Alta Fox Opportunities Fund commentary for the third quarter ended September 2021.

Q3 2021 hedge fund letters, conferences and more

Limited Partners,

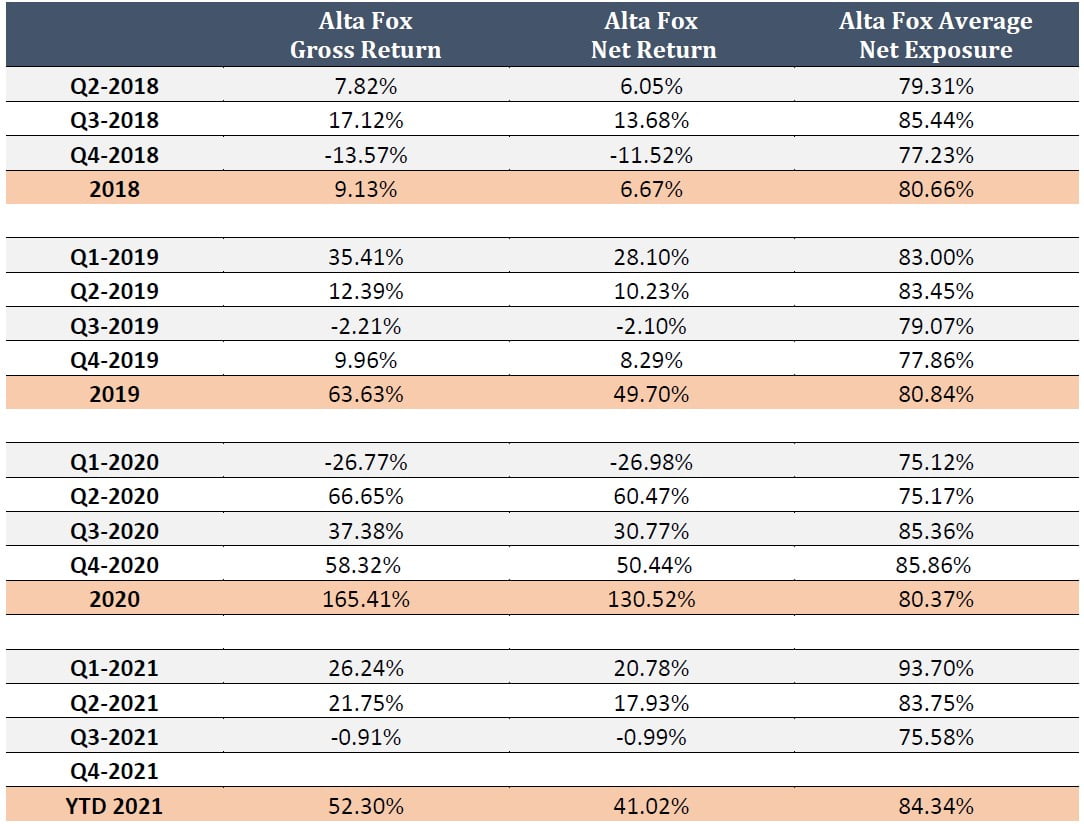

In Q3 2021, the Alta Fox Opportunities Fund (“the Fund”) produced a gross return of -0.91% and a net return of -0.99%. The Fund’s average net exposure during the quarter was 75.58%. Since inception in April 2018, the Fund has produced a gross return of 621.94% and a net return of 419.08% compared to the S&P 500’s return of 73.88%, the Russell 2000’s return of 50.75%, and the Russell Microcap’s return of 56.74%.

As always, Alta Fox strives to ignore short-term price fluctuations and instead focus on the intrinsic value growth in our portfolio holdings, which should converge with portfolio performance over time. We encourage limited partners to do the same both in times of outperformance and underperformance. I firmly believe that in the long run, our strategy of buying high-quality and underfollowed businesses at cheap prices will deliver attractive absolute and relative returns. Most importantly, our process will remain disciplined with strict risk controls, minimal gross leverage, and a sound research process.

Research Process Review

Relative to recent quarters, Q3 2021 felt uneventful. We experienced lower volatility in the portfolio, a few winners and losers, but in the end, we basically finished where we started—with the net return modestly down for the quarter. With mostly strong fundamental performance from our portfolio companies and a weak environment for small-cap stocks, we are generally satisfied with this quarter’s results.

