Alluvial Fund commentary for the third quarter ended September 2021, discussing the IPO of P10 Holdings Inc (NYSE:PX).

Q3 2021 hedge fund letters, conferences and more

Dear Partners,

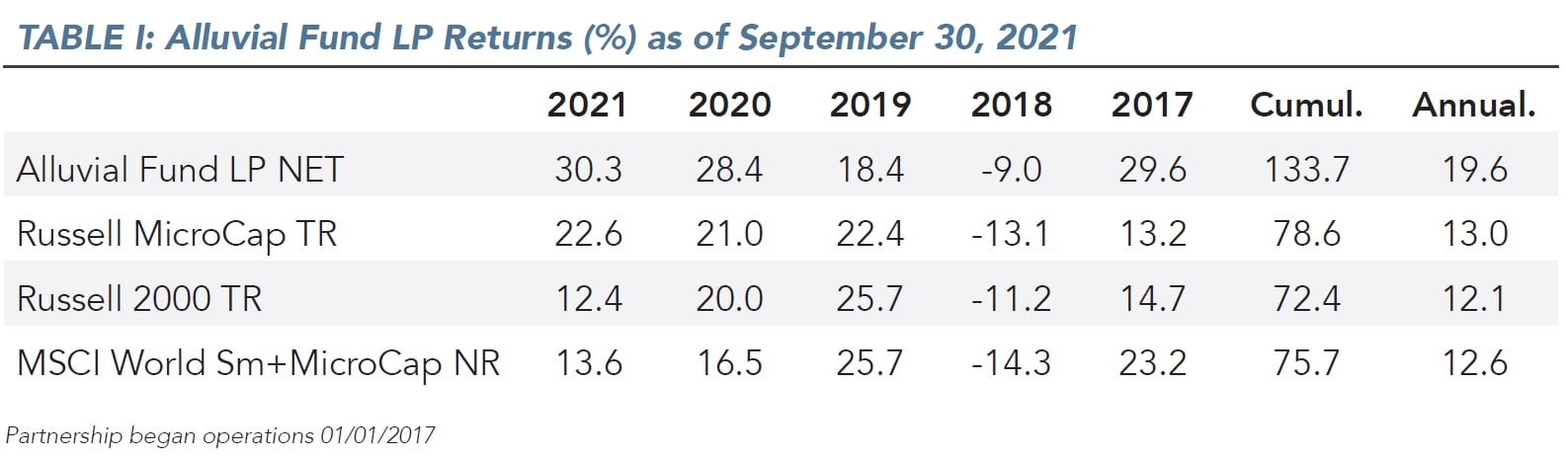

Alluvial Fund Performance

I am happy to report Alluvial Fund enjoyed another strong quarter, up 8.5% as small-cap and micro-cap stock indexes struggled. To date, it has been a very good year for our enterprise.

It feels good to see the market validate the thought and effort that has gone into building our very unusual portfolio. Much more commonly, the market treats our holdings with a disinterest bordering on disdain. Therein, of course, lies the opportunity, but it is not an enjoyable environment to occupy. It’s nice to have a strong quarter, just like it’s nice when your favorite baseball team wins a game or a series. But just as a strong quarter does not make a successful investment, winning a game or a series does not bring home the pennant. (As a fan of baseball’s sorriest franchise of the modern era, the Pittsburgh Pirates, I know this well.) I am enjoying our recent success as much as anyone, but I won’t let it distract me from the disciplined pursuit of long-term results, whatever ups and downs we may experience.

A Market Debut For P10 Inc.

