Blue Tower Asset Management commentary for the first quarter ended March 31, 2021, discussing their new position in Georgia Capital PLC (LON:CGEO).

Q1 2021 hedge fund letters, conferences and more

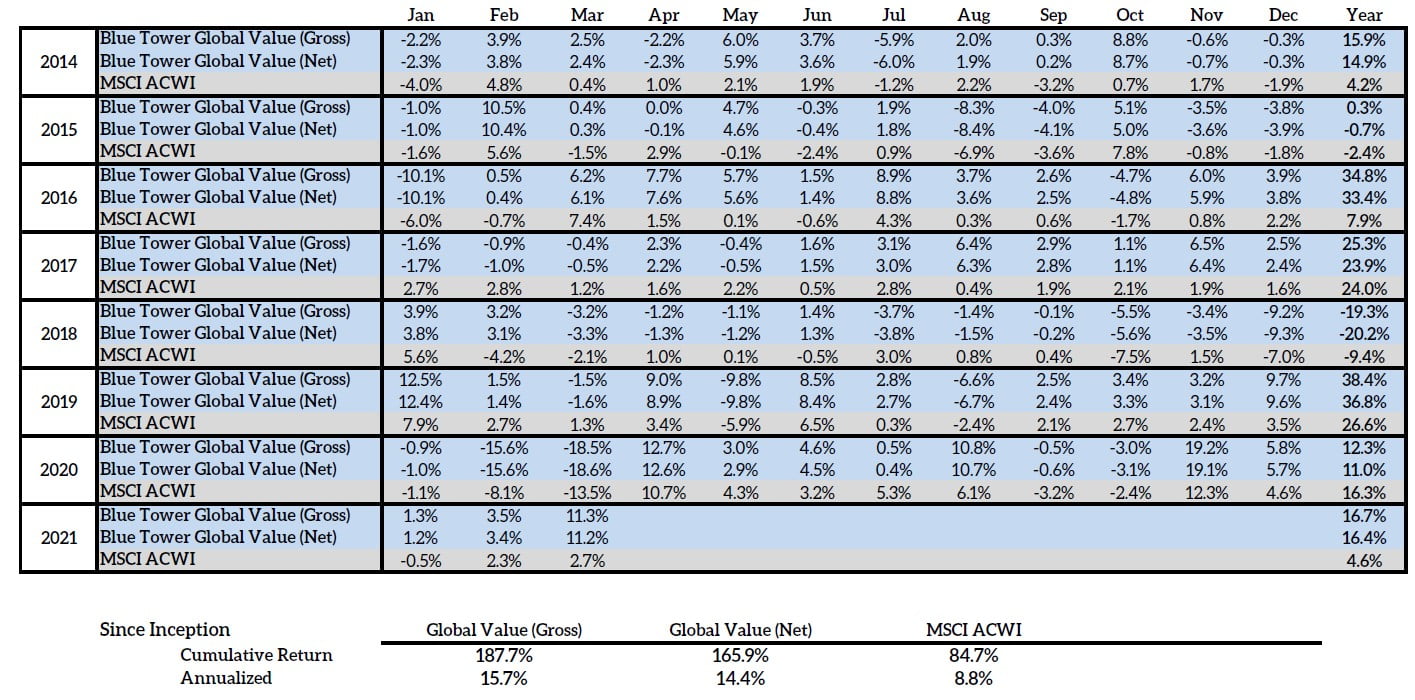

Our Global Value strategy began 2021 with a strong first quarter. Our composite delivered a gain of 16.41% net of fees (16.72% gross). In Q1, there was a movement of the market away from the highly valued speculative technology equities back towards “value” stocks.

In our previous letter, I discussed the management buyout of Joban Kaihatsu. The proxy vote was completed during this quarter and the management was successful in their tender offer to gain a controlling stake of the company. It is unfortunate to have to exit our position at this price as I believe the true fundamental value of the shares was even higher, but we are still making a profit from our average cost basis.