While we actively avoid pontificating on macro-related news and instead focus on quality bottom-up fundamental analysis, it is impossible to ignore some developing market risks. In a rather short period, COVID has gone from a daily national headline to a sobering backdrop in most states, trillions of dollars of liquidity have been pumped into the economy through unprecedented measures, and the stock market has roared higher, with the S&P 500 up more than 15% though Q3 and 20%+ YTD.

From a bottom-up perspective, it is our opinion that the opportunity set across market caps and styles seems less attractive today than at any point in the last 18 months. The shock and uncertainty from the onset of COVID in 2020 led to a significant selloff in almost every area of the market, including quality businesses that were benefitting from COVID trends, thereby creating opportunities for nimble stock pickers. However, recent market strength has seemingly done the opposite, and most companies’ valuations have increased to levels that are likely to yield mediocre annualized returns for the associated risk. Moreover, we question aspects of both current fiscal and monetary policy and have deep concerns about broken supply chains causing significant business disruptions ahead of a pivotal Q4 for many industries.

Of course, even in a potentially frothy market, there are attractive off-the-run opportunities, and we are working hard to find them. We remain net long the market (albeit at the lower end of our normal net exposure range), and we own a collection of fantastic businesses that we expect to compound earnings at attractive rates of return. However, our portfolio’s position is more conservative today than it has been in quite some time. We will not sacrifice our underwriting discipline or lower our return thresholds because of the market’s current exuberance. While it is frustrating to turn over rock after rock only to pass because of valuation and then watch the market send that same security roaring higher, we are confident that maintaining our underwriting discipline is the right long-term strategy. We have high conviction that our growing watchlist of securities will eventually yield actionable investments. Alta Fox is playing the long game, and our disciplined and rigorous research process should help us capitalize on extraordinary opportunities while mitigating permanent capital loss during market drawdowns.

Select Investment Commentary

In July, we published our research on IDT Corporation (NYSE:IDT). IDT is the investment we have spent the most cumulative research time on this year. Researching this business has been a fascinating deep dive into various operating businesses and a management team and Board that we believe are some of the greatest capital allocators of all time. In September, we announced a private deal to purchase 2.5% of NRS, a subsidiary of IDT, for $10 million. For reasons highlighted in our original IDT report, we believe NRS has the potential to be worth a couple of billion dollars in a few years, multiples of the entire IDT enterprise value today.

In August, we published research on Victoria PLC (LON:VCP) which remains one of our largest holdings today. The business has an excellent Chairman, Geoff Wilding, whose mission statement is “to create wealth for our shareholders.” Wilding has successfully executed his mission statement to date, having compounded total shareholder return at VCP over 50% per year since he became Chairman in October 2012.

In September, we exited VQS entirely and highlighted our reasons in this thread. While any loss is painful, we do not stick around if our thesis is impaired. In this case, we strongly disagreed with the significant dilution that was taking place to execute on management’s business strategy. For this reason, we cut our losses, moved on, and redeployed capital to higher conviction names.

Regarding the opportunity set today, we are spending more time on industrials than we have in recent memory while patiently waiting for many asset-light compounding gems to return to more attractive valuation levels.

Business Updates

Given capital inflows and strong strategy performance year-to-date, we have temporarily closed the Fund to new subscriptions. Although we do not believe that we are close to the upper bound of the strategy’s capacity, this fundraising pause will allow us to assess any capacity constraints as market conditions change. It will also allow us to digest our growth and pursue our goal of being world-class across all aspects of the business. This pause is in line with our commitment to generating the highest risk-adjusted returns for our investors. Even though the Fund is currently closed, we remain open to speaking with investors who understand our strategy and are long-term focused. Please note that the effective minimum initial investment is $1.0 million, and due to regulatory requirements, the Fund will only be available to Qualified Purchasers.

In Q3, we also added to our operations team and welcomed Noah Peppler as the firm’s Controller. Prior to joining Alta Fox, Noah was the Controller at Yieldpoint Stable Value Fund, where he managed all firm operations. Before Yieldpoint, Noah was a financial analyst at Satori Capital, where he worked directly under the firm’s CFO and was involved in aspects of both the private equity and alternative investment business units. Noah’s contributions will allow us to continue to service LPs in-line with the highest standards, and we are thrilled to have him on the team.

Conclusion

We are humbled that you have elected to invest a portion of your assets with Alta Fox. We continue to strive to improve all aspects of our research and operational processes in our pursuit of building a world-class investment firm.

Sincerely,

Connor Haley