Starting a small business is a dream come true for many Americans. According to the Small Business Administration (SBA), there are 28.8 million small businesses in the country. Small businesses add 1.1 million new jobs to the market and help increase minority ownership.

Sign Up For Our Free Newsletter

Challenges For Small Businesses

While there are many benefits to small businesses, the COVID-19 pandemic brought challenges to all workforce sectors. But, it has been especially challenging for small businesses in the United States. Many have applied and received government assistance to keep their businesses alive, yet many unfortunately have had to close their doors permanently.

Having the funds and access to capital is an essential factor in the success of a small business. For many companies, the availability of small business loans made the difference between staying open and closing their doors.

AdvisorSmith, a leading resource for small business and insurance research, released its newest study that found the average loan amount for small businesses in the U.S.

The Average Loan Amount

To find the average loan amount, AdvisorSmith used data from the Federal Reserve’s Small Business Loan Survey. The survey applied to businesses with up to $5 million in annual sales and contained data reported by 105 lenders. The loans included in the study were commercial and industrial loans to U.S. nonfarm small businesses at the end of 2020.

To determine the average small business loan balance, AdvisorSmith calculated the average loan balance for term loans by taking the total loan balance divided by the number of outstanding loans.

AdvisorSmith found that the average small business loan amount for U.S. small businesses was $71,072 in 2020. The average loan amount varied widely based on the type of business borrower, the type of bank or lender, and the loan terms, with averages ranging from $5,000 to $2.2 million.

The study also found the average loan balance by loan type, alternative lenders, and Small Business Administration (SBA) loans.

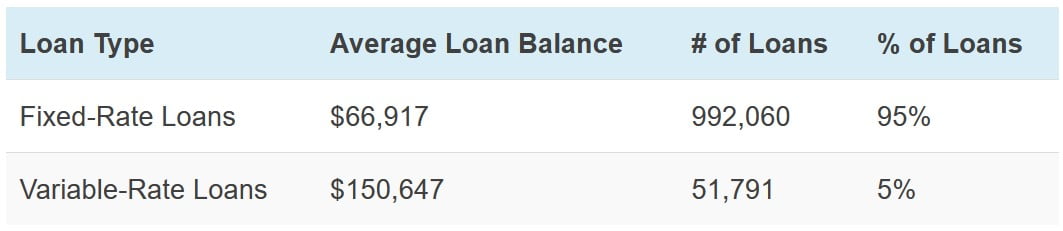

For loan types, the interest rate on small business loans can be either fixed or variable. AdvisorSmith found that the average loan balance for fixed-rate loans was significantly lower than that for fixed-rate loans for small business term loans.

The average balance for a fixed-rate loan was $66,917, while the average for a variable-rate loan was $150,647.

A Newly Popular Option

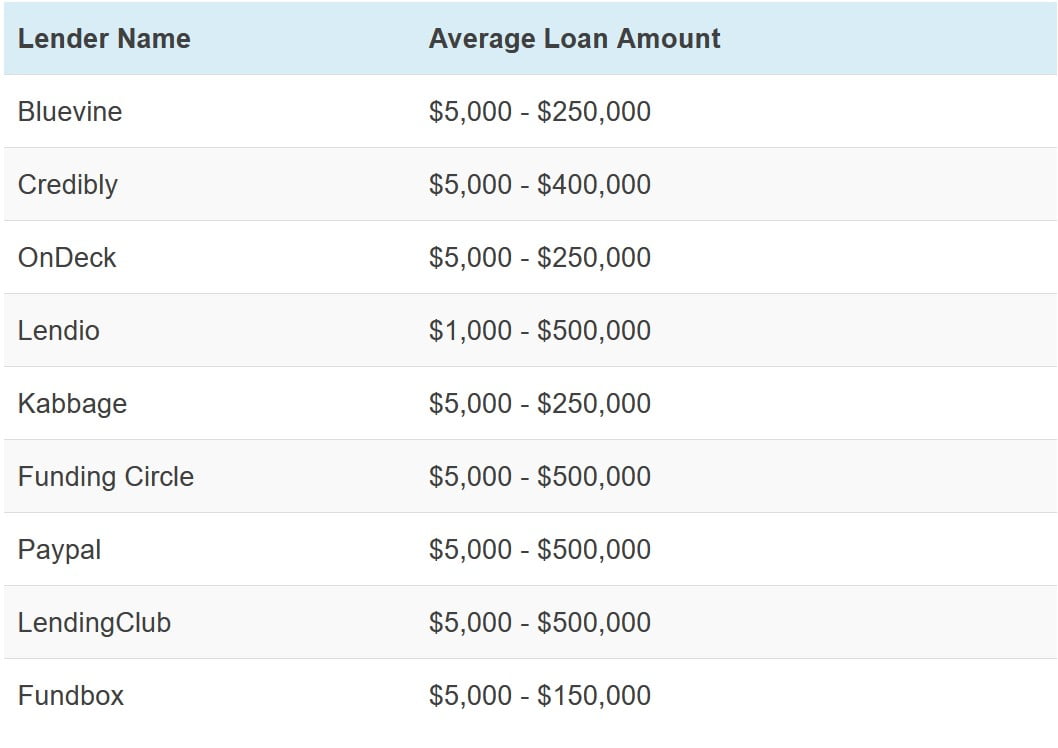

Alternative lenders are a newly popular option for small business loans. These lenders offer loans to small businesses with more flexible terms and, in some cases, quicker underwriting compared with traditional lenders. AdvisorSmith included a table where they listed several leading alternative lenders and the range of small business loan amounts available at these lenders.

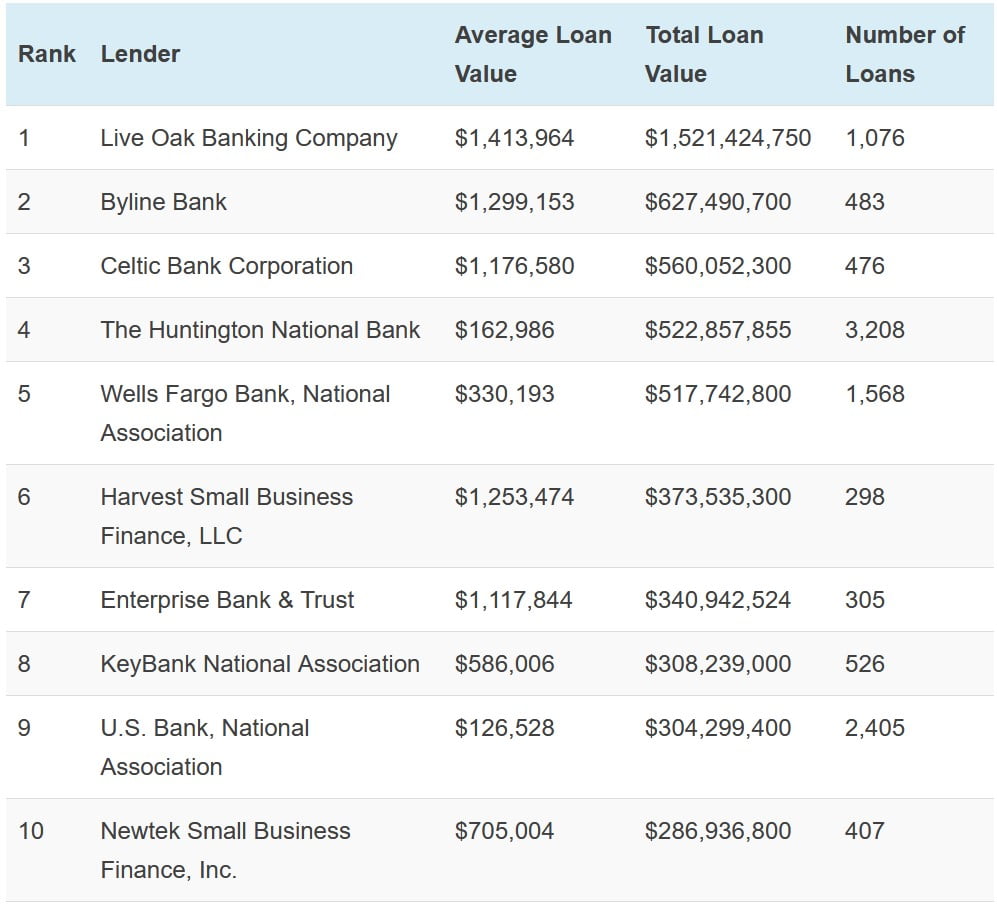

The U.S. Small Business Administration (SBA) also provides loan guarantees for loans to small businesses issued through banks. AdvisorSmith has included the top 25 SBA loan lenders in their study.

The average loan amount for loans guaranteed by the SBA 7(a) loan program was $567,599 in 2020. The SBA guaranteed 73.5 percent of the loan amount on average, or $417,567. SBA 7(a) loans have a maximum loan amount of $5 million, and the SBA’s full guarantee is $3.75 million, which is 75% of the maximum loan amount (for loans above $150,000).

To view the complete study and see the average for all loans, please visit https://advisorsmith.com/.