Alluvial Fund commentary for the fourth quarter ended December 31, 2021.

Q4 2021 hedge fund letters, conferences and more

Dear Partners,

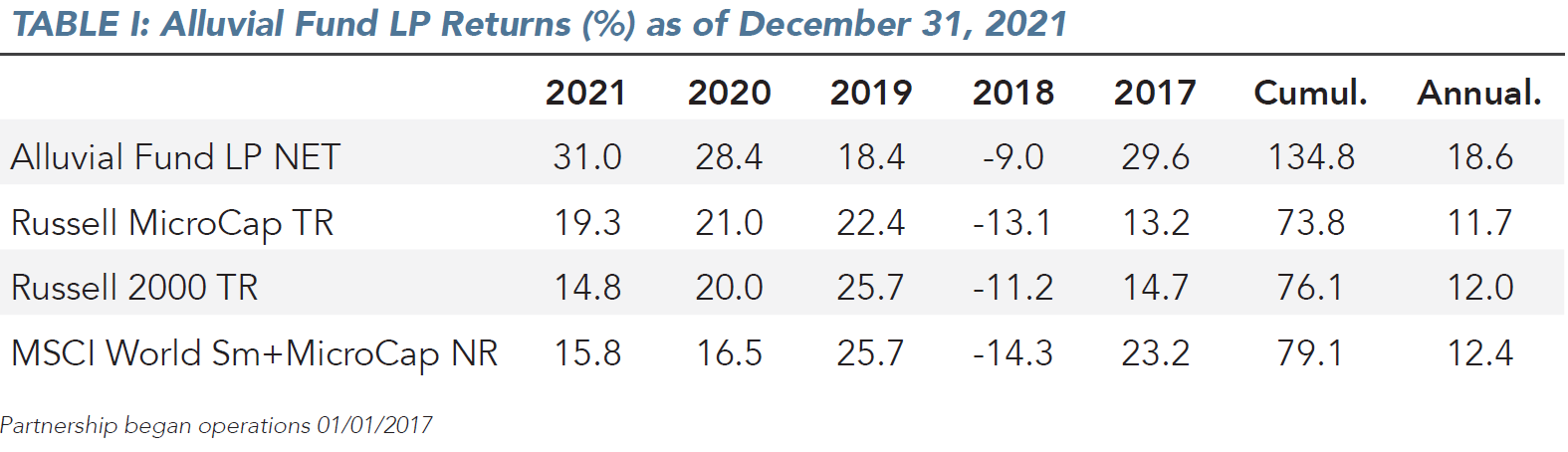

Alluvial Fund closed out an excellent year on a quiet note, returning 0.5% in the fourth quarter. For the full year, Alluvial Fund rose 31.0%, nearly double the returns of benchmarks. 2021 was the finest year in Alluvial Fund’s history, the first in which our net return to limited partners exceeded 30%. This new year also marks a milestone for the fund: five full years of operations! This milestone leads me to contemplate both the fund’s history and its future. I am proud of many of the investments we have made and the processes we used to identify them. A few others…well, at least they were learning opportunities. Above all, I am as dedicated as ever to the pursuit of that next great idea. Thank you for entrusting your capital to Alluvial. Our best years are ahead.

As I write, markets are experiencing fear and consternation over the specter of prolonged inflation, rising interest rates, and the deflation of the massive bubble in unprofitable technology companies and highly speculative offerings. As is typically the case, our collection of obscurities and misfits is weathering the storm quite well. I don’t know if markets will regain their confidence or if this is the beginning of a deeper drawdown. Whatever may come to pass, I will say I am excited both by our present portfolio and by the opportunities I see to invest in new holdings. The more markets fall, the more excited I will become.

Portfolio Updates

P10

P10 Inc (NYSE:PX) remains the fund’s largest holding. The company’s latest achievement is successfully refinancing its debt, lowering the interest rate from 7.00% to 2.25% and extending the term. This new agreement provides P10 with plenty of available capital to pursue its acquisitions strategy and build its stable of alternative investment managers. Assets under management should soon exceed $17 billion, with a clear path to $20 billion and higher. P10’s only disappointing aspect has been its lackluster share price movement since its IPO. Despite its peerless cash flow profile and predictability, growth options, and management skill and alignment, shares continue to change hands at just 17x my estimate of current free cash flow. I remind myself that though P10 is now an NYSE-listed company, the value of its free-floating stock is just $260 million. For trading purposes, P10 is still just a micro-cap. It should be no surprise that it acts like one.

I expect the market to change its assessment of P10 in the course of the year as the firm reports growing assets under management and perhaps an acquisition or two. P10’s story has been one of remarkable speed and agility. The firm’s rapid development makes quarter-to-quarter comparisons of little use. With so much change, it’s no surprise that the market occasionally falls behind, failing to appreciate the ongoing transformation. If we do end up in a bearish market environment, there is a lot to be said for a company that knows what its revenues will be almost down to the penny for years to come.

