Professional Budget Management from Beginning to End

Effective budget management is necessary for your business to keep operating successfully year after year.

Q3 2021 hedge fund letters, conferences and more

Budgeting ensures that your sales cover your costs and that resources are effectively utilized to meet strategic goals.

Companies need funds for standard business operations such as incorporating a new business as well as for projects to improve products or services — all of which need to be budgeted for.

Over 50% of projects run over budget, which significantly impacts their ability to deliver benefits for the organization.

In this article, we’ll look at exactly what budget management is and why it’s so important. Plus, we’ll walk you through a six-step process to effectively manage your budget from beginning to end.

What Is Budget Management?

A budget is a financial plan created to help you achieve your organization's strategic and operational goals.

Strategic goals are things like increasing your customer conversion rate or becoming an industry leader.

Operational goals are related to routine tasks that are needed to keep the business running.

One example would be implementing a new filing system that allows administrative employees to perform their jobs faster and more efficiently.

Budget management is the effective planning, execution, and control of your budget.

It's mainly done through a process of tracking and managing your income and expenses.

After all, your budget is only useful if you actually stick to it. So, somebody needs to constantly manage the budget and make sure that the company is still on track to meet its goals.

Budget management is different from financial management because of the time frame that it covers. A budget tends to only look out to a year into the future, at most. It focuses on immediate money issues.

In contrast, financial management tends to take a more long-term approach and may look at the company's overall position in five or ten years.

Why is effective budget management important?

Managing a budget is a lot of work. So if you have to do it, you’d better have a good reason for doing so.

The truth is, there are many benefits of creating and managing a budget. So it’s well worth the time you’ll invest.

Let’s explore the various benefits of creating, executing, and controlling a budget that makes effective budget management so important.

Benefits Of Creating A Budget

- Budget planning forces you to analyze what money you have (or expect to have in the future) and plan costs against it. You have to think ahead strategically for better investments.

- You’re less likely to be surprised by forgotten expenses.

- It prevents you from taking on projects that you don’t have the cash for.

- Employees become more cost-conscious and try to conserve resources.

- Avoid having to repair your credit score due to bad financial decisions.

Benefits Of Executing A Budget

- Sharing the plan with the rest of your organization helps everybody to know where the focus is.

- It gets managers all on the same page. It lets everyone know what should be a priority and helps to keep the team on track.

- This leads to better planning and coordination of business activities.

- It also ensures short and long-term profitability. Profit margins increase from effective cost management.

Benefits Of Controlling The Budget

- You can see early when overspending occurs. That way, you have more time to react.

- You’ll see when unexpected revenue comes in, so you can more quickly decide what to do with it.

- You can pinpoint any “cash leaks” or issues and work to reduce or resolve them.

- It allows the company to review its organizational plans (and change them when necessary) to maximize its financial resources.

6 Steps To Successfully Manage A Budget

Now that you understand the importance of a well-managed budget, it’s time to learn the six key steps to building an effective budget management process.

-

Determine The Scope Of Your Budget

You can use a budget at nearly every level of your organization. So the first step needs to be figuring out what the scope of your budget is.

What level of the organization are you budgeting at? This might be at a department level or budgeting for a specific item or product.

You also need to figure out what period you’re budgeting for. Are you planning things out on a weekly, monthly, quarterly, or annual basis?

You can be managing a budget related to the number of snacks in an office vending machine each month. Or you could be managing a budget for the entire marketing department for the year.

-

Create Your Budget

If you’re starting from scratch, then you’ll need to create a budget before you can begin managing it.

If your company already has budgeting software, you can make use of that. Otherwise, you can find a template online to use.

You’ll want to pull in all of the previous historical data that you’ve got about income and expenses (if you’ve got it). Include all of the revenue related to your budget as well as both fixed and variable costs.

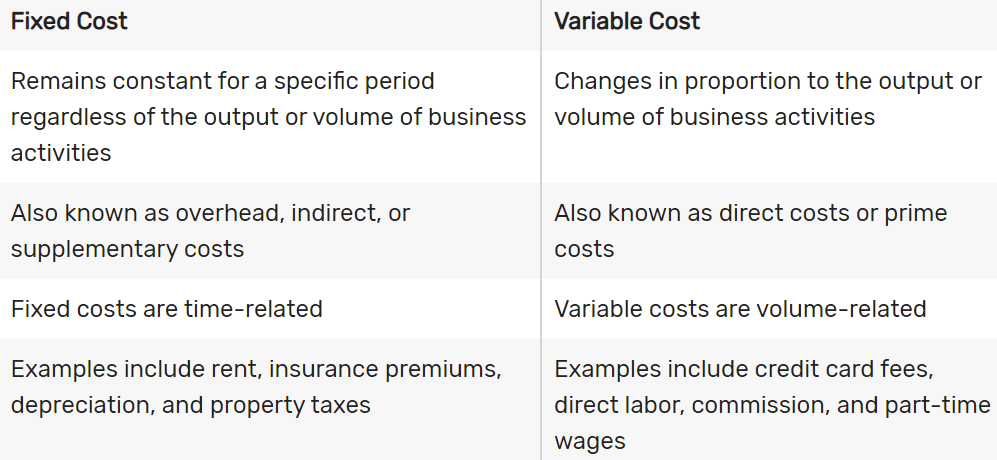

Fixed costs remain the same irrespective of how much volume you produce, e.g., factory lease. Variable costs fluctuate depending on production volume, e.g., labor costs.

Be sure to adjust for any cyclical or seasonal changes that may affect your business. If you’re running a landscaping business, your budget is going to look a lot different in the summer than in the winter.

Try to anticipate any new upcoming expenses or changes that might impact your budget. For example, a new hire or a new project will increase your costs. Projected growth will mean more revenue coming in.

Don’t forget to account for any irregular costs like annual fees or licenses.

-

Involve Other Decision-Makers

Depending on your position within the company, you may need to get your budget reviewed and approved before you can start managing it.

Even if you’re the only person who needs to approve it, it’s good to get feedback from other employees before finalizing your plans. They may be able to point out some unexpected expenses or other items that you’ve missed.

As your budget influences your business planning for the coming year, it’s worth gathering a team of subject matter experts or other managers together to review your budget and discuss it.

Getting the team more involved helps with any concerns they may have about how the budget may impact their department. Anybody who’ll be bound to the budget should get a chance to give their feedback before it’s finalized.

People will quickly let you know if they feel like anything is missing or the numbers aren’t realistic.

Once you receive feedback, you can adjust and revise your numbers to develop a final approved budget.

After the budget is finalized, encourage buy-in from anyone who has to stick to it. For example, have the marketing department “own” the marketing budget.

-

Execute Your Budget

A budget doesn’t do any good if you just toss it in a drawer until the end of the year until it’s time to take it out and review how you’ve done. Budget monitoring needs to be done on an ongoing basis and needs to be communicated effectively to your team.

You need to share and publish the budget where the team and cost owners can see it. That might mean printing it and putting it on a prominent notice board where people can refer to it at any time. You can also make an electronic copy available on an internal company website.

Once your budget is out there, you also need a way to track costs against it.

This is usually done using project management software in larger companies. However, smaller companies may be able to do it with just an Excel spreadsheet.

Having a way to track costs will only work if there’s data coming in. You also need some way to get the information into your system.

That could involve employees submitting an expense report each week. Or you may be able to provide them online access to log in and update their own expenses if your software allows for it.

The closer to real-time that you’re able to track your expenses, the more effective the whole process will be. You don’t want a one-month lag between a significant spike in spending and when you’re able to identify it.

Someone needs to be assigned as a budget manager to track and manage all of this. If you aren’t doing it yourself, then be sure that someone is responsible for managing the budget and keeping information up-to-date.

The person managing your budget will be an invaluable resource for the company. They can raise the alert if costs exceed what’s been approved, help adjust the budget when necessary, and keep things on track.

-

Review Your Budget

Whoever is in charge of managing the budget should be providing reports or having meetings with the decision-makers in the company who are affected by the budgets on a regular basis.

The frequency of these regular reviews will depend on the period of the budget. But generally, an annual budget will need to be broken down into monthly and quarterly forecasting.

The person responsible for managing the budget will also be responsible for preparing reports that show actual numbers against forecasted numbers. That way, it’s easy for everyone involved to see which areas are performing well and where some adjustments might be needed.

Besides regularly reviewing the budget, it’s essential to have certain controls in place that are performed continuously.

These additional parts of the budget review process include:

- Reviewing and approving purchase orders

- Signing off on invoices

- Approving overtime requests against the budget

Lastly, you need to have processes in place for what to do if actual numbers end up being far off what has been budgeted for.

-

Repeat The Process

A budget isn’t something that you just do once. It’s a constantly ongoing process of anticipating and forecasting the operations of your business.

Before the period from your first budget is done, it’ll be time to review the data and create a new budget for the next period.

Adjust your next budget based on actual numbers, ongoing market trends, current events, seasonality, and other changes.

Additional Budget Management Tips

The steps above will get you started on the right foot when managing your budget. Here are three further tips to have you manage your budget like a pro.

Use Budgets As An Opportunity To Improve, Not To Punish

It’s easy for a team member (or even a manager) to let costs get out of hand and exceed a budget without realizing it. Particularly if they’re new to managing a budget or if your company is only starting to get serious about budgeting.

It’s important to understand why targets are getting missed and find a way to correct that next time instead of just casting blame.

Set Realistic Budget Goals

A budget is about where your company or department will realistically be at the end of a time period or specific project, not where you wish you would be.

Setting overly-ambitious goals that people can’t realistically meet will only serve to demoralize your team.

Put Your Plan Into Action

Effective budget management isn’t a passive activity. You need to take an active role and use your budget to guide the decisions in your department or organization.

For example, if you receive extra income above what your budget expected, you don’t want to let it sit. You need to decide how the extra money will be spent to further your organization's goals and update the budget.

Effective Budget Management Is Essential To Financial Success

In this article, we’ve looked at why good budget management is so important to the success of your business and staying profitable in the short and long term.

You also learned six vital steps to creating and managing a budget and how to work with other colleagues in your organization to get feedback and keep financial information up to date.

The ability to read financial statements is an important first step in understanding a company’s financial health. And it’s crucial for effective forecasting and accurate budget formation.