Worm Capital commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

Dear Partners,

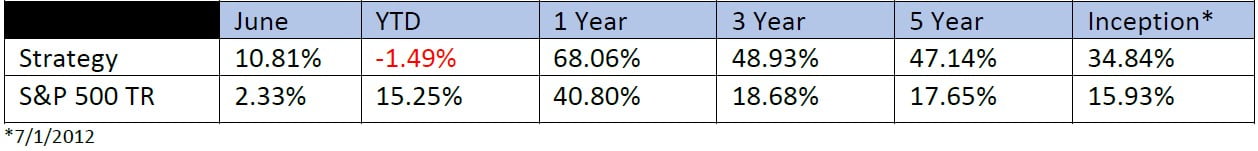

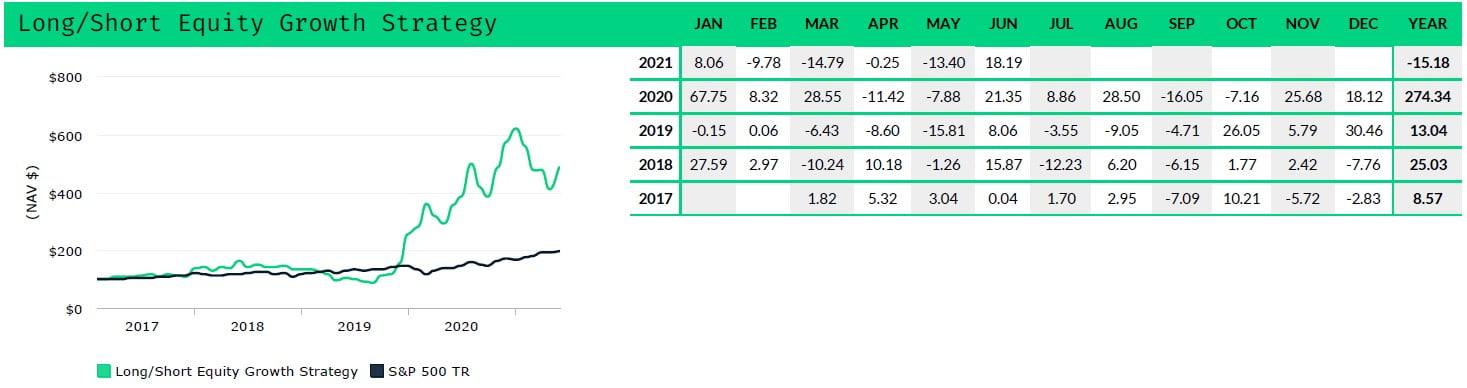

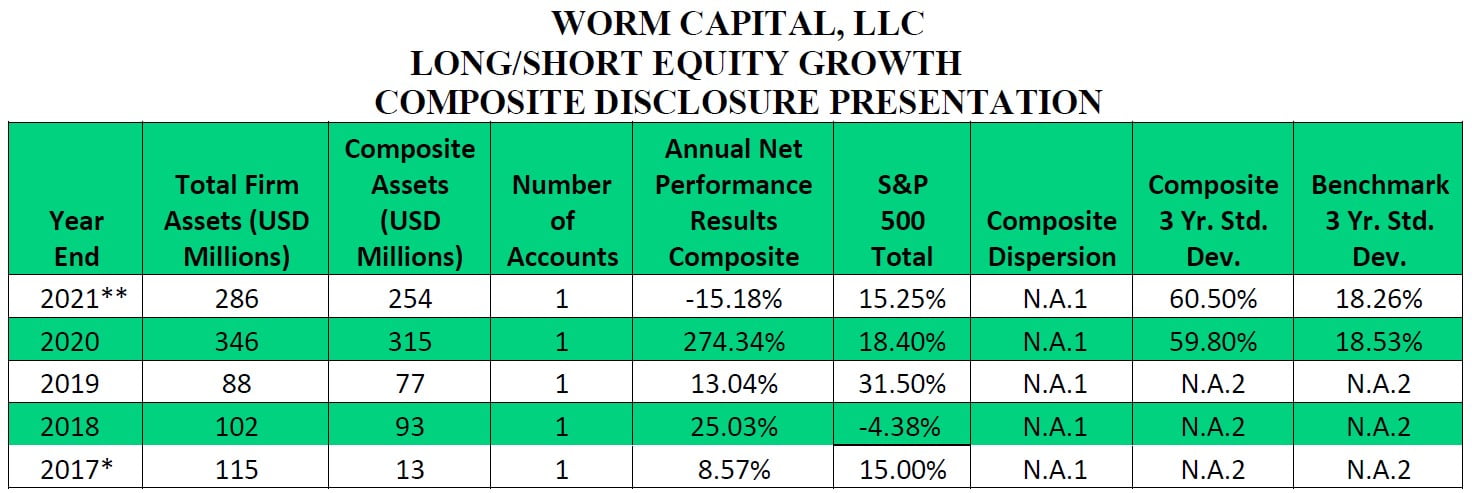

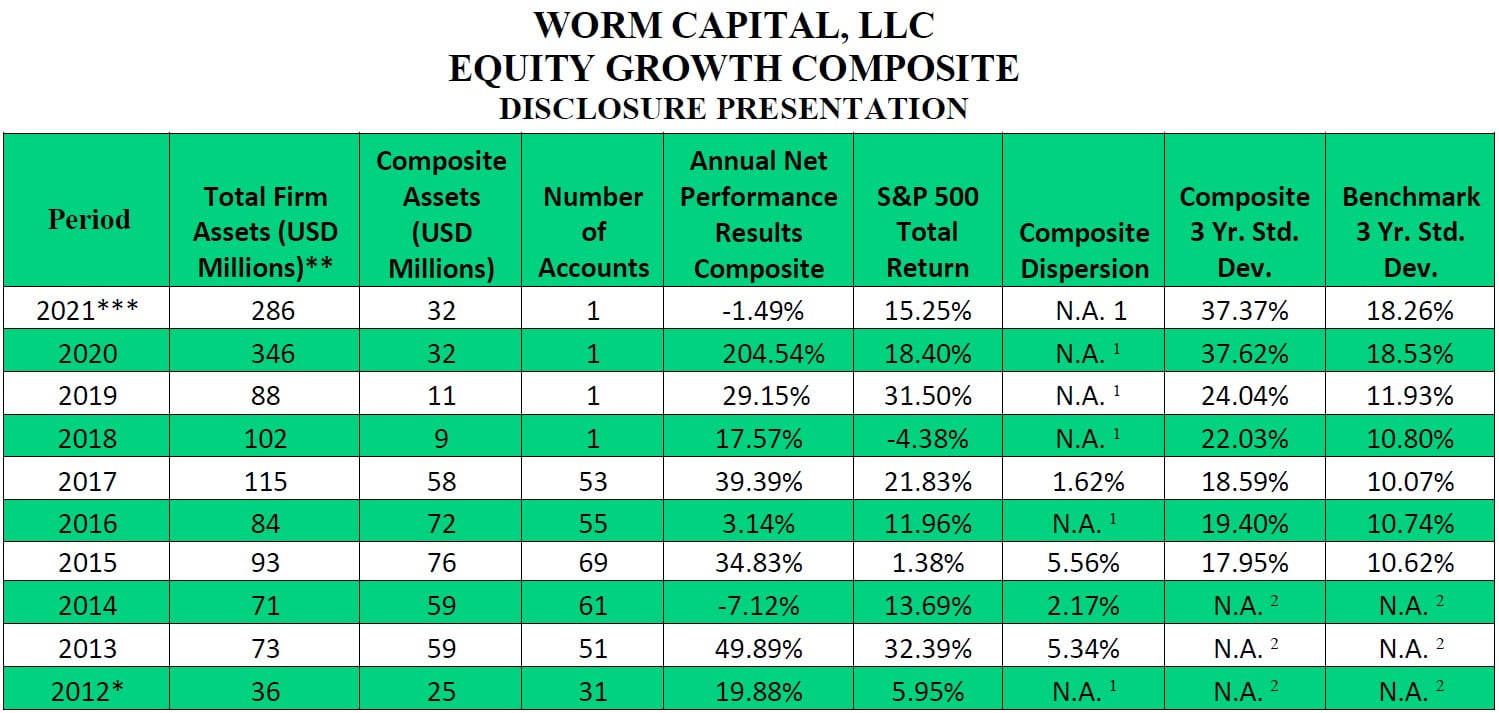

Year-to-date, our long/short equity growth strategy returned -15.18% net of fees, and our long-only equity strategy returned -1.49%. This was compared to the S&P 500 TR of 15.25%.

Since inception in March 2017, our long/short equity growth strategy has annualized returns of 44.11% net of fees, compared to the S&P 500 TR of 16.98% over the same time period. Since inception in July 2012, our long-only equity growth strategy has annualized returns of 34.84% net of fees, compared to the S&P 500 TR of 15.93% over the same time period.

Please see below for results since inception.

Long/Short Equity Growth Strategy Net Performance

Long-Only Equity Growth Strategy Net Performance

Core Holdings

As of the end of the quarter, our core holdings, which accounted for over 90% weighting of the long book, were: Tesla Inc (NASDAQ:TSLA), Spotify Technology SA (NYSE:SPOT), Shopify Inc (NYSE:SHOP), Airbnb Inc (NASDAQ:ABNB), and Amazon.com, Inc. (NASDAQ:AMZN). Notable sells in the quarter included Netflix Inc (NASDAQ:NFLX) and Tencent Music Entertainment Group (NYSE:TME). The drawdown and volatility in prices also gave us entry points into 2-year LEAP call options in our long/short fund, focused on names in our core holdings. Some of the action and news flow we saw on TSLA over the last six months was similar to what we observed in the first six months of 2019, when we saw a 40% drawdown in the equity from January to June before a significant run in the second half of the year and into 2020. (While that of course does not mean the same thing will happen in 2021, we tend to believe the Twain quote that “History never repeats itself, but it does often rhyme.”)

The options market for high-growth business models tends to be fairly price (and thus not worth the premium), but occasionally—especially during bouts of volatility and when the market is panicking—we are able to scoop up two-year call options at a fraction of what we think they should be worth. We’ll never put more than a few points of our total capital into our options book, but when we spot an attractive risk/reward scenario with a 2-year outlook that has the potential for a significantly levered return, we like the upside optionality it creates for the Partnership and our strategies. Historically, we’ve had some notable successes on these trades in the past, and we’re hopeful we may see a similar outcome.

Our shorts, which have worked against us throughout the year so far, are much more heavily diversified, but focused on sectors of the market that we believe face terminal decline: Firms across the oil and gas industry, combustion-engine-based business models, brick and mortar retailers, and so on. Though many of these “value” names had a strong showing in the first half of 2021, we think their long-term outlooks are in decline. As of right now, very few of our short positions exceed even 0.5% weighting, but we are gearing up for some potential opportunities on the short side—particular across name in the legacy automotive industry—when the time is right. We’ll be patient there.

Airbnb

Throughout the quarter, you may have noticed that we averaged into a significant position in Airbnb (ABNB). Though the stock has been a relative underperformer since its February highs, we are highly confident about the company’s prospects and its ability to generate meaningful compounded returns over time.

Some history: We have been following Airbnb’s journey for several years, long before the company went public earlier this year. (In fact, nine years ago, in November 2012, Eric profiled the company for Inc.: “Airbnb Is Changing Travel.”)

Whenever we underwrite a new investment, we look for a few key attributes that help us determine the potential long-term value of a business, as well as its risks. In particular, we focus on management (Are they founders? Do they have skin the game? Are they playing the long game?), addressable market size (How big is the opportunity?), its relative growth and creativity to expand (Are they constantly innovating to make the product better for their customers?), margin expansion (Where can we find operating leverage in the model?), its status in the industry (Are they the dominant player? Can they take market share from incumbents?), business risks (What are we missing? Are customers dissatisfied? What do employees say?) and probably a dozen more elements that are critical to our process. It’s only then do we take out the pencils do the valuation work.

In short, ABNB fulfills pretty much every element of a business model we’re attracted to: First, it’s highly scalable marketplace-based business model that unites buyer and seller with observable flywheel effects. (This is an important observation, in that the platform creates significant economic value for millions of hosts who rely on Airbnb, which in turn attracts new hosts who identify the opportunity, which creates more inventory, which turn attracts more travelers, which attracts more hosts, and so on.) Second, it has a global focus with significant opportunities to expand its operating leverage; Third, its management—which is still founder-led—stands out to us as long-term thinkers capable of handling crisis, which the team demonstrated throughout the pandemic by dropping operating costs and turning the business into a more efficient, lean organization. (Like Churchill said: “Never let a good crisis go to waste.”)

Amazon And Shopify

We also think there are also several other intangible tailwinds both benefiting (and enabled by) Airbnb. In particular, the very nature of travel is changing: Longer stays, more flexible remote work policies, and so on. As its marketplace matures, we see significant similarities to our position in Shopify: An international focus led by managers who understand that, in land-grab environment, focusing on its unique value proposition for its sellers—i.e. keep costs low, improve the platform with additional features, etc.—takes precedent over short-term earnings. In other words, we like businesses that play the long game.

Unlike Airbnb, Shopify drove positive attribution this past quarter. Still, we think this opportunity is still vastly undervalued over the long-term.

Last year, in the Q2 2020 Investor Letter, we wrote a bit about the similarities and differences between AMZN and SHOP, but concluded they “both display winner-take-most dynamics in their respective domains.” We still believe that thesis is true: E-commerce is still, relatively speaking, in its early days. Despite the pandemic push, e-commerce retail still represents less than 15% of overall retail sales, per latest Fed data.

What that means, in practice, is that the opportunity for low-end disruption (i.e. create a scalable backbone for sellers to launch e-commerce business cheaply) is an enormous, underappreciated opportunity to create new economic value. Shopify is growing its GMV at high velocity (114% YoY in its most recent quarter to over $37 billion) but it’s a tricky business to value—which is good. We like tricky valuations. Our research process looks out several years into the future, which is really the only way to value a business properly—especially in a disruptive environment. (Trying to look at potential short-term earnings or even a simple price-to-sales multiple is not a good way to model out valuations on Shopify.)

When thinking about a position like Shopify, we view them as generational company—much like AMZN—that is building the global infrastructure to enable small and medium-sized business to transact online, and, most importantly, keep their unique identity and branding.

Where AMZN optimizes for efficiency, SHOP optimizes for experience. The scale of this opportunity is vast, and Shopify’s reach is wide. The focus—much like ABNB—is keeping costs low for sellers, attract new vendors, improving the ecosystem for merchants. “The rebels are winning,” Shopify president Harley Finkelstein said recently (in a quote we liked so much we made it the title of this letter). “We are betting on a different vision of the future of commerce. We are making it possible for every business to present their brand in their own unique way. A stark contrast to selling on a centralized marketplace.”

Some important key insights to think about regarding a position like Shopify—but really our entire portfolio:

- Earnings ≠ Value in a landgrab environment

- It’s a winner-take-all landscape (the Internet is the catalyst)

- Business is a competition to deliver the best value proposition

- Volatility is not risk

Tesla and Spotify

As investors, we are simply trying to grow our pile of assets over time. Simple—but not easy.

Both Tesla and Spotify underperformed in the quarter, but we maintain our high conviction in the longterm thesis on each business model. Much like art or writing, investment research is a continuous process—it never really ends. Prices can move in either direction in any given quarter, but our advantage often comes from knowing the businesses so well that short-term fluctuations in pricing shouldn’t affect our decision-making. On high conviction positions, this patience is often rewarded, which is why research is so valuable to our process.

Eric and Dan spoke a bit about the concept of “optionality” regarding both SPOT and TSLA on the recent Good-Investing podcast (link here), but the gist of the idea of this: We believe both companies have multiple ways to win. We have written extensively about both companies in the past, but just to offer some brief updated views:

- Tesla is in a class of its own. What many in the market seem to (still) not understand is that Tesla is not a car company so much as a complex manufacturing firm—with significant recurring software potential—growing, in our view, at a targeted rate of 50-100% YoY over the next several years. Unlike any other automotive firm in existence today, Tesla alone is a vertically integrated hardware and software business developing state-of-the-art manufacturing techniques that will revolutionize the auto industry (i.e. its Giga Presses, 4680 cells, etc.). It is a generational company and we anticipate it will eventually be the largest company in the world. Many of the conventional narratives around competition displacing Tesla’s lead are fundamentally flawed, and the many headlines surrounding Tesla’s approach to autonomy are frustratingly superficial. (As an aside, we highly recommend watching Andrej Karpathy’s, Tesla’s head of AI, his recent presentation from June: “Tesla details its self-driving Supercomputer that will bring in the Dojo era”)

- On Spotify: Spotify has 350+ million users and 158 million paid users—and multiple catalysts for improved operating leverage over time. While the headline focus tends to revolve around margins and lack of current earnings, few on Wall Street seem to recognize the long-term potential: SPOT is focused on a land-grab of users while simultaneously innovating on the platform to create new margin-heavy lines of revenue (e.g. its podcasting advertising platform, live events, virtual events, direct monetization, etc.). Last May, when SPOT was trading under $200, we wrote that Spotify should be a $500 stock. We maintain that view.

Clearly, performance this year has been lackluster, but nothing particularly out of the ordinary. We’ve gone through periods like this before, and we almost certainly will again in the future. We don’t claim to be market-timers—our advantage comes with time and duration. Historically, drawdowns have created solid entry points for investors to add additional capital in our strategies. Of course, the future is uncertain, but what we do know is that the businesses that we own are meeting (and often exceeding) our internal expectations, and we like the momentum heading into 2022 and beyond.

At a high level: We could not imagine a better investment landscape for stock selection over the next decade: Lots of change, lots of upheaval. We’re also seeing plenty of misinformation and short-term, superficial research out of Wall Street—which is excellent. Efficiency means businesses get priced at fair value. If everything is efficient, we lose our edge. The consequence of all this chaos, however, can be short-term volatility.

This is core to our belief structure as a firm. And it’s why we think the next decade could provide such an attractive return profile for concentrated strategies. Traditional Wall Street investment analysis tends to value businesses by looking backwards. But all value is created in the future. And that future, we believe, belongs to the innovators. Not the incumbents.

Exxon Mobil

One of the more fanciful tales being told right now is that companies like Exxon are “pivoting” to renewables (see here for a recent story about an Exxon lobbyist admitting that the oil company has no intention to pivot), and that General Motors and Ford are “reinventing themselves” as electric vehicle manufacturers. (We are short both.) Over the last 6 months, especially during this recent “rotation from growth to value,” we think the market is making a critical error: It’s significantly underestimating the potential for many established firms—the incumbents—to face obsolesce in the next several years.

Because the market tends to focus on short-term noise, it often misses the longer-term existential issues for businesses around the world. And we think there are many—especially across the energy industry (where many incumbents have been disastrously slow to move away from fossil fuels) and the combustion engine-based automotive industry (that is just now waking up to the terrifying reality that they are not prepared for the future of electric transportation). And it’s not just that the incumbents are slow to adapt—which they are—but that we think there will only be increasing consolidation in a small handful of “winners” across the industrial landscape.

In previous decades, the market share among businesses in a specific sector tended to be relatively distributed among several firms. This made sense: That was a result of a relative lack of transparency, regional tribalism, personal relationships, and so on. But if all information was readily accessible—if customers knew exactly which business offered the best value proposition—market share would quickly consolidate into the top company. This is happening now. The principal agent of this change? The Internet.

Some 20 years ago, the Internet became the catalyzing force for this era of disruption we are living through today. The Internet created an ecosystem of transparency where customers could easily distinguish which business offered the best value proposition. Everyone is connected. No one wants second-best.

This dynamic has created force function—an imperative—for how investors must think about valuation frameworks, but for now, let’s just focus on the core of the issue: The new economic and industrial reality, as we see it, is shaped by winner-take-all dynamics. Informally, we call this the “One Room Hypothesis.” When everyone is connected, there is little reason for 2nd, 3rd or 4th place finishers. There are no intermediaries. Everyone is linked. There are quick responses. Less cycles. And most importantly: winner takes the goods.

We have seen elements of this play out across the Search landscape (i.e. Google) and across the smartphone segment (i.e. Apple). But we increasingly believe this dynamic will roil new sectors like energy, transportation, retail, entertainment, and so on. It’s an up-for-grabs business environment, and the economy is being reimagined.

The theme of last quarter’s letter was all about getting into position. We can’t predict what prices will do this quarter or the next, but what we can say with a near certain degree of certainty is this: It is imperative to get into position for the next decade of industrial consolidation. Hyper-disruptive companies are threatening the legacy incumbents at accelerating speed. Like Harley says, “The rebels are winning.”

Amidst this paradigm shift, our credo is simple: Investors must get in position. When innovation is about to realized, and when fabulous opportunity is in sight, we have our own mandate: To get our partners in position. To fully participate in innovation.

***

Netflix And Tencent Music Entertainment

In Q2, we sold our last remaining NFLX lots after first purchasing shares in 2014. Frankly, we believe our entry and exit makes a good case study for how we think about building a position over time, and ultimately exiting.

When we first bought NFLX in 2014, this was a common headline we recall seeing in 2014 and into 2015:

In the early days of our position, NFLX was a very volatile position, with regular 10%+ swings in either direction. While that sort of volatility can make many uncomfortable, it was attractive to us as investors. Why? It told us the market still didn’t know how to properly value the opportunity. Initially, that’s an element that attracts us to certain companies—complexity in valuation. Not all complex companies will perform nearly as well as NFLX, of course, but stable, simple-to-understand companies don’t provide much asymmetric upside if the market already has it figured out.

In the early days of our NFLX position, we recall that many on Wall Street seemed to hate the stock— they deemed it structurally unprofitable, a loser to the studios, etc.—but they failed to see how, over the long-term, NFLX was attempting to build a powerful free cash flow machine with a magnificent global opportunity. Reed Hastings and his team deserve all the credit in the world for sticking true to their long-term mission. So, why did we finally sell?

In essence, we believe the company began to trade at parity with its intrinsic value—i.e. where price meets value—which is ultimately where our edge begins to decay.

If a stock is priced rationally, then upside is limited. And, given other opportunities we see in the market, we believe our fund’s capital is better deployed into higher conviction, higher-upside companies. These companies may be more volatile (i.e. TSLA, SPOT), but we also believe that’s an indication the market is still figuring out how to value them. We learned a great deal from our years studying the NFLX model, and we’ll continue to follow the evolution of the company. In our experience, however, it’s worth pointing out that the most contrarian or divisive companies where opinion diverges—these are the companies to pay most attention to.

Another position we mostly exited over the quarter was Tencent Music (TME). We’ve long admired Tencent Music—China’s largest music streaming company—because of its similarities to SPOT and its dominant status in the audio industry. It’s a company with roughly 840 million users with 72 million paid users (growing at ~30% YoY).We like the multiple monetization opportunities it presents, from live virtual events to audiobooks to premium membership. At its core, it’s a healthy, growing business.

Unfortunately, the market is filled with curveballs. During Q2, TME and many other Chinese technology firms (IQ, VIPS, etc.) got swept up in the liquidation of Archegos Capital, which severely impacted their share prices. (There were also increased regulatory concerns coming from the Chinese government.) Both factors have made investing in Chinese equities more complicated, at least in the short-term. TME was a relatively small position for us, but we decided to exit the equity position in May (although we kept our LEAPs) to focus capital elsewhere until we can get more clarity on the situation. In general, much like March 2020, when we lose visibility on a position, we like to reduce our exposure, which limits our risk.

***

Conclusion

Winding down here: This quarter, prices overall didn’t go our way. But we rest easy knowing that we own extraordinarily innovative business models, run by world-class operators, who we believe are all poised for a decade-long run of sustained growth. In our view, each of the businesses we own are deeply complex organizations with ample upside optionality.

To find future value, you have to look forward—to the future. And over the long-term, we’re hugely bullish on this market and the opportunity it presents to compound out extremely attractive returns. More often than not, it takes patience—and perseverance—but we’re still in the early days of our journey.

As always, if you have any questions for us, contact Philip Bland, our Director of Investor Relations.

Sincerely,

Worm Capital