Alta Fox Capital Management’s detailed research on IDT Corporation (NYSE:IDT).

Q2 2021 hedge fund letters, conferences and more

Table of Contents

Show

Executive Summary

- IDT is a collection of businesses overseen by Chairman Howard Jonas, who in our opinion is one of the greatest capital allocator s of all time. We believe the management team of IDT has an exceptional track record of building businesses and creating significant v alu e for shareholders via tax free spin offs.

- We believe two of the best businesses within IDT today (NRS and net2phone) are likely to be spun off to shareholders, providi ng two near term catalysts to unlock the substantial hidden value within IDT.

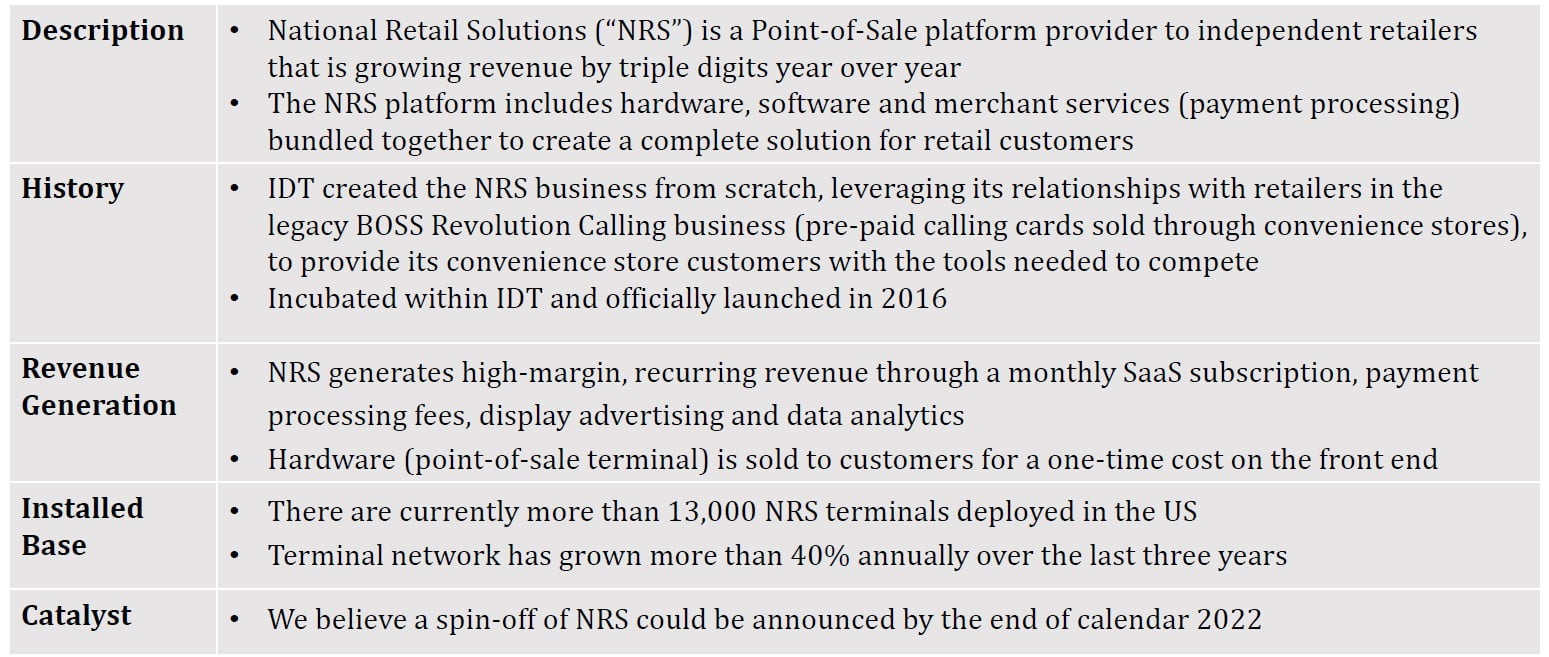

- Shares of IDT present an opportunity to own NRS, which we believe is the fastest growing point of sale terminal and payments bus iness that is off the radar of most investors. We believe NRS is worth more than $1 billion in the near term (more than the entire cur rent market cap of IDT) and will likely be spun off within two years.

- We believe net2phone is the fastest growing UCaaS provider among peers and we expect a spin off to be announced within six months.

- In addition to NRS and net2phone, IDT owns a collection of other businesses that generate strong free cash flow that is reinv est ed into incubating and building the next generation of IDT businesses.

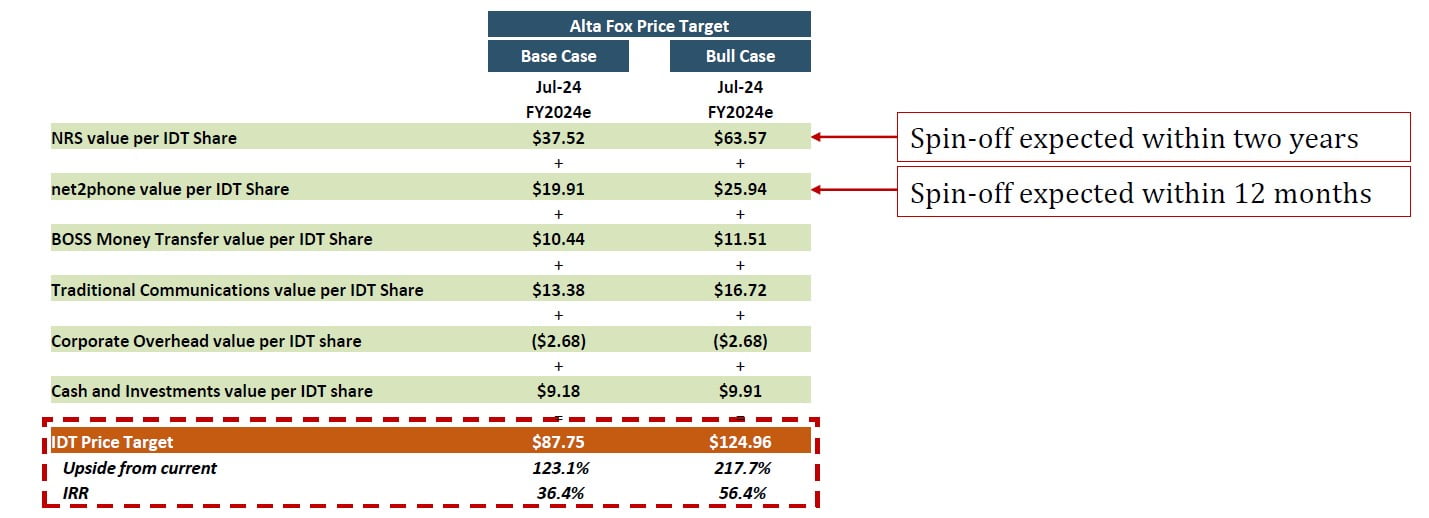

We believe IDT will trade (in our base case) to $88/share by early 2024, representing 123% upside from the current price

IDT Overview

- IDT is a collection of telecom and payments related businesses that was founded in 1990 by Chairman Howard Jonas

- The company is led by CEO Shmuel Jonas and CFO Marcelo Fischer. Alta Fox thinks very highly of both given their knowledge of IDT’s businesses and focus on value creation

- The company’s businesses include:

- National Retail Solutions (“NRS”)

- net2phone

- BOSS Money Transfer

- Traditional Communications (Traditional Communications is a segment that itself is a collection of businesses)

- The company has 1,600 employees (with ~350 in R&D functions) across six continents

- Many of IDT’s businesses were built in house by the management team, leveraging its roots and relationships in the telecom industry to expand into new markets and services

- We believe IDT has an excellent track record of using strong cash flow from its legacy telecom businesses to fund and incubate higher growth businesses that are ultimately spun off to shareholders

- Since its founding, IDT has completed five spin offs of various businesses to shareholders and sold several more

IDT Sum of the Parts

“I think that NRS one day is going to be way more valuable than IDT is today. And if you’re buying into IDT today, you’re getting a great deal, because we’re getting three huge opportunities that already exist.” – IDT CEO, 3/4/21 earnings call

Why Does This Opportunity Exist?

- Small market cap, sub $1 billion

- No sell side research coverage

- Consolidated financials mask the true growth profile of the higher growth businesses

- Conservative management team has limited interaction with Wall Street

- Two spin offs expected over the next two years provide catalysts to unlock the discount to the sum of the parts

Main Thesis Points

Alta Fox believes:

- Howard Jonas, Chairman of the IDT board, is one of the greatest capital allocators of all time, supported by an exceptional management team

- NRS is a dominant point of sale terminal and payments business growing revenue triple digits and operating in less competitive end markets

- net2phone is the fastest growing UCaaS player in a market with multi year secular tailwinds that will be spun off within 12 months

- BOSS Money Transfer is a well positioned international remittance business with additional levers for growth

- Traditional Communications is a stable collection of businesses that generate strong free cash flow to fund IDT’s growth businesses and the next generation of investments

Who is Howard Jonas?

- Howard Jonas is the Chairman of IDT, which he founded in 1990 and took public in 1996

- Launched as International Discount Telecom to provide low cost international calling and wholesale telecom services

- Prior to graduating from Harvard, Howard Jonas got his start in business delivering tourist brochures to hotels and selling hot dogs from his homemade hot dog stand in New York

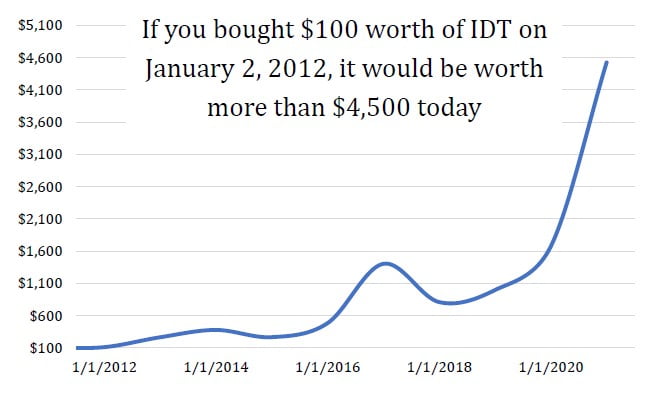

- Alta Fox estimates that under Howard Jonas’s leadership, IDT stock has compounded at a 49% annual return over the last 10 years

- If you bought $100 worth of IDT on January 2, 2012, it would be worth more than $4,500 today (assuming reinvestment into IDT shares)

- Since its founding, IDT has completed five spin offs and sold several other businesses that were incubated within IDT

- Notable Howard Jonas led transactions include:

- Sold a stake in net2phone to AT&T for $1.1 billion, ultimately buying it back a few years later for pennies on the dollar (and will now be spun off to shareholders)

- Sold Straight Path Communications (an IDT spin off) to Verizon for more than $3 billion

- Straight Path spun off from IDT at ~$6.00/share and was acquired for $184.00/share

- After studying Howard Jonas and reading his books, we believe he is ethical, does business the right way, and is extremely philanthropic (donating more than 20% of his income to charity annually, as mentioned in Howard Jonas’s book “On a Roll”)

We believe Howard Jonas is one of the best capital allocators on the planet and has created tremendous value for IDT shareholders

NRS: Business Overview

NRS: Product Overview

- NRS offers a purpose built solution for independent convenience store operators rather than a one size fits all point of sale terminal

- The NRS terminal is an easy to use, feature rich solution that provides SKU based retailers with everything they need to efficiently manage their store

- Features include inventory management, vendor management, customer loyalty software, user permissions, store operating statistics and more

- The terminal hardware is sold for an upfront cost of $599 –$999 and requires a software subscription of $24.95 –$64.95 per month

- For additional monthly charges, store operators can add premium features such as employee time clock, security camera integration, tobacco scan data and more

- In addition to the monthly software subscription, customers can opt in to NRS Pay which enables the POS terminal to process credit card payments for 2.49% of transaction value

- Included with the terminal is a customer facing screen that shows advertisements to the customer during checkout, which NRS is monetizing via blue chip consumer brands

NRS: Opportunity

- With an addressable market of more than 200,000 independently owned convenience, liquor, grocery, and tobacco stores in the US, NRS is less than 10% penetrated today

- We believe quarterly terminal deployments will accelerate as management continues to invest in NRS sales efforts, having recently added 40 direct sales representatives with a near term goal to reach 60 reps

- Monthly ARPU has substantial upside driven by the following levers:

- Payment processing is only utilized by 37% of installed terminals today, but the attachment rates on NRS Pay are ~70% of new terminal placements

- Proprietary checks confirm that ARPU on NRS Pay users is nearly 3x the ARPU vs. non NRS Pay users

- NRS’s ad network (shown on the customer facing terminal screen) continues to expand its reach, with more than 100 million monthly impressions, and blue chip advertisers beginning to take notice

- In fiscal 2020, NRS sold only 9% of its available advertising network capacity of 7.7 billion annual impressions

- The network is collecting scan data on each transaction which is in the early stages of being sold to consumer brands and data aggregators like Nielsen

- Payment processing is only utilized by 37% of installed terminals today, but the attachment rates on NRS Pay are ~70% of new terminal placements

Continue reading the full report here.