The greatest influence on the markets continues to be the coronavirus pandemic and the unprecedented government stimulus response to it. The vaccine roll out has been proceeding at a swift pace within the US and several other developed countries, and the daily new case count has been dropping in those countries. However, vaccine rollout has still been slow in most countries, and global supply chains continue to show signs of disruption and shortages. Prices of building-related commodities have been skyrocketing, with the price increases accelerating since the beginning of the year. Steel rebar prices have increased 21% YTD and 64% since the end of Q1 2020. Copper prices have increased 15% YTD and 68% since the end of Q1 2020. North American lumber prices have increased 29% YTD and 334% since the end of Q1 2020. It is important to monitor these fluctuating commodity prices due to the short-term effects it may have on some of our construction and industrial stocks.1

Overall, global equity markets remain quite volatile and irrationally priced. While some stocks appear to be trading in a speculative bubble, others can’t seem to catch a bid and trade at extremely low valuations.

In this environment, we will continue to invest based on our philosophy of seeking out quality businesses trading at bargain valuations. The volatility and economic disruptions of the current environment can create opportunities which we can take advantage. Some of these opportunities may be due to investment flows whereby sellers are dumping certain sectors, geographies, or other collections of companies creating value opportunities. These areas can then become attractive areas for investors, especially considering the currently high valuations among stocks in the United States.

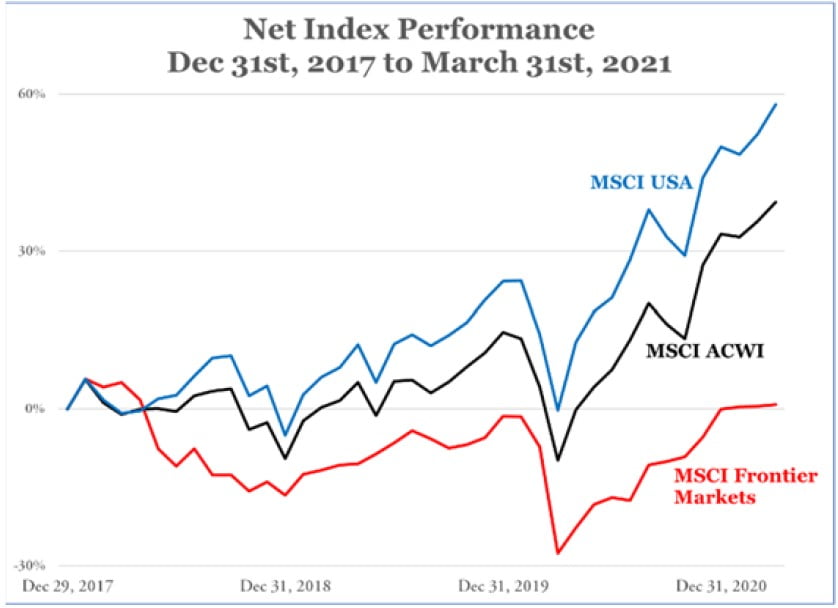

Frontier markets are countries that are generally considered to be less developed than the emerging market countries on the cusp of becoming developed economies. Frontier stock markets have underperformed overall markets in large part due to foreign investors pulling their capital since the beginning of 2018. This can be seen in the net asset flows for many prominent ETFs and mutual funds focused on frontier markets and overall index performance as seen below.

One company operating in a frontier market that recently entered our portfolio is Georgia Capital which we will examine in this letter.

Georgia Capital

Georgia Capital PLC (LON:CGEO) is a conglomerate focused on investing in business opportunities to be found within the Republic of Georgia. The shares are listed in the UK and trade on the London stock exchange. These investments can be either private market or listed shares, but the management of the company has indicated that they wish to keep the portion of their investments in listed shares to be no more than 20% of NAV.

The company was created through a demerger of its predecessor company, BGEO Group, into the Bank of Georgia and Georgia Capital. Georgia Capital continues to own 19.9% of the Bank of Georgia, which while a large investment relative to the rest of Georgia Capital’s portfolio is still small enough not to subject Georgia Capital to banking regulations. The demerger benefits the efficiency of the investment business by allowing alignment of incentives of management with the performance of the investment business, freeing the company from banking regulations, allowing investors to target exposure to just the investment business, and making it easier to raise debt.