Crawford United

For the second year running, Crawford United Corp (OTCMKTS:CRAWA) celebrated the new year with acquisitions. This time around, Crawford spent $4 million to acquire Florida-based Reverso Pumps and Separ of the Americas. Assuming a purchase multiple of 6x EBIT, the acquisitions will increase Crawford’s earnings by 15 cents per share. While individually they may seem small, the continued acquisition of quality niche industrial companies adds up to major growth in Crawford United’s earnings power. I expect the company’s results to feel some short-term pressure from supply chain troubles and inflation, but I like what the company is building. I am confident that Crawford’s earnings will exceed $10 per share at some point in the next decade and its shares will rise accordingly.

Garrett Motion Inc (NASDAQ:GTX) is also feeling the effects of the troubles with global supply chains. Difficulties in sourcing semiconductors have led many large automotive manufacturers to slow production, which in turn delays orders for Garrett Motion’s turbochargers. Still, the environment has not prevented Garrett Motion from making progress on improving its balance sheet and beginning to return capital. In November, the company announced a plan to repurchase $100 million in common and preferred stock. Then in December, Garrett Motion announced it would accelerate the planned redemption of its Series B preferred stock held by Honeywell. By this time next year, Garrett Motion will have meaningfully reduced its liabilities and bought in quite a bit of stock at a very attractive price. As supply chains normalize, the company’s earnings and cash flow will benefit, giving the company the ability to return more capital to shareholders and invest in the transition to products for electric vehicles.

LICT Corporation

We are still awaiting the results of LICT Corporation (OTCMKTS:LICT)’s strategic review. The announcement of any decision on strategic alternatives was likely delayed by the company’s participation in FCC Auction 110, in which LICT successfully bid on $7.7 million in mid-band spectrum to support its wireless offerings. With the auction over, I look forward to news from the company. Even if the result of the process is a decision to maintain the status quo, LICT’s status as a provider of essential communications infrastructure and its commitment to returning capital make its shares attractive in the mid-$20,000s.

Unidata

On the topic of essential communications infrastructure, I could not be more excited about Unidata SpA (BIT:UD)! For the first time, Unidata has laid out its 2022-2024 strategic plan, projecting 2024 revenues of EUR 64-79 million and EBITDA of EUR 19.1-23.3 million. At the mid-point of these projections, Unidata currently trades for just 6 times 2024 EBITDA, a gigantic discount to competitor valuations and to fair value using a common-sense free cash flow-based approach.

These are ambitious targets, but they are achievable. Unidata’s strong, recurring cash flow will enable it to invest $40 million in its fiber network from 2022 to 2024 without taking on debt. This extended network will allow Unidata to offer its broadband services to thousands upon thousands of new customers, both residential and enterprise. Doubling revenues from 2021 to 2024 will require Unidata to expand its offerings to adjacent products and services like data centers and internet of things applications, but the demand is there. Unidata richly deserves its position as Alluvial Fund’s second-largest holding.

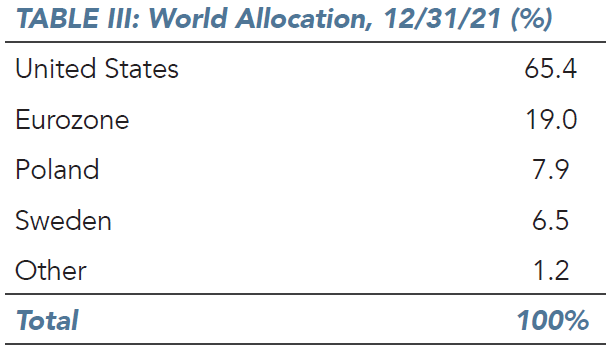

A New Market, A New Holding: Tim SA

I spent a lot of time in 2021 investigating a new market: Poland. I came away extremely impressed by the average quality and the sheer number of firms listed there. This is one of the most dynamic European markets, but US investors seem to be entirely unaware. The Warsaw Exchange offers an embarrassment of riches. There are scores of wonderful small companies listed there, all of them highly profitable and growing. Most feature strong balance sheets and high insider ownership. The best part is that they can often be bought at single digit multiples of earnings and/or cash flow. I spent weeks and weeks researching several Polish companies, ultimately selecting a few of the best for our portfolio. I am thrilled with the potential of these companies, and even more pleased with how little we are paying for that potential.

Now, it must be noted that unique risks accompany investing in places like Poland, where a testy relationship with the European Union and saber-rattling from the East promise no shortage of political ups and downs. Because of these risks, Polish stocks will make up only a small percentage of the fund’s assets regardless of their prospective returns. However, in several ways, the current Polish market reminds me of the market for small Italian companies a few years ago. Many traded extraordinarily cheaply due to inattention and perceived political and economic risk. We were able to take full advantage of this environment in Italy, from which came Intred and Unidata, two of our most successful investments to date.

With these thoughts in mind, it’s time to formally introduce one of our newest holdings. Tim SA (NYSE:TIMB) is a distributor of electrical components with a fast-growing third-party logistics (“3PL”) business. TIM has grown revenues at a 14% annual pace since 2016, accelerating recently as e-commerce takes off in Poland. The company worked hard to transition its business model to online sales over the last several years and wound up creating the 3PL segment almost unintentionally. As its online business grew, TIM found it could use excess warehouse space to fulfill online orders on behalf of other Polish companies. Today, more than half of TIM SA’s 3PL revenues come from external clients, including blue chips like IKEA. TIM SA is taking steps to accelerate the growth of the 3PL business and highlight its value by preparing to offer a portion of the business on the stock exchange. In my view, the fast-growing, highly profitable 3PL business is worth more than 70% of TIM SA’s current market capitalization.

TIM SA’s business benefited from COVID, but the growth has not slowed even as COVID has receded. In December 2021, revenues were up 22.6% year over year. Strong operating leverage caused third quarter profits to rise 156% versus 2020. Despite TIM SA’s remarkable growth profile and upcoming IPO catalyst, shares trade at just 10x trailing earnings. The planned 3PL IPO is scheduled to take place in the first half of 2022.

Special Situations: A Quick Conclusion

One of our special situations, Hexion Holdings, paid off in the fourth quarter, agreeing to be acquired by a private equity firm. Hexion was a classic Alluvial holding: little-known, illiquid, and boring. Then again, one person’s “boring” is another’s “fascinating.” I never found Hexion’s chemical products all that interesting, but I did respect their critical role in the production of ubiquitous products like plywood and particleboard. (On the flip side, I understand others may view my beloved rural telecom networks as just a bunch of lonely cables.) When we first purchased shares a few months ago, Hexion’s business was recovering from a cyclical downturn and the company had announced a plan to spin off its lower-margin, commodity business to shareholders and list its higher-quality operations on the NYSE. I pegged the combined value of the two entities in the lower $30s/share. In the end, the plan changed. Hexion agreed to sell its epoxy business (the planned spin-off) to Westlake Chemical. I bought more shares when the epoxy sale was announced, figuring the company was one step closer to a stock market debut or other transaction.

It didn’t take long. Hexion reached a deal with American Securities to acquire the remaining businesses for $30/share. The ultimate sale price came in a little lower than I had hoped, but I understand the company’s decision not to chance an IPO. A chemicals company could have a tough time igniting investor imaginations in an IPO ecosystem dominated by SPACs and hypergrowth tech companies. Hexion’s acquirer will not face antitrust or financing issues. However, because this is a two-part deal with American Securities’ purchase contingent on Westlake buying the epoxy business, I judged $28.50 as a fair discount to deal value and sold our shares a couple of days into the new year. We realized gains of 12-35% on our various purchases. Would that all our special situations worked out so quickly and cleanly!

A New Path Ahead

At its inception in 2017, Alluvial Fund took on a seed investment from Willow Oak Asset Management, LLC. In return for its sizable investment in the fund, Willow Oak was entitled to a percentage of the fees generated by the fund. Willow Oak provided some marketing support, but otherwise was not involved in the fund’s day-to-day operations or investment process and had no ownership in the fund’s general partner, Alluvial Capital Management, LLC (My company, of which I own 100%.)

Time marches on and business needs change. As of year-end, we no longer have a seeding relationship with Willow Oak. For various business and regulatory reasons, Willow Oak decided to cease making direct investments in nascent investment funds and has withdrawn all its capital from Alluvial Fund. I always enjoyed my interactions with Willow Oak staff and I wish them all the best as we move forward independently.

Willow Oak’s redemption leaves Alluvial Fund with a much more diversified set of limited partners. At March 31, 2021, Willow Oak’s investment represented 44% of the fund’s total capital. Today, no single partner represents more than 7% of the fund’s assets. I prefer it this way. With over 60 limited partners and a median LP investment of just under $300,000, we have a highly stable capital base that enables us to invest in the often esoteric, off-the-run securities that offer incredible value. Going forward, I intend to limit the size of any potential investments by new LPs in order to maintain this advantage. As always, the entirety of my family’s investable assets is in Alluvial Fund, and I sleep well.

Being fully independent once more feels good. Alluvial Capital launched in 2014 with no institutional capital or cornerstone investors, just me in my cheap little Pittsburgh row house apartment and a handful of clients willing to take a shot with a young, unproven investment manager. (And for those clients, I am forever grateful!) Charting our own course is familiar territory.

Thank you for your confidence in Alluvial. As always, I appreciate the opportunity to manage capital on your behalf. I know your investment represents years of hard work and prudent investing, and I will do my utmost to be a responsible steward of that legacy.

Other Updates

We have welcomed a number of new limited partners lately. Hello! You are in good company. I have always strived to manage Alluvial Fund in a way that attracts the like-minded: people who are unafraid to invest well off the beaten path, with the patience to stick with investments that might take years to pay off. I am happy to see more and more of these people commit to Alluvial Fund. However, there is a limit to how much capital a strategy like ours can accommodate. We are not close yet, but when the day comes, Alluvial Fund will close to new entrants.

The annual audit process has commenced and will soon begin working on tax reporting. As in years past, I will work closely with the fund’s administrator to deliver K-1 statements as early as possible, ideally by mid-March.

Thank you for reading. I welcome your questions and comments. Should you wish to discuss Alluvial Fund’s strategy or holdings in greater depth, I am always just an e-mail or phone call away.

Best wishes to you and your families.

Best Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC