Avenir Global Fund commentary for the first quarter ended March 2021, discussing new additions to their portfolio Daito, Rackspace, and Alibaba.

Q1 2021 hedge fund letters, conferences and more

Dear Partner

The Avenir Global Fund (the “Fund”) generated a net return of 12.9% for the March 2021 quarter following the 13.9% return for the December 2020 quarter. Again, the March quarter performance was more than twice the market with the MSCI ACWI index (AUD) up by 5.9%. This brings the past 1-year return for the Fund to 46.0% (net)1 well in advance of the 24.2% return delivered by the MSCI ACWI index (AUD).

What A Difference A Year Makes

What a difference a year makes. This time last year the world was in lockdown and we were writing about stock market declines of over 30%. We said in our March 2020 letter that:

“As always, all members of the Avenir investment team are invested in the Fund alongside our investors, and while the current uncertainty and volatility can be very unsettling, we believe that the portfolio is currently trading at deeply discounted levels with the embedded margin of safety and prospective five-year returns as high as they have ever been.”

Despite our confidence in our portfolio, even we did not foresee the speed with which markets and, even more dramatically, the Fund, would bounce back. In the twelve months to 17th March 2021, the Fund increased by 66%, the largest 12-month gain in our history. This gain was despite currency moves providing a headwind of roughly 28% over the period.

It seems the pandemic was just a speed bump on the bull market highway with business as normal resuming and markets now back to all time highs. John Templeton famously said that “Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.” At the very least we are now in the optimistic phase and there are increasing signs of euphoria. We said in our December 2020 letter:

“So where are we now? Following on from our comments at the end of 2019, and despite a tumultuous year, the signs of excess and exuberance have only grown. While we don’t like to throw the term “bubble” around loosely, it is getting increasingly hard to avoid it.”

The March quarter only added to this feeling with some extraordinary market events. The retail investor mania, that had been growing for some time, exploded with the reddit chat forum (r/wallstreetbets) inspired short squeeze in the stock of GameStop, a traditional brick and mortar retailer of video games. The surge in the share price of GameStop, from about US$17 at the beginning of the year to a peak of $483 by late January, almost caused the implosion of the stockbroker, Robinhood, and caused catastrophic losses for several well-known hedge funds that got caught on the wrong side of the short squeeze.2

Then, market participants were fascinated by the implosion of the previously unheralded, and largely unknown, Archegos. Archegos is the family office of Bill Hwang who was formerly an analyst at Julian Robertson’s famed Tiger Management. Hwang then ran his own Asia focused hedge fund, Tiger Asia, before it closed after pleading guilty to criminal fraud. Hwang had built a personal fortune, now estimated to be as much as US$10 billion, but still felt the need to lever that up 5-7 times to invest in a highly concentrated portfolio of companies3 . The financial institutions lending him the money to do this included Goldman Sachs, Morgan Stanley, Credit Suisse, UBS and Nomura, each of which appeared unaware of the loans of the others and so unaware of the full, extraordinary extent of the leverage being employed in Hwang’s trades. Goldman Sachs appears to have emerged largely unscathed while Credit Suisse, Nomura, Morgan Stanley, and UBS have announced losses of US$5.5 billion, US$2.9 billion, US$0.9 billion, and US$0.8 billion, respectively, on their loans to Hwang. Hwang, himself, appears to have been wiped out financially when the trades turned against him.

Other indicators of potential market frothiness include record SPAC issuance of US$88 billion in the U.S. in the first quarter of this year5, and dramatic increases in retail participation in investing in cryptocurrencies such as Bitcoin and Dogecoin, often driven by nothing more than tweets or comments in T.V. interviews by people like Elon Musk.

These events make for entertaining viewing, but we have no intention of getting onto the field to join the fray. There is plenty of opportunity to make money without throwing caution to the wind nor by seeking the false comfort of the most popular and crowded trades.

While the market is likely to benefit, in the near term, from strong underlying economic growth and ongoing extraordinarily accommodative monetary and fiscal policy stances by governments around the world, we are less confident of the prospect for strong market returns over the next 5-10 years. Valuation matters and, on many metrics, equity markets are highly elevated. No-one has a privileged view of the future, but we can take guidance from the past and, for the stock market, good times follow bad, and, bad times follow good. From these elevated levels, markets have typically not delivered attractive returns over the medium-term. GMO have just released their latest 7-year asset class forecasts showing an annual decline of 7.3% for U.S. large cap equity over the next 7-years5.

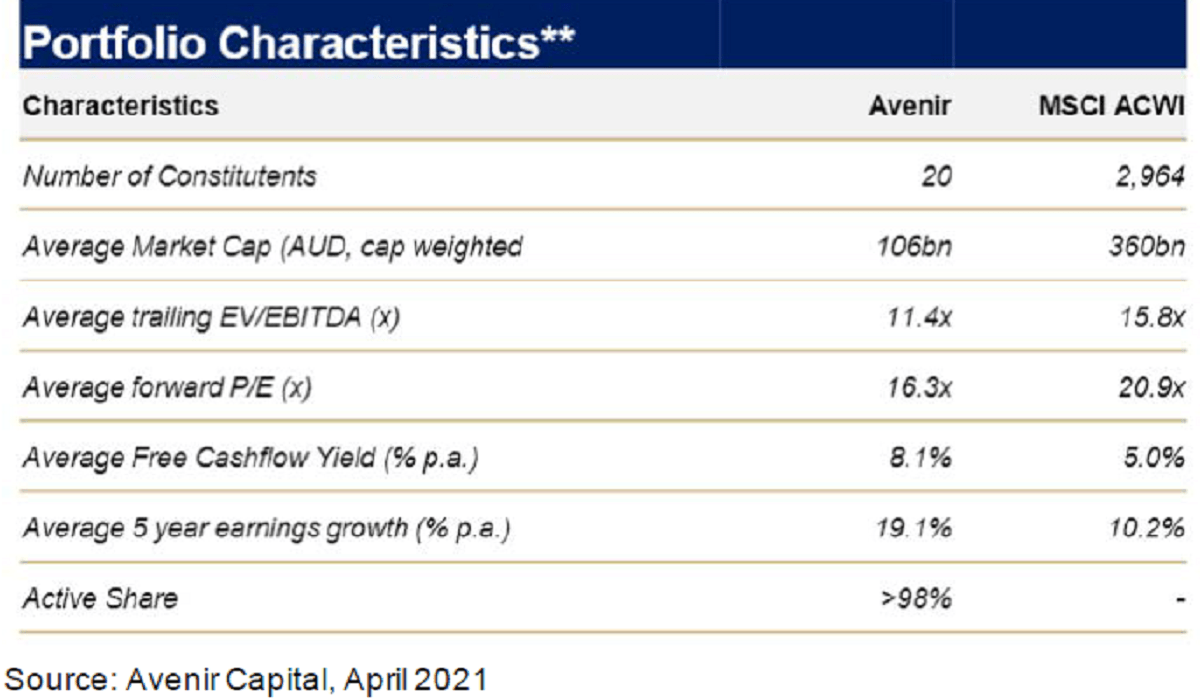

We think at a portfolio level, we can avoid that fate by continuing to selectively and patiently assembling a portfolio of quality, robust businesses that are available at attractive valuations due to temporary and solvable problems. As highlighted in the table below6 , the Avenir portfolio currently trades at a 38% discount to the market (on a free cash flow yield basis) despite having achieved annual earnings growth almost twice that of the market (19.1% vs 10.2% per annum) over the past five years.

We believe that the portfolio we currently own is well positioned to thrive no matter what the medium-term future holds for us, including the potential for higher inflation. Importantly, we remain confident that the Fund can deliver the types of returns that we have delivered over the past, almost, 10 years, regardless of the direction of the broader market over the next ten years.

The past twelve months have demonstrated two things that we have said repeatedly but, now, hopefully ring true. Firstly, we invest in high quality and, importantly, robust companies that provide stability of value. All of the companies we owned in the portfolio as at 1st January 2020, including those few we sold, have proven remarkably resilient with their share prices now either exceeding, or within shouting distance of, their 1st January 2020 share price despite the Covid pandemic providing the sternest test possible for these companies. Secondly, we offer a differentiated set of exposures to the broader market. In a market trading at elevated and, in some cases, extraordinarily expensive levels, that is a good place to be.

Top Contributors

General Motors

Our biggest winner was General Motors Company (NYSE:GM) which increased by 37% during the quarter. We have been arguing for the benefits of the cultural change that has been underway at GM for several years now, and how that is leading to a forward looking company intent on being at the forefront of automotive technology trends including electrification and autonomous driving. The market is now starting to see more obvious signs of those changes and rewarded the company with a share price that is up 120% over the past 12 months.

Bluegreen Vacations

Our next biggest contributor for the quarter was Bluegreen Vacations Corp (NYSE:BXG), a US vacation ownership operator that is benefiting from the “reopening trade” and the ramp up in vaccinations in the U.S. leading to expectations of a world returning to more normal patterns of behaviour. BXG ended the quarter up 36% and has increased 124% over the past twelve months.

ECN Capital

The third biggest contributor for the Fund in the quarter was ECN Capital Corp (TSE:ECN) (OTCMKTS:ECNCF) which rose 21% over the period. ECN Capital continues to deliver strong operating results and is a beneficiary of the increased housing related spending underway by the U.S. consumer who is currently working their way through the recent US$1.9 trillion stimulus package. ECN Capital continues to gain market share in a growing underlying market and still trades at less than 11x the earnings we expect the company to generate next year. ECN has been a strong performer for the Fund having more than doubled in value in the 2.5 years we have owned it.

There were no material detractors for the quarter.

New Additions

We added three new companies to the portfolio in the recent quarter.

Daito

Daito Trust Construction Co Ltd (TYO:1878) (OTCMKTS:DIFTY) is a Japanese build-to-rent homebuilder with a very distinguished record of compounding shareholder value over a long time. The company’s share price is down almost two-thirds from its 2018 highs, a trend that was exacerbated in 2020 due to Covid. The company suffered over the past few years due to regulatory changes that stimulated demand in their market but also led to an influx of new short-term operators into the build-to-rent industry and a lowering of overall industry standards and behaviour. Daito was not implicated in any of the bad behaviour but a regulatory crackdown and tighter lending standards by banks led to a shakeout of the industry with Covid providing the coup-de-gras for numerous smaller operators. We think that Covid will provide long-term benefits to Daito due to a more favourable industry structure now that weaker competitors have been forced out of the industry. At our purchase price, Daito was trading at >11% free cash flow yield and 40% below its normal trading range. The company earns stellar returns on capital of >60% and has a dividend payout ratio of 50%.

Rackspace

Rackspace Technology, Inc. (NASDAQ:RXT) is the only U.S. pure play, publicly listed multicloud service company that helps companies develop and implement their multicloud strategy. Rackspace provides an interesting investment opportunity as it went through a material transformation under private equity ownership, after having been a public company, before being recently returned to the public market. We believe that the market has not yet fully appreciated the transformation from a capital intensive company, engaged in a futile head-to-head competition with Amazon Web Services (AWS), to an asset light company that benefits from the tremendous growth in the cloud (in particular, the multicloud space) while working cooperatively with AWS, Microsoft Azure and Google Cloud.

Apart from the benefits from the business transformation, the company earns roughly $1 per share in free cash flow more than its book earnings per share helping to create an interesting pricing opportunity. The company is delivering strong growth in bookings in a massive and rapidly growing market and, along with some debt paydown, should see rapid growth in free cash flow per share over the next few years. At our purchase price we paid roughly 10x our anticipated free cash flow (FCF) per share in 2022 and we anticipate FCF per share to grow strongly from there.

Alibaba

Alibaba Group Holding Ltd (NYSE:BABA) was added to the portfolio as the company suffered from the fallout of the Chinese governments attack on founder, Jack Ma, and a general increase in government scrutiny on the Chinese mega cap tech companies. Sentiment turned negative on Alibaba following the cancellation of the late 2020 planned IPO of Ant Group (30% owned by Alibaba) following some public comments by Jack Ma that were not well received by the authorities. While both Ant (in particular) and Alibaba can expect tighter regulatory oversight, which is likely to reduce growth opportunities, Alibaba is still a formidable company that is still growing very strongly. Given the increasing tension between China and the western world, we do not think the Chinese government has any interest in destroying Alibaba as it is needs technology companies like Alibaba to ensure China remains competitive in the global technology race which is even more important to the Chinese government than their desire to silence Jack Ma.

As an illustration of the pricing opportunity we see in Alibaba, investors often liken Alibaba to Amazon. Amazon has been crowned as an enormous Covid winner with its share price increasing by 80% since the beginning of 2020. Alibaba, on the other hand, has only seen a 5% share price appreciation over that period despite, presumably, benefiting from many of the same changes in consumer and corporate behaviour that benefits Amazon. The two companies are not the same and the competitive dynamics in their markets in the U.S. and China are not the same, but other Chinese tech heavyweights like Tencent and JD are up 65% to 100% since the beginning of last year suggesting that the “Jack Ma discount” which, at the low end of this range, equates to roughly US$400 billion, maybe unduly wide for Alibaba.

Our private equity heritage encourages us to view every investment we make as if we are buying the whole company. This helps to keep our focus on the quality of the underlying business, its long-term prospects and the price we are being asked to pay, rather than trying to speculate as to what the market or individual company prices may do over the short-term.

In a market that is increasingly displaying some behaviour that can only be described as ‘exuberant’, we are still finding what we regard as quality, long-term and differentiated investment ideas that can help drive attractive returns without undue risk of permanent loss of capital. The team at Avenir remain excited and confident about the opportunity set we are seeing and look forward to the future with enthusiasm.

“I believe that the present, accurately seized, foretells the future.” - V.S. Naipaul

Adrian Warner

Managing Director, Avenir Capital

- Performance figures refer to the Avenir Global Fund – Class A launched on 25 August 2017. Returns are calculated after fees have been deducted and assume distributions have been reinvested. No allowance is made for tax when calculating these figures. For full performance figures please see our website at www.avenircapital.com.au. Past performance is not a reliable indicator of future performance. Source: Fidante Partners.

- For example, Melvin Capital suffered losses of 53% in January alone amid the record rally in GameStop shares, which the fund was betting against. GameStop: Hedge fund Melvin Capital lost more than 50% in January (cnbc.com)

- Inside Archegos’s Epic Meltdown – WSJ

- https://www.businesswire.com/news/home/20210407005635/en/ICR-the-Leading-SPAC-Advisor-Publishes-Q1-2021-SPAC-Market-Update.

- GMO 7-Year Asset Class Forecast: 1Q 2021

- Source: Avenir Capital analysis; Style Analytics.