As a former Soviet Republic, Georgia has undergone extensive economic reforms over the last thirty years. In 2014, legislation came into force which aimed to restrict the state’s ability to interfere in the economy and force referenda for tax changes. The Economic Liberty Act caps government expenditures to 30% of the GDP, debt-to-GDP at 60%, and budget deficit to 3% of GDP. Real GDP growth has averaged 4.8%/year over the last 10 years. In 2020, the World Bank ranked Georgia the 7th best country for ease of doing business and 7th best in protecting legal rights of minority interests.

Tourism has become an increasingly large portion of the Georgian economy. In 2018, 72% of Georgia’s service export revenue came from tourism-related activities2. The relative safety of the country, mild climate, and appealing Black Sea beaches have attracted many European vacationers, especially from Russia. The heavy reliance on tourism has been painful during a global pandemic, and the number of tourists entering the country in 2020 fell by 81% compared to 2019. The lack of travelers has caused a shortage of foreign currency and a weakening of the Georgian lari from 2.86 GEL/USD at the beginning of 2020 to 3.43 GEL/USD today. This 17% depreciation should be viewed in the context of the lari’s average inflation rate over the past 10 years of only 3.7%. The currency weakening has decreased the value of Georgia Capital as denominated in GBP or USD due to their locally-denominated financial assets in the country and foreign liabilities. Once borders reopen to travelers, we expect the balance of trade to be restored and the Georgian currency to regain its strength.

Conglomerate of Operating Businesses

The conglomerate discount refers to the phenomenon of stock markets to often value a holding company as being less valuable than the sum of its parts. In developed markets, these discounts are usually in the range of 6 to 12%. Often times in closed end investment vehicles, this reflects the markets view of the management being a poor allocator of capital or nonaligned with investor interests. It may also reflect confusion by investors of how to analyze the various segments of the business or views that the holding company imparts additional administrative costs on the business.

Georgia Capital currently trades at an extreme discount both compared to other conglomerates and to its own short trading history. The company has tried to combat the analysis complexity problem by offering a NAV calculator online which uses valuation multiples chosen by an independent third-party firm for its various portfolio companies. By their net asset value (NAV) calculation, the company currently trades at a discount of over 40%.

Bank of Georgia: Incorporated in the UK, the Bank of Georgia has operations in retail banking, payment services, corporate and investment banking, and wealth management. The bank also has significant operations in Belarus. Georgia Capital owns a non-voting 19.9% equity stake in the bank. The banking sector of Georgia is dominated by a duopoly of the Bank of Georgia and its competitor, TBC Bank.

Healthcare Services: Georgia Capital bought out the minority interest of the Georgia Healthcare Group through a stock swap in 2020 and reorganized it as their healthcare services division. The healthcare services business of Georgia Capital is the largest healthcare market participant in the country and accounts for 20% of the country’s hospital bed capacity. The division has 17 referral hospitals, 19 community clinics, and 15 polyclinics that provide both outpatient testing and medical treatment. They have a diagnostic medical testing business which includes the largest pathology and testing laboratory in the Caucasus region.

Retail (pharmacy): Georgia Capital has a partial 67% ownership of the pharmaceutical division which is both a pharmaceutical retailer and wholesale supplier. The wholesale business suppliers both hospitals and independent pharmacies. Within the Georgian pharmaceutical sector, they have a 33% market share by revenue.

Insurance: The insurance segment consists of a P&C insurance business (28% market share in the country) and a health insurance business acquired through the aforementioned GHG acquisition.

Renewable Energy: The company owns 70 MW of hydro power plants and 21 MW of wind farms development. Once developed, the projects are very profitable. The renewable energy segment has a 75% EBITDA margin.

Education: Georgia Capital has a majority stake in four private schools within the country. They will be developing new private schools under their 90%-owned Green School brand.

Regulated water monopoly: From the 2020 Annual Report: “the Georgian regulator increased the tariffs for our water utility business, translating into an approximately 38% growth in allowed water revenues for the 2021-2023 three-year regulatory period.” This increase of fees for their water utility will add roughly $50 million GEL (approx. £11 million GBP) to revenues per year, a material amount for a company of this size.

Other: There are five smaller divisions that collectively comprise 7% of the estimated portfolio value of the company. These are the Housing Development, Hospitality and Commercial Real Estate, Beverages, Auto Service, and Digital Services business groups. As Georgia Capital does not believe that these businesses have the growth or return prospects of their main portfolio businesses, they intend to liquidate or divest all of these businesses in the next 2-3 years.

Investment Allocation

Internal rate of return and multiples of invested capital over their projected holding period are the key metrics for Georgia Capital’s investment decision making. Return on invested capital (ROIC) should exceed weighted average cost of capital for all of their new investments. Portfolio companies that have non-core assets or assets with low ROIC are encouraged to divest of those assets in order to free capital for investing in superior opportunities. This can be seen in the recent sale of the HTMC hospital in 2020 which boosted the ROIC for their healthcare division.

Georgia Capital also sees the value of their own shares as their hurdle rate for new investments. The management will not make new investments if buying back shares is a better use of capital. Additionally, if the shares of the company are offering a lower return than the opportunity set presenting itself to management, they will use their shares as currency to purchase new portfolio companies or raise capital.

The management of Georgia Capital has aligned incentives with investors through large share ownership. Collectively, they have over 3% of the company either directly owned or through deferred share compensation. Irakli Gilauri, Chairman and CEO of the company, was previously CEO of the predecessor CGEO Group and before that was CEO of the Bank of Georgia. I think it is noteworthy and a possible indication of Georgia Capital’s growth potential that Gilauri, the CFO, and other managers from CGEO chose to dedicate themselves to Georgia Capital instead of the Bank of Georgia after the demerger despite the latter having a significantly larger market capitalization.

Valuation

Valuing a company like Georgia Capital is difficult due to the lack of suitably comparable companies, its short history as an independent public stock, the differing nature of their component companies, and the early growth stage of some of their private businesses. At Blue Tower, we typically value predictable businesses based on their forward rate of return (a summation of normalized free cash flow and normalized revenue growth rates). We will value this business in two ways. Firstly, using a modified version of the forward rate of return method that uses operating cash flow for private assets and net income for the bank. For this exercise, we would therefore be ignoring growth and capital expenditures. Secondly, using the same NAV method used internally by Georgia Capital.

Operating cash flow yield: Due to the varying nature of the portfolio businesses’ capital expenditure needs, we will use net operating cash flow instead of free cash flow, and use net income for the ownership interest in the Bank of Georgia. Georgia Capital’s private portfolio generated 376 million GEL in net operating cash flow. Taking 19.9% of the Bank of Georgia’s 295 million GEL of 2020 profit (as Georgia Capital owns 19.9% of the Bank of Georgia) gives us 59 million GEL. The combined bank net income and private portfolio operating cash flow is 434 million GEL. Using a 4.7 GEL to GBP exchange rate, we get a combined total of 92.4 million GBP which divided by market cap gives a 32% yield at the current share price of £5.95. Given the quality of the company, the high growth of the Georgian economy, and the current global investment opportunity set, we would be comfortable owning the company at a forward cash flow yield as low as 10% which translates to a share price of £19.31. If the country’s currency appreciates considerably against its neighbors, we may need to consider demanding a higher yield as this would make Georgia relatively less competitive going forward.

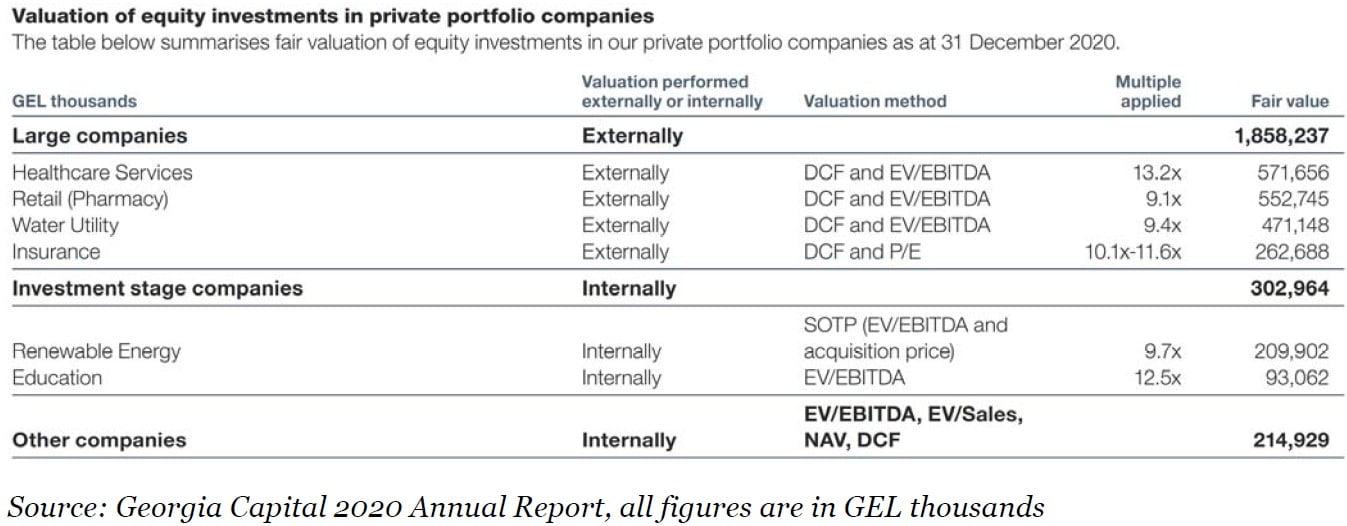

NAV: The chart below, taken from the company’s 2020 annual report, shows the valuation method used for private portfolio holdings by the management of the company to derive their NAV figures. For the minority interest in the listed Bank of Georgia, they use the most recent share price. As of the current BoG share price of £11.06, this translates to a portfolio value of 510 million GEL.

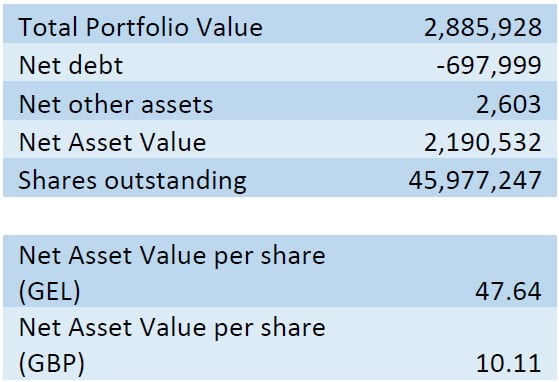

The above valuation multiples give us a NAV per share of £10.11, 70% above the current share price of £5.95.

Risks

The main risks to Georgia Capital are similar to those found in other businesses operating within frontier market countries. There is the risk of conflict with their neighbors as can be seen in the 2008 war with Russia over the breakaway provinces of Abkhazia and South Ossetia. Regional wars like that between Armenia and Azerbaijan last year will have negative effects on international trade and the tourism sector within Georgia. In addition to these external geopolitical threats, there is the danger of potential future internal instability which would disrupt businesses operating within the country.

At the operating business level, there are always pressures on margins posed from local competition. Georgia Capital was induced into divesting assets in the past when they were no longer generating acceptable returns on invested capital.

A loss of faith in the Georgian lari would severely impair the value of the Bank of Georgia.

It is my hope that this discussion of Georgia Capital illustrates the types of opportunities we are finding in the market today and how we analyze them.

Best regards,

Andrew Oskoui, CFA

Portfolio Manager