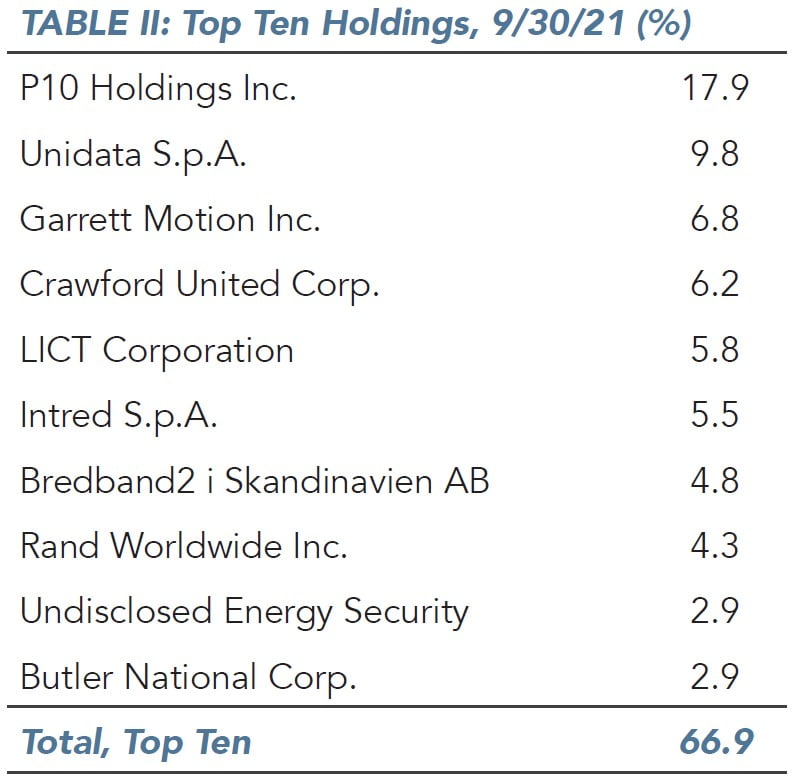

And downs arrive in due course. For quite a while, I have been anticipating the day when our largest holding, P10 Inc., would conduct an IPO and up-list its shares to a major exchange. The day has come! Unfortunately, the company’s IPO has arrived with more of a dull thud than a splash, pricing below the indicated range.

I can think of multiple reasons why the IPO failed to live up to expectations. It was a small offering, with the company and insiders looking to raise only $300 million or so. The shares being offered have little voting power, meaning buyers will have no ability to affect the company’s governance or strategic direction. Despite P10’s success thus far, it remains a new and unproven company, and a small one in the context of public companies. Whatever the reasons, this represents only a temporary set-back, not a change in narrative. I remind myself that at the IPO price of $12 (postreverse split) P10 shares have returned to where they traded just six weeks ago, before rumors of an IPO began to circulate. And compared to then, P10 is now better capitalized, more profitable, and an SEC-reporting NYSE company.

At $12, shares of P10 offer remarkable value. Following the IPO, P10 has a market capitalization of $1.5 billion and debt of $180 million. Within six months, P10’s fee-paying assets under management should reach $17 billion, resulting in annual revenue of $170 million and normalized cash operating income of $94-102 million. Against this, P10’s interest expense will be around $11 million, resulting in free cash flow of $83-91 million, or 66-73 cents for a free cash flow yield close to 6%. Remember that P10 has virtually no need for capital expenditures and will not pay cash taxes for quite some time thanks to its large net operating loss carryforwards. This is my near-term outlook, but I believe P10’s free cash flow per share will climb past $1 in short order. Under the current capital structure, this would require assets under management to climb to $23 billion, a figure that I expect to be achieved inside of two years from a combination of internally generated AUM growth and ongoing acquisitions activity.

P10’s business is among the best I have ever seen. It is supremely predictable and robust through all economic conditions. Its margins and returns on invested capital are tremendous, as is its runway for growth. I have confidence in the leadership of Robert Alpert and Clark Webb, each of whom has over $170 million at stake in P10 and his career and reputation on the line. 17x nearterm free cash flow is a bargain price to pay for a firm that could be worth multiples of its current value just a few years hence.

P10’s underwhelming IPO is a short-term detour that costs us a little, but nothing about the longterm story or investment thesis has changed. Dips and declines are a fact of life in investing. This is the fourth or fifth time that P10 has fallen 20% or more since we have owned our shares, and it will not be the last. From time to time, I have sold some P10 shares for risk control purposes or to fund other opportunities. I had planned to let more shares go if the IPO priced in the high teens, but at $12, good luck to anyone trying to pry them from my fingers!

Telcos: Comings And Goings

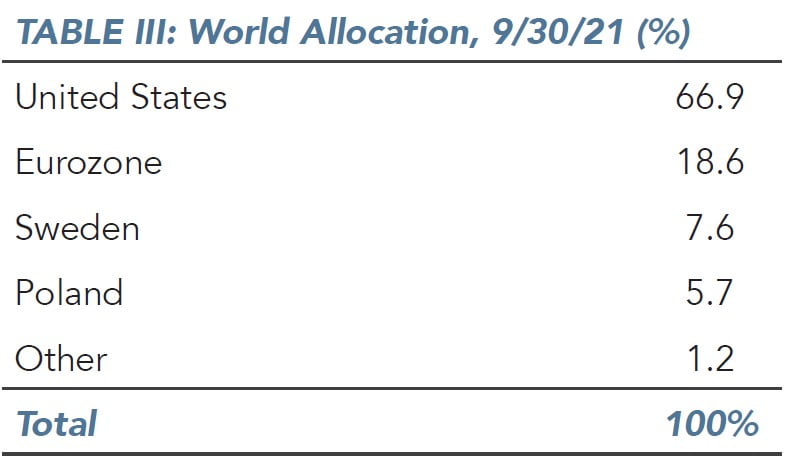

Communications, as usual, remains an important theme for Alluvial Fund. Broadband is the new electrification. Much as the early and middle 20th century saw electricity reaching remote and rural areas, the story of our era is high-speed internet becoming available to most of humanity for the first time. Broadband, whether provided by traditional incumbent telcos and cable companies or upstarts like satellite providers and fibercos, is simply indispensable for participating fully in modern social and economic life.

I believe providers of modern communications infrastructure should be valued much like gas, water, and electric utilities. It seems the market is slowly coming around to this view, particularly for our Italian fiber companies, Intred SpA (BIT:ITD) and Unidata SpA (BIT:UD). Both are up handsomely this year on growing revenue and excellent cash flow, and each continues to have a remarkable growth outlook at Italy races to catch up with its Western European peers. Intred will soon begin receiving revenue related to its winning tender to provide over 4,000 schools with broadband. Unidata’s joint venture with the Central Europe Broadband Fund will see the company invest in greenfield projects in suburban, exurban, and rural areas in the Rome metropolitan area. While each company remains a good valued, Unidata is the more attractive of the two and I have sold some Intred shares in favor of Unidata.

On the domestic telecom front, LICT Corporation (OTCMKTS:LICT) just keeps performing its usual routine: generating cash, reinvesting in the business, and buying back stock with the excess. On a yearover- year basis, LICT repurchased 3.4% of shares outstanding. I expect the same or more this year. Meanwhile, LICT’s strategic review continues. The most likely outcome appears to be a spin-off of the company’s Michigan assets, which are cable-heavy and should trade at a reasonable multiple. Last week, LICT disclosed it had received an offer to buy the entire company at a premium, but that the offer was insufficient. I value LICT shares at $35,000-$40,000, and significantly more if the company is successful in buying back substantial additional shares.

We are parting ways with our other domestic telecom, Nuvera Communications Inc (OTCMKTS:NUVR). Not for any particular failing by the company or concerns about valuation, but rather a loss of credibility. Over the years, management has assured me repeatedly that Nuvera would step into the spotlight, quit being the “quiet company” and begin telling its story to investors. Also, that the company would be active on the acquisitions front. Here we are, years later, with no changes and no activity. Nuvera still eschews press releases and any other attempt to build familiarity with investors. Even as Minnesota broadband mergers and acquisitions activity has heated up, Nuvera has sat on the sidelines. Any of a half dozen recent transactions in Minnesota would have been beneficial for Nuvera, but the company was either uninterested or unsuccessful in acquiring these assets. Meanwhile, the company’s balance sheet is rock solid with debt the lowest since the acquisition of Scott-Rice in 2018. To me, the economic rationale for acquiring assets at 6-10x free cash flow and funding these deals with debt at 4% is unassailable, but Nuvera apparently believes otherwise.

