The record-breaking inflation rate has led to a stalled recovery (or recovery reversal) for small businesses across North America, as Alignable’s November Road To Recovery reveals. Released today, this report is based on a poll of 3,430 small business owners from 10/30/21 to 11/9/21, as well as 655,000 historical responses from SMBs since March 2020.

Q3 2021 hedge fund letters, conferences and more

Record-Breaking Inflation Rate Impairs Recovery For SMBs

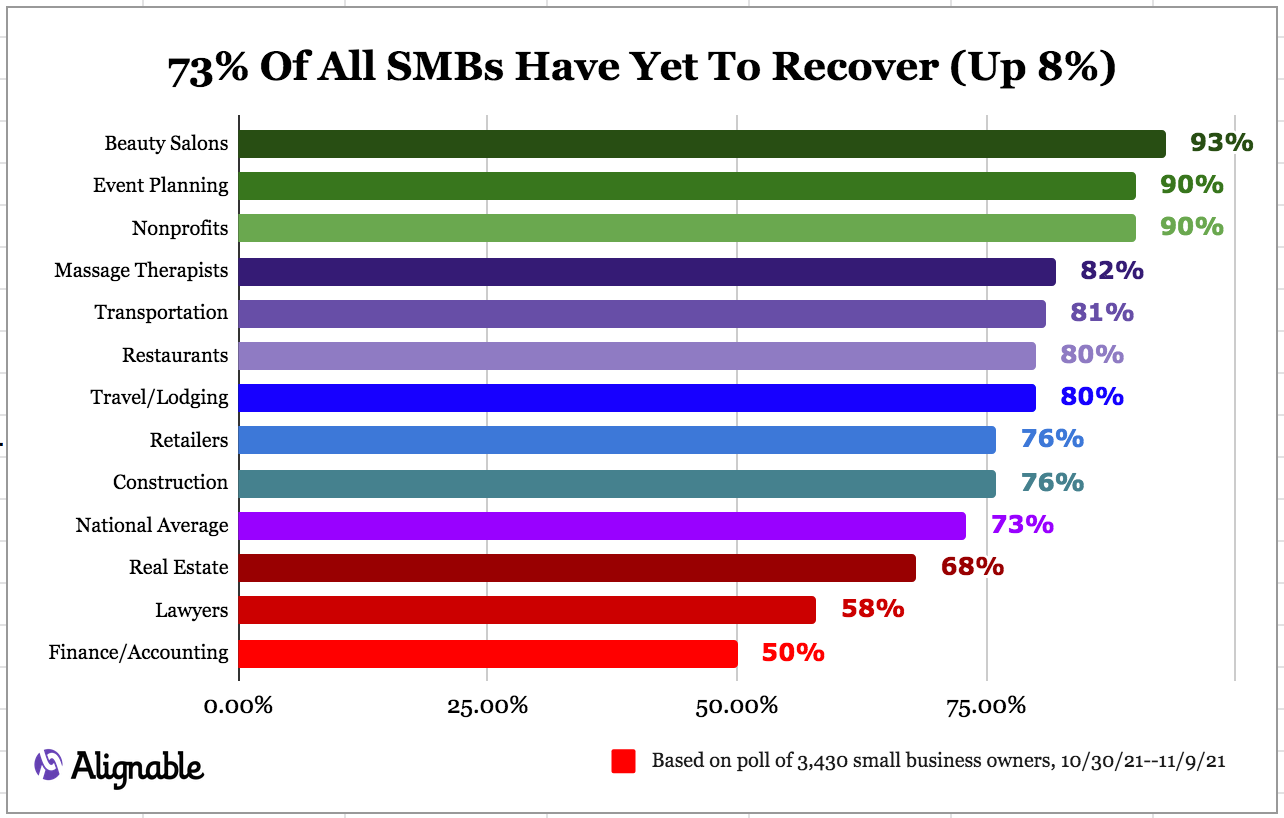

More than 20 months after COVID first struck, 73% of small businesses have yet to recover fully, an all-time high this year. In fact, that figure represents an 8% spike since July and a 3% increase since last month.

Even worse, 85% of minority-owned businesses are still struggling to match their pre-COVID revenues, along with 77% of veteran-owned firms and 76% of those owned by women.

And many SMBs in key industries are in rough shape now, too, as this chart indicates:

The broken supply chain has led to a scarcity of goods, delays in getting supplies to sell, and skyrocketing inflation, which is now the No. 1 concern among small businesses for the second month in a row.

In fact, 90% of small businesses fear inflation will negatively impact their recovery, and 48% are “highly concerned.”

Here are a few other report highlights:

- 33% of restaurants, 26% of retailers and 25% of small B2B businesses are at risk of closing for good in Q4, 2021, based on how much they believe they’ll earn the rest of the year vs. how much they need to keep their businesses afloat.

- 42% of small businesses are generating half or less of the monthly revenue they earned prior to COVID (up 2% this month).

- 89% say the cost of supplies and inventory is up compared to pre-COVID times (that’s up 4% from last month), noting that supply chain issues are getting worse.

- 66% say they’re still suffering from a labor shortage. For the past three months, 2 out of 3 small business employers have shared that complaint. And 65% say they’re paying more for the workers they can actually find.

- Mid-2023 is now the time most SMB owners predict they might be fully recovered. In June, that date was early in Q3, 2022.

The full report has much more information showing widespread recovery issues, along with powerful quotes from small business owners across the U.S.