametrically opposed. An investment in Bitcoin could conceivably be considered an investment in ESG, given its potential impact on energy use and generation mix. Bitcoin already uses a good amount of renewable energy and a majority of miners have access to renewable energy sources. As political and environmental pressures mount, miners may shift towards using even more renewable energy. On top of that, as innovative techniques for powering Bitcoin mining enter the mainstream, energy companies can thrive by monetizing otherwise wasted energy. Bitcoin is helping to improve some aspects of clean energy capabilities. For that, ESG proponents should be optimistic.

We look forward to further research so that we can learn even more about Bitcoin’s energy use and carbon footprint. Lastly, we hope that this report spurs deep discussion around Bitcoin’s true energy cleanliness in boardrooms, on Zoom calls, in government halls and at dinner tables.

ANNEX: What is Bitcoin Mining?

Bitcoin is where the “blockchain” (the term “proof-of-work chain” was used in the original white paper) was first successfully implemented commercially. Mining is the “consensus mechanism” where the blockchain is made. We can think of miners as a bunch of computers that are connected to each other. These computers are application-specific integrated circuits (ASICs) computers customized for a specific use (in this instance, Bitcoin mining), that carry out mining via what is known as “hashing.” These computers are doing two things as they mine, 1) they are broadcasting or receiving information about transactions that are happening on the Bitcoin network and 2) they are validating that these transactions do not break the rules of Bitcoin. Miners bundle these transactions into a “block” while concurrently searching for a random number that satisfies the Bitcoin protocol’s rules. When a miner successfully finds a random number that fits the rules, that block is broadcast to the network and quickly validated. Once proved as valid, the block gets added to the current blockchain and the process starts again.

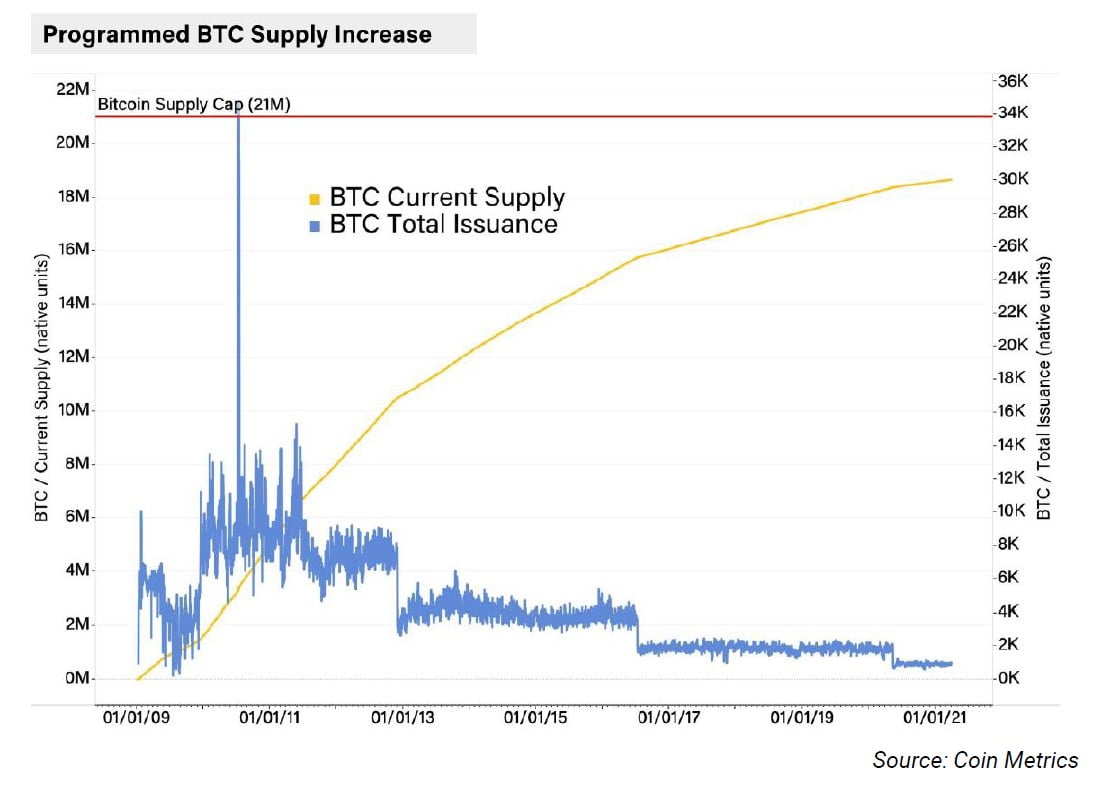

As a reward, the miner that processed the block gets transaction fees (a small fee individuals pay to have their transaction included into blocks) and what is called the “coinbase transaction.” The coinbase transaction contains new bitcoins, at time of writing 6.25 bitcoins per transaction (see page 17 for issuance trend).

Winning a block is also completely random. In fact, the Bitcoin protocol automatically adjusts to make it harder to win a block if a lot of computing power and energy is consistently thrown at it. As a result, the most likely way to win more bitcoin is to amass as much hashing power or “hashrate,” and therefore energy or work, as possible. Hence, the term proof-of-work chain. As the network grows and more power is put towards mining, it becomes prohibitively expensive to hack or attack the Bitcoin network.

Right now, we are in the “first phase” of Bitcoin mining. We will remain in the first phase until around the year 2140 when the 6,930,000th block is mined. Every 210,000 blocks (~4 years) the coinbase transaction is halved. The coinbase transaction started at 50 with the launch of Bitcoin in 2009 and recently moved to 6.25 in 2020. By the year 2140, the coinbase transaction will contain no new bitcoin and all bitcoins that will ever exist will have been issued and distributed. This “halving cycle” is why you may hear bitcoin described as “deflationary” or “hard-capped at 21 million coins.”

In the issuance trend you can see the three halvings that occurred in 2012, 2016 and 2020 that coincided with the drops in daily issuance.

When the coinbase transaction reaches zero, we enter the “second phase” where the only compensation miners will receive for validating transactions is transaction fees. What that means for Bitcoin is unclear. There will be many changes to the Bitcoin ecosystem in the next 120 years and the move to a zero coinbase transaction will occur slowly over four year intervals.

Article by George Kaloudis, CoinDesk