There is nothing really wrong with being a sleepy company. Countless tiny banks and utilities operate quietly, serving their communities well and paying regular dividends, but otherwise doing little for shareholders. But companies like these owe it to investors to be honest about their goals and ambitions so investors may value them accordingly. And so, on to the next opportunity, having realized a healthy gain on our Nuvera shares. I don’t doubt that Nuvera will do fine in the coming years, but we are attempting to do better than just “fine.”

Special Situations And Other Updates

In other disappointing IPO-related news, I was elated see our acquisitive Cleveland industrial holding company, Crawford United Corp (OTCMKTS:CRAWA), file for an IPO in August only to withdraw the filing earlier this month. Crawford intended to use the IPO proceeds to strengthen its balance sheet and fund additional acquisitions. The company did not comment on the development. I suspect Crawford may be feeling the effects of the tight labor market and higher raw materials costs, which will put pressure on short-term results. Whatever the company’s short-term results may be, its long-term value will be driven by its ability to identify and acquire attractive manufacturing assets. Costrelated stresses on small manufacturers could actually prove a boon for Crawford if it enables them to acquire assets at lower valuations.

It was a mixed quarter for our special situations investments. On one hand, Pegroco preferred shares moved up as the Swedish investment company reported strong results and prepared for the IPO of its largest holding, Nordisk Bergteknik (STO:NORB-B). The preferred shares are now trading just under face value. I expect the company to catch up on its dividend arrearage in the next few quarters. Plenty of upside remains.

On the other hand, Series D preferred shares of Wheeler Real Estate Investment Trust Inc (NASDAQ:WHLR) trended slightly downward. The company and certain shareholders are at loggerheads over the treatment of Series A and B preferred shares, with a large holder threatening litigation. The most likely scenario in the months ahead remains a large repurchase of the Series D preferred shares, though it is also possible that a negotiated exchange agreement is reached with holders of the various series. Wheeler’s underlying properties must be worth at least $390 million or so for Series D preferreds to be worth at least their current trading price of $16. That is equal to 87% of gross property value and an implied cap rate of 9.5%. Wheeler’s grocery-anchored strip malls are nobody’s trophy assets, but they produce cash flow and are worth more than that. With a hard catalyst in the 2023 conversion option on the Series D preferreds, I am willing to wait for resolution.

Markets may be at all-time highs, but I continue finding plenty of value in small, off-the-run companies and overlooked markets. Lately, I have identified several promising opportunities in Poland, where vibrant, profitable, and growing companies trade at one-third or less the multiples that similar companies fetch on US exchanges. More than one US post-bankruptcy/postrestructuring situation is wildly cheap, as well. I am adding to these holdings as the market allows. Expect more detail in the next quarterly letter.

Thank you for your confidence in Alluvial. As always, I appreciate the opportunity to manage capital on your behalf. I know your investment represents years of hard work and prudent investing, and I will do my utmost to be a responsible steward of that legacy. The entirety of my family’s investable assets are invested in Alluvial Fund.

I had planned to host some sort of partners’ gathering in New York this autumn, but I have decided to forgo any such event out of an abundance of caution. Perhaps I will see many of you in the spring.

My associate, Tom Kapfer, and his wife Bailey welcomed a baby girl last month. All are doing well! Tom also passed level 2 of the CFA exam earlier this year. How he did it while juggling a fulltime job, house, and growing family, I do not know. It was certainly easier for me to pull off as a 20-something single guy sitting in my cheap apartment most evenings. Congrats!

I remain available to discuss the portfolio in greater detail at any time. Please don’t hesitate to call or e-mail. And if you find yourself in the greater Pittsburgh area, dinner is on me! I hope you and your families are well, and I look forward to writing to you again in the new year.

Best Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC