Argosy Investors commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

Dear Investors,

Year-to-date 2021 performance was 16.5% in select accounts. The S&P 500 by comparison returned 15.3%.

I am thankful for our good fortune so far this year, but I remain surprised that the portfolio did not take a breather (giving us an opportunity to add to some of our favorite holdings). I try to focus on the businesses we own, but feel a responsibility to share some thoughts on current events and their potential impact on the portfolio.

Inflation is the topic on everyone’s minds, and with good reason. Everything from lumber to various meats to shipping containers have all seen large price increases. Other items like computer chips for vehicles have been in very short supply. Every fast food restaurant and manufacturing company has “Help Wanted” signs placed prominently outside their stores, accompanied by sometimes massive bonuses for simply working for a minimum wage. So naturally inflation is set to increase for several years, correct?

I believe the material shortages are not long-term in nature because the forces driving them are artificial, in my opinion. The massive fiscal and monetary stimulus pumped through the U.S. economy is a one-time stimulant that once it runs its course will revert to a more normal pattern of consumption. How the labor market evolves is less clear.

There are reports of older workers retiring en masse and many millions of people have changed jobs or even industries. Finding workers now is very challenging, and while some of that impact could be attributable to generous unemployment policies, I don’t believe all of it is. Relative to the overall workforce the remaining unemployed population is not significant enough to explain the dramatic move in compensation I am seeing. Factories and fast food chains are offering $2,000-5,000 bonuses for individuals willing to make the “long-term” commitment of one year. In short, I believe wage inflation is likely to persist beyond the end of this pandemic, which echoes research I shared in the letter of one year ago.

So how are our largest holdings affected in a world of higher wage inflation? As a general rule, I will evaluate current and potential future holdings on their capital intensivity and their ability to raise prices. Trisura, Dream Finders, Facebook, Amazon, and Vizio are now our top 5 largest equity holdings. Trisura, as a large surety insurer, could see higher risks of contractors failing to execute contracts due to labor shortages or losses from inadequately priced contracts. Their fee-based business is less likely to be directly impacted because their fee is a percentage of total premiums written (assuming premiums experience inflation of some sort).

Dream Finders is a homebuilder and is likely to need to increase wages to continue their growth. Failure to do so could lead to slower growth and unhappy customers, while raising wages will likely reduce their gross margins. Hopefully they can price their houses to maintain EBIT margin dollars at levels they would have achieved with higher gross margins, but homebuilding is competitive so I’m not terribly optimistic. Additionally, if wage inflation leads to more general inflation, interest rates are a significant input into the home buyer’s ability to afford a house. If interest rates increase, even a little bit, from current levels, home buying and thus homebuilding activity would probably slow down, perhaps dramatically.

I am probably least concerned about Facebook’s ability to thrive during an inflationary period. Because they are so efficient with capital, the market for IT programming labor is already fiercely competitive, and their advertising offering is considered to be very effective (and underpriced for its value), I think Facebook should weather any kind of inflation fairly well.

Amazon is a more complex story. Their AWS business is largely a similar story to Facebook. Their first-party retail business is very asset- and labor-intensive given their extensive warehousing footprint. I think Amazon would have more pricing power than any other player, and despite being one of the largest employers in the US, bricks-and-mortar retail is likely still more asset- and labor-intensive than Amazon’s ecommerce footprint. With all that said, overall Amazon’s first-party business would be adversely impacted by inflation, but the combination of Amazon’s AWS and advertising business should provide fairly robust inflation protection.

Vizio, a new position this quarter, could be negatively impacted in producing its low-margin TV’s, although wage inflation might be a lower impact event than any material shortages such as on computer chips. Their advertising business should be fairly well-insulated, but given their relatively minor position in the Connected TV market today, they may have less ability to raise advertising prices than industry leaders like Roku may be able to.

Inflation is a serious concern given the current valuation of the market. Market prices have been justified for years as “cheap given the interest rates”, or “There is no Alternative (TINA)”. The portfolio is not somehow immune to broader movements in the cost of capital. If inflation (and interest rates) are higher 3 years from now, the portfolio would likely be negatively impacted. Owning high-return on capital businesses with strong growth rates best position the portfolio to weather any period of inflation.

Existing Portfolio Activity

Element, Molson Coors, Colliers, Endava, Wells Fargo

I trimmed our stakes in ESI, TAP, CIGI, DAVA, and WFC during the quarter. Each of these had appreciated significantly since purchasing and I considered none of them except DAVA a core position at this time, though I would like to buy more CIGI and perhaps ESI in the future.

Both CIGI up (+69% from August 2020 purchase to sale) and ESI (+94% from early 2019 purchase to sale) are run by major shareholders who have created a lot of value over time, so I may revisit them in greater size at a later date. DAVA has been a huge winner for us, up 279% from Feb. 2019 purchase to sale. I struggle to sell these, but my valuation discipline makes it hard not to. Endava's business, for example, has not grown 279% in 2 years, not even close, so it is now valued at a high multiple, and we may continue to sell if the valuation continues to climb.

TAP (+52% from August 2020 purchase to sale) and WFC (+91% from October 2020 purchase to sale) were never intended to be core positions. I expected WFC could hit $60 in a number of years, but it got to the high $40’s in less than a year. It seemed like a good time to trim. Same goes for TAP. I expected a couple of years of deleveraging and perhaps some excitement around the hard seltzer category, but the stock price increased faster than I expected. I have not fully exited these positions as I rarely do all in one trade, but hopefully this gives some perspective into my thinking on selling so quickly.

KAR Auction Services

I went over my reasons for upping the ante on KAR in last quarter’s letter. Why am I now selling? I made a mistake of judgment. KAR’s business is challenged, and the IPO of ACV Auctions revealed their advantages compared to KAR. As a result, I sold, and of course the stock promptly went up almost 20% after a not-so-bad quarter. The short-term price action is fun to joke about, but when I see a stock that I already knew was facing secular growth challenges getting its lunch eaten by a fast-growing new upstart from Buffalo, NY, not exactly a hotbed of innovation, I decided to exit stage left. We will only know with hindsight whether this choice was correct or not, but I will definitely be watching ACVA’s progress relative to KAR.

CBOE

I sold CBOE during the quarter because I have been trying to trim ideas that are no longer great values or I simply did not believe I would ever make the position meaningful. This exercise to rationalize the portfolio to allow greater concentration is ongoing. In any event, there was nothing wrong with CBOE except that I did not have strong conviction in it, and I have been finding other ideas that I find more compelling so I kicked this stock to the curb to make room for others.

New Portfolio Activity

Ferguson

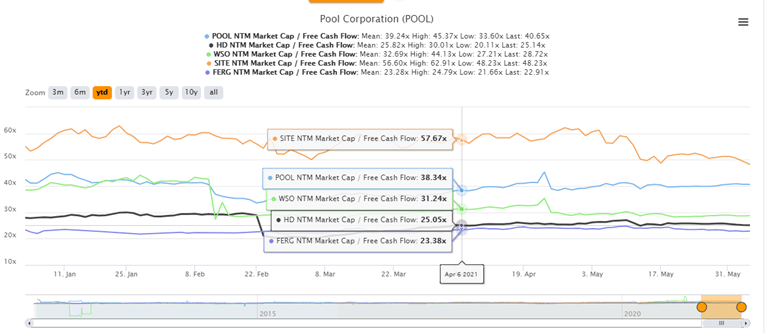

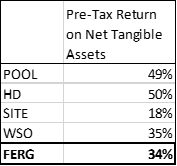

We generally like the distribution business, particularly when it is a many-to-many market structure. The two “many’s” are suppliers and customers. When there are many suppliers and many customers, neither one has significant negotiation power, and there is a natural role for a distributor that can aggregate the supply of suppliers and the demand of customers all in one place. Some of the best businesses of the last 20 years have been distributors. Companies like Home Depot and Lowe’s in home improvement, Pool Corp in pool supplies, Watsco in HVAC distribution, and SiteOne in Landscape Supply are just a couple of examples of strong distributors in their respective niches. The challenge with all of these businesses is everyone already appreciates the strengths of their businesses, as reflected in their valuations. Many trade for over 30x FCF, while FERG trades at 23x.

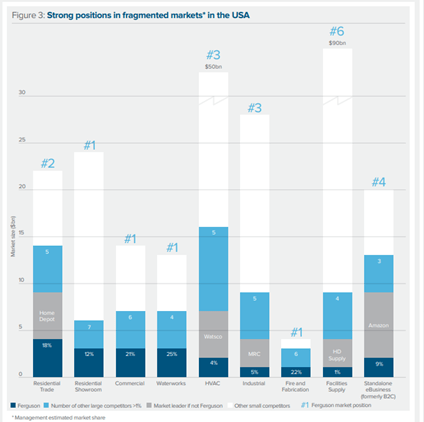

I believe Ferguson deserves to be among that list of distributors in at least some of its focus areas shown below. They have significant market power within many of the segments in which they compete, with >20% market share in several segments, and opportunity to grow in others. There will be opportunity for them to consolidate even more in the U.S. market in the future. Ferguson provides products from over 39,000 suppliers each year, satisfying one of the criteria of a many-to-many distributor. Ferguson usually sells to the contractor customer, and Ferguson states that contractors tend to work within 20 miles of their home base. There are tens of thousands of contractors around the U.S. who visit Ferguson, so we believe Ferguson meets the criteria for being included on the list above, qualitatively.

Quantitatively, FERG’s returns on net tangible assets are competitive with this rarefied group of companies. There is no reason why they should trade at a discount to the rest of this group of great businesses.

The final piece to the puzzle for us is their balance sheet, which is in great shape. They have approximately zero net debt and have been actively buying back shares since beginning trading on U.S. markets. We believe starting from about 20x FCF, growing revenues at 6-7% annually (4% organic and 2-3% via acquisition) growing FCF’s at low-teens rates and returning excess capital via dividends and/or buybacks, we can earn mid-teens returns over time.

Amazon.com / Microsoft

I purchased shares of both Amazon and Microsoft during the quarter. I have no particularly controversial view on either of these, but these are two of the best businesses in the world and will likely be for many years. Both are involved in the cloud computing business, which continues to grow quickly. Amazon can grow revenues and profits at 15% and 20% for several years and when using normalized margins on their businesses, the stock is very cheap. They have large opportunities in their retail, AWS, Prime Video, and shipping businesses. All of these industries are very exciting on their own. Each of these businesses could be massive on their own. We wish we had been involved at least $2,000 ago in the share price, but better late than never. Microsoft for its part can grow revenues at 10%+ and cash flows at 13-15% per year for a long time. Their core Office 365 product suite plus their cloud computing business, Azure, will drive growth for years. While I like an obscure stock idea as much as the next investor, there are no points for degree of difficulty in investing. These are two of the most high-quality businesses in the history of the world, and they are priced reasonably.

Arlo Technologies / Vizio Holdings

I grouped these two ideas together because they are both businesses in transition that appear to be low margin but are just razor-razor blade business models in the early phase of their rollouts. Margins will inflect higher for both businesses as their higher-margin segments continue to grow.

Let’s look at Vizio first. Vizio’s first business was as a low-end TV manufacturer. Over time, their TV’s have gotten incrementally better. What really attracted me is their Smart TV business. Roku really is the premier Smart TV provider, even though they don’t produce TV’s. Their remotes are well-known by this point by most people who have “cut the cord” on their cable subscriptions.

Roku was first perceived somewhat quizzically by the stock market because most people just perceived them as selling a cheap remote that helped put streaming apps in one place. They really opened investors’ eyes when they began to receive ad revenue from ad-supported channels on their platform as well as a percentage of subscription revenues from streaming services purchases through Roku. All of these revenue streams are high-margin and transformed their business from a low-margin hardware business with no competitive advantage to a very important middle man in the fast-growing streaming economy.

Vizio has a similar software loaded on all of their Smart TV’s called SmartCast. This new segment for Vizio more than doubled last year to $147 million, and I believe there is a credible path to over $1 billion in SmartCast-related revenue which sports 70%+ gross margins. The Vizio team is focused on improving the streaming experience and is effectively executing a playbook to create enormous value for shareholders over time. With the combination of TV hardware revenue, we believe VZIO could earn $900 million in EBIT by 2025. Valued at 25x after-tax earnings, Vizio could be valued at over $17 billion by 2025, vs. a current enterprise value of ~$4 billion. When you consider that ROKU is valued at >20x revenues, there is certainly some possibility Vizio gets valued similarly to Roku, which could put Vizio’s value north of $25 billion by 2025, though I have some doubts about that method of valuation.

Arlo Technologies is very similar to Vizio in that they were previously focused on selling hardware, in this case security cameras, and they belatedly started selling subscription services to help customers maintain their security. This change will also significantly improve their profitability and the stickiness of their products.

Financially, the pivot to a razor-razor blade model has very positive implications for their future profitability. I believe it is possible they evolve in the direction of Alarm.com, which sports gross margins in the mid-60’s, whereas Arlo’s margins will be about 25% this year. Arlo is currently losing money and lots of it, with operating margins in 2020 of -30%. If they can grow their business in the next 2 years to a break-even level, that should be more than enough to demonstrate that profitability is on the horizon (we think steady-state margins of ~15% is the end game).

I’m depending on 15-20% growth over the next few years, driven by 40%+ compound growth in subscription revenue and aided by modest 10% growth in hardware sales. Putting all of this together, I arrive at a $700 million revenue business in 2024 with a path to 15% operating margins (11% after-tax). Capitalized at 20x earnings or 2.3x sales, which we think is not at all demanding given ALRM trades at 50x earnings and 5.5x revenues, this business would be worth $1.6 billion vs. $400 million today. At ALRM levels, ARLO could be worth $3.9 billion in just a few short years; optimistic, yes, but the risk-reward seems attractive given ARLO has $170 million of cash on hand that gives them breathing room to execute their growth plans.

Conclusion

I am finding interesting ideas among discarded COVID reopening plays, buying more of our existing positions, the wreckage of SPAC-mania, spin-offs and some recent non-tech IPOs. There is quite a bit of opportunity in the markets these days, and while I remain cautious about the elevated multiples I see generally, I believe our sweet spot is finding companies with double-digit growth prospects and trading at a mid-20s multiple or less of near-term cash flows. I am getting more creative about identifying some of those potential companies while remaining patient with companies I like but that do not offer a good mix of valuation and likely future returns. It is challenging to remain disciplined and patient, but I believe our elevated cash levels and long-duration growth portfolio positions us best to weather whatever inevitable storms may lie ahead.

Until October,

Argosy Investors

Appendix