From the book THE HYPE MACHINE: How Social Media Disrupts Our Elections, Our Economy, and Our Health-and How We Must Adapt by Sinan Aral. Copyright © 2020 by HyperAnalytic, Inc. Published by Currency, an imprint of Random House, a division of Penguin Random House LLC. All rights reserved.

Q3 2020 hedge fund letters, conferences and more

The Attention Economy

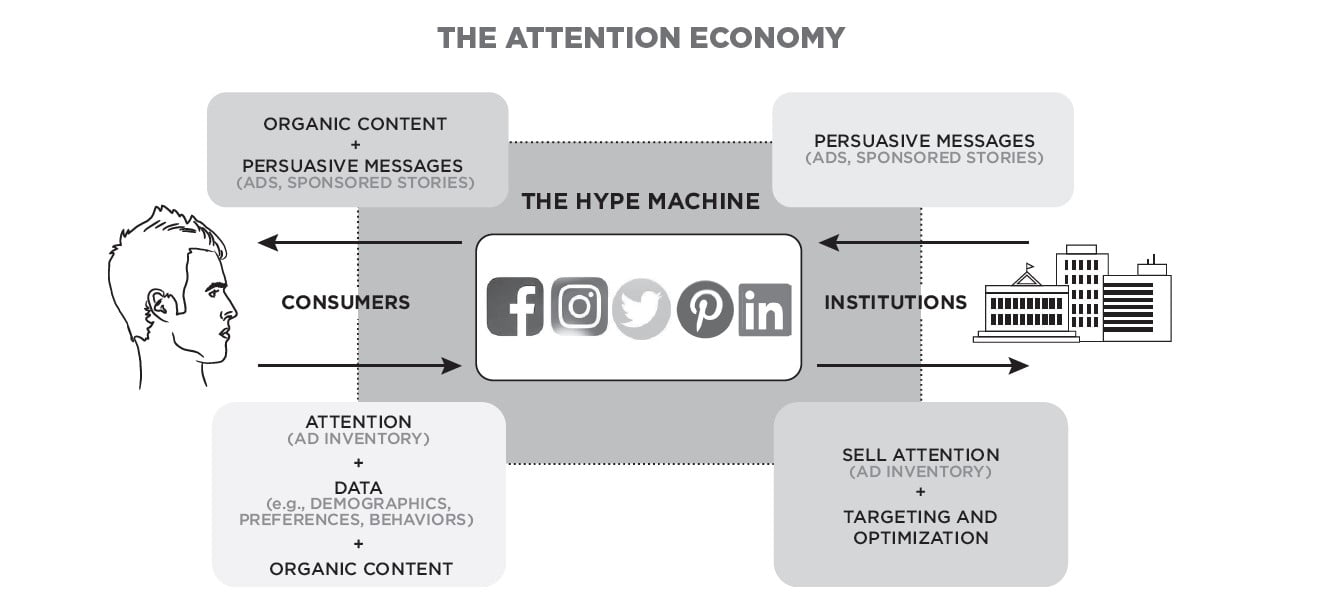

Attention is valuable because it’s a precursor to persuasion. Platforms like Facebook, Twitter, and YouTube provide connections, communication, and content to get consumers’ attention. They then sell that attention to brands, governments, and politicians who want to change people’s perceptions, opinions, and behaviors with ads. The amount and quality of the platforms’ ad inventory - the units of advertising they have to sell - scales with the number of consumers they serve and how engaged those consumers are with the content the platforms curate (Figure 9.1). That’s why the platforms are obsessed with (and why their market valuations depend on) user growth (the increase in the number of users on a social platform) and engagement (the frequency and intensity of users’ interactions with social content and features).

Figure 9.1 The structure of the attention economy. The social media platforms that make up the Hype Machine serve as intermediaries between consumers and institutions (brands, governments, nonprofits, and small-business advertisers) delivering content and persuasive messages to consumers and selling consumers’ attention to institutions, in the form of ad inventory, as an opportunity to persuade them to change their behavior, as well as targeting and optimization services to improve the effectiveness of the institutions’ persuasion.

When we were building Humin (my second startup, which we sold to Tinder in 2016), we were obsessed with analytics. We built a dashboard to track all the key metrics describing the growth and use of the platform around the world. To keep our team informed, we installed a large TV monitor in the most central spot in our San Francisco office, right across from the kitchen, where everyone would congregate during breaks from coding. The monitor cycled through screens summarizing what was happening on the platform in real time - the number of times the app was downloaded, user retention, connections between users, conversations, profile opens, searches. But the two metrics that were the most critical for managing the business were user growth and engagement. We didn’t sell advertising, and we didn’t share users’ data, but our market valuation depended completely on how fast our user base grew and how engaged consumers were with the app. These two numbers summarized how many people’s attention we had and what fraction of their attention we commanded every day. That, in essence, determined how much we were worth.

Value Of Ad Inventory

In ad-driven businesses, the more users an app, platform, or publisher has, and the more time their users spend with them, the more ads the app, platform, or publisher can show: in marketing-speak, the more ad inventory they have to sell. But not all ad inventory is valued equally. It’s priced, sometimes by auction and sometimes through direct sales, according to who the ad will be shown to, the page on which it will be shown, the time it will be shown, where on the page it will be shown, what type of ad it is (for example, a video interstitial ad, a newsfeed ad, or a banner display ad), and so on. Different platforms fetch different prices for their ads as well. For example, Facebook can charge higher per-click prices for its ads. (An advertiser typically pays for an ad only when it’s clicked on, known as the “cost per click,” or CPC, pricing model.) Twitter’s prices, by contrast, are lower. And Snapchat’s cost per click is somewhere in between - it can charge more than Twitter because it attracts coveted millennials more than other platforms. So the price of attention varies by platform.

Gary Vee exploits this price variation. As he describes it, he’s built his career on investing in “underpriced attention.” His ability to sell books and high-priced marketing services to brands, sports stars, and musicians depends on his ability to garner attention (and to leverage that attention to achieve his clients’ aims). So beginning in the 1990s, when he took his father’s wine business online and grew its annual revenue from $3 million to $60 million, he looked for underpriced access to consumers’ attention and favored the cheapest and most effective channels to get it.

At the time, the cheapest attention was available through email marketing, so he invested in email to drive his business. Then prices and effectiveness changed as new platforms and social services, like Google and Facebook, came online. To grow their own businesses, new platforms like Google initially underpriced their attention. So Gary Vee invested his marketing dollars in Google. As it became established, the price of Google’s attention increased, and even newer services, like Twitter and YouTube, came online. So when their price of attention was lower, Gary poured his money into those platforms. Now he’s touting TikTok as the next attention gold rush. He says he has no particular affinity for any channel—he’s “platform agnostic.” He simply engages in attention arbitrage. “I’ve built a career on exploiting underpriced attention. Email marketing in ’97, Google AdWords in 2000, YouTube in ’06, Twitter ’07, Snapchat,” he says. “That’s my career.”

Ad inventory is also differentiated by a platform’s ability to target its persuasive messages at the right people - the people they are intended to persuade. If, for example, a politician wishes to persuade conservatives, aged 35 to 45, in specific districts of a particular state, with a message about gun rights, the platforms that can most accurately identify 35-to-45-year-old gun enthusiasts in those districts are more likely to attract ad revenue and be able to charge a premium for their ads. So platforms that can most effectively target ads at the right people, and brands and marketers that understand targeting, have a competitive advantage. This ability to microtarget persuasive messages—to direct ads at narrower and narrower categories of consumers—depends on the quantity and quality of the data that social media platforms collect about the demographics, opinions, behaviors, psychological profiles, locations, and social networks